I don’t buy calls because I think something is going straight up tomorrow.

I buy calls when time + structure create asymmetric outcomes.

That’s what this is.

Microsoft isn’t cheap.

It also isn’t extended.

Right now, it’s compressing beneath a key level, while the market debates whether this is exhaustion — or simply digestion before the next leg higher.

That uncertainty is where convexity lives.

The Setup

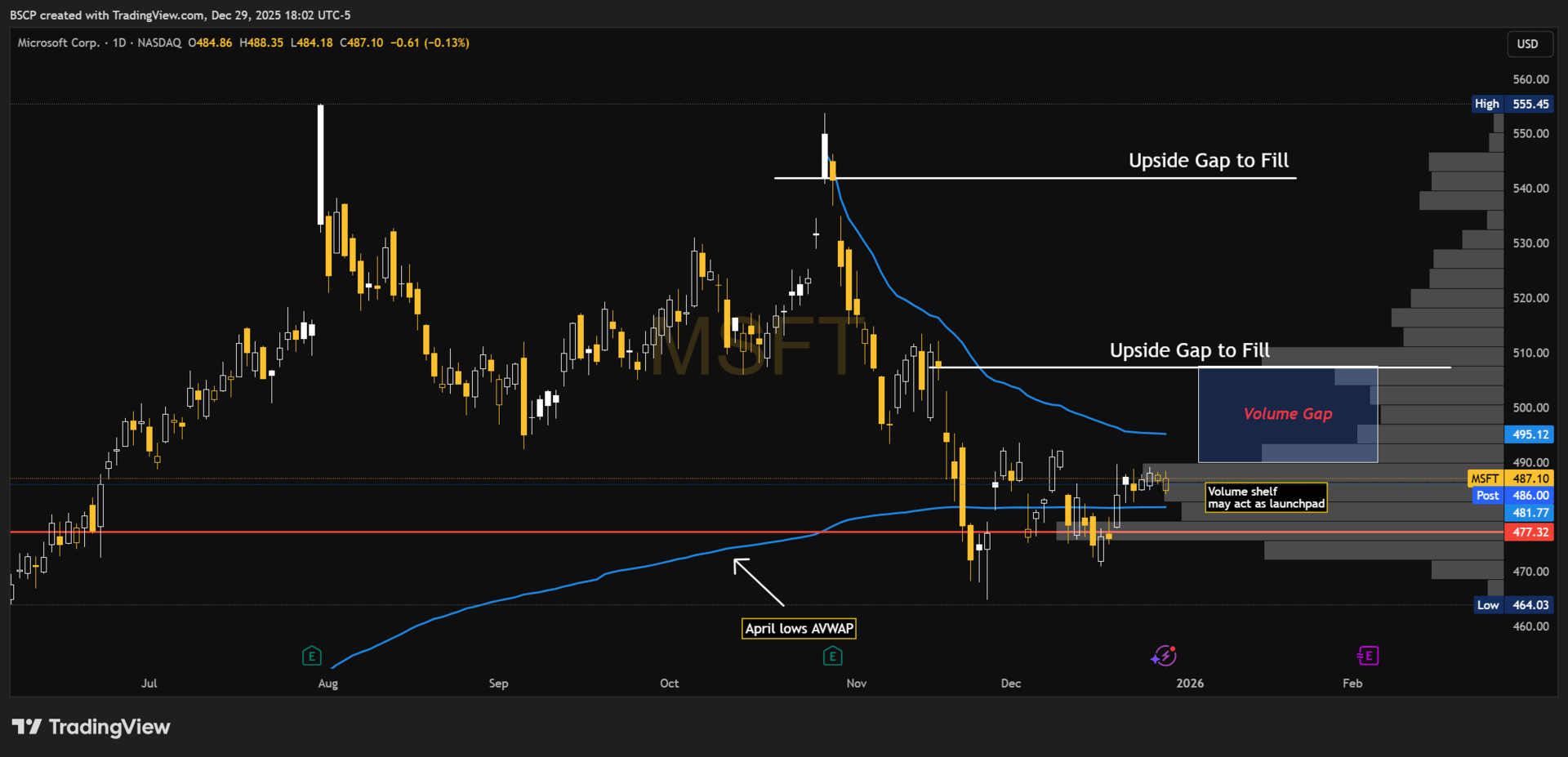

Daily Chart

4-hour chart flagging directly at the volume shelf

MSFT is trading below a major pivot AVWAP from October 28th.

That level matters.

It represents a zone where:

Prior buyers are waiting for confirmation

Sellers are leaning on overhead supply

Breakouts often fail before they finally stick

Price doesn’t usually slice through levels like this cleanly.

It stalls. It ranges. It frustrates both sides before resolving.

This phase can last longer than most people expect.

That’s the opportunity.

The Trade

MSFT 02/20/2026 $520 Calls

This is not a breakout call.

It’s a time-based convex position.

These calls allow MSFT to:

Continue compressing below resistance

Absorb supply without forcing direction

Let fundamentals, earnings, and AI monetization work in the background

If MSFT clears the pivot sooner, optionality expands quickly.

If it needs months to build, the position survives.

Time isn’t an accessory here.

It’s the edge.

How Convex Alpha Actually Works

Convex Alpha does not use stop losses.

That’s intentional.

Positions are sized from day one with the assumption they can go to zero.

Why?

Because convexity requires:

Staying power through chop

Freedom from being shaken out early

Letting a small number of large winners outweigh many small losses

Most trades fail.

The few that work are designed to matter.

This Framework Has Already Played Out

Using the same convex approach:

FCX → +400%

RIVN → +300%

SCHW → +130%

PL → +400%

CLSK → +600%

Different charts.

Different environments.

Same math.

Options trades like this are shared separately, with full context around:

Duration

Strike selection

Position sizing

How structure evolves as price develops

No alerts.

No forced timelines.

Just the process.

Risk Disclosure

Options involve risk and are not suitable for all investors.

Convex Alpha positions are intentionally sized with the understanding that some trades will go to zero. This is not investment advice — it’s a transparent look at how I structure asymmetric risk in my own portfolio.

Know your risk.

Size accordingly.

If you want to follow how convex trades are actually structured — not just called — that’s what Alpha Premium is built around.

If you want to learn more about this options strategy read the Convex Alpha section of this post:

— Connor

Alpha Before It Prints

Upgrade to Alpha Premium — Founding Members keep $14.99/mo or $150/yr permanently.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe