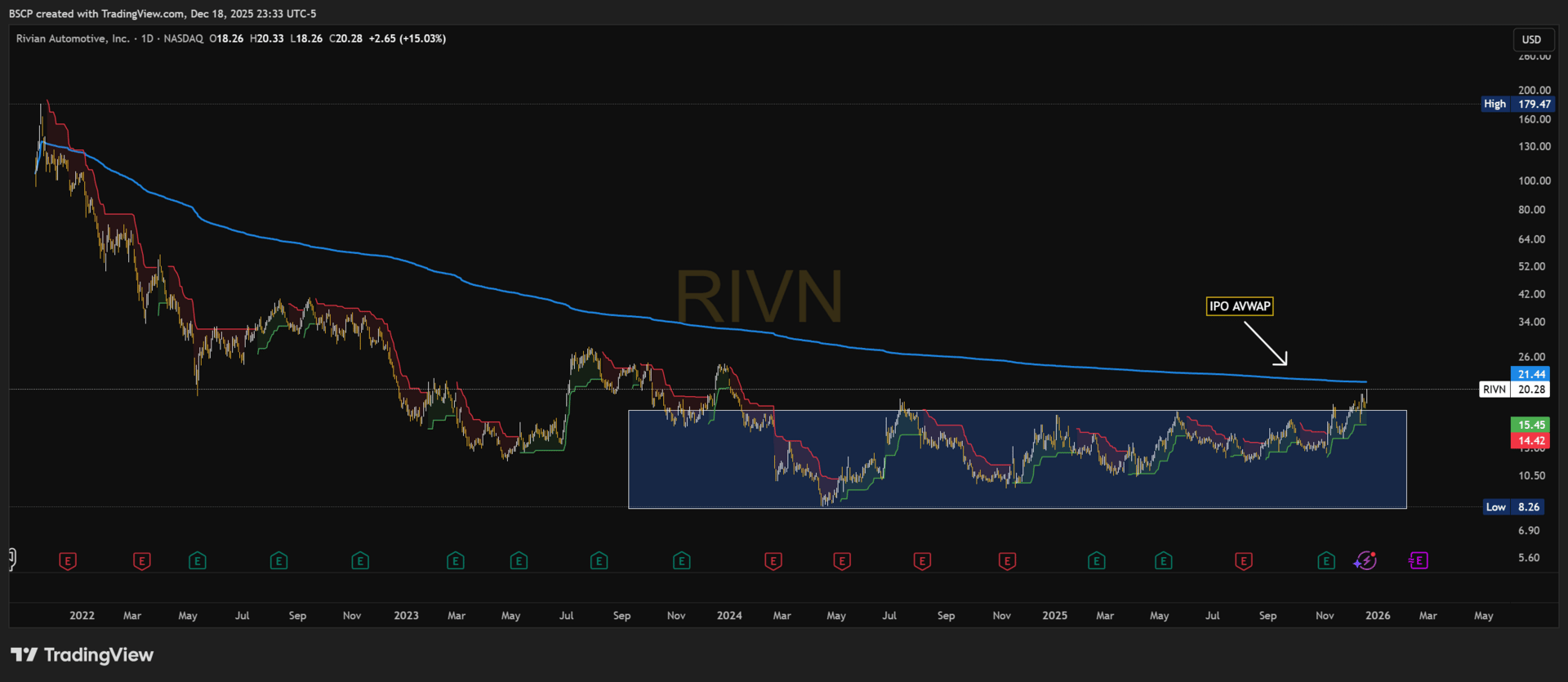

$RIVN — Breaking Out of the Andy Dufresne

DAILY CHART

WEEKLY CHART

For a long time, this was an unownable chart.

IPO hype

Narrative collapse

Cash burn fears

Margin headlines

Then came the part nobody posts about.

Years of dead money.

Sideways frustration.

No one left defending it.

That was the Andy Dufresne phase.

Not because the business was perfect —

but because expectations were already destroyed.

What’s different now isn’t hype returning.

It’s structure changing.

After spending years in a tight base, $RIVN is finally pushing out of the tunnel:

• Sustained higher lows

• Price reclaiming key long-term levels

• Pressure building against the IPO anchored VWAP

This is what it looks like when a stock stops being priced for failure.

The easy part isn’t buying the breakout.

The hard part was owning — or even watching — it while nothing worked.

That’s the tax.

Most people only notice Andy Dufresne after he’s clean and standing in the rain.

The opportunity is recognizing when he’s just made it out of the tunnel.

— Connor

Alpha Before It Prints

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe