This past week felt uncomfortable if you were watching headlines.

Tech pulled back.

Volatility picked up.

Sentiment flipped quickly.

But when you step back and look at what actually moved beneath the surface, this wasn’t structural damage — it was rotation and timing.

And timing matters a lot right now.

Growth vs. Value: The Leadership Shift Is Real

This is the most important chart in the entire update.

Growth dominated for years. That dominance cracked earlier this cycle.

Recent attempts for growth to reclaim leadership have stalled, while value continues to grind higher.

This doesn’t mean growth is finished.

It means leadership is changing hands.

And leadership changes are how bull markets extend — not how they end.

SPX: Digestion After New Highs, Not Structural Damage

After pushing to new all-time highs, the S&P pulled back.

That alone is not a signal.

What matters is how it pulled back.

Price remains supported.

The range is intact.

There’s been no cascade and no loss of control.

This is what digestion looks like after a strong run — not the start of a larger unwind.

Tech Is the Weight — Not the Whole Market

A big reason this week felt worse than it actually was is because the weakness was concentrated.

NVDA undercut near-term levels.

Semis rolled over.

A few heavyweights did the damage.

But this wasn’t contagion — it was concentration.

When markets are topping, weakness spreads everywhere.

When markets are rotating, weakness stays narrow.

So far, this remains the second case.

Breadth Softened, But Didn’t Break

Even with tech under pressure, the market’s internals held together better than headlines suggested.

Breadth ran roughly 2:1 negative — but critically, the damage stayed mostly inside Technology.

Outside of that pocket, participation didn’t collapse.

That’s not how bear markets start.

That’s how leadership transitions unfold.

Small Caps vs. Large Caps: Relative Strength Is Improving

One of the quieter but more important developments is what’s happening beneath the index level.

Small caps have been breaking a long-term relative downtrend versus large caps.

This is exactly what should happen if the market is transitioning away from narrow mega-cap dominance and toward broader participation.

This chart reinforces the same message as growth vs value — just through a different lens.

Yields: A Near-Term Headwind That Fits the Rotation

Another key input this week was the bond market.

Despite a dovish Fed cut, yields didn’t collapse. They bounced and look positioned to push higher near term before rolling over into 2026.

That matters because:

higher yields pressure long-duration growth

favor value and cyclicals

and often coincide with leadership changes, not market tops

This is a timing issue — not a trend killer.

Individual Stocks: Early Signs of Bottoming Beneath the Surface

Rotation doesn’t just show up in ratios.

It shows up in individual stocks starting to respond to buying interest.

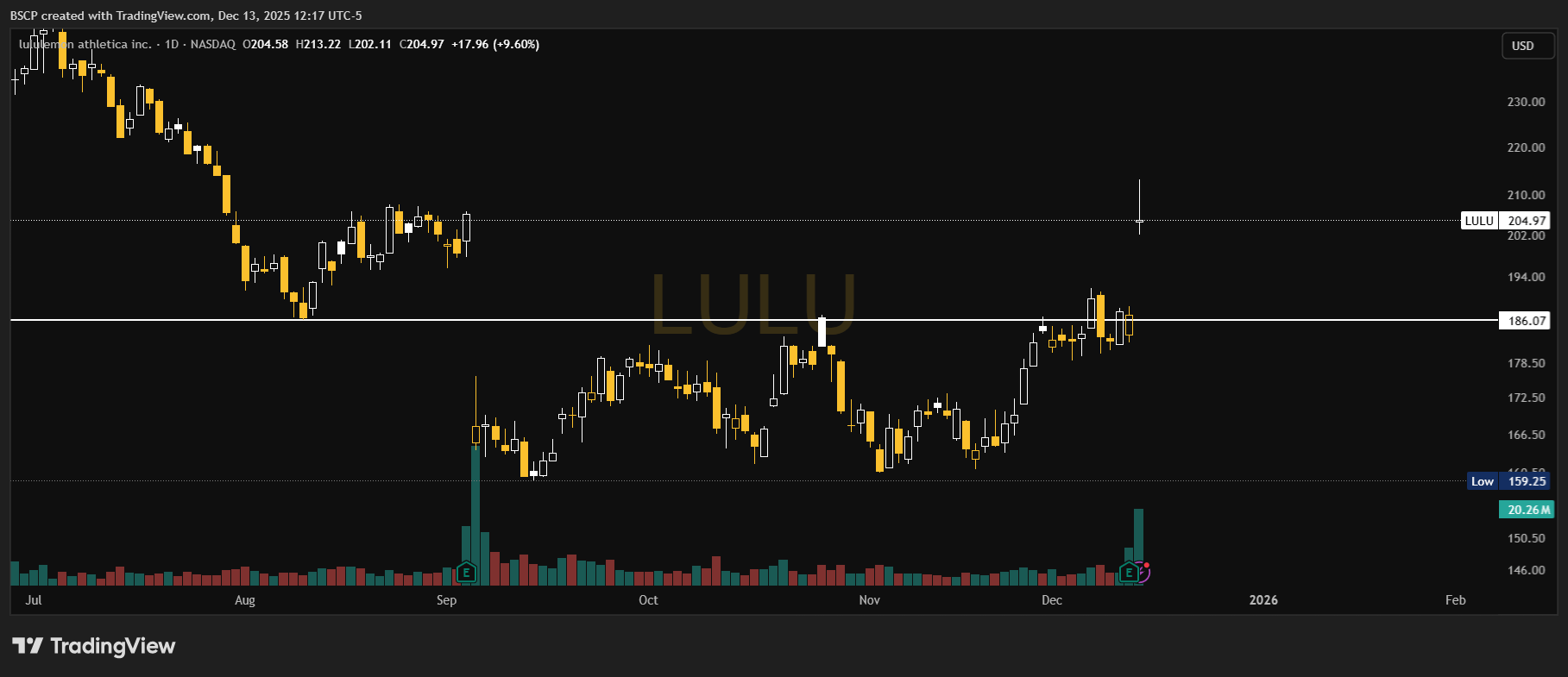

LULU just had a sharp upside move on the highest volume in months after a long basing process.

It’s still well below prior highs — which is exactly why it’s interesting from a risk/reward perspective.

These types of moves often show up before broader confidence returns.

Not a chase.

A signal.

Now Add the Calendar to the Equation

Next Friday (12/19) is quad witching.

Quad witching is the quarterly expiration of major derivatives tied to:

index futures

index options

stock options

What matters isn’t the label — it’s the forced positioning.

Into quad witching, large players have to:

unwind expiring exposure

roll positions

rebalance index-linked portfolios

That almost always pulls volume and volatility forward, especially late in the week and into the close.

Translation:

price action next week can look worse than the underlying trend actually is.

Why a Late-Week Low Would Be Constructive

If selling continues into next week and resolves by the end of day Friday, that wouldn’t be a red flag.

It would be textbook.

And it would line up perfectly with the true definition of a Santa rally, which most people get wrong:

the last 5 trading days of December

plus the first 2 trading days of January

Anything before that window is just positioning.

Selling into quad witching:

shakes out weak hands

clears expiring options

resets short-term sentiment

leaves the market under-positioned

and sets up a rally once forced flows are gone and liquidity thins

That’s how Santa rallies usually start — not from comfort, but from frustration.

What I’m Watching From Here

The focus isn’t day-to-day noise — it’s structure.

Does growth vs value continue to favor value?

Does small-cap relative strength persist?

Does tech weakness remain narrow?

Do yields finish their near-term push and stabilize?

Does volatility peak into quad witching rather than after it?

If those conditions hold, this week will be remembered not as the start of something worse — but as the point where leadership changed hands.

Bottom Line

This week didn’t break the market.

It clarified it.

Growth paused.

Value leaned in.

Indexes digested gains.

Leadership broadened.

Quad witching doesn’t change the trend — it compresses the timing.

If selling resolves by Friday, the runway opens for a classic Santa rally window right when the calendar, liquidity, and positioning finally align.

This looks like rotation, not rupture.

— Connor

Alpha Before It Prints

A quick note on how I express conviction

For anyone wondering how this framework translates into actual positioning:

I run two live portfolios that reflect two very different parts of my thinking.

The Black Sheep Base Case Portfolio is exactly what it sounds like — core positioning for how I expect the broader market to resolve when structure matters more than headlines.

The Alpha Framework Portfolio is different.

That’s where I take long-term swings on smaller companies I believe can materially outperform over full cycles — names that usually look wrong before they look obvious.

A few past examples from that framework:

HIMS — $8.36 → +722% (ATH)

SOFI — $5.84 → +452% (ATH)

PLTR — $26.58 → +679% (ATH)

LMND — $31.31 → +171% (ATH)

ONDS — $1.74 → +532% (ATH)

CIFR — $2.96 → +762% (ATH)

IREN — $5.97 → +1,161% (ATH)

No alerts.

No perfection.

A lot of patience.

That’s not a promise — it’s just context for how I think and how I size risk.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe