Alpha Framework Portfolio

Exclusively for Alpha Premium Members

Last Updated: 11/28 10:49pm

New premium features launching soon:

📊 CHARTS

📈 WEEKLY INSIGHTS

🚀 MICRO CAP HOME RUNS

Portfolio Overview

Week one of the Alpha Framework Portfolio is complete.

The portfolio is now fully deployed across twelve positions, each chosen based on:

structural upside

clean price behavior

liquidity

and defined risk

No trims.

No sells.

Nothing touched invalidation.

Performance outpaced the broader market, and the portfolio is behaving extremely clean early — exactly how a new book should look.

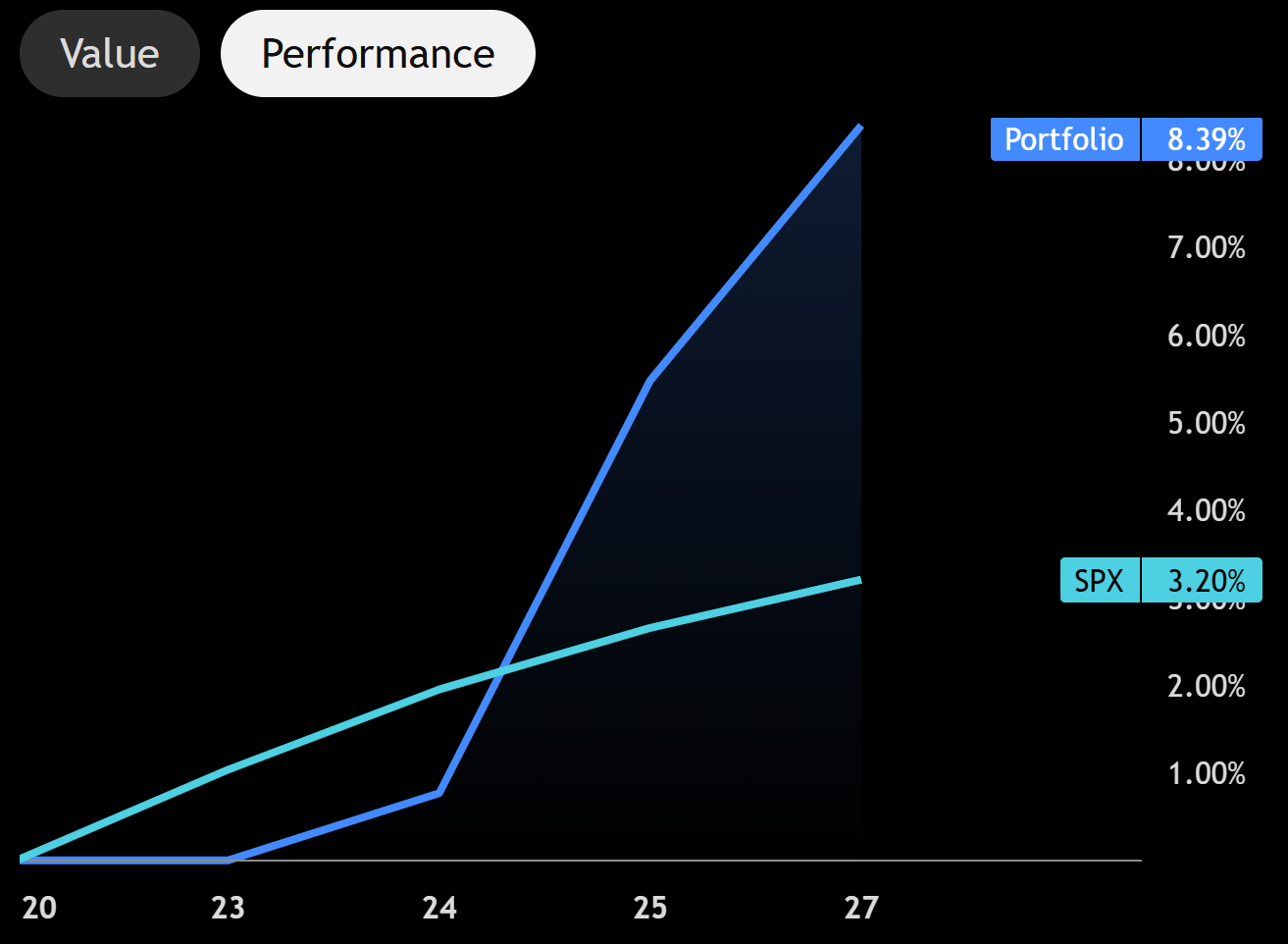

Performance vs Benchmark

Portfolio: +8.39%

SPX: +3.20%

Outperformance: +5.19%

Portfolio value: $43,327.37

Unrealized gain: +$3,327.37 (+8.57%)

Realized gain: $0.00

Total gain: +$3,327.37 (+8.32%)

Cash: $1,155.36

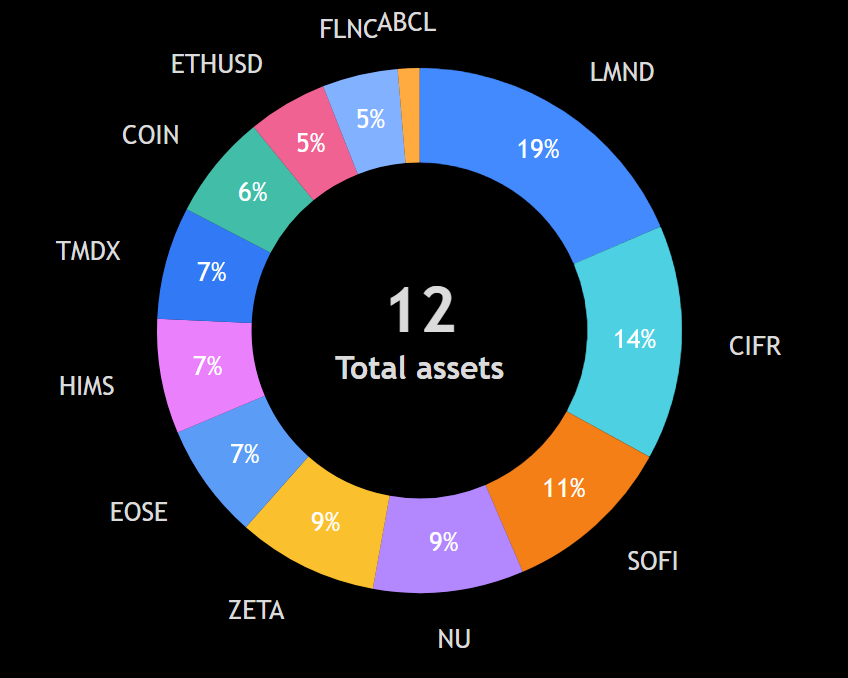

Portfolio Allocation (Current Weights)

Core Positions

Largest weights. Clear structural upside. Strongest conviction.

LMND

CIFR

SOFI

NU

ZETA

Mid-Tier Positions

Meaningful weight. Strong setups. Slightly lower priority than core.

EOSE

HIMS

TMDX

COIN

Smaller / Optionality Positions

Sized intentionally small. Carry long-term asymmetric potential.

ETHUSD

FLNC

ABCL

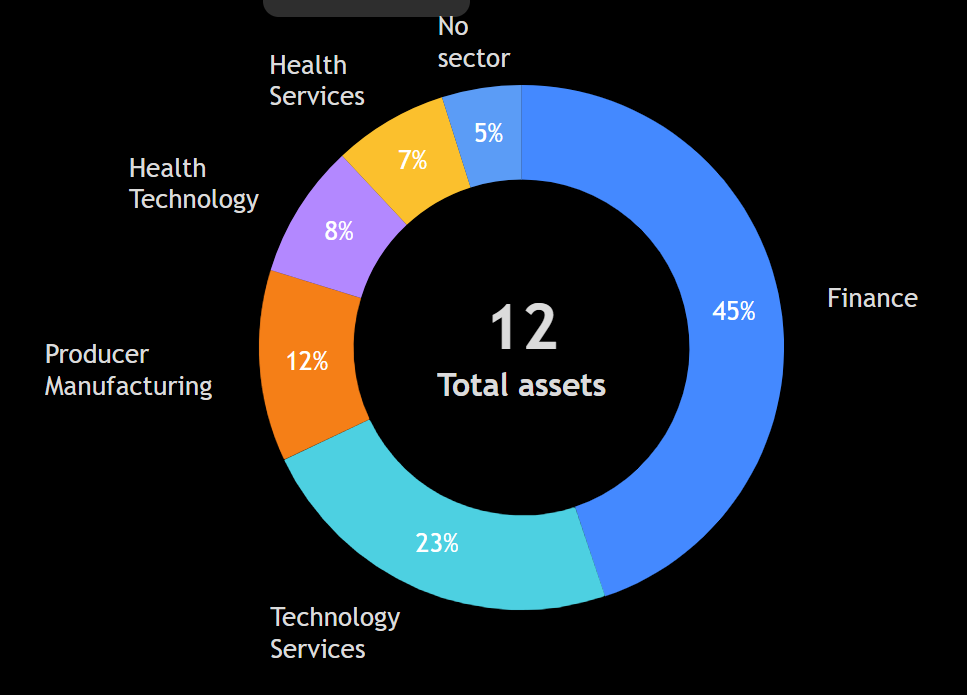

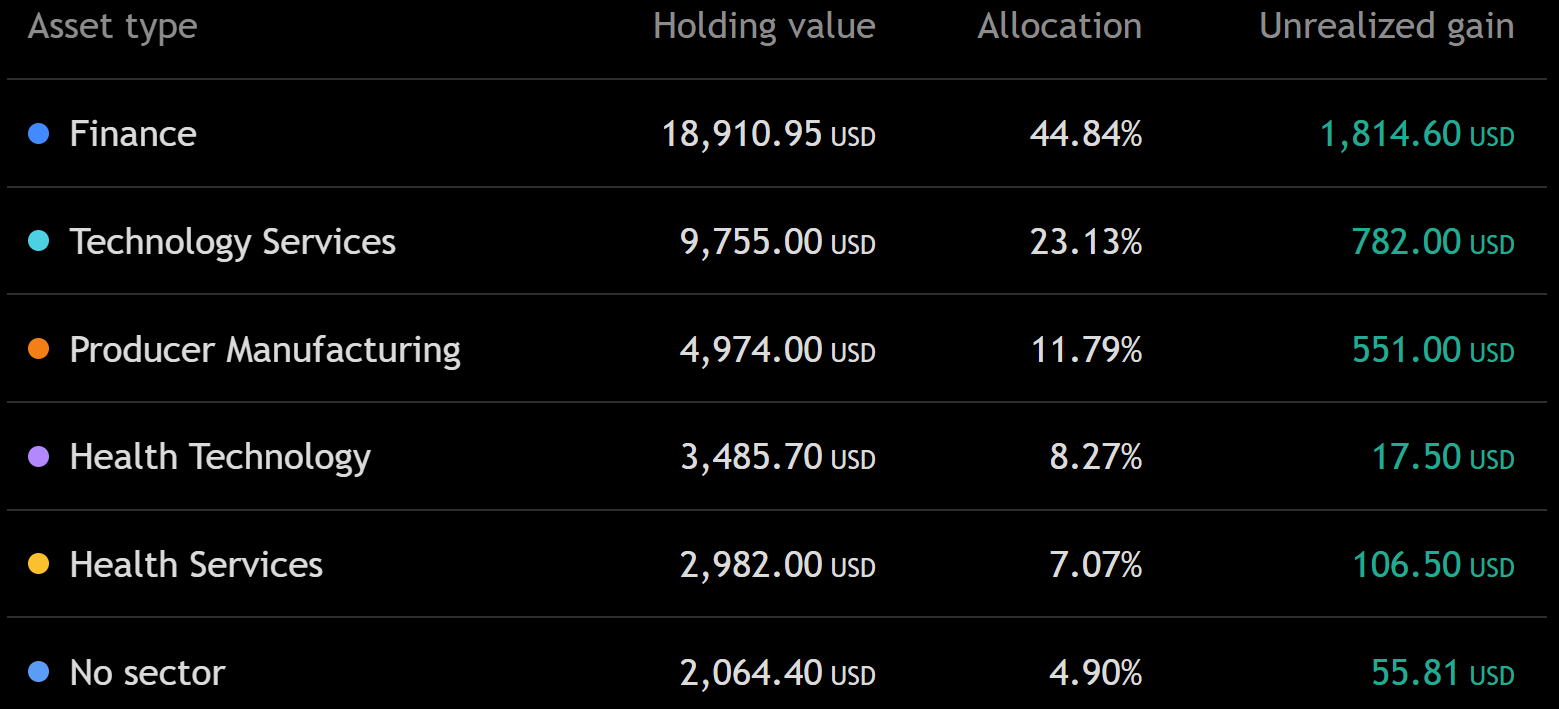

Portfolio Allocation (Sector Weights)

Sector Breakdown

AI Infrastructure / Hyperscaler Compute Lessors

The real bottleneck in AI isn’t GPUs anymore — it’s power and energized capacity.

Cipher sits directly in that slipstream.

CIFR – AI-infrastructure developer with $8.5B in binding AWS + Google/Fluidstack contracts. Controls energized megawatts and converts power into high-value compute for hyperscalers. Existing 150MW at Black Pearl pulls revenue into 2026. One of the most mispriced assets in the entire AI-infra ecosystem.

Fintech / Neobanking / Financial Infrastructure

Tech-enabled financial services — digital money movement, lending, underwriting.

SOFI – Consumer finance + digital bank

NU – Leading LatAm neobank

LMND – Insurtech underwriting automation

COIN – Crypto financial infrastructure & custody

Software / Data / Ad-Tech / Insurtech

Recurring revenue. Data-driven personalization. Modern software rails.

ZETA – Enterprise marketing cloud, ML personalization at scale

LMND – Automation-driven underwriting (hybrid classification)

Energy Storage / Grid Infrastructure

Industrial exposure to the energy transition.

FLNC – Utility-scale energy storage

EOSE – Long-duration zinc-based storage

Healthcare / Medical Devices / Telehealth / Biotech

A mix of a high-quality operator, a consumer health platform, and biotech R&D.

TMDX – Medical logistics + transplant device platform

HIMS – Direct-to-consumer telehealth with recurring demand

ABCL – Antibody discovery engine (biotech R&D)

Layer-One Settlement Infrastructure

The decentralized settlement layer for global stable-coins and tokenized assets.

ETHUSD – Ethereum, the base-layer blockchain powering stable-coin flows and on-chain liquidity. A long-duration settlement asset — not a traditional currency and not tied to AI cycles.

My Watchlist

This Week’s Moves

Initiated Positions:

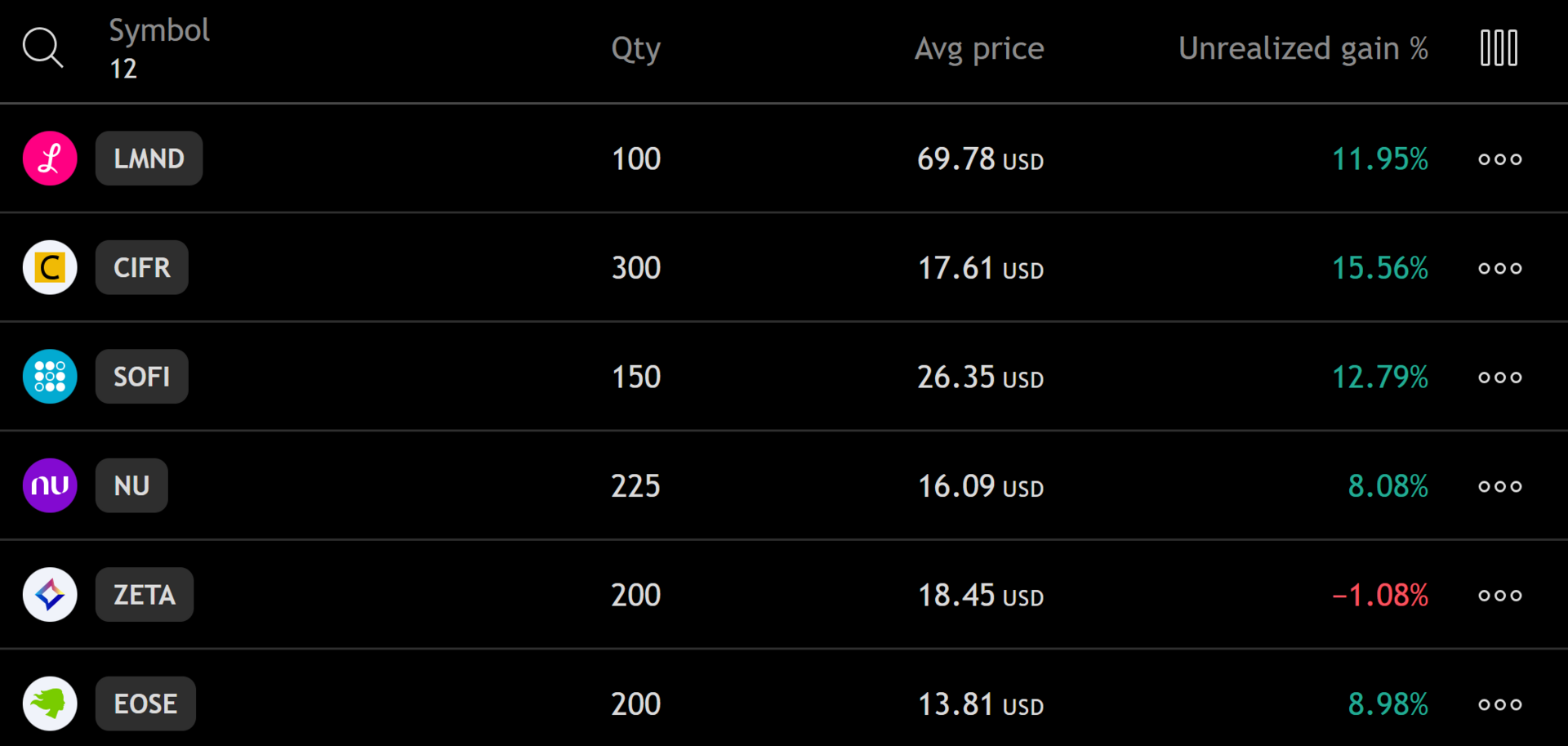

LMND – 100 @ $69.78

Early entry into a mispriced growth story. Structure remains tight.CIFR – 300 @ $17.61

Hyperscaler-aligned AI-infrastructure developer. Contracts exceed EV. Earnings pulled into 2026.SOFI – 150 @ $26.35

Multi-month structure intact. Fundamentals continue to improve.ZETA – 200 @ $18.45

Execution strong. Price aligning with fundamentals.NU – 225 @ $16.09

Clean trend, surging profitability.TMDX – 20 @ $146.11

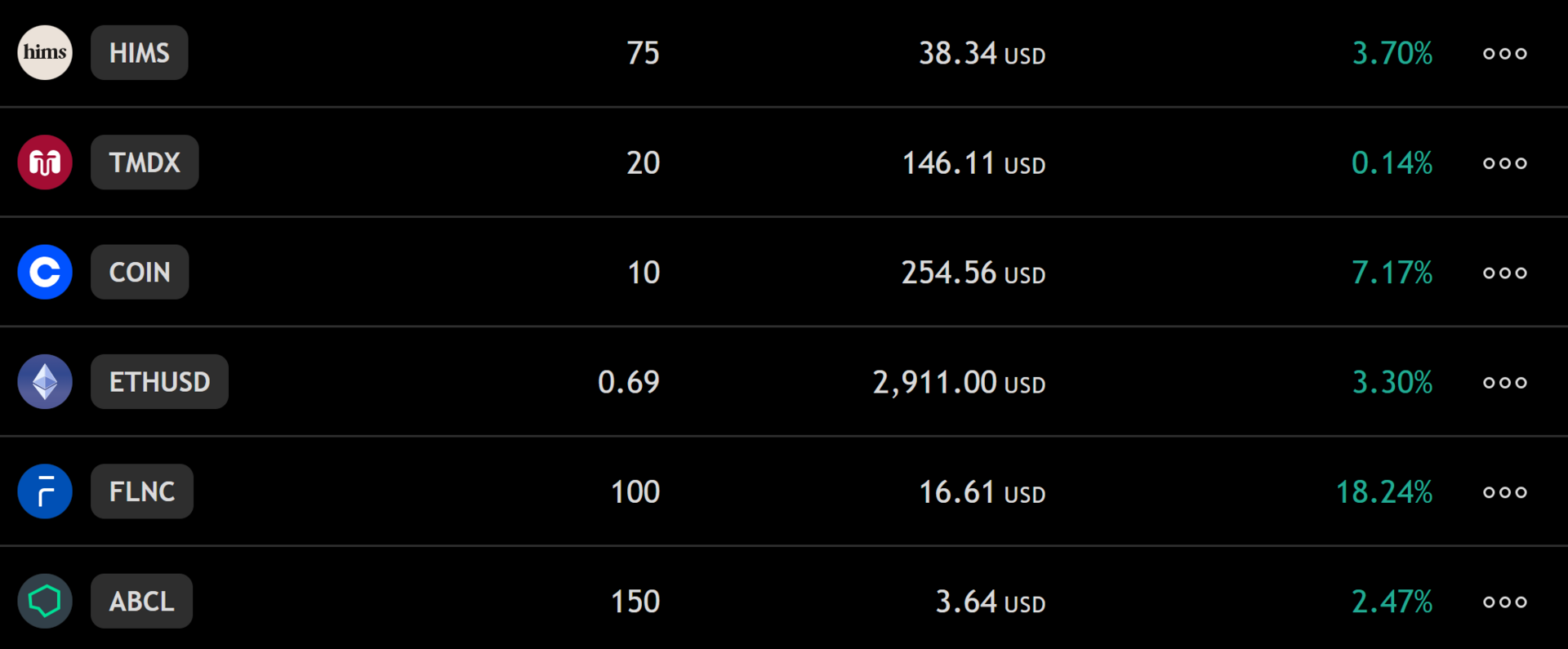

High-quality operator with durable demand.HIMS – 75 @ $38.34

Predictable DTC health model with recurring revenue.EOSE – 200 @ $13.81

Tight structure. Watching volume continuation.COIN – 10 @ $254.56

Controlled crypto-linked exposure.ETHUSD – 0.69 @ $2,911

Base-layer blockchain providing settlement for stablecoins.FLNC – 100 @ $16.61

Utility-scale storage exposure.ABCL – 150 @ $3.64

Small optionality position.

Trims:

None

Sells:

None

Notes:

Week one was strictly portfolio construction.

Core names got size, optionality names stayed small, and nothing approached risk levels.

Purpose of This Page

Why It Exists:

To give Alpha Premium members a clear view of the portfolio’s structure.

To show exactly how conviction is expressed through sizing.

To outline where capital is deployed and where it isn’t.

To provide transparency behind every move made each week.

To keep all activity in one place for easy review.

How to Use It:

Check the page after each weekly update.

Follow sizing and conviction shifts over time.

Use it as the anchor for what matters during the week.

Reference it when new trades or updates are released.

This page updates once per week and reflects all activity shown in the weekly Alpha Framework Portfolio emails.