The market is doing exactly what it should be doing after a strong late-November move.

Grinding.

Rotating.

Frustrating anyone who’s either over-levered or glued to the five-minute chart.

This is not distribution.

This is digestion.

The market is bleeding out excess optimism without breaking structure — which is usually how the next move gets set up.

Big Picture

The broader trend is still up

The short-term tape is messy

Leadership (big tech) has been a headwind, not a collapse

Defensive sectors are weak — which matters more than most people realize

When defensives don’t work during a pullback, that’s usually not the start of something ugly.

It’s usually the opposite.

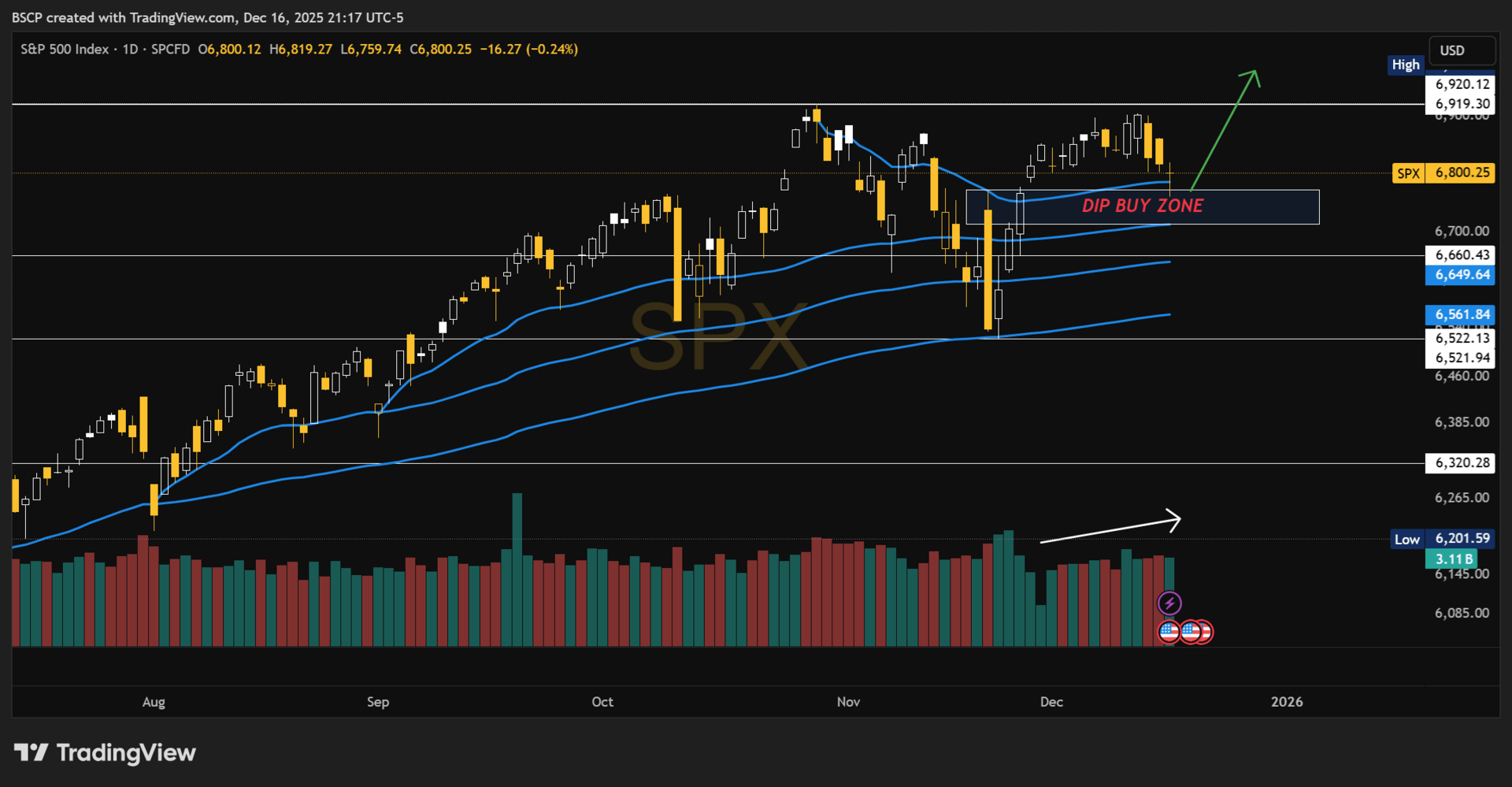

S&P 500: Controlled Pullback, Not a Breakdown

This pullback didn’t catch us off guard.

We planned for it.

In the Saturday Alpha Notes, I explicitly mapped out this scenario — including the dip-buy zone where the market is now trading.

That level was not reactive.

It was pre-defined.

Today, price traded directly into that zone.

This is exactly how healthy markets behave after strong advances:

they pull back into support, not through it.

Downside levels to respect remain the same:

First area: ~6750–6760

Stretch zone: ~6700

That second level matters. A clean break below ~6700 would change the conversation.

Until then, this is still consolidation — not breakdown.

Risk/reward improves as price moves deeper into areas that were identified before the volatility showed up.

If you missed it, you can revisit the original chart and thesis here:

👉 Saturday Alpha Notes — SPX Dip Buy Zone

Why This Feels Worse Than It Is

The pressure is coming from the names that matter most:

AAPL

NVDA

MSFT

GOOGL

When the heaviest weights stall, the index looks sick — even if the underlying structure is fine.

At the same time:

Small caps are breaking higher

Mid caps are breaking higher

Equal-weight indices already resolved up

That’s rotation, not risk-off.

If this were a real top, defensives would be screaming higher.

They’re not.

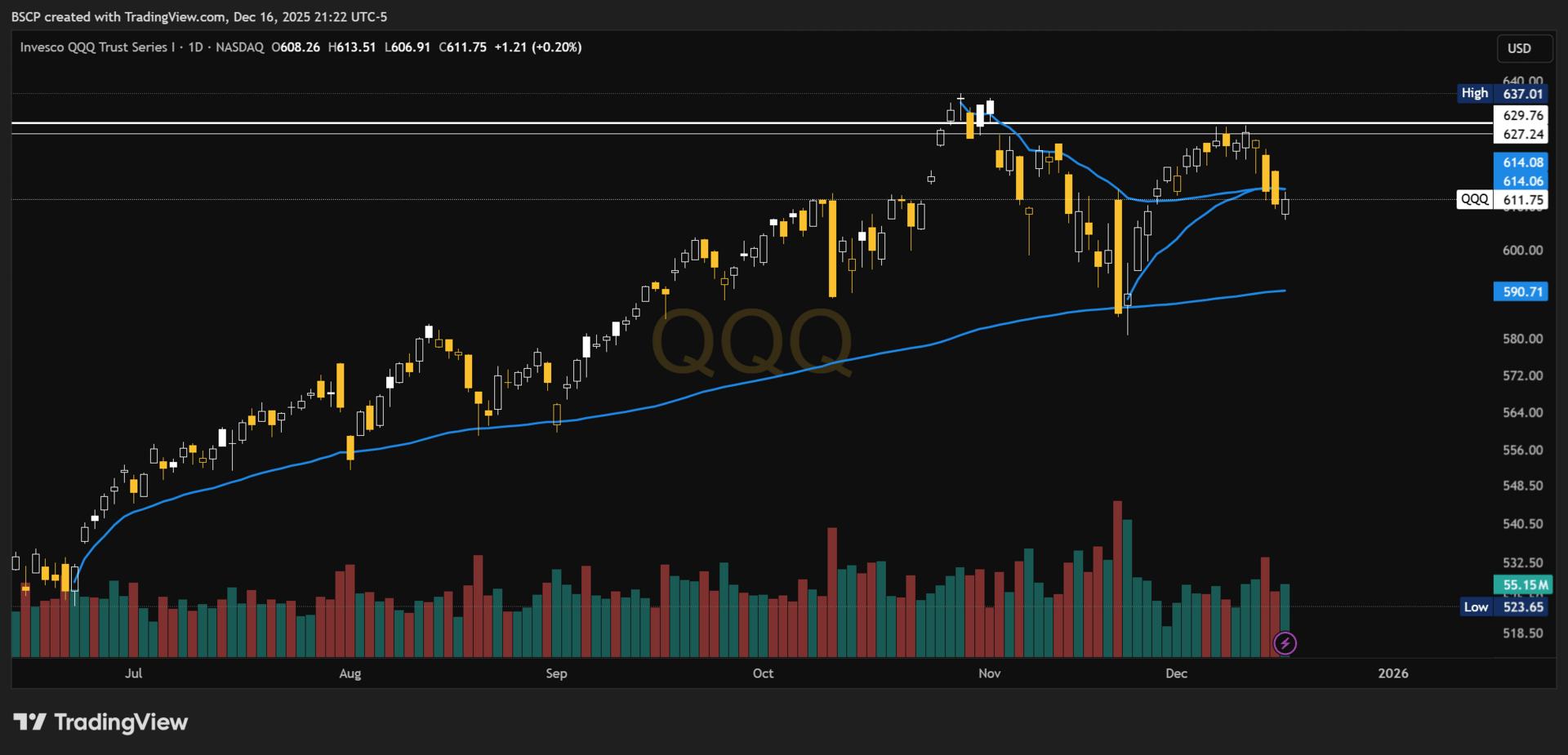

Technology: Weak, But Getting Close

Tech has been the problem — and that’s exactly why it’s becoming interesting.

The decline is starting to look overdone when viewed through timing and cycle lenses rather than pure momentum.

This does not mean straight-line upside tomorrow.

It means downside velocity is slowing.

NVDA: Short-Term Pain, Near-Term Bounce

NVDA matters — not because of hype, but because of weight.

The current setup suggests:

A cycle low forming late December

A bounce window opening between now and late February

A move that helps lift indices broadly

That does not mean a smooth 2025.

A tradable bounce can exist inside a choppier year.

MAG 7: Trend Still Intact (For Now)

Despite the noise:

Structure has not broken

November lows remain key support

As long as those hold, playing for a push back toward highs is logical.

Leaders rotate.

Trends don’t die quietly.

Portfolio Update (Free)

There are still only 15 total transactions in this portfolio since inception.

That’s intentional.

The market exists to move money from impatient hands to patient ones with a plan.

Today, I added 75 shares of $CIFR, as shown in the transaction log.

No reaction trade.

No short-term thesis change.

This is a continuation of a longer-duration position built with the expectation that volatility is the cost of admission.

I’m underwriting years — not weeks.

Upgrade to Alpha Premium — Founding Members keep $14.99/mo or $150/yr permanently.

A quick note on how I express conviction

For anyone wondering how this framework translates into actual positioning:

I run two live portfolios that reflect two very different parts of my thinking.

The Black Sheep Base Case Portfolio is exactly what it sounds like — core positioning for how I expect the broader market to resolve when structure matters more than headlines.

The Alpha Framework Portfolio is different.

That’s where I take long-term swings on smaller companies I believe can materially outperform over full cycles — names that usually look wrong before they look obvious.

A few past examples from that framework:

HIMS — $8.36 → +722% (ATH)

SOFI — $5.84 → +452% (ATH)

PLTR — $26.58 → +679% (ATH)

LMND — $31.31 → +171% (ATH)

ONDS — $1.74 → +532% (ATH)

CIFR — $2.96 → +762% (ATH)

IREN — $5.97 → +1,161% (ATH)

No alerts.

No perfection.

A lot of patience.

That’s not a promise — it’s just context for how I think and how I size risk.

Subscribe to Alpha Premium to read the rest.

Become a paying subscriber of Alpha Premium to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Full Alpha Framework Portfolio Allocation

- Weekly Alpha Notes (what changed, what matters, what’s noise)

- Weekly Macro Updates

- Position sizing & conviction levels for every holding

- Before-it-prints setups I’m watching early

- Priority ticker breakdowns (member requests reviewed weekly)

- Charts

- Micro-cap Home Runs