Under the hood, Tuesday showed us a labor market cooling, metals diverging, autos breaking, China slipping, and a Fed that’s already boxed in — all pointing to a clearing event, not a risk event.”

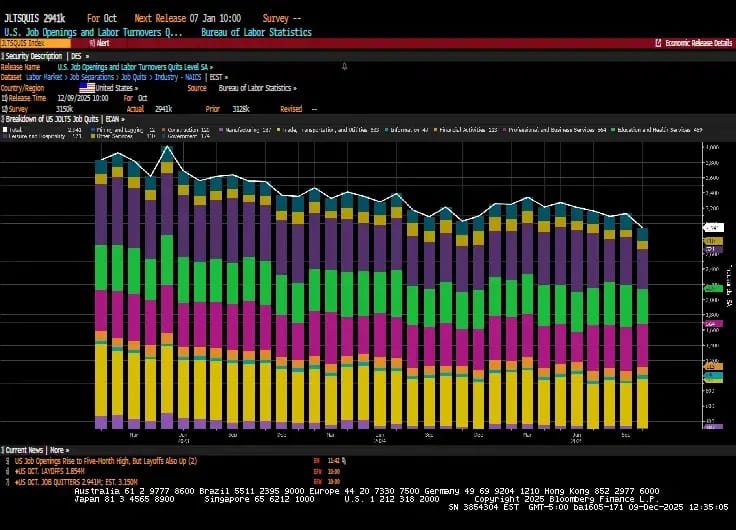

1. JOLTS Looked Strong — The Internals Weren’t

The headline JOLTS number beat expectations —

but the internals painted a very different picture:

• Quit rate → lowest in 5 years

• Layoffs → ticking higher

People aren’t quitting because they don’t feel confident in upgrading jobs.

That’s not strength — that’s the early stages of softening labor demand.

This is why yields and the dollar moved higher even with a “strong” report.

2. Silver Ripped Higher — But Gold Didn’t Confirm

Silver exploded over 4% today and broke out of a multi-week range.

But the move isn’t fully confirmed:

• Silver is extremely stretched

• Gold didn’t participate

• Historically, Silver-only breakouts fade fast

It’s a bullish development —

but not a signal you blindly chase without confirmation.

3. Auto Parts Retail Quietly Broke — And It Matters

AutoZone fell almost 8% — its worst day since April — after another earnings miss.

But the real story is the technical damage:

• Multi-month topping pattern confirmed

• Major support broken

• Heavy volume on the breakdown

ORLY, AAP, and GPC all followed lower.

This group has shifted from “defensive safety plays” to early-cycle underperformers.

4. China Slips Again — FXI Lost Its Recent Uptrend

Despite new stimulus messaging out of Beijing, Chinese equities weakened again.

FXI broke below a short-term uptrend and now sits just above its November lows.

China has been stuck in a trendless, choppy range for months.

Today didn’t change that — it reinforced it.

5. FOMC Expectations: A Hawkish Cut Is Already Priced In

Prediction markets show 93% odds of a 25 bps cut tomorrow.

But the cut itself isn’t the catalyst — the removal of uncertainty is.

Here’s what actually matters:

• QT ended on Dec 1

• Fed is effectively absorbing ~$50B/mo in Treasuries

• Labor markets are cooling

• Inflation continues to soften

• Investors just want this meeting behind them

This is a market clearing event, not a risk event.

Even a hawkish tone won’t surprise anyone.

The setup into year-end still leans higher.

6. Streaming Wars: Paramount Just Hit Netflix With a Counterpunch

Netflix thought it secured Warner Bros. with a $72B deal.

Paramount responded with a $108B hostile all-cash bid backed by sovereign wealth financing.

This signals two things:

1. The streaming wars are far from over

2. The government is becoming an active player in competitive outcomes

That regulatory angle is not priced into valuations yet.

My Read Going Into FOMC

Here’s the common thread across every asset today:

Markets aren’t pulling back — they’re clearing the runway.

• Labor market softening beneath the surface

• Silver running without confirmation

• Autos breaking down

• China slipping

• Fed cutting

• QT over

• Liquidity improving

• Volatility refusing to expand

This isn’t fear.

This is positioning.

Tomorrow isn’t about the cut itself —

it’s about what markets do once the uncertainty disappears.

And relief rallies don’t wait for permission.

— Connor

Alpha Before It Prints

A quick note on how I express conviction

For anyone wondering how this framework translates into actual positioning:

I run two live portfolios that reflect two very different parts of my thinking.

The Black Sheep Base Case Portfolio is exactly what it sounds like — core positioning for how I expect the broader market to resolve when structure matters more than headlines.

The Alpha Framework Portfolio is different.

That’s where I take long-term swings on smaller companies I believe can materially outperform over full cycles — names that usually look wrong before they look obvious.

A few past examples from that framework:

HIMS — $8.36 → +722% (ATH)

SOFI — $5.84 → +452% (ATH)

PLTR — $26.58 → +679% (ATH)

LMND — $31.31 → +171% (ATH)

ONDS — $1.74 → +532% (ATH)

CIFR — $2.96 → +762% (ATH)

IREN — $5.97 → +1,161% (ATH)

No alerts.

No perfection.

A lot of patience.

That’s not a promise — it’s just context for how I think and how I size risk.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe