There’s a scene in The Shawshank Redemption that never leaves you.

Andy Dufresne crawls through a river of shit…

and comes out clean on the other side.

That’s what some stocks do.

When a business completely detaches from projected earnings and the disruptive narrative collapses, price doesn’t just fall — it gets abandoned.

The story breaks.

The holders leave.

The chart becomes unownable.

That’s where the Andy Dufresne pattern starts to form.

Not because the company is dead —

but because expectations have been fully flushed.

What an Andy Dufresne looks like

You’ll usually see:

A long, painful base

Narrative fatigue

Capitulation-level sentiment

No one defending the name anymore

Time doing the work, not price

If you don’t know what you own, these charts look toxic.

If you do, they’re exactly the setups that get interesting.

Below are examples of stocks that already made it out — each in a different way.

$IREN — Early Escape

Years of dead money.

Narrative broken.

Nobody watching.

That long base wasn’t boredom — it was capitulation.

Once the business survived long enough for reality to matter again, price didn’t drift higher.

It re-priced fast.

The escape always looks obvious in hindsight.

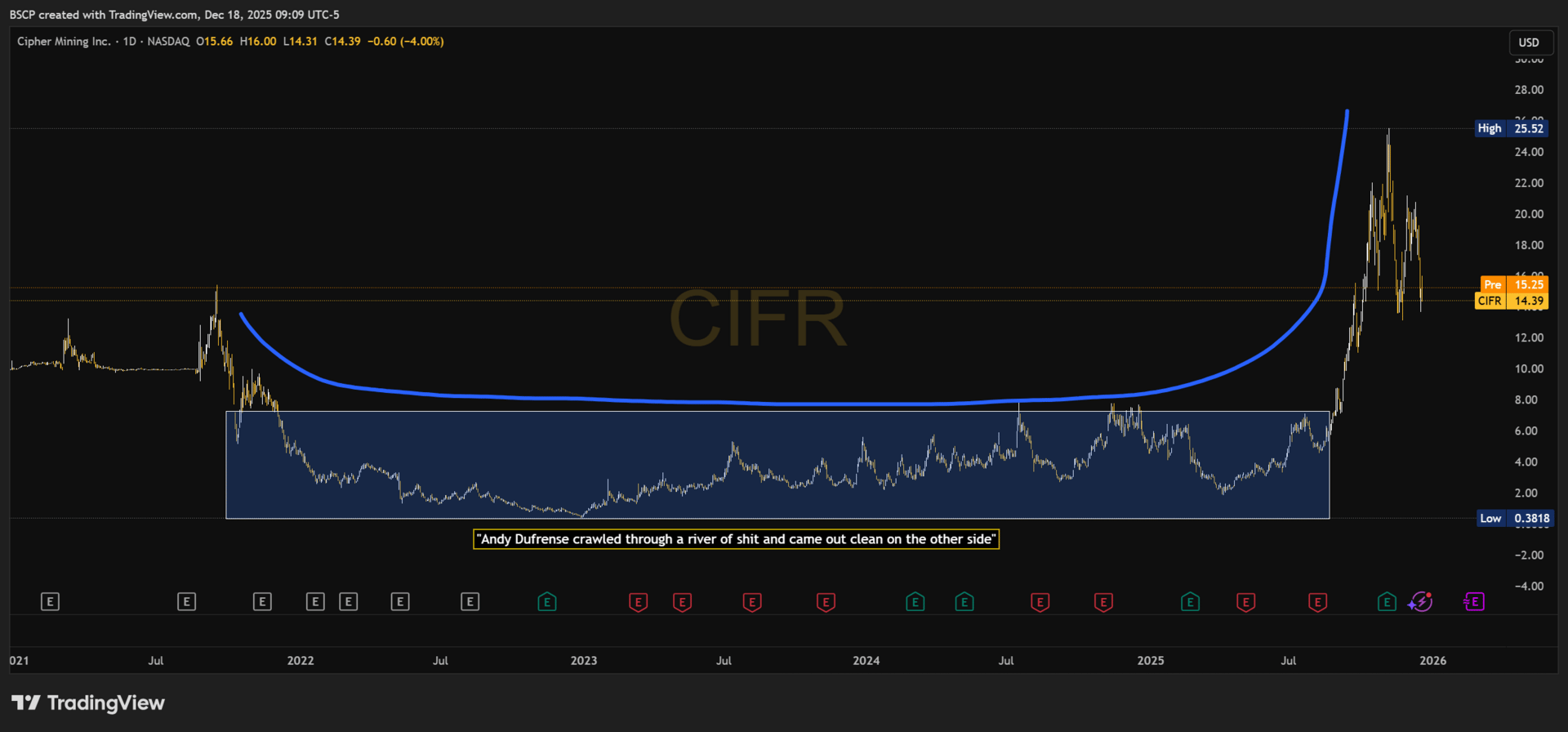

$CIFR — Violent Re-Rating

Long base.

No urgency.

No sponsorship.

Then fundamentals stopped getting worse — and price didn’t ask for permission.

This is what happens when expectations are crushed flat and suddenly forced to rebuild.

$HOOD — The Textbook Case

Few stocks have been as universally hated.

IPO hype.

Public backlash.

Regulatory noise.

Then came years in the box.

No narrative.

No defenders.

Just a business quietly fixing itself.

Once expectations reset, price didn’t grind higher — it snapped.

By the time it looked “safe,” the opportunity was already gone.

$SOFI — Post-Escape Digestion

Not every Andy Dufresne is a straight shot out.

This is what it looks like after the escape.

The breakout already happened.

Now expectations are being tested again.

If you know what you own, pullbacks are information.

If you don’t, they feel like failure.

That difference matters.

$LMND — The Long Crawl

This one didn’t sprint.

Peak hype.

Narrative collapse.

Years of quiet pain.

No hero moment.

No violent re-rating.

Just survival.

Some Andy Dufresnes crawl longer than others — and those are usually the hardest to hold.

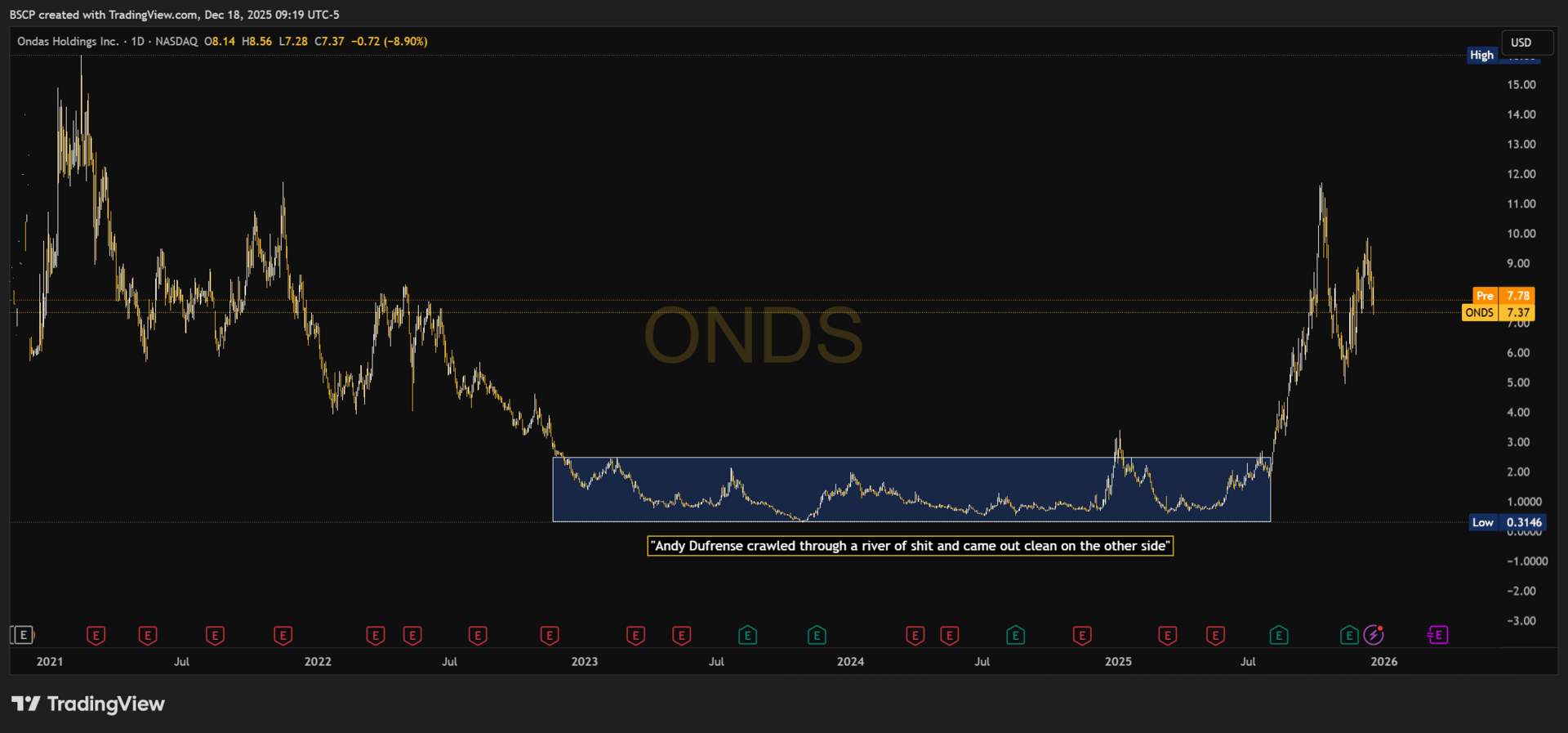

$ONDS — The Deep End

This wasn’t just a broken chart.

It was a broken company in the market’s eyes.

Liquidity questioned.

Relevance doubted.

Left for dead.

That base is where names disappear — not recover.

Survive long enough, and price eventually has to admit it was wrong.

$HIMS — Escape, Then Excess

This one ran too far, too fast.

Expectations reset…

then overshot.

The Andy Dufresne pattern doesn’t mean “straight up forever.”

It means expectations rebuild — sometimes irrationally.

Understanding that keeps you rational on both sides.

$PLTR — The One Everyone Mocked

Cult following.

Relentless skepticism.

Years of dead money.

The business executed while the market laughed.

That base wasn’t uncertainty — it was exhaustion.

Once expectations finally reset, price re-rated an entire decade of disbelief in months.

This is the Andy Dufresne at full scale.

Still in the Tunnel

Not every Andy Dufresne has escaped yet.

Some are still crawling — and that’s where it gets uncomfortable.

These are not breakouts, just candidates still serving time.

$DLO

Hype came early.

Punishment came fast.

What followed was years of expectation compression.

Still in the tunnel.

$PATH (FAVORITE ONE THAT IS STILL IN THE TUNNEL)

Once treated like a category winner.

Then quietly forgotten.

The base here isn’t excitement — it’s time rebuilding trust.

No escape yet.

$GRAB

Peak SPAC excess.

Violent unwind.

Then… nothing.

This is what digestion looks like after speculative capital leaves entirely.

Boring.

Unloved.

Still alive.

Final Thought

You don’t make money buying great charts.

You make money buying misunderstood businesses that survive long enough for the chart to heal.

The market only rewards patience after it humiliates it.

That’s the Andy Dufresne.

— Connor

Alpha Before It Prints

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe