Why this matters:

The market is already pricing a more dovish Fed leadership outcome into 2026. The back-and-forth between Warsh and Hassett reflects uncertainty, but the direction is what matters — the Fed regime is shifting, and markets are front-running it.

Markets feel heavy right now.

It takes a lot of effort for stocks to move higher, but very little to knock them down. That’s exactly why inboxes are filling up with nerves, second-guessing, and “should we be worried?” conversations.

And that’s also why I still like the risk/reward into year-end.

Why Stocks Feel Awful (and Why That Matters)

We’re staring at a growing wall of worry:

Oracle headlines and AI funding noise

Venezuela and oil risk creeping higher

Political division and Fed chair uncertainty

Three-year equity gains making everyone feel late

Valuation anxiety around AI

Social and geopolitical tension everywhere you look

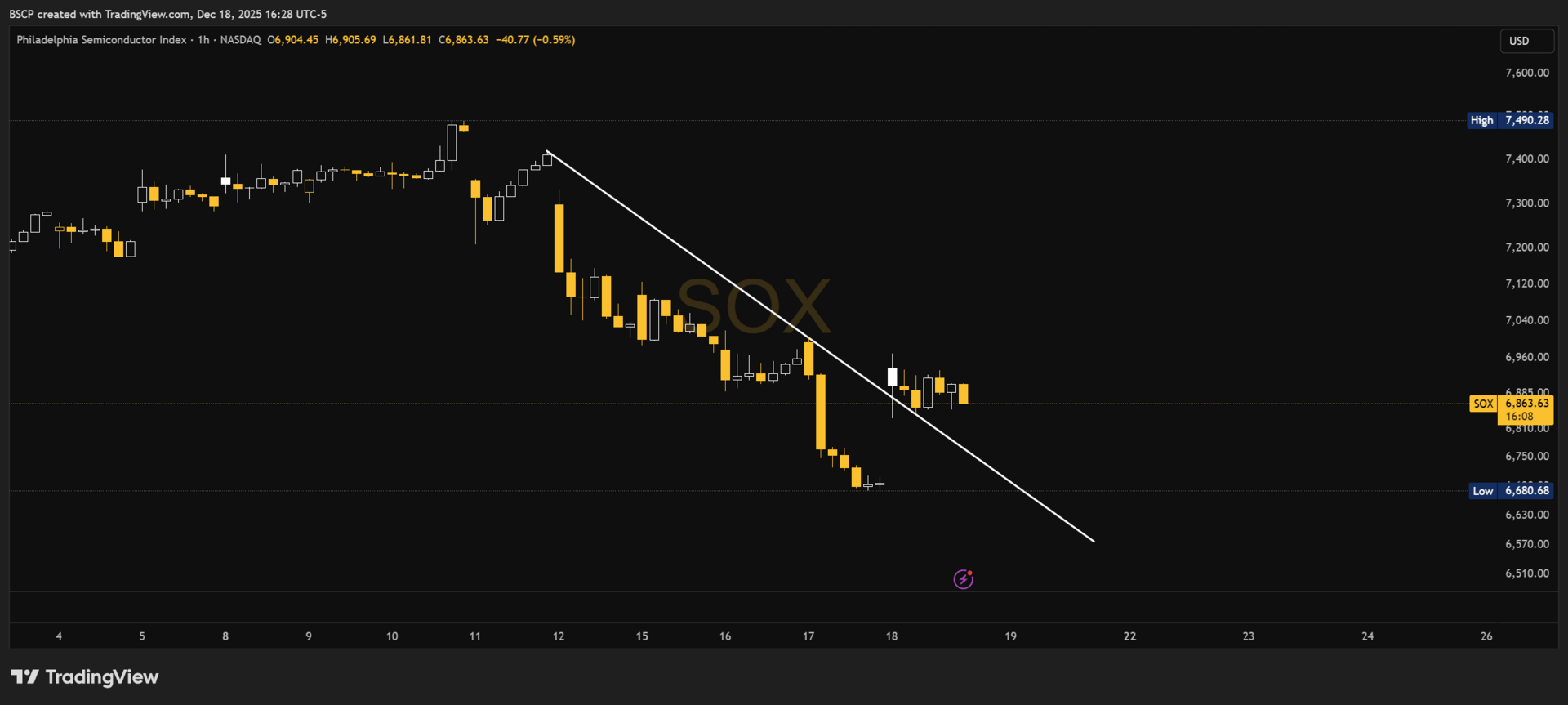

The market has been chopping lower within a very controlled pullback, not breaking structure — which is exactly how corrections behave in bull phases.

Historically, this is when rallies are born.

The Big Macro Shift Most People Are Missing

The most important change isn’t earnings.

It isn’t AI headlines.

It’s the Fed regime shift.

No Fed “put” since 2022 (inflation fight)

December FOMC: hikes are off the table

Cuts now tied to jobs, not inflation

QT ending → liquidity improving

2026 sets up for a structurally more dovish Fed

When the Fed’s priority shifts to protecting employment, the fastest lever they have is the wealth effect.

That’s a Fed “put” on stocks.

CPI Isn’t the Risk People Think It Is

This CPI print is unusual, but the signal is clear:

Inflation is falling faster than expected

Policy error risk is declining

The Fed has room to stay accommodative

A tame CPI reinforces the idea that downside economic risk matters more than overheating.

Seasonality + Positioning = Asymmetric Setup

Late December is historically strong.

Stocks are short-term oversold.

Sentiment is cautious.

Semiconductors breaking minor downtrends and consolidating is a tell — leadership isn’t breaking, it’s resetting.

Bottom Line

Seasonals remain supportive.

Liquidity is improving.

The Fed is no longer an enemy.

A ~5% move into year-end remains reasonable, putting S&P 500 ~7,000 as a base-case outcome.

What I Like Into Year-End

Large-cap growth / core leaders

Bitcoin & Ethereum

Energy & basic materials

Financials (large-cap and regionals) - $SCHWB 😉

Industrials

Select small-caps

— Connor

Alpha Before It Prints

A quick note on how I express conviction

For anyone wondering how this framework translates into actual positioning:

I run two live portfolios that reflect two very different parts of my thinking.

The Black Sheep Base Case Portfolio is exactly what it sounds like — core positioning for how I expect the broader market to resolve when structure matters more than headlines.

The Alpha Framework Portfolio is different.

That’s where I take long-term swings on smaller companies I believe can materially outperform over full cycles — names that usually look wrong before they look obvious.

A few past examples from that framework:

HIMS — $8.36 → +722% (ATH)

SOFI — $5.84 → +452% (ATH)

PLTR — $26.58 → +679% (ATH)

LMND — $31.31 → +171% (ATH)

ONDS — $1.74 → +532% (ATH)

CIFR — $2.96 → +762% (ATH)

IREN — $5.97 → +1,161% (ATH)

No alerts.

No perfection.

A lot of patience.

That’s not a promise — it’s just context for how I think and how I size risk.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe