This post is a sneak peak of what premium members will receive on a weekly basis.

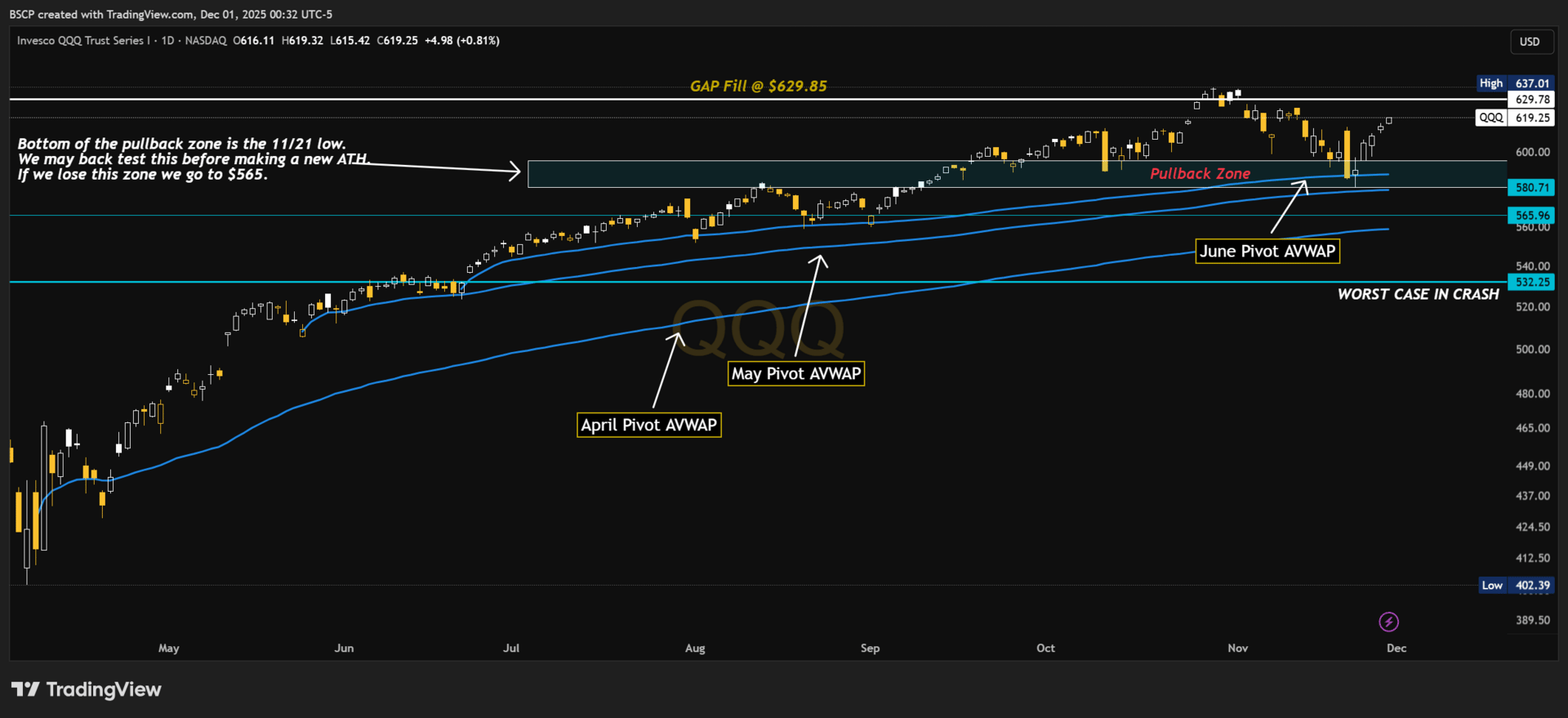

MACRO SECTION — QQQ BUY ZONE ROADMAP

QQQ just gave us the cleanest pullback of the year.

It dropped directly into the anchored VWAP stack from April, May, and June — the exact area institutions defend during powerful bull markets. The 11/21 low is the bottom of the pullback zone, and as long as we stay above it, nothing about the trend is broken.

Key Levels

Pullback Zone: $580–$600

The institutional bid zone.Lose this → next stop: $565

Worst-case crash level: $532

Upside magnet: Gap fill at $629.85

Macro Path

Chop into FOMC

BTC/ETH flush into mid-December

Equities hit their dip zones

QQQ holds the pullback range

January goes vertical

This is the window where high-beta stocks finally give you clean entries — not when everything is green and euphoric.

Everything below now plugs directly into this macro framework.

THE ALPHA 40K BUY ZONE PLAYBOOK

(Premium Only)

Below is the complete breakdown of every stock currently in the Alpha 40K portfolio — with exact dip-buy zones, long-term targets, and execution plans.

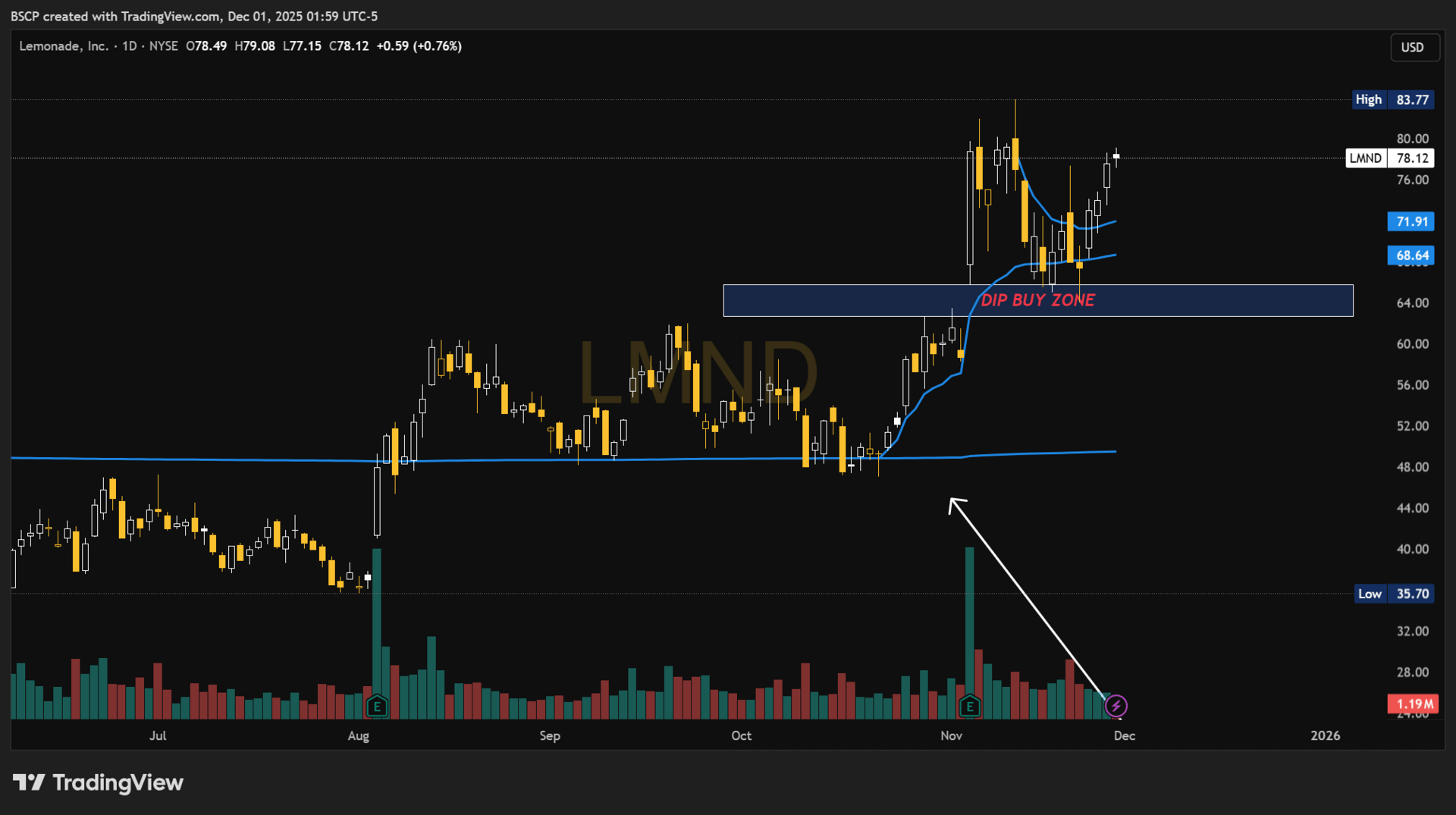

1. LMND — Lemonade

Long-Term Price Target: $755

Reclaimed IPO AVWAP + multi-year base → breakout. This is how generational compounders form.

Buy Zone 1: $63 – $68

Buy Zone 2: $55 – $58

Extreme Value: $48 – $52

Invalidation: Close below $47

Weekly Chart:

Daily Chart:

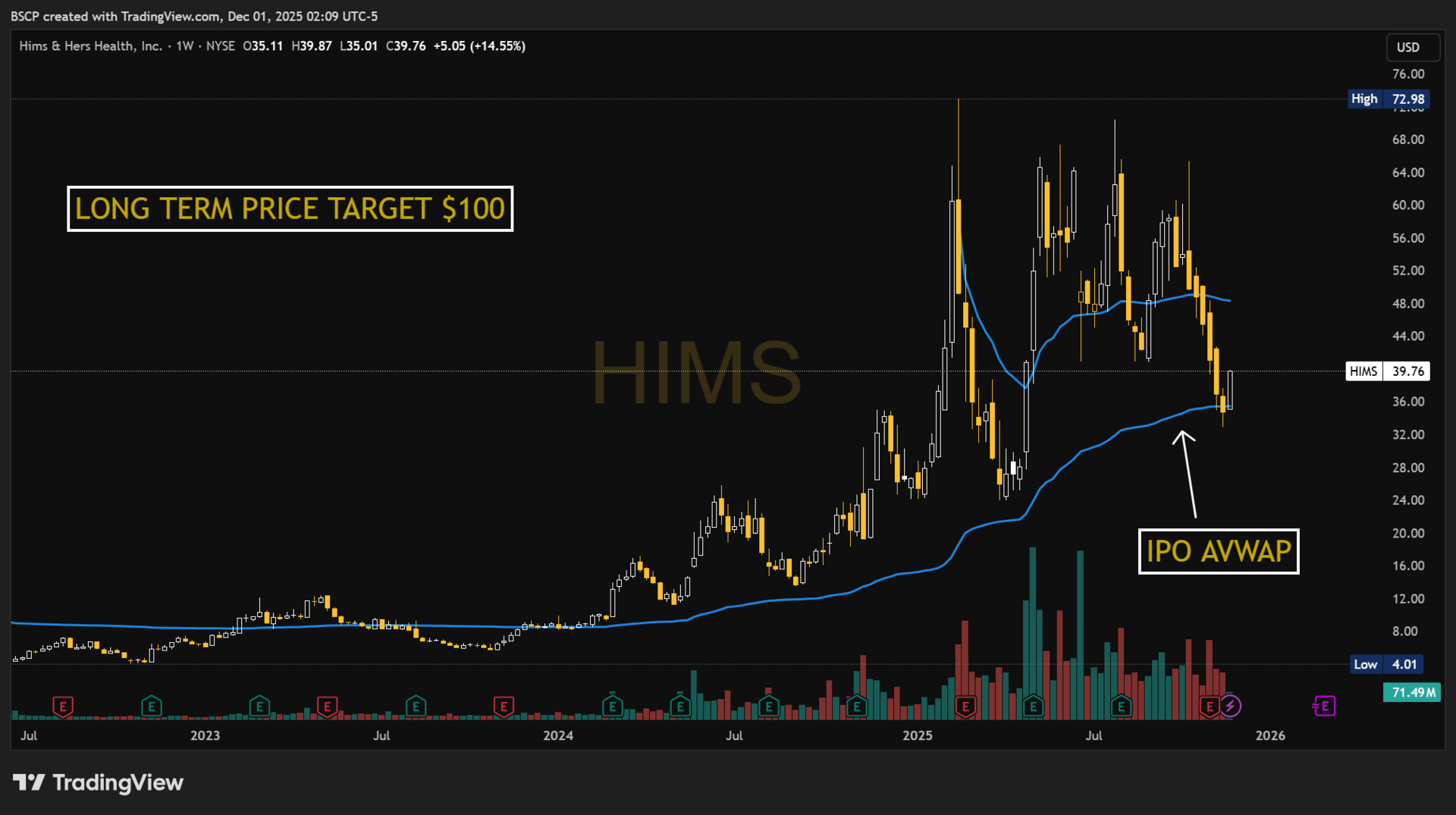

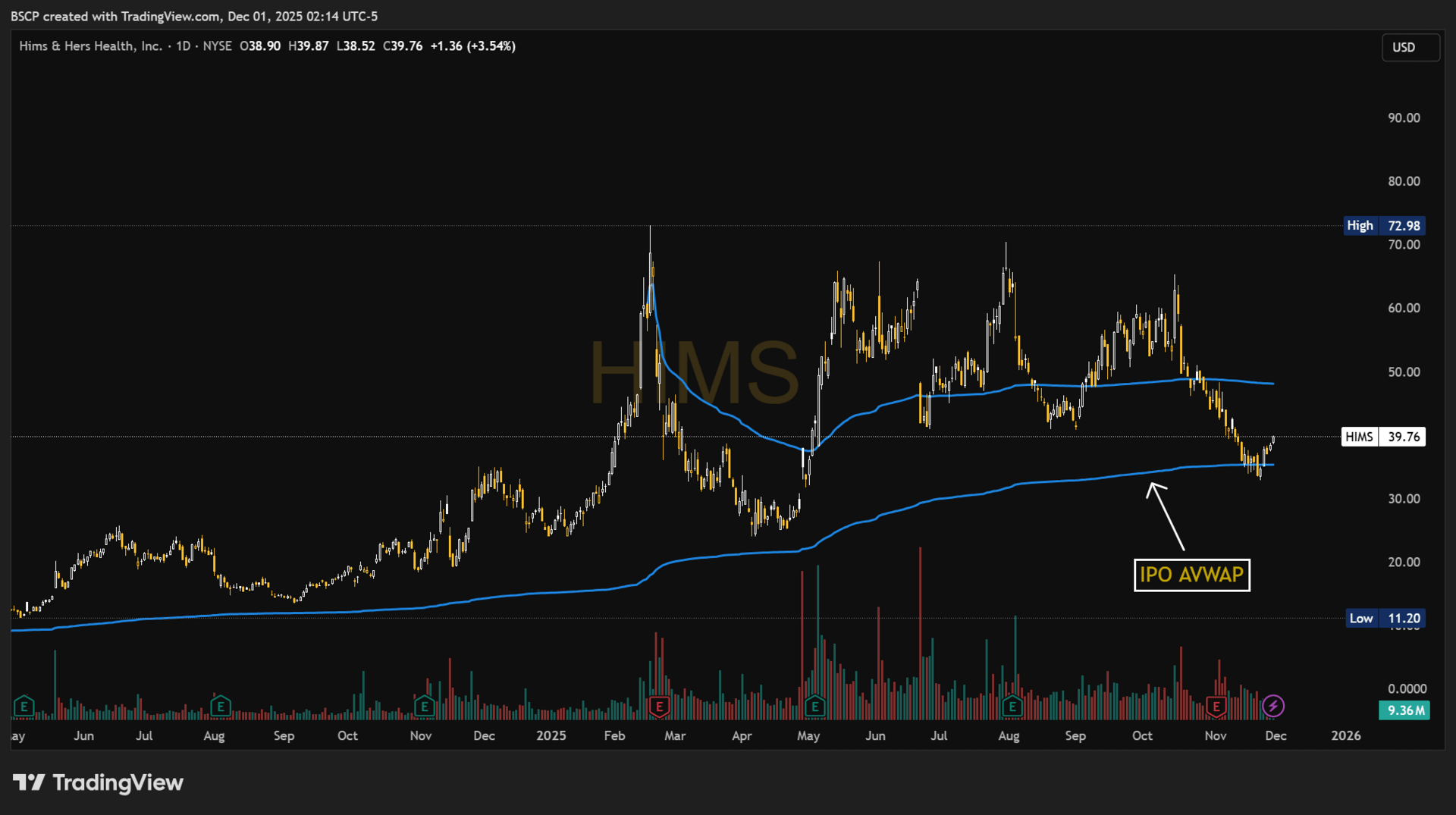

2. HIMS — Hims & Hers Health

Long-Term Price Target: $100

IPO AVWAP held perfectly on the weekly. Daily trend is untouched. Monster setup.

Buy Zone 1: $36 – $39

Buy Zone 2: $31.5 – $34

Extreme Value: $28 – $30

Invalidation: Close below $27

Weekly Chart:

Daily Chart:

3. NU — Nubank

Long-Term Price Target: $30

A monster fintech trend with nearly perfect structure.

Buy Zone 1: $15.40 – $16.20

Buy Zone 2: $14.25 – $14.70

Extreme Value: $13.50 – $14.00

Invalidation: Close below $13.40

Weekly Chart:

Daily Chart:

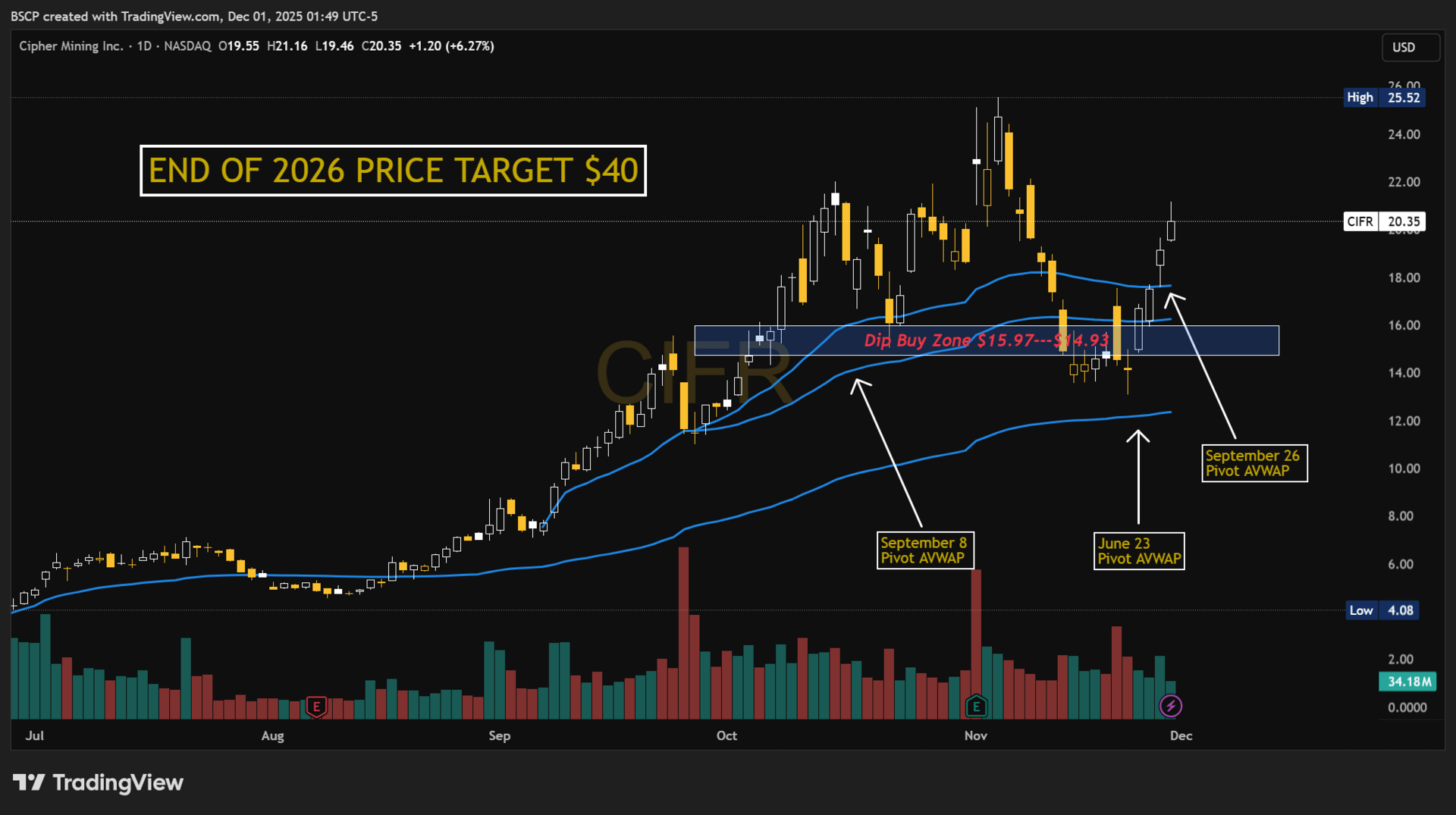

4. CIFR — Cipher Mining

Long-Term Price Target: $40

This isn’t a miner anymore — it’s AI compute infrastructure leveraged to BTC + the next HPC cycle.

Buy Zone 1: $15.97 – $14.93

Buy Zone 2: $14.50 – $13.70

Extreme Value: Below $13 (Not expected)

Invalidation: Close below $13

Daily Chart:

5. ZETA — Zeta Global

Long-Term Price Target: $35

Enterprise AI + data infrastructure with a clean breakout → retest → expansion setup. This is the closest thing to a “stealth compounder” in the portfolio.

Buy Zone 1 (Primary)

$17.05 – $16.25

Buy Zone 2 (Aggressive / Overshoot)

$15.40 – $14.80

What Happens If It Breaks Below Zone 2?

Instead of an “invalidation,” here’s the correct lens:

If ZETA breaks below $14.80 on a closing basis, it simply means the stock is:

moving into a deeper accumulation phase,

offering a better long-term entry,

It does NOT invalidate the long-term uptrend unless fundamentals change.

ZETA doesn’t have a clean chart-based invalidation level.

It has value zones that shift depending on macro + volume structure.

That’s how institutional swing names behave.

Daily Chart:

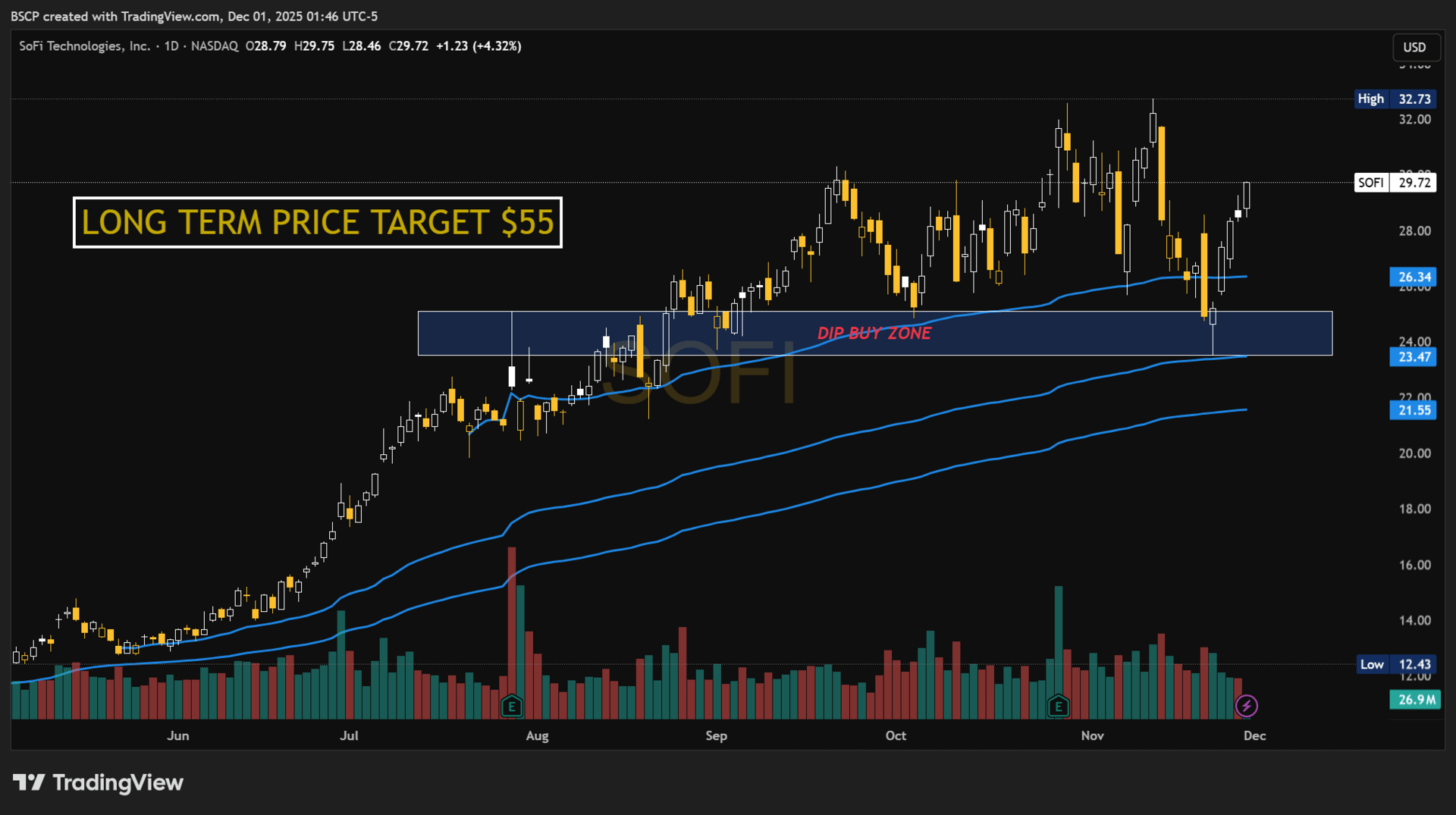

6. SOFI — SoFi Technologies

Long-Term Price Target: $45

Not a meme fintech — a real consumer finance platform with structural tailwinds.

Buy Zone 1: $23 – $24.40

Buy Zone 2: $21.20 – $22.10

Extreme Value: $19.40 – $20

Invalidation: Close below $19

7. EOSE — Eos Energy

Long-Term Price Target: $40

Multi-year base → breakout → retest. Classic early-stage industrial compounder.

Buy Zone: $11.62—$9.78

Invalidation: Close below $10.12

Weekly Chart:

Daily Chart:

8. TMDX — TransMedics

Long-Term Price Target: $305

Medical monopoly + secular growth + recurring revenue. Price structure confirms everything.

Buy Zone 1: $131 – $137

Buy Zone 2: $108 – $115

Extreme Value: $95 – $102

Invalidation: Close below $94

Weekly Chart:

Daily Chart:

9. COIN — Coinbase Global

Long-Term Price Target: $700

Crypto’s core infrastructure stock. IPO AVWAP + ATL AVWAP rising together is a generational signal.

Buy Zone 1: $185 – $210

Buy Zone 2: $165 – $180

Extreme Value: $140 – $155

Invalidation: Close below $135

Weekly Chart:

Daily Chart:

You now have the full roadmap:

Where each name becomes mispriced

Where true value appears

Where to add quietly

Where the trend strengthens

Where the long-term returns are built

Not at the highs.

Not when things feel safe.

But in the zones most people are too emotional to buy.

That’s what separates Alpha Premium from everything else out there.

This is how you build wealth before the market realizes what's happening.

This is the Alpha 40K mindset:

Clear levels.

Clear structure.

Zero hesitation.

Zero noise.

Just high-probability execution over and over again.

You’re early.

You’re in the right place.

And every level you just read is built from the same process I use with my own capital.

Share this with someone who’s tired of getting in late.

— Connor

Alpha Before It Prints

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe