Back in early 2024, I bought 40 call contracts on $HOOD — $20 strike, Jan 2025 expiry.

I got in at $1.10. Total risk: $4,400.

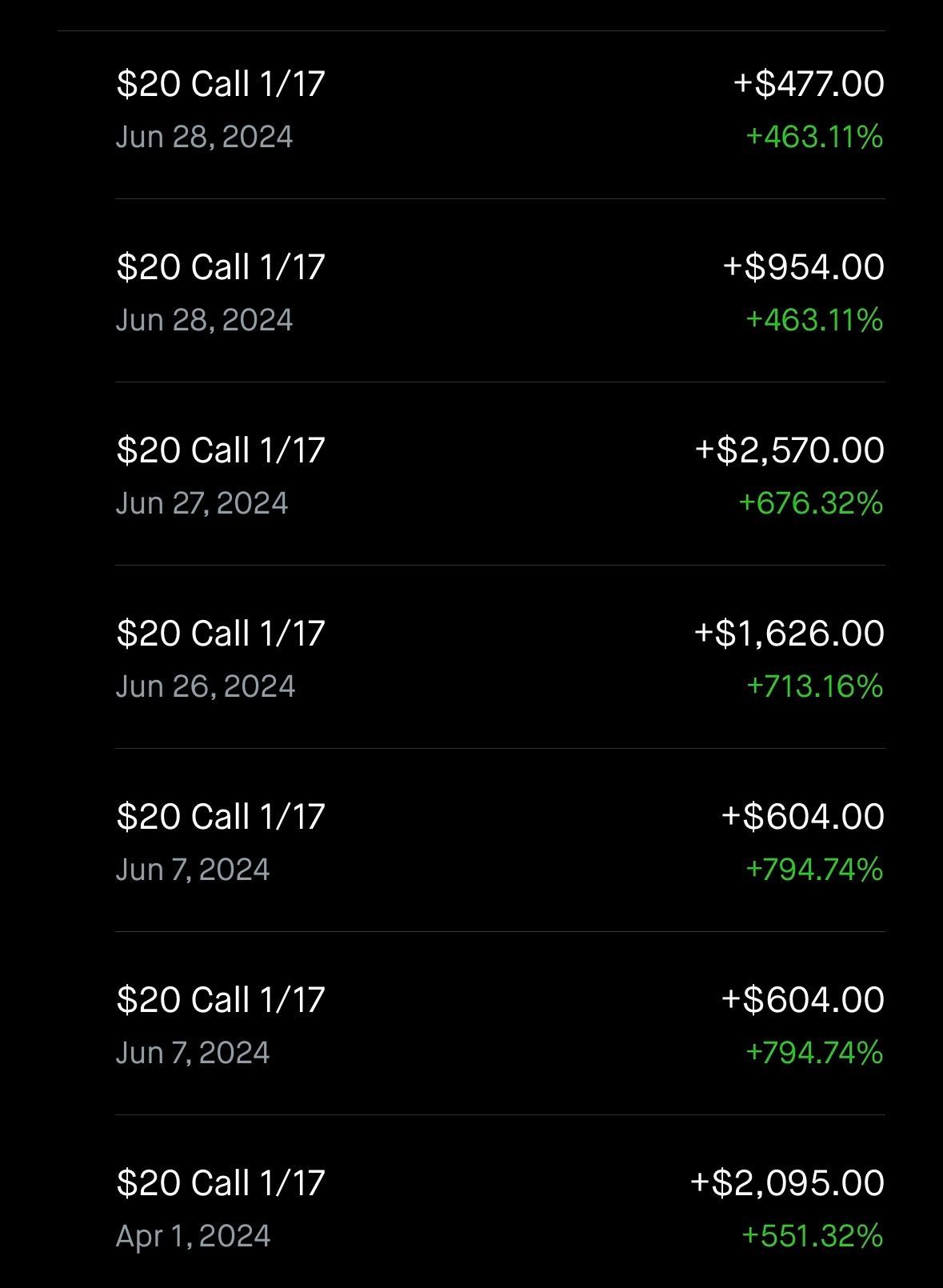

The stock started moving, so I trimmed. Booked some 400%, 600%, even 700% wins.

Final tally: $14,681.46 in profit.

Here’s a screenshot of a few of my actual sales — just so you know I’m not full of shit:

Sounds like a win, right?

But then December hit.

$HOOD ran to $40.

My calls that I sold for $6–$9 apiece? They were trading over $20 per contract.

That’s $82,000 in value.

I had $4,400 in.

I walked away with $14K.

I left ~$67,000 on the table.

What I learned (the hard way):

Take profit? Yes. But not on the whole position.

Let your winners run. The “trim and trail” strategy exists for a reason.

If you’re directionally right, don’t cap your own upside. That’s the market’s job.

One monster runner can make your year.

But only if you’re still in the trade.

I’m not mad I booked a win.

I’m mad I didn’t let the best part of it happen.

This is how experience compounds. Not just money.

—

PS — Want to see what I am holding through the next leg up?

Here’s what I’m buying right now for asymmetric upside:

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn

© 2025 Alpha Before It Prints

Unsubscribe