Over the years, some of my highest-conviction investments were made when companies were still considered microcaps — messy, volatile, and easy to dismiss if you were anchored to clean quarters.

A few examples:

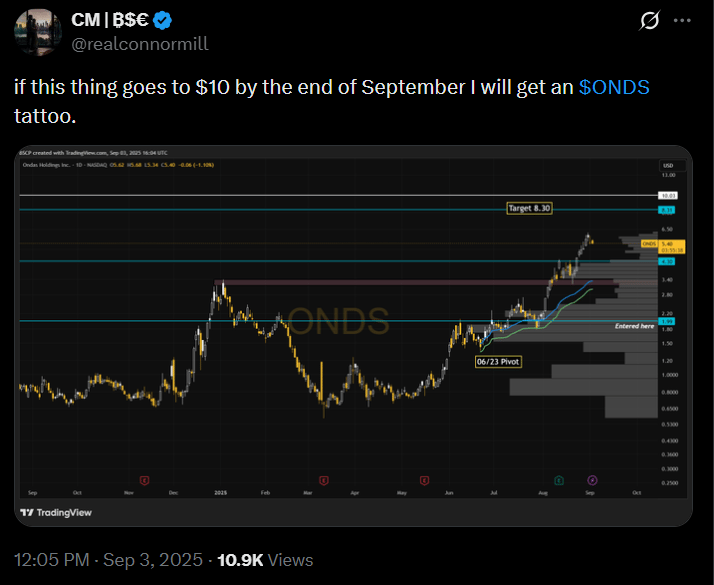

Ondas Holdings ($ONDS) — bought when it was still written off as niche infrastructure, later delivered a multi-hundred-percent move from my entry to its highs of $11 +

Good thing $ONDS went to $10 + after the month of September was over…

Cipher Mining ($CIFR) — positioned early, before scale and operating leverage became obvious to the market my first buy went from $2.96 to $25

Iris Energy ($IREN) — dismissed early, then violently repriced as fundamentals caught up to narrative… my first buy went from $5.97 to $80

None of these looked “easy” at the time.

All of them required being early — and being comfortable there.

Microcap Home Runs is where I document that process in real time.

Subscribe to Alpha Premium to read the rest.

Become a paying subscriber of Alpha Premium to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Full Alpha Framework Portfolio Allocation

- Weekly Alpha Notes (what changed, what matters, what’s noise)

- Weekly Macro Updates

- Position sizing & conviction levels for every holding

- Before-it-prints setups I’m watching early

- Priority ticker breakdowns (member requests reviewed weekly)

- Charts

- Micro-cap Home Runs