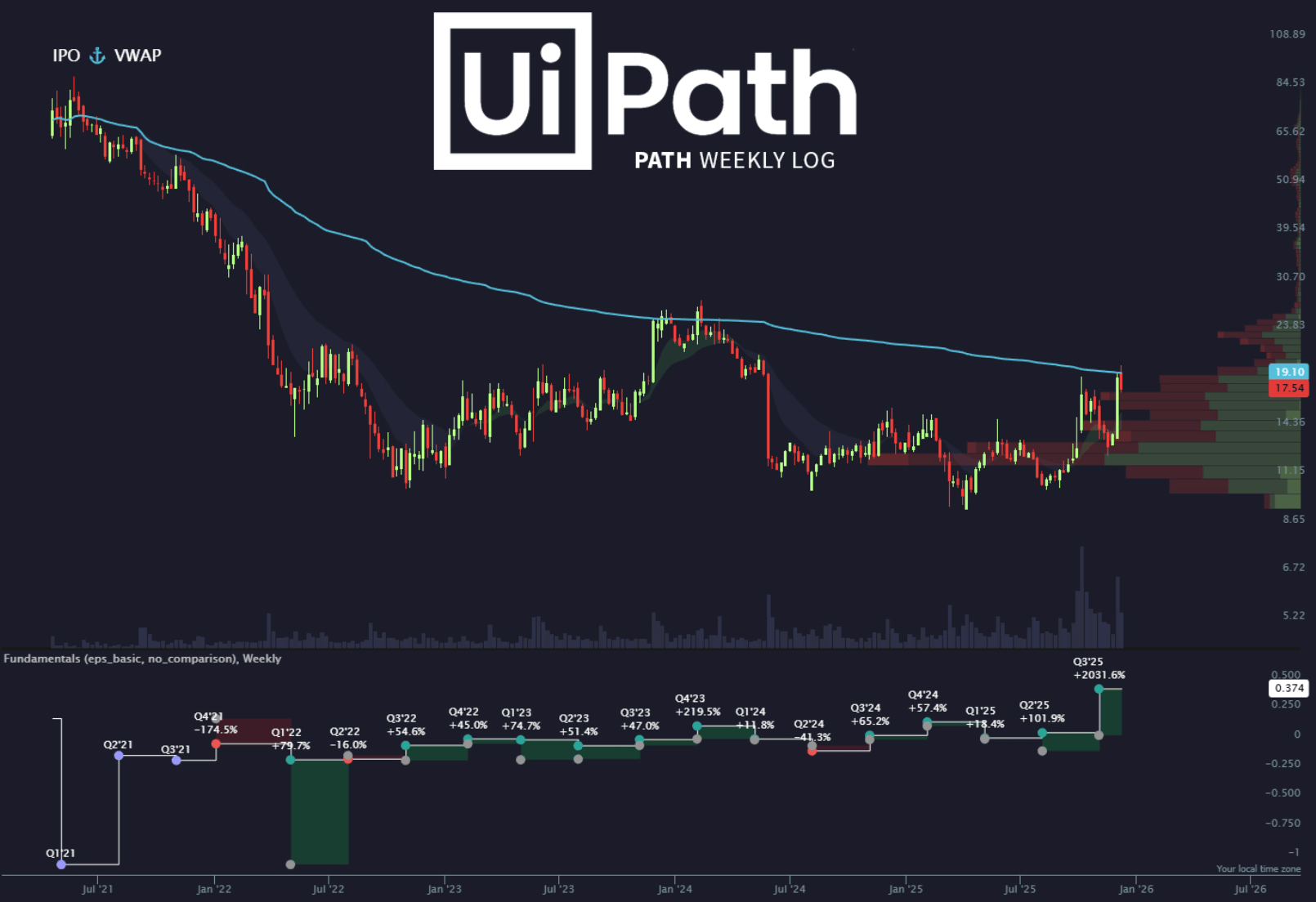

Most investors look at UiPath and stop at the chart.

Down roughly 80% from its highs.

Trading around $16–17.

Sentiment completely shot.

And the conclusion they land on is simple: this business is broken.

That conclusion doesn’t line up with reality.

When this thing breaks above the IPO AVWAP… look out

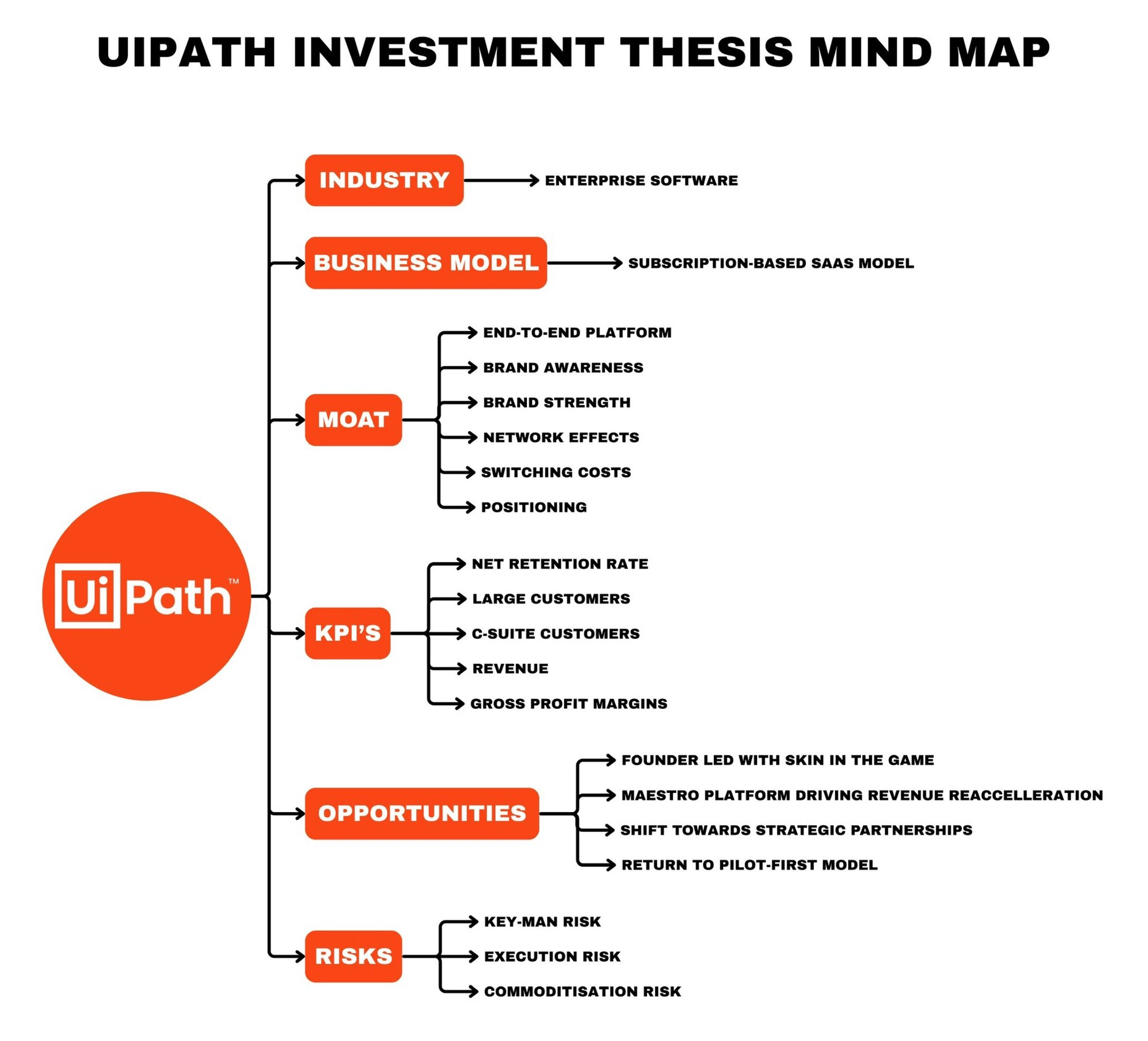

The business didn’t break — expectations normalized

UiPath is still a scaled, real enterprise software company:

~$1.3B in annual revenue

10,000+ customers

Deep penetration across the Fortune 500

Automation software embedded directly into mission-critical workflows

What changed wasn’t the relevance of the product.

What changed was the timeline investors were pricing in.

Enterprise automation adoption pulled forward during a narrow window when companies were aggressively modernizing operations. That pace was never permanent — but the underlying demand never disappeared.

Automation remains a necessity for organizations trying to:

Reduce cost pressure

Improve margins

Increase productivity without adding headcount

That structural need didn’t go away. It simply normalized.

The financial profile is improving — not deteriorating

This is the part the chart completely hides.

UiPath is now non-GAAP profitable

Free cash flow has turned positive

Operating leverage is beginning to show

Hiring has slowed and sales efficiency is improving

This is not a company scrambling to survive.

It’s a company transitioning into a more durable, self-funded operating model — one that can compound without relying on capital markets.

The balance sheet provides real downside protection

This is one of the most underappreciated parts of the story.

~$1.8B in cash and equivalents

Zero debt

Cash represents roughly 25% of the current market cap

That creates flexibility:

To weather slower enterprise spending

To invest selectively

To avoid dilution entirely

This is not a balance sheet priced for distress.

Valuation reflects extreme skepticism

At roughly 5× forward sales, the market is effectively saying:

“This business will never re-accelerate.”

That’s a strong assumption for a category leader in automation that is:

Profitable

Cash-flow positive

Still growing

Still deeply embedded inside large enterprises

You don’t need heroic assumptions for this to work.

You just need execution to remain steady.

Management stability is being misread

Founder Daniel Dines returning as CEO is often framed as a negative.

I see it as stabilizing.

He’s deeply technical, product-focused, and aligned with long-term value creation. The company has clearly shifted toward discipline, focus, and execution.

That’s not flashy — but it’s exactly what you want at this stage.

Bottom line

The chart looks bad.

The fundamentals are improving.

The balance sheet is strong.

Expectations are washed out.

What matters from here isn’t whether UiPath “works” as a business — it’s what the business is actually worth if execution simply continues.

That’s where opinion stops being useful and the model takes over.

Behind the paywall, I break down:

My forward revenue model for UiPath through FY28

The valuation framework I’m using and why

What UiPath is worth under reasonable execution, not perfection

The options structures I’m personally adding, including timeframe and rationale

This is where numbers replace narratives.

For readers who want to go a step further:

I also offer a separate, optional upgrade for live trade transparency through Savvy Trader.

That includes:

Real-time text and email alerts for every buy and sell

Full visibility into my personal portfolio

Position adds, trims, and exits as they happen

Alpha Premium gives you the why.

If you want access to the full Ui Path model showing my price targets through 2028 and how I’m positioning, that lives inside Alpha Premium.

— Connor

Alpha Before It Prints

Subscribe to Alpha Premium to read the rest.

Become a paying subscriber of Alpha Premium to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Full Alpha Framework Portfolio Allocation

- Weekly Alpha Notes (what changed, what matters, what’s noise)

- Weekly Macro Updates

- Position sizing & conviction levels for every holding

- Before-it-prints setups I’m watching early

- Priority ticker breakdowns (member requests reviewed weekly)

- Charts

- Micro-cap Home Runs