Most people treat VWAP like a moving average.

That’s already the mistake.

VWAP isn’t a trend indicator.

It’s a receipt.

It shows you where real money transacted — not where price happened to print, but where size actually changed hands.

And when you anchor VWAP to the IPO, it stops being a trading tool and starts acting like a map of long-term positioning.

This is why it sits near the top of my charting filters.

What VWAP is actually telling you

In plain terms:

VWAP shows the average price weighted by volume.

Which means it approximates where the largest concentration of capital entered.

Not opinions.

Not narratives.

Cost basis.

Above VWAP, participants are generally in profit.

Below VWAP, they’re generally underwater.

That distinction matters more than any indicator setting you’ll ever tweak.

Why IPO AVWAP matters more than almost everything else

Anchoring VWAP to the IPO does one thing extremely well:

It tells you whether long-term holders are winning or losing.

Above IPO AVWAP

Most holders are in profit

Less urgency to sell

Supply tightens

Breakouts tend to stick

Below IPO AVWAP

Most holders are underwater

Rallies get sold into

Supply overhang persists

Price churns or bleeds

This is why so many stocks feel heavy for years — and then suddenly don’t.

Nothing mystical changed.

They reclaimed the level where memory flips.

Reclaims are where the real moves start

Look at enough charts and you’ll notice a pattern that isn’t talked about enough:

The biggest expansions tend to happen after IPO AVWAP is reclaimed — not before.

Why?

Because once that line is reclaimed:

Long-term sellers disappear

Pullbacks get bought instead of faded

Time starts working for the position, not against it

That’s when trends stop needing constant confirmation.

What this looks like in real portfolios

To make this concrete, here are examples from the Alpha Framework Portfolio — not cherry-picked bottoms, just IPO AVWAP reclaims.

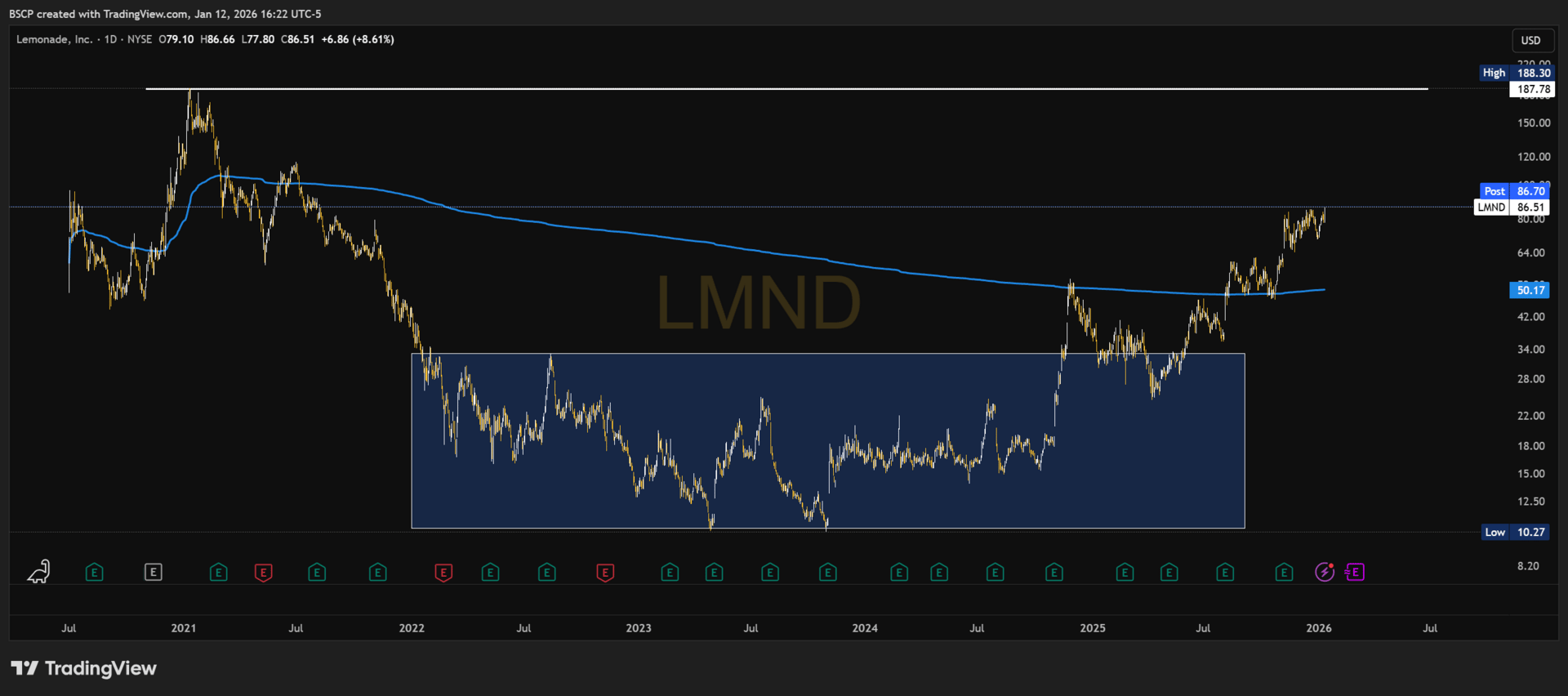

$LMND

IPO AVWAP reclaim around $50 → $86 ≈ +72%

$LMND ( ▼ 0.97% ) is ready to breakout higher to $100 then $185

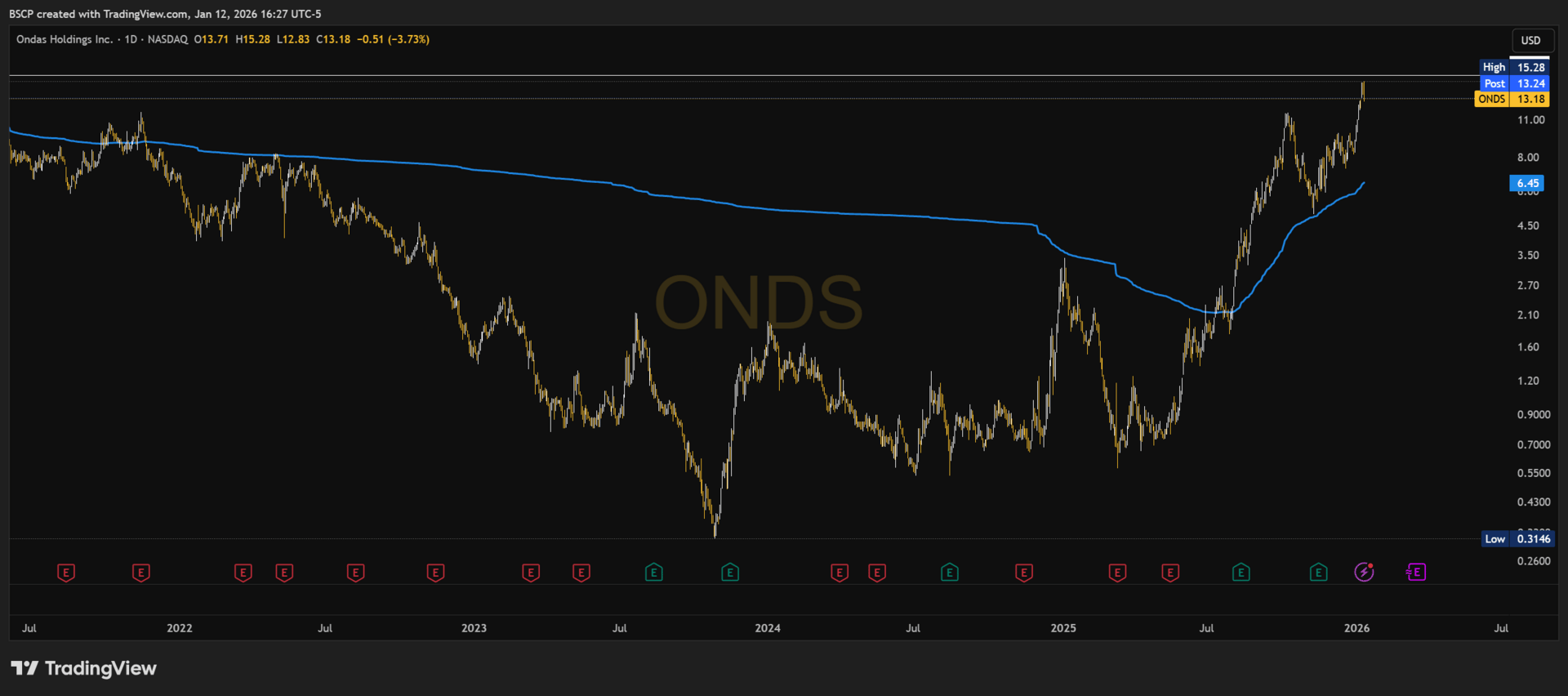

$ONDS

IPO AVWAP reclaim around $2.20 → $15 ≈ +582%

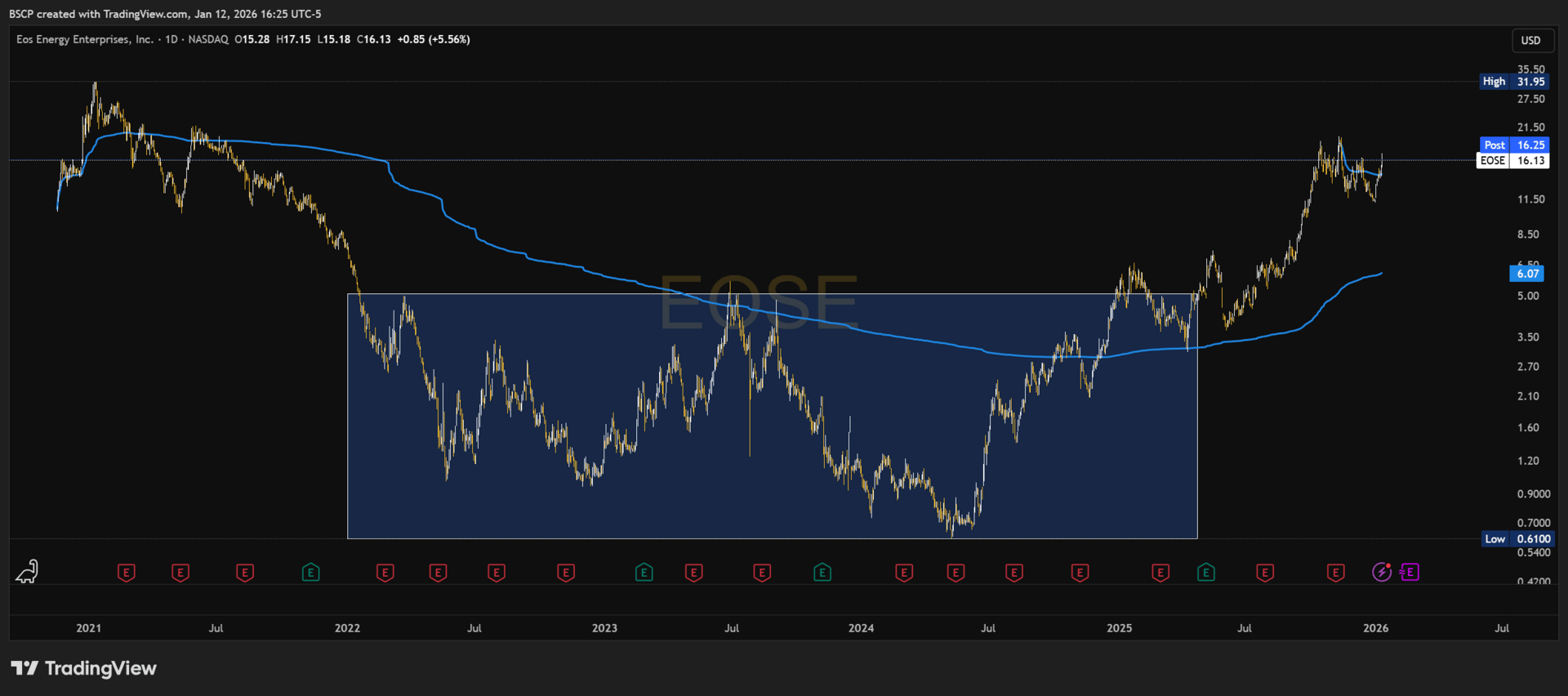

$EOSE

IPO AVWAP reclaim around $3.15 → $19 ≈ +503%

No perfect timing.

No macro calls.

No heroic entries.

Just alignment with the point where long-term capital flipped from underwater to in profit.

That’s the part most people miss.

IPO AVWAP isn’t about predicting upside.

It’s about removing structural resistance.

Why VWAP matters most when everything else breaks

There are moments when traditional structure fails:

The 200-day gets lost

Channels break

Moving averages flatten into noise

This is where most people either panic — or freeze.

Anchored VWAP doesn’t disappear in those moments.

It often becomes the only level that still matters.

Not because it’s magical — but because it’s where capital remembers committing.

Why this framework works best in growth stocks and recent IPOs

This approach isn’t universal.

It’s most effective in growth stocks — especially companies that have gone public in the last 4–6 years.

Why?

Because in newer IPOs:

The shareholder base is still forming

Cost basis is tightly clustered

There’s less “forgotten” capital from decades ago

Memory is cleaner and more relevant

In mature stocks, legacy holders, buybacks, and decades of distribution dilute the signal.

In newer growth names, IPO AVWAP is the memory.

It represents:

The average cost of the earliest public capital

Where institutional positioning first anchored

The line that separates early belief from regret

That’s why reclaiming IPO AVWAP in growth stocks often marks a regime change, not just a bounce.

Below it, rallies struggle.

Above it, trends breathe.

This is also why the biggest percentage expansions tend to happen in:

Companies still proving their model

Businesses exiting their first full market cycle

Stocks moving from skepticism to acceptance

IPO AVWAP doesn’t just tell you where price is.

It tells you when the market has decided the business deserves another look.

And in growth, that decision matters more than almost anything else.

How this shows up in my process

Very simply:

If a stock is below IPO AVWAP, it starts with a handicap

If it reclaims and holds IPO AVWAP, it gets my attention

If it holds above and uses it as support, I stop fighting the tape

This doesn’t guarantee upside.

It removes structural headwinds.

That alone changes the entire risk profile.

The part most people miss

VWAP isn’t about precision entries.

It’s about alignment.

Alignment with:

Where money actually entered

Where pressure flips from sell-side to buy-side

Where time stops being an enemy

That’s why VWAP is one of the only indicators I use on every chart I look at.

Not because it predicts the future —

but because it keeps me aligned with real money, not narratives.

If you’ve ever wondered why some stocks suddenly stop going down —

and others never seem to go up —

This is usually the level everyone ignored.

— Connor

Alpha Before It Prints

Editor’s note:

For the next few weeks, we’re keeping the Alpha Framework Portfolio publicly accessible via SavvyTrader.

This is the live portfolio started with $125,000 where we express posture, sizing discipline, and exposure — including names like Zeta — before ideas become consensus.

Updates to the portfolio can be followed via email or text for those who want visibility into changes as they happen — adds, trims, and exits — without needing to check in daily.

That portfolio will move back behind the paywall once this window closes.

One important detail on how this is set up:

Savvy does not allow retroactive edits, performance smoothing, or after-the-fact positioning.

Every add, trim, and exit is logged in real time, time-stamped, and publicly visible by design.

That constraint is intentional — it forces discipline and makes the portfolio a record, not a narrative.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe