Zeta: The Sleeper AI Stock That Just Woke Up

While everyone’s chasing hype, Zeta quietly launched the one AI tool that might actually drive revenue — and Wall Street’s still asleep at the wheel.

1. Nobody’s Paying Attention to Zeta — Yet

A few weeks ago, Zeta Global rolled out a new AI product called Athena. It barely made a blip on most traders’ feeds — which is exactly why I’m writing about it.

While the crowd keeps chasing the same handful of “AI darlings,” Zeta’s been quietly stacking the kind of infrastructure that doesn’t make headlines — but makes money.

Most people still think of Zeta as a small-cap marketing cloud — a distant cousin of Salesforce or Adobe. What they’re missing is that Zeta built a unified platform years ago that tracks, segments, and activates customer data across channels in real time. It’s a data machine disguised as a marketing company.

Now, they’ve layered Athena on top of it — and that’s the catalyst.

Athena isn’t some gimmicky chatbot that writes subject lines. It’s a command center. You ask it questions in plain English, and it acts. “Who’s most likely to convert this week?” — Athena runs the model. “Where should I reallocate budget?” — Athena does it. “Launch a new campaign using high-intent data from the last 48 hours.” — Athena executes.

That’s not ChatGPT for marketing. That’s a self-driving CMO.

2. The Inflection Point

Zeta’s been building this foundation for years, long before “AI marketing” became the buzzword it is now. Their data cloud spans over 235 million consumer identities, tied to real-world behavior, not just cookies and clicks.

That matters because AI without high-quality data is just noise.

Most so-called AI marketing platforms today are trained on scraped web data — not real transactional signals. Zeta’s advantage is that its AI is plugged into authenticated data streams. When Athena makes a decision, it’s grounded in truth, not guesswork.

And here’s the bigger play: Zeta isn’t trying to sell AI licenses — they’re trying to become the operating system for modern marketing. Every brand wants fewer vendors, cleaner data, and more automation. Athena checks all three boxes.

So when I say “inflection point,” I’m not talking about quarterly EPS. I’m talking about narrative. This is the moment Zeta shifts from “that martech stock nobody follows” to “the platform every marketer wishes they had before budgets got cut.”

3. Why I’m Buying This Week

There’s a narrow window when a story moves from “ignored” to “inevitable.” That’s where alpha lives.

Right now, ZETA is trading like a forgotten software name. But underneath the hood, management just dropped a product that could expand margins, accelerate adoption, and rewrite how the Street values their business.

A few reasons I’m taking a position now:

Asymmetric setup. The downside is limited — Zeta already trades at a discount to peers. The upside? If Athena lands with enterprise clients, we could see a multiple re-rating like we saw with Hims once investors recognized real leverage.

Data moat. You can’t replicate what Zeta’s built. They own the pipes, the data, and now the interface. That’s vertical integration — and it’s rare in martech.

Timing. They unveiled Athena just weeks ago at Zeta Live 2025. The market hasn’t absorbed it yet. But it will — especially once early enterprise case studies hit.

I’m not buying this because it’s trendy. I’m buying because it’s undervalued execution — the kind that gets rewarded once proof points start stacking up.

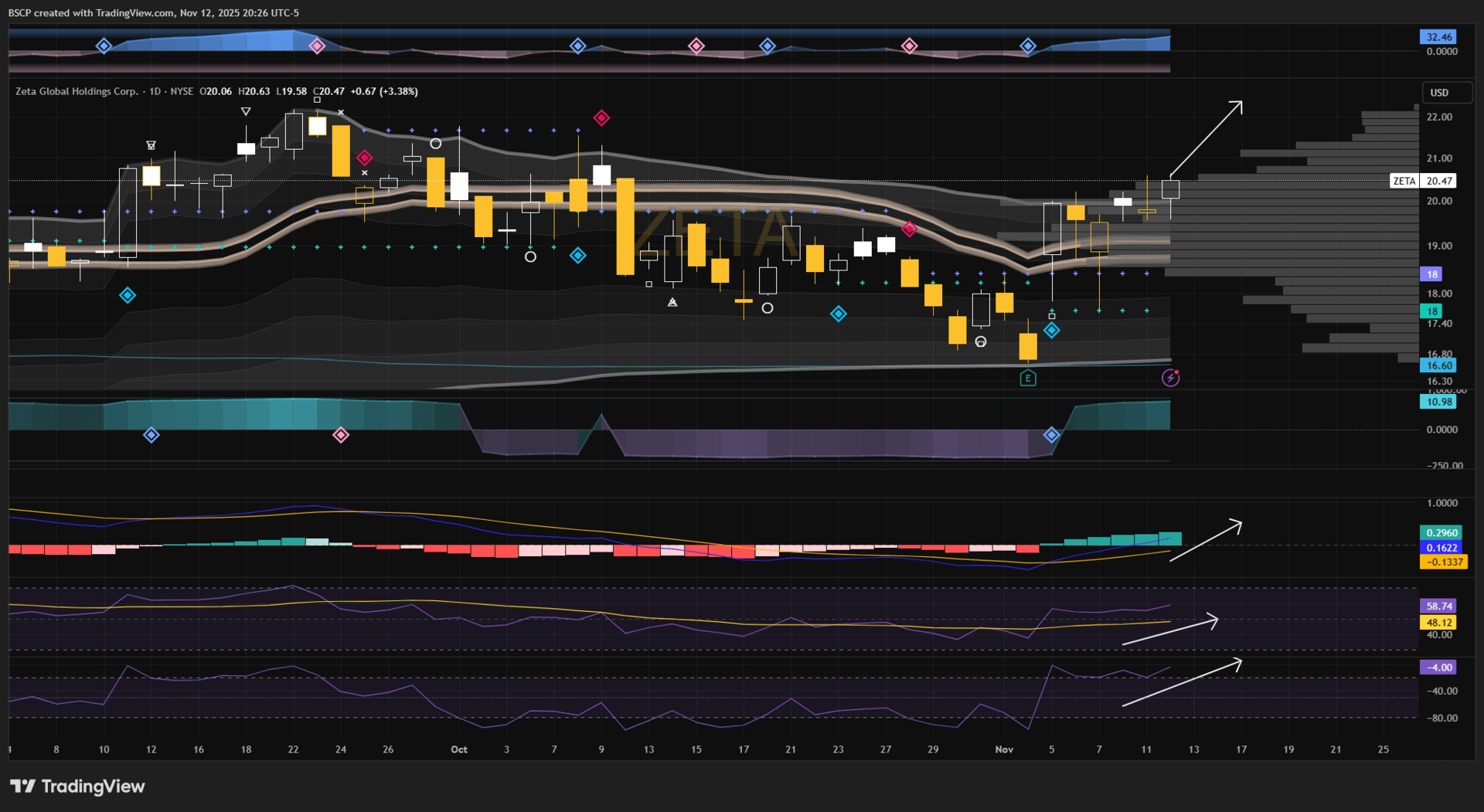

3A. Technical Snapshot

The fundamentals aren’t the only thing turning up — the chart agrees.

On the Monthly:

The MACD cross is incoming after nearly a year of red momentum, echoing the setup from mid-2023 when ZETA ran 4x.

A deep volume shelf around $16–17 shows strong institutional accumulation — that’s real support, not retail chop.

Price is pressing against the All-Time-High anchored VWAP, a breakout above which often precedes trend acceleration.

RSI is lifting off mid-range with plenty of headroom.

On the Daily:

We’ve cleared a heavy volume cluster at $20, flipping resistance to support.

The MACD lines have already crossed bullishly, confirming what the monthly is just now hinting at.

RSI and momentum oscillators all turned higher together — a textbook convergence that signals strength before the move.

Next supply zone sits around $23–24, then open air until $28.

Put simply, ZETA’s multi-timeframe setup looks ready to expand. When technicals and catalysts align, you don’t wait for CNBC — you act.

4. What I’m Watching

Customer adoption. When the first Fortune 500 brand publicly says Athena helped cut spend or increase conversions, the narrative shifts overnight.

Guidance revisions. I’m looking for management to hint at higher margins or lower CAC through automation.

Institutional flow. The next few months will tell you everything — if ZETA starts catching steady accumulation on light news, that’s quiet smart money taking positions.

5. The Bigger Picture

The marketing world’s about to split in two:

Companies still trying to duct-tape data together with half a dozen vendors.

And companies that let an AI system do it for them.

Zeta’s Athena is the first serious attempt at the latter — and it’s coming from a public company that’s already profitable, already scaled, and already connected to the pipes that feed the system.

That’s what the market is missing. Everyone’s chasing “AI narratives,” but few are realizing that Zeta may have built the most practical, cash-flow-driving AI product in the enterprise space.

When Wall Street wakes up to that, it won’t reprice slowly.

6. How I’m Positioning

I started building a position this week. Nothing massive yet — but meaningful enough that I’ll feel it if I’m right. I’ll scale if we start seeing volume confirm what I think is coming.

My time horizon is 6–12 months. I don’t need this to double tomorrow. I’m betting on the narrative catching up to the fundamentals.

If Athena delivers real-world ROI, Zeta will go from a forgotten ticker to a feature segment on CNBC by next summer — right around the time most investors realize they missed it.

7. Final Take

Zeta Global isn’t trying to look like an AI company — it’s becoming one.

Athena isn’t about press releases or investor decks; it’s about automating the thing every CMO cares about: performance.

And right now, almost nobody’s talking about it. Which, for me, is exactly the point.

Disclosure:

This post reflects my personal opinion, not financial advice. I may hold a position in $ZETA at the time of writing and may buy or sell without notice. Do your own research.

Subscribe to Alpha Before It Prints for deep dives like this—before the story breaks wide open.

A Personal Note Before You Go

If you’ve been following Alpha Before It Prints for a while, you know this project isn’t just about catching alpha early — it’s about multiplying it into something that matters.

Part of every trade I make now goes through The Faithful Shepherd Project, which helps fund the expansion of the Gerber Medical Center in Uganda.

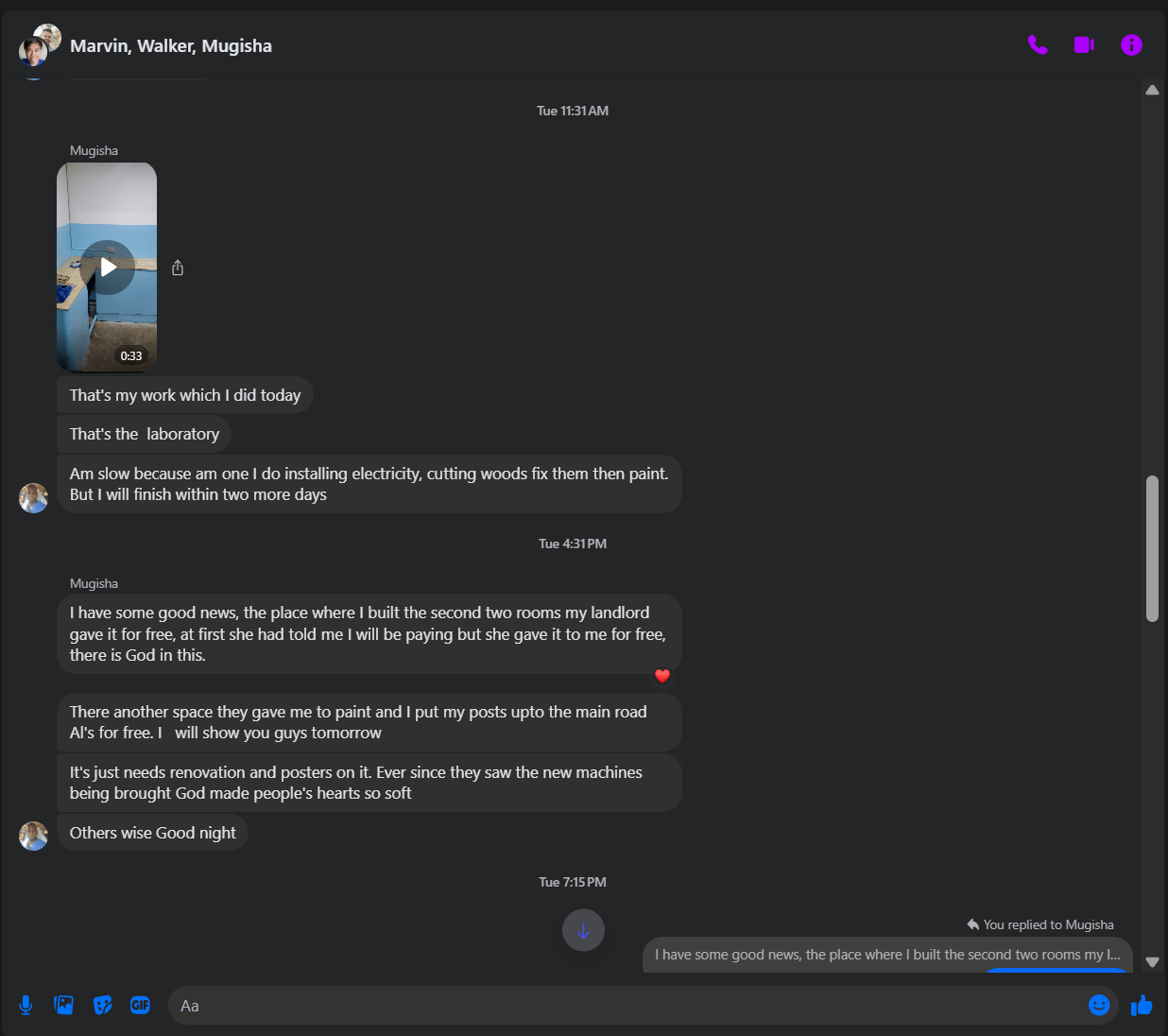

Just this week, Byron — the man overseeing the project — sent me this message:

“The place where I built the second two rooms, my landlord gave it to me for free. At first, she told me I’d be paying, but she gave it to me for free. There is God in this.”

If you want to see what God is doing there — and how a few faithful steps can create generational impact — check out the write-up here:

👉 “When God Says Go, You Go”

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe