Trump’s Robotics Order Just Unlocked the Next Multi-Year Trade

Trump’s new Executive Order on robotics is the first true catalyst this sector has had in years. Regulation usually slows innovation, but this time Washington accidentally poured gasoline on an industry that has been quietly building the next industrial supercycle.

Most people will sprint to Twitter and fire off hot takes. CNBC will mispronounce half these tickers. And the majority will chase whatever pops first.

But robotics is not one category — it’s an ecosystem. Hardware, software, automation, medical robotics, defense robotics, logistics robotics… each with its own leaders, laggards, and hidden gems.

Here’s the cleanest breakdown of the space:

Now let’s get into what actually matters — the names that stood out on my first pass, based on a blend of fundamentals, technicals, and my personal portfolio framework.

These aren’t consensus picks. These are the types of early mispricings I’ve built Alpha Before It Prints on.

My Robotics Watchlist (With Personal Ratings)

Everything below reflects my own portfolio lens, not financial advice.

Ratings: Buy / Small Buy / Small Spec Buy / Watch

PATH — UiPath

Rating: Buy

PATH crushed earnings today — clean beat across the board, margin expansion, top-line strength, and guidance that puts them back in the driver’s seat of enterprise automation.

PATH isn’t a follower in this trend — it is the automation trend.

And with the chart turning a major corner, this is a legit Buy for me.

TSLA — Tesla

Rating: Buy

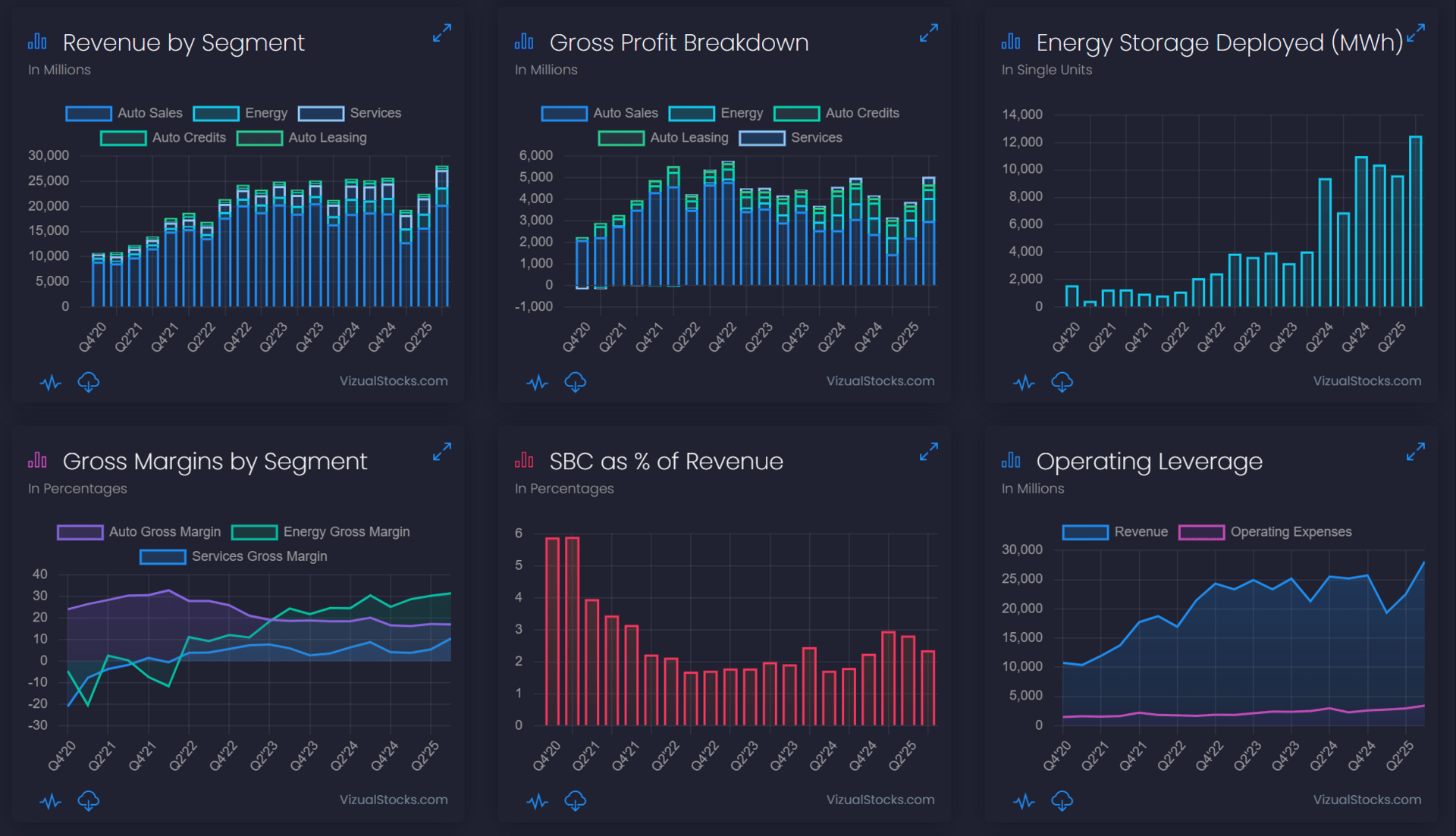

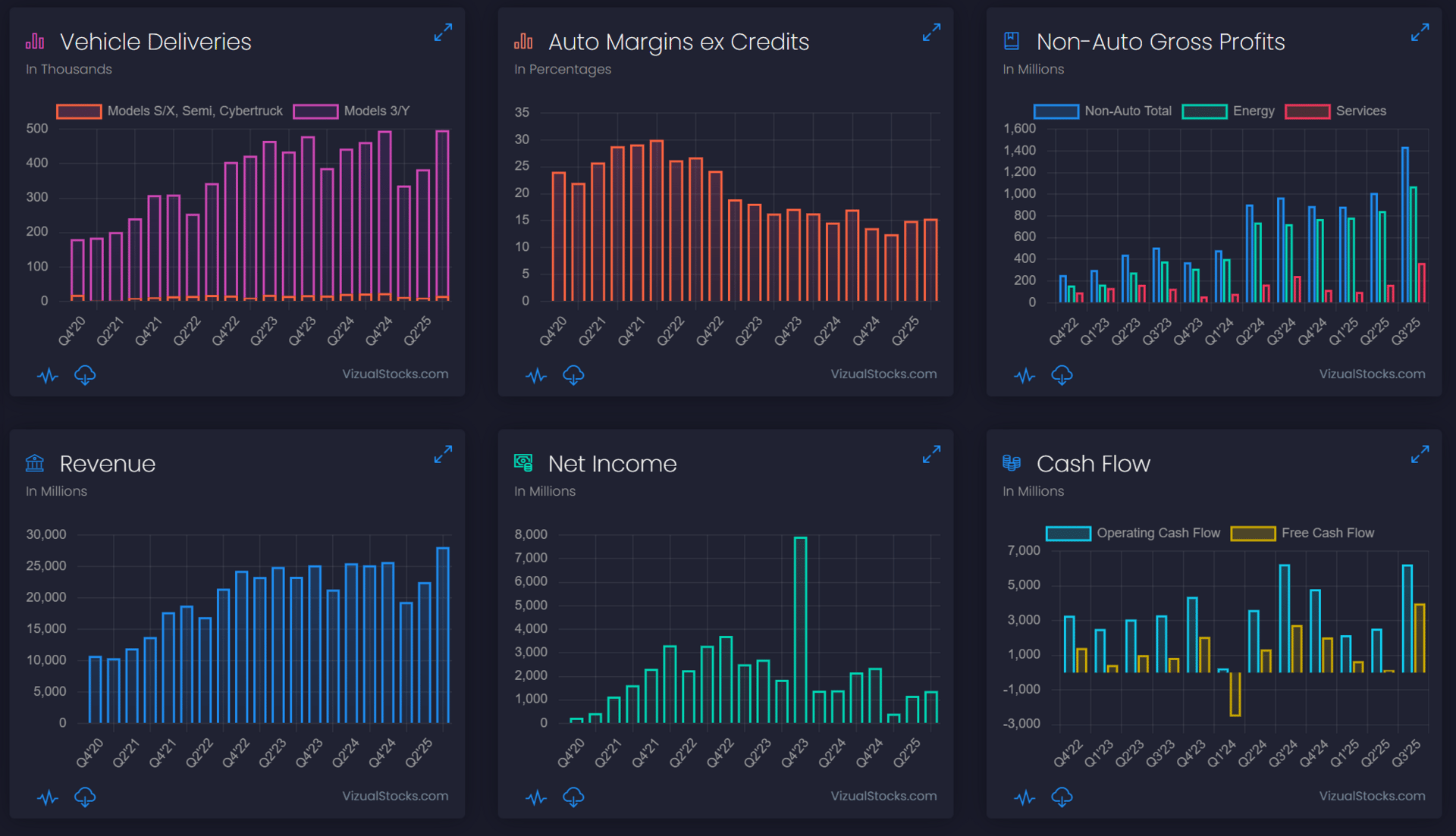

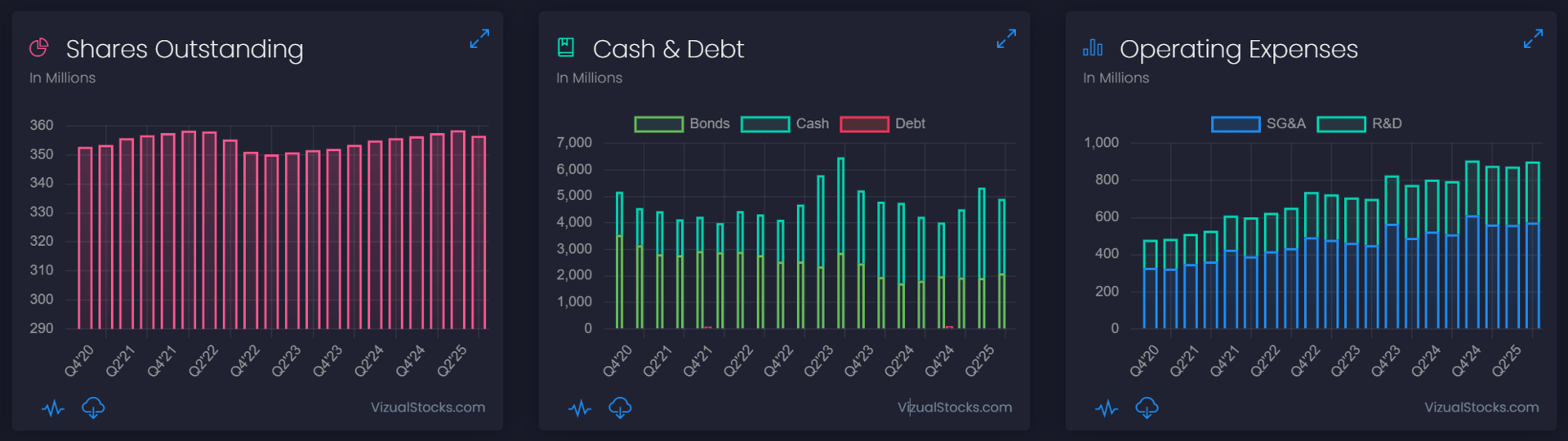

Tesla’s auto numbers look rough right now — no sugarcoating it.

Margins have compressed, ASPs slid, profits per vehicle dropped, and inventory days are climbing. The charts lay it all out clearly:

Profit per vehicle down dramatically from the peak

Auto gross margins ex-credits at multi-year lows

ASPs trending down faster than COGS

Vehicle deliveries stagnating

Inventory in days of supply elevated

Operating expenses creeping higher

This is exactly why everyone on FinTwit is bearish.

But here’s where they’re missing the plot:

Tesla’s stock is no longer priced on today’s auto business — it’s priced on the optionality of autonomy, robotics, and their AGI-driven future.

Let’s walk through the real data that matters:

1. Energy is quietly becoming a monster business

Energy revenue: up and to the right

Energy storage deployments: exploding

Energy gross margins: holding steady and improving

Non-auto gross profits trending up consistently

Energy is becoming Tesla’s AWS — the reliable, scaling, high-margin business that Wall Street still values like a side hustle.

2. Operating leverage is re-emerging

Despite the softness in auto, Tesla’s total revenue still grinds higher, and OpEx remains relatively flat.

The chart says it plain:

Revenue up.

OpEx flatish.

That’s the recipe for future margin expansion once the cycle turns.

3. The real upside is not cars — it’s autonomy + robotics

This is why TSLA remains a Buy for me.

• Full Self-Driving (FSD)

If FSD solves even 80% of real-world driving, the financial model changes from selling cars to selling software + licensing an autonomy stack.

• Robo-taxi network

This is the holy grail — a global ride-hailing platform that operates with near-zero labor cost.

Uber with 100% margin on the driver side.

• Optimus

Tesla’s humanoid robot is the biggest underpriced asset in the entire robotics sector:

It already performs basic tasks

It leverages Tesla’s massive real-world AI training engine

It plugs into Tesla’s vertical manufacturing advantage

It creates the world’s largest robotics data moat

If Optimus hits commercial viability, Tesla becomes the first trillion-dollar robotics company.

• Real-world AI

No one else on the planet has billions of real-world miles to train an AI system capable of autonomy + robotics. That is Tesla’s true monopoly.

You’re not buying auto margins.

You’re buying the world’s largest real-world AI training engine.

4. Balance sheet strength buys them time

Cash rising.

Debt shrinking.

Negative quarters don’t kill Tesla — they give them a reset while competitors bleed out.

5. The chart doesn’t lie

TSLA is in a long basing structure — the kind of multi-month reset that historically precedes massive multi-year runs when the narrative flips.

Catalyst for that narrative flip?

Anything autonomy.

Anything robotaxi.

Anything Optimus.

Bottom Line:

Auto numbers suck.

Energy is quietly ramping.

Margins are cyclical.

But autonomy + robotics is forever.

TSLA is a Buy because it’s not a car company anymore — it’s the most advanced real-world robotics platform in the world, and the world still hasn’t priced that in.

CGNX — Cognex

Rating: Watch

Great higher-low setup. Clean pivot to define risk.

But I want confirmation before allocating capital here.

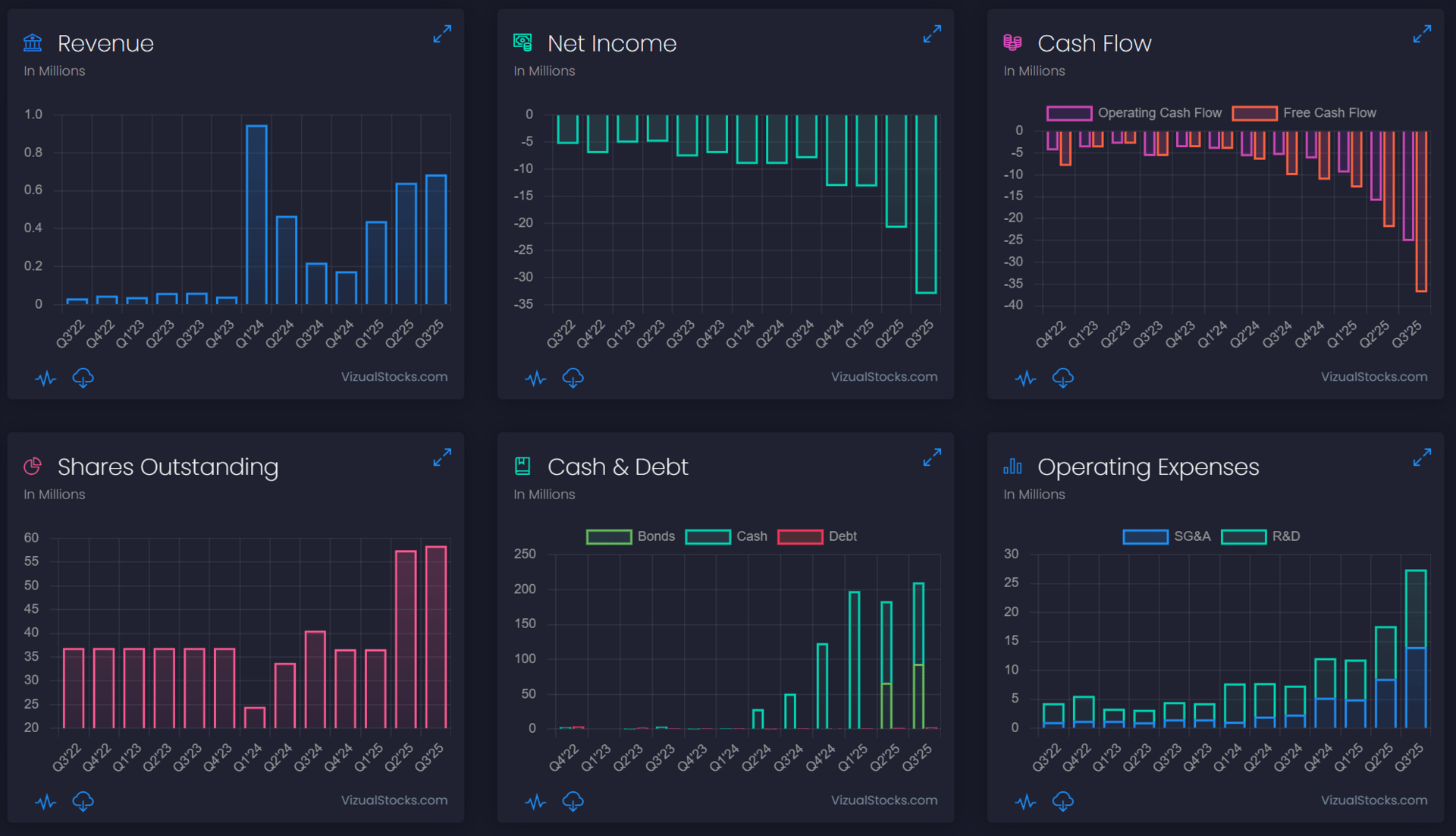

PDYN — Paladin AI

Rating: Small Buy

Microcap + high risk + early bottoming behavior.

Forward estimates look bullish.

This is a “toe-in-the-water” position — a small buy, not a full swing.

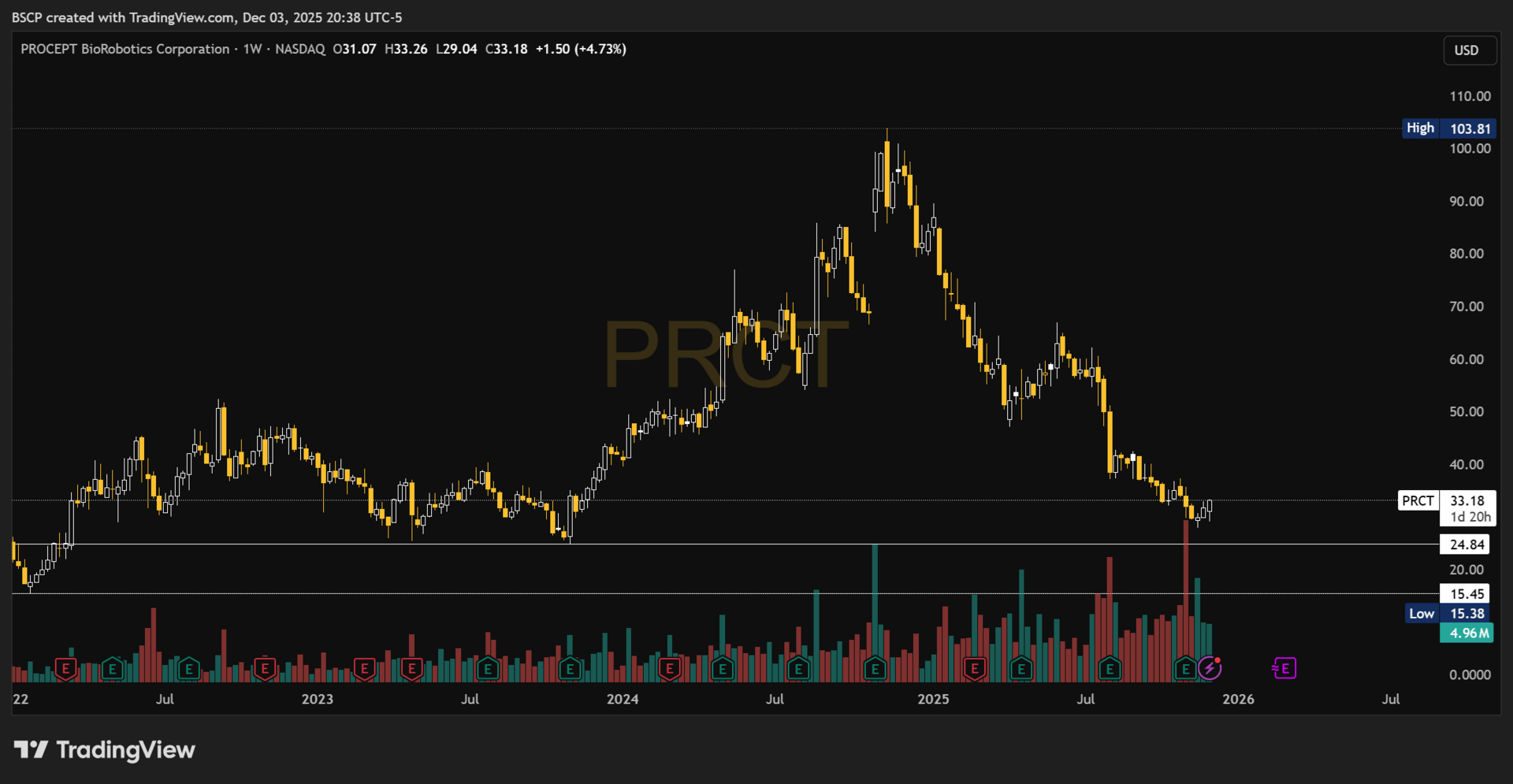

PRCT — PROCEPT BioRobotics

Rating: Buy

One of the cleanest bottoming structures in med-robotics. Accumulation showing up. But the real story is that PRCT is moving toward cash-flow positive operations.

Once a small-cap robotics company can fund its own growth:

Dilution risk drops

Multiples expand

Institutions take notice

This is a textbook early-cycle Buy for me. Chart looks to have found a bottom.

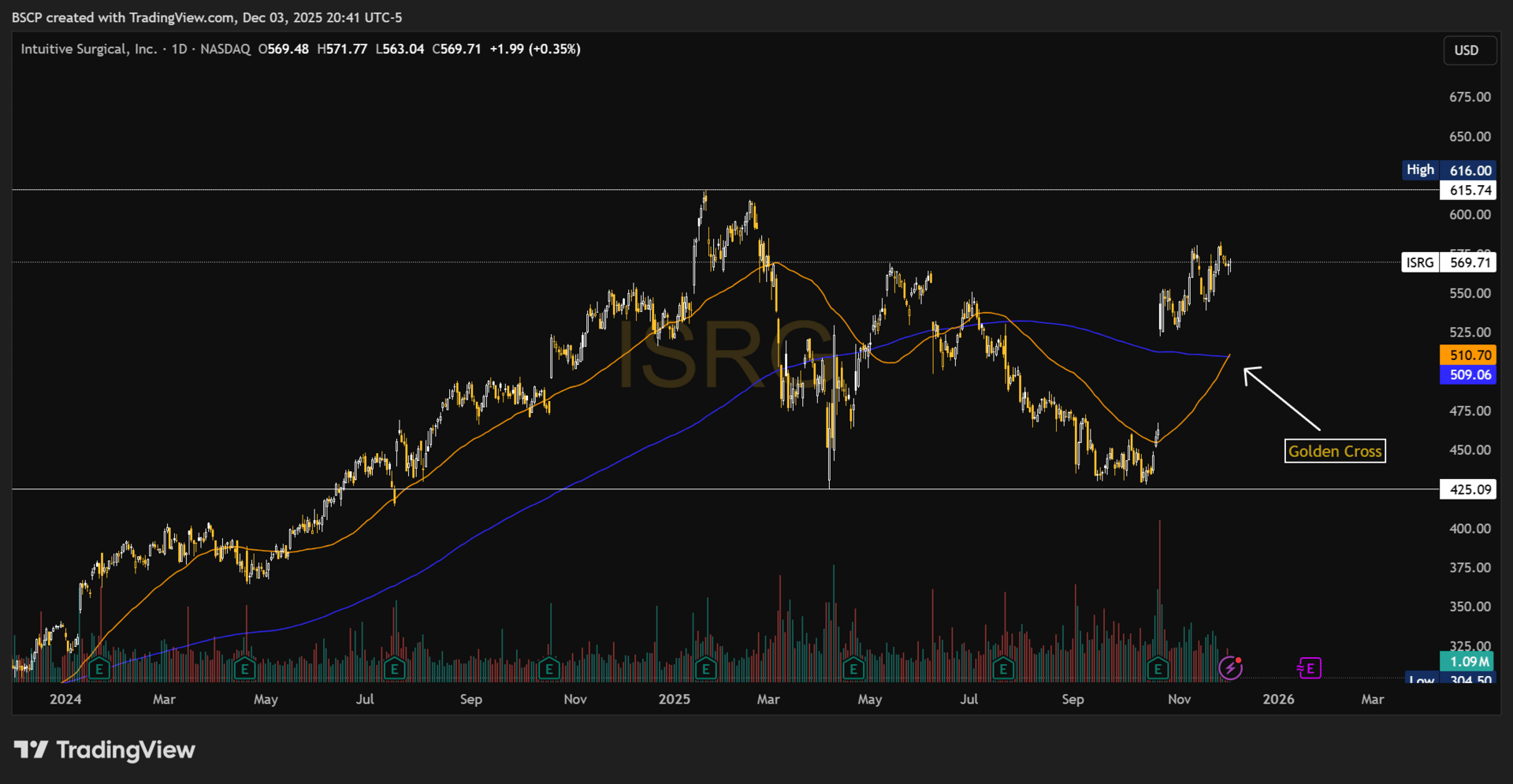

ISRG — Intuitive Surgical

Rating: Buy

This is the name everyone calls “fully valued”…

until they actually read the numbers.

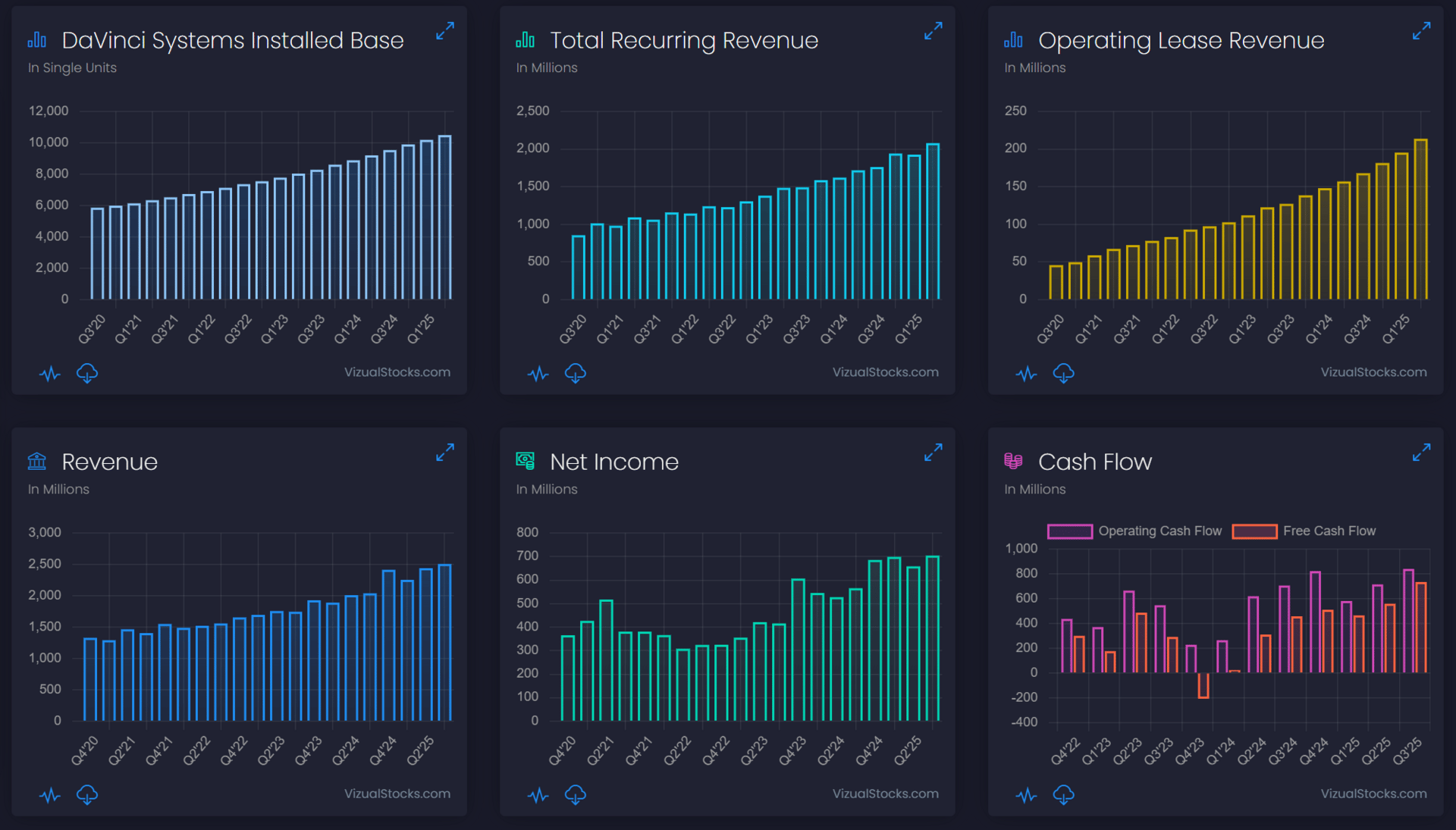

Here’s what’s happening under the hood:

• 23% revenue growth + massive EPS double beat

ISRG posted $2.40 EPS vs $1.99 expected, with 23% revenue growth — a $100M beat.

This is not how $200B med-tech companies usually behave.

This is acceleration.

• 19% procedure growth is the key

Procedures drive recurring revenue, operating leverage, and future upgrades.

ISRG crushed expectations here too.

• dV5 rollout is becoming an upgrade super-cycle

427 systems installed in Q3, with projected 17–17.5% growth ahead.

• Operating income up 30%

Free cash flow per share is now $6.36.

Substantial leverage emerging.

• EPS runway toward $10+

If they execute even moderately, ISRG can push toward double-digit EPS.

Technical setup:

A golden cross is imminent.

RSI made new highs.

Stock is consolidating just under heavy resistance at $600 — classic pre-breakout behavior.

Analysts can call it a Hold.

I call it a Buy.

This is how multi-year compounders set up before the next leg.

SERV — Serve Robotics

Rating: Buy (Small — startup stage)

SERV is still essentially a startup, which means the only way to approach it is with disciplined, small sizing — but the setup continues to be one of the better asymmetric plays in early-stage robotics.

Pushing straight into a major supply zone. This level has rejected price multiple times, so a short-term pullback or consolidation here wouldn’t surprise me. That’s normal behavior when you hit real overhead supply for the first time.

But the structure underneath it is what matters:

1. The base is real

SERV has a proper multi-month bottom, reclaimed trend, and is now knocking on the first door that needs to break before a bigger move can happen.

2. Fundamentals have real upside potential

Forward estimates look strong for a company this early in its lifecycle.

If they execute, the rerating won’t be subtle.

3. How I’m playing it

• Buy shares for the long term — treat it as an early, high-upside robotics bet if the business proves itself.

• Calls sized small — sized for 0, so a total loss doesn’t matter, but the upside is meaningful if SERV delivers. - March 20, 2026 $15

This matches the reality: SERV is early. High potential, high volatility.

You use shares to participate in the long-term story — and small, defined-risk calls to amplify the upside without letting the downside hurt you.

Bottom line

Short-term consolidation is likely, but the structural setup hasn’t changed.

SERV remains a small, high-upside long-term buy, with the options sized small enough that a complete 0 is acceptable.

ATS — ATS Corp

Rating: Watch

Bottoming structure looks almost ready.

Estimates improving.

But I want another signal before stepping in.

ESLT — Elbit Systems

Rating: Watch

Strong defense-robotics name with a chart that wants higher — but needs confirmation.

KTOS — Kratos Defense

Rating: Buy

IF THIS BREAKS THE CURRENT JUNE 26 AVWAP LIKELY HEADING TO THE LEVELS BELOW

Bottoming process looks real.

Fundamentals strong.

If robotics becomes a national priority, KTOS will catch a bid quickly.

RTX — RTX Corp

Rating: Watch

Large-cap defense robotics exposure.

Chart looks constructive.

But not actionable yet.

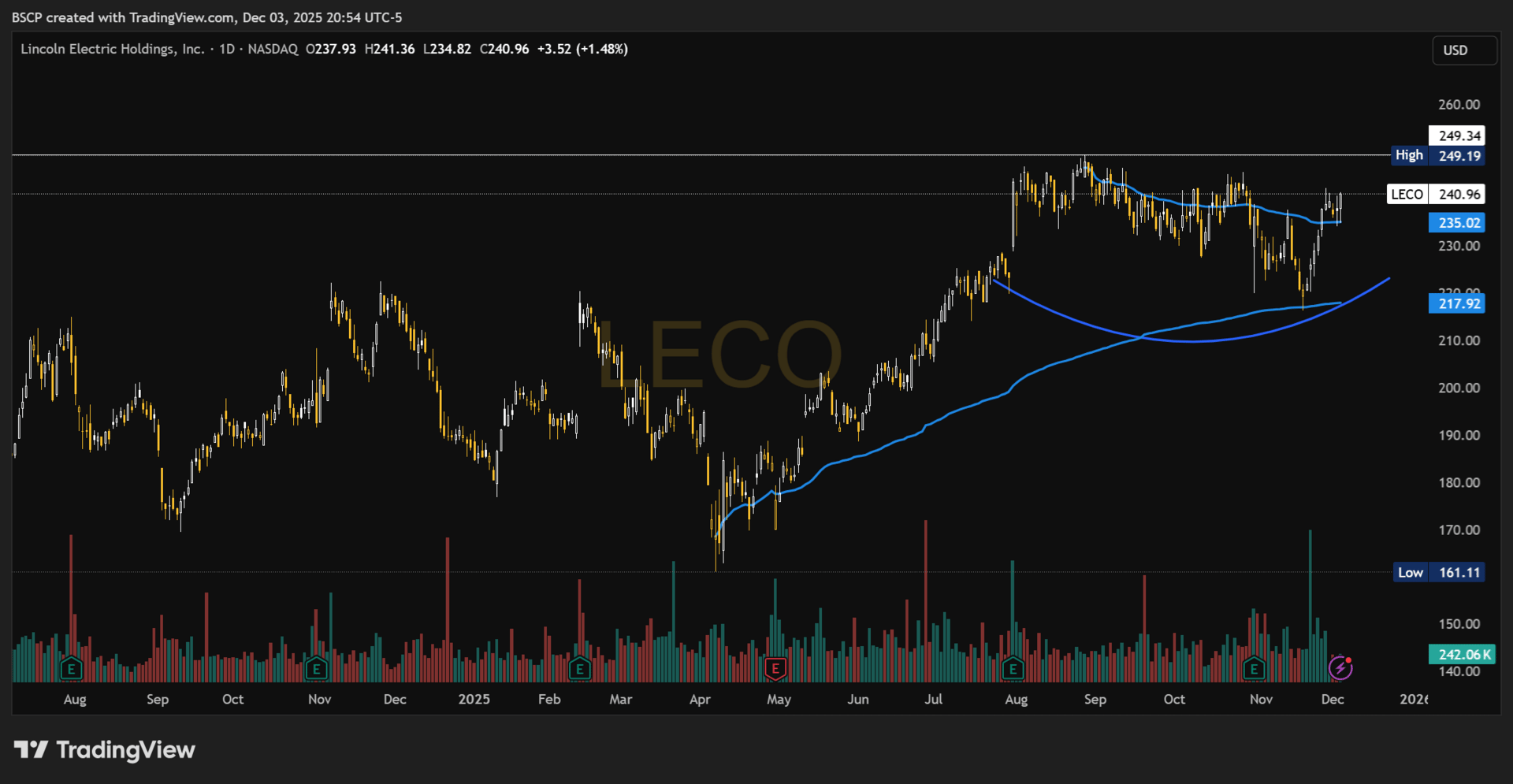

LECO — Lincoln Electric

Rating: Buy

One of the most bullish charts in the entire sector.

Fundamentals could be stronger, but price action is undeniable — and price always leads.

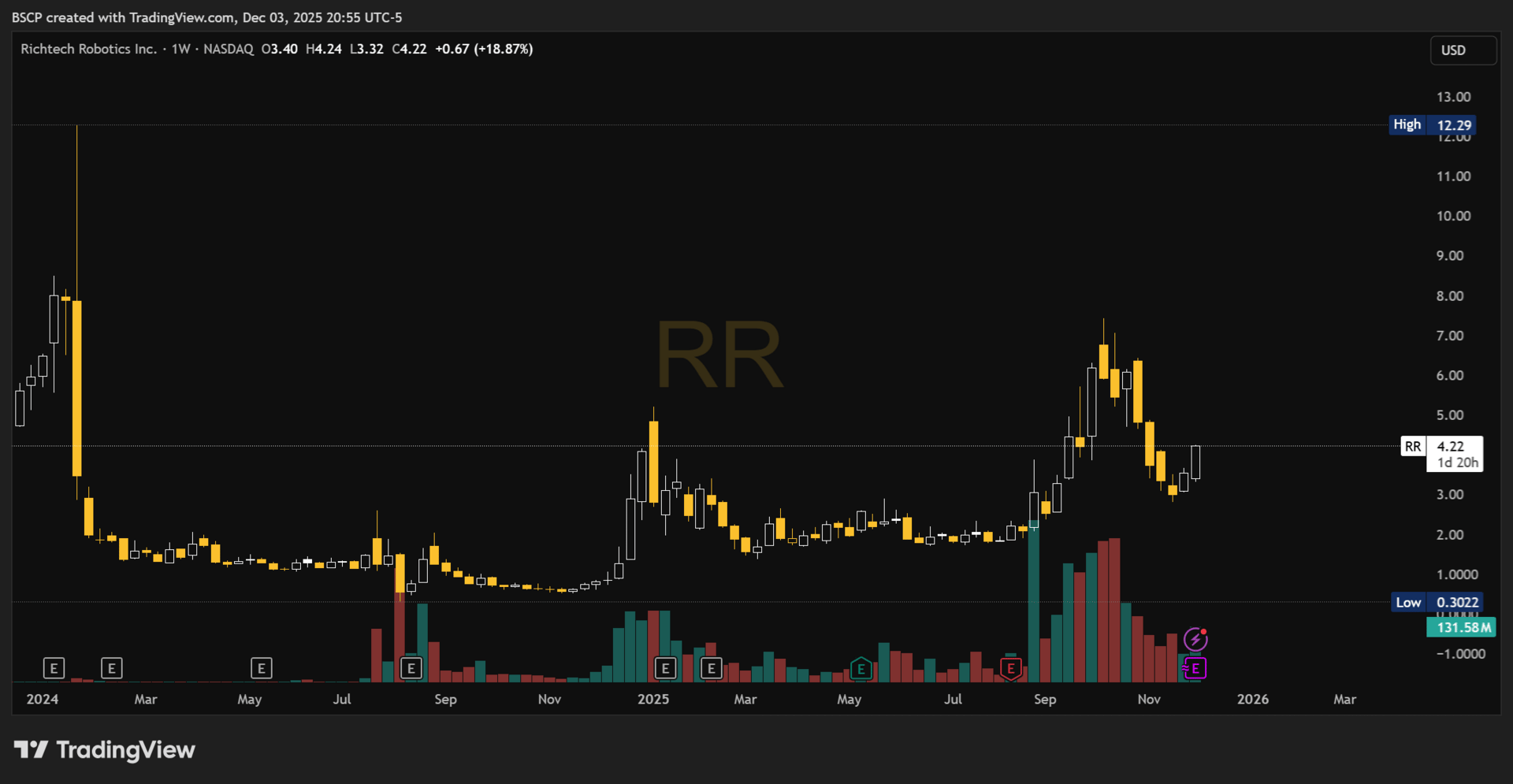

RR — Richtech Robotics

Rating: Small Spec Buy (startup stage)

RR has one of the cleanest microcap robotics charts you’ll find — clear accumulation, tight ranges, and a textbook base.

But again:

RR is still basically a startup.

That means:

Huge potential

Huge execution risk

Small position only

My approach:

March 20, 2026 $5 calls — defined risk, unlimited upside. Same sizing as SERV.

Final Thought

Everyone will chase the obvious robotics names.

But the real money is always made before the narrative forms — in the companies that look “too early” until suddenly they aren’t.

This Executive Order didn’t create the robotics supercycle.

It just exposed how badly the market has been mispricing it.

This is the moment where early conviction pays.

— Connor

Alpha Before It Prints

A quick note on how I express conviction

For anyone wondering how this framework translates into actual positioning:

I run two live portfolios that reflect two very different parts of my thinking.

The Black Sheep Base Case Portfolio is exactly what it sounds like — core positioning for how I expect the broader market to resolve when structure matters more than headlines.

The Alpha Framework Portfolio is different.

That’s where I take long-term swings on smaller companies I believe can materially outperform over full cycles — names that usually look wrong before they look obvious.

A few past examples from that framework:

HIMS — $8.36 → +722% (ATH)

SOFI — $5.84 → +452% (ATH)

PLTR — $26.58 → +679% (ATH)

LMND — $31.31 → +171% (ATH)

ONDS — $1.74 → +532% (ATH)

CIFR — $2.96 → +762% (ATH)

IREN — $5.97 → +1,161% (ATH)

No alerts.

No perfection.

A lot of patience.

That’s not a promise — it’s just context for how I think and how I size risk.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe