Here’s the stat that matters — and almost no one is anchoring to it:

For every $1 a customer spends with Zeta, they generate ~$5–$7 in return.

Not “potential.”

Not “modeled.”

Actual customer economics.

That changes everything.

This Is Why ZETA Works When Budgets Tighten

When companies pull back, they don’t ask:

“What’s the coolest AI tool?”

They ask:

“What pays for itself?”

A 5–7x return puts ZETA in a rare bucket:

It’s not discretionary

It’s not experimental

It’s not brand spend

It’s ROI infrastructure.

That’s why ZETA survives cuts — and scales aggressively when budgets normalize.

Most Software Sells Hope. ZETA Sells Payback.

The majority of SaaS companies sell:

productivity promises

efficiency narratives

future optionality

ZETA sells measurable revenue lift.

That’s a massive distinction.

If a CFO knows:

spend $1

get $5–$7 back

That budget doesn’t get debated.

It gets expanded.

This Is Why ZETA Is Mispriced

The market is still valuing ZETA like:

enterprise spending is fragile

marketing budgets are optional

ROI is uncertain

But a platform that consistently delivers 5–7x returns doesn’t get treated like a cyclical ad tech name forever.

Eventually, it gets re-rated as:

revenue infrastructure

mission-critical software

a scaling profit center

That re-rating doesn’t happen gradually.

It happens fast.

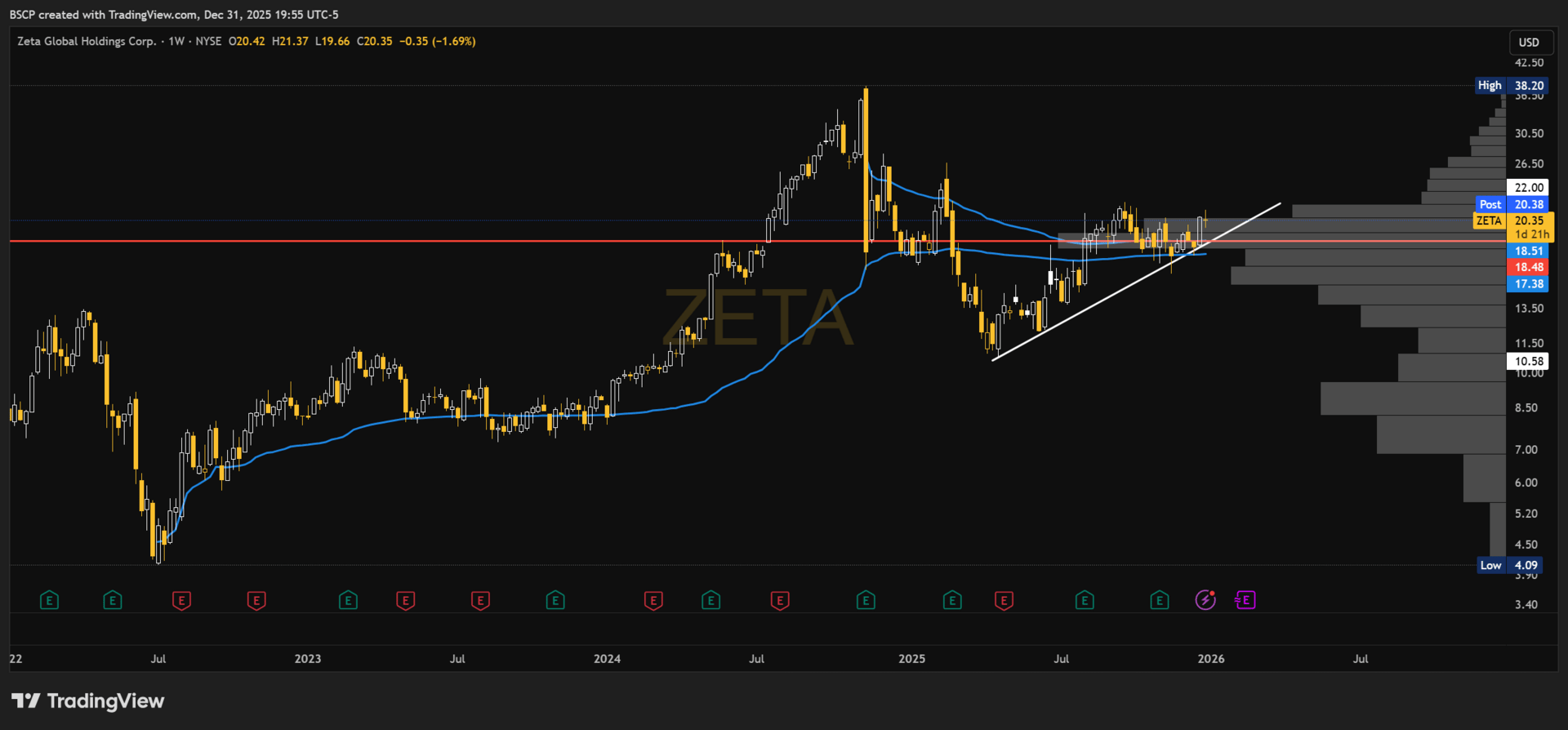

Technical Confirmation (What Changed)

What’s different now isn’t sentiment — it’s structure.

On the weekly chart, ZETA has now reclaimed all key anchored VWAPs and is consolidating directly on a high-volume shelf.

That matters.

When a stock:

Reclaims higher-timeframe AVWAPs

Holds above them

And accepts price on heavy volume

It’s not drifting.

It’s being absorbed.

This is where failed rallies usually roll back over.

Instead, ZETA is holding — despite lingering skepticism and a year of frustration.

At this stage, continuation isn’t about momentum indicators or headlines.

It’s about who’s left to sell.

From a market-structure perspective, this looks far more like positioning ahead of a move than distribution after one.

That’s why the technicals now support the broader 2026 catch-up thesis — not contradict it.

The Setup Most People Miss

ZETA doesn’t need:

AI hype cycles

speculative capital

narrative momentum

It needs:

stable enterprise budgets

a return to rational spending

time for ROI math to compound

That’s exactly the environment setting up into 2026.

Bottom Line

ZETA isn’t a bet on innovation.

It’s a bet on a simple equation:

$1 in → $5–$7 out

When the market starts valuing math instead of stories,

these are the names that move first — and hardest.

— Connor

Alpha Before It Prints

If you want to see how I think through setups like this — across structure, fundamentals, and timing — that’s exactly what I share inside Alpha Premium.

Upgrade to Alpha Premium — Founding Members keep $14.99/mo or $150/yr permanently.

Editor’s note:

The Alpha Framework Portfolio was started with $125,000 as a live record of posture, sizing discipline, and exposure — not a performance showcase.

The long-term objective is simple but demanding: compound this portfolio to $1 million by 2030 through disciplined positioning, risk control, and selective aggression when asymmetry is present.

There are no guarantees. No smoothing. No retroactive edits. Every add, trim, and exit is logged in real time by design.

For the next few weeks, the Alpha Framework Portfolio is being kept publicly accessible via SavvyTrader.

This is the same live portfolio where posture and exposure are expressed before ideas become consensus — including names like Zeta — with updates delivered via email or text for those who want visibility into changes as they happen, without needing to check in daily.

Once this access window closes, the portfolio will move back behind the paywall.

One important structural detail:

Savvy does not allow retroactive edits, performance smoothing, or after-the-fact positioning.

Every decision is time-stamped, immutable, and publicly visible.

That constraint is intentional.

It forces discipline — and ensures the portfolio remains a record, not a narrative.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe