Rate Cuts Locked In — But Breakouts May Stall First

Why This Week Favors Operators Who Scale Fear While Tourists Chase Noise

The ADP number didn’t come in soft — it came in dead.

Estimate: +10,000

Actual: –32,000

There’s no debate left:

We’re getting a rate cut next week.

Minimum 25 bps.

But here’s the part most people get wrong:

A guaranteed rate cut does NOT guarantee a clean market breakout.

The indices are pressing into heavy resistance, sentiment is warming up, and rates haven’t fully rolled over yet.

When you combine those ingredients, you don’t get straight-up continuation — you get:

Chop → fakeout → expansion.

Most people chase the chop.

Operators wait for the expansion.

Let’s zoom into QQQ and SPX before diving into breadth and positioning.

QQQ — Nasdaq 100

QQQ is pushing straight into a heavy resistance band with multiple supply layers stacked between 625–637. You're seeing sellers show up exactly where they should — not because the trend is weak, but because this is where every algorithm on Earth is programmed to take profit.

Here’s the clean read:

Base case:

A pullback into 610–619 before the real breakout attempt.

That level isn’t random — it’s the last major shelf that converted from resistance to support on the November push. If QQQ does pull back, that’s the spot where higher-timeframe buyers should step back in.

Upper target:

A breakout over 629–630 opens the door to 637+ quickly. There’s also a real chance we sweep the highs first — a quick liquidity grab above 629–630 — before pulling back into the 618–620 consolidation zone. That kind of fake breakout is perfectly normal at major resistance and often sets up a cleaner, stronger move into new all-time highs afterward.

Lower boundary:

As long as QQQ holds 610 on a daily closing basis, the trend is completely intact.

Lose 610 → you look toward the rising AVWAPs below (but that’s not base case right now).

Interpretation:

This isn't weakness — it’s a textbook bull-market stall into resistance.

What you want is the pullback first, then the breakout.

Not the other way around.

This is the exact tape where chasing gets you punished and patience gets you paid.

SPX — S&P 500

SPX is pushing directly into a major resistance band — the same zone that rejected the last rally. This is where sellers should show up, and they're doing exactly that.

This doesn’t signal weakness.

It signals location.

Here’s the real read:

Base Case

SPX pulls back into the demand block before making a real attempt at breaking out.

A pullback into that area is not a breakdown — it’s the reset the market needs before a meaningful push higher.

Breakout Level

A sustained move above 6,890–6,920 opens the door to new highs.

There’s no resistance once SPX clears that band.

Lower Boundary

As long as SPX holds the demand block, the trend remains firmly bullish.

Lose that, and buyers step back in near 6,660 — but that’s not the primary scenario.

Interpretation

This is a textbook setup:

Stall at resistance

Controlled pullback

Recharge

Expansion

This is where chasing gets punished and patience gets paid.

You want the dip first, then the breakout.

THE CHARACTER OF THIS MARKET: FAILED BREAKDOWNS EVERYWHERE

This tape is behaving exactly like a bull market should:

• Breakdown attempts failing

• Sellers getting absorbed

• Rebounds happening faster

• Weakness turning into fuel

This is failed-breakdown → slingshot behavior.

Not a topping pattern — an accumulation pattern.

Breadth Check (The Part Everyone Ignores Until It’s Too Late)

Internally, the market is getting stronger:

• Volatility getting crushed

• Up days actually sticking

• Breadth widening across sectors

• Failed breakdowns showing up everywhere

• Risk appetite rotating back in

The best real-time example is homebuilders:

They lost support… then instantly reclaimed the 200-day and snapped back above supply.

That’s demand — not weakness.

Exactly what you want heading into a rate-cut week.

When breadth turns up at the same time breakdowns fail, you’re not trading a top.

You’re trading the build-up before expansion.

FED LIQUIDITY SHIFT — A QUIET TAILWIND

Another underappreciated tailwind:

The Fed ended QT on December 1st.

QT is the mechanism that removes liquidity from the system.

Ending QT means:

The balance sheet stops shrinking

All maturing Treasuries get reinvested

Liquidity pressure comes off the market

The Fed is no longer tightening in the background

This isn’t “QE” in the 2020 sense — but it is the market losing a major headwind and quietly gaining a structural bid underneath risk assets.

Combine that with failed breakdowns, widening breadth, and a coming rate cut?

You get a market that wants higher, even if it chops first.

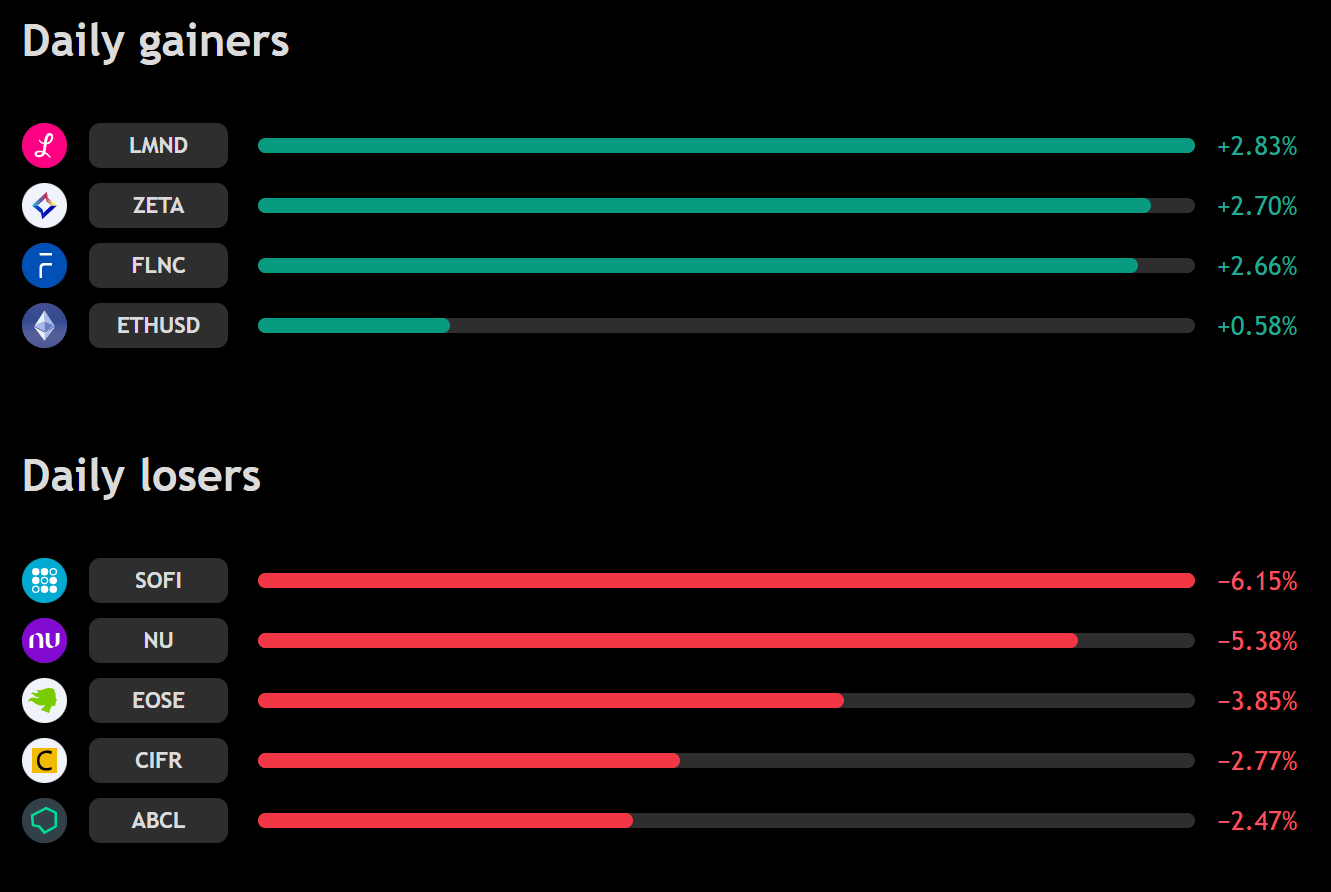

SECTOR LEADERSHIP SNAPSHOT

• Homebuilders, cyclicals, financials leading

• Tech breadth widening

• Defensive sectors lagging (bullish in this context)

• Broad participation improving

This isn’t a fragile market — it’s a coiled market.

THE NEXT WEEK PLAYBOOK

Expect volatility Monday–Wednesday

First FOMC reaction is usually a head-fake

Breakouts may stall before pushing through

Buy structured fear, not strength

Failed breakdowns are your friend

Use your zones — don’t chase

Breadth > headlines

This isn’t a forecast.

It’s the behavior of a trending market approaching a catalyst.

CATALYSTS (NEXT 14 DAYS)

• FOMC

• CPI / PPI

• OPEX

• Year-end positioning

• Crypto liquidity windows

• December → January seasonality

This is the coil, not the release.

POSITION-BY-POSITION BREAKDOWN

Below are the updated reads, zones, and interpretations.

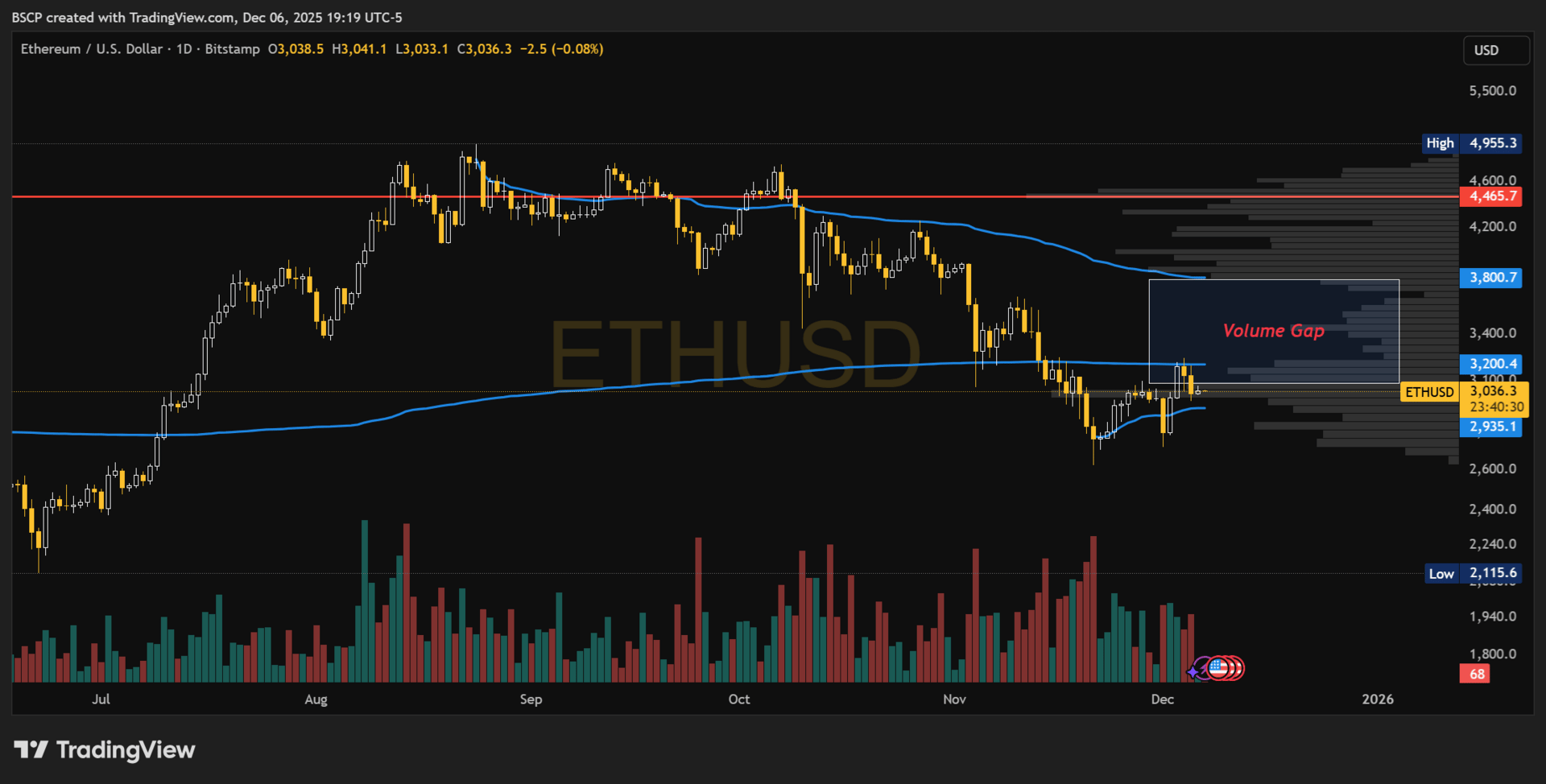

ETHUSD — Ethereum

ETH pushed into its downtrend near 3,300 and failed, unwinding half the rally in one move.

The structure is simple:

ETH Invalidation:

Daily close below 2,764

A break triggers the next downside levels:

• 2,621

• 2,362 (deeper exhaustion pocket)

Above 2,764, the structure is intact.

Below it, the December flush scenario reactivates.

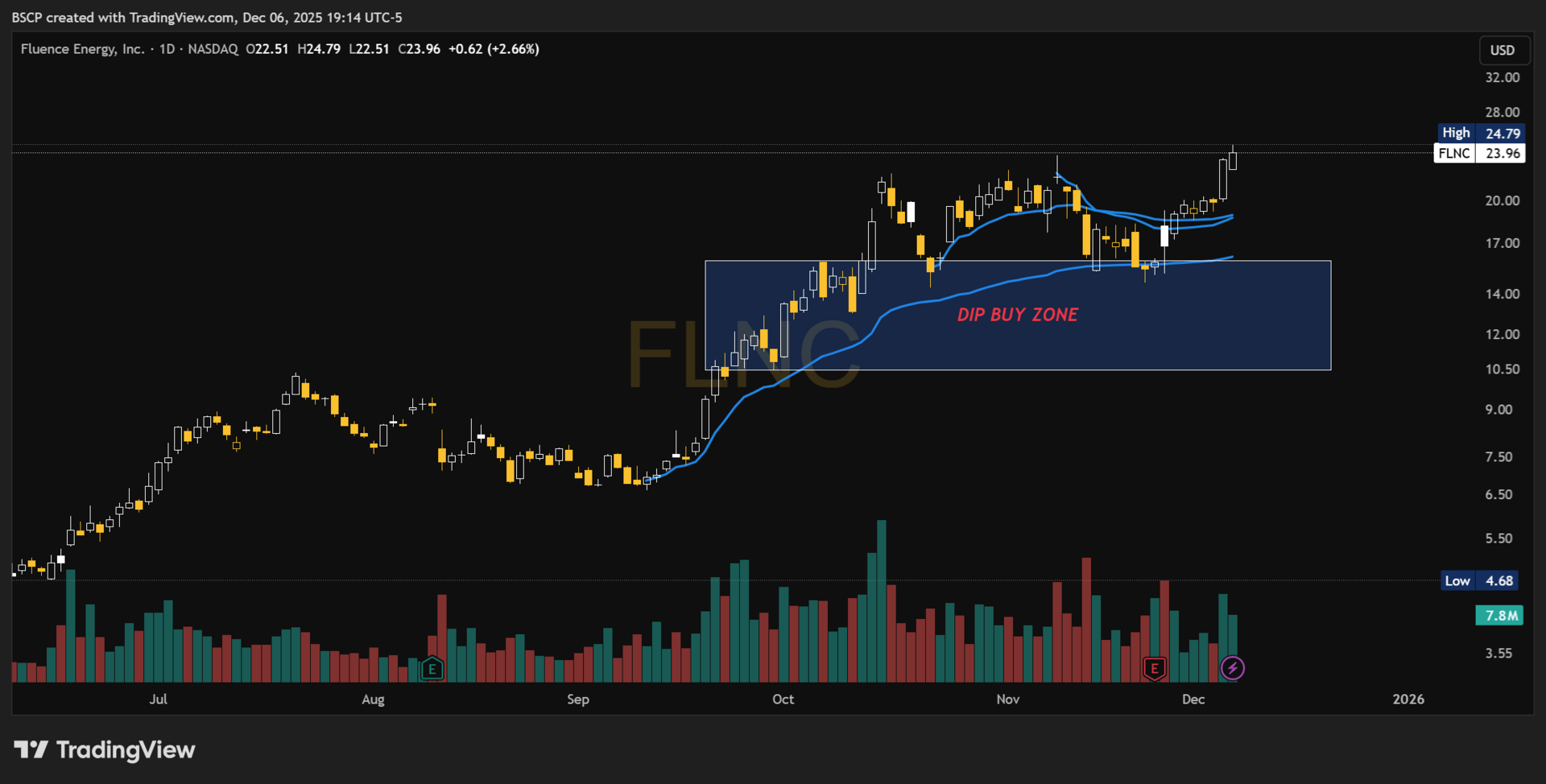

FLNC — Fluence Energy

Stair-step breakout. Clean trend. Strong accumulation.

Dip Buy Zone: $13–$16

Interpretation: Above this zone 30s remain completely realistic.

COIN — Coinbase

Two perfect demand shelves:

• Zone 1: $205–$235

• Zone 2: $165–$185 (aggressive accumulation zone)

Interpretation: IPO AVWAP remains the anchor. Pullbacks are opportunity, not risk.

TMDX — TransMedics

TMDX sold off right into the upper demand band — and nothing about this move breaks the structure.

This is a name that moves fast in both directions. That’s the deal.

Here’s the clean read:

As long as TMDX holds above the lower zone (98.91–109.29), the trend is intact.

If we pull into that area, it’s where I want to get heavier — not lighter.

This isn’t about chasing momentum.

It’s about letting the volatility come to you and using it correctly.

HIMS — Hims & Hers

Reclaimed IPO AVWAP.

Building a base under a clear upside gap at $57.87.

Interpretation: Early-stage compounding structure. No signs of weakness.

EOSE — Eos Energy

High volatility, high asymmetry. A scale-in name.

NU — Nu Holdings

Exploded out of the buy zone. Retesting the breakout.

Interpretation: Still early in a multi-year EM fintech cycle. Dips = adds.

ZETA — Zeta Global

Elite operator. Elite setup.

• Dip Zone 1: current range

• Dip Zone 2: load-the-boat level

Interpretation: As long as AVWAP holds, this is one of the strongest bases in the entire portfolio.

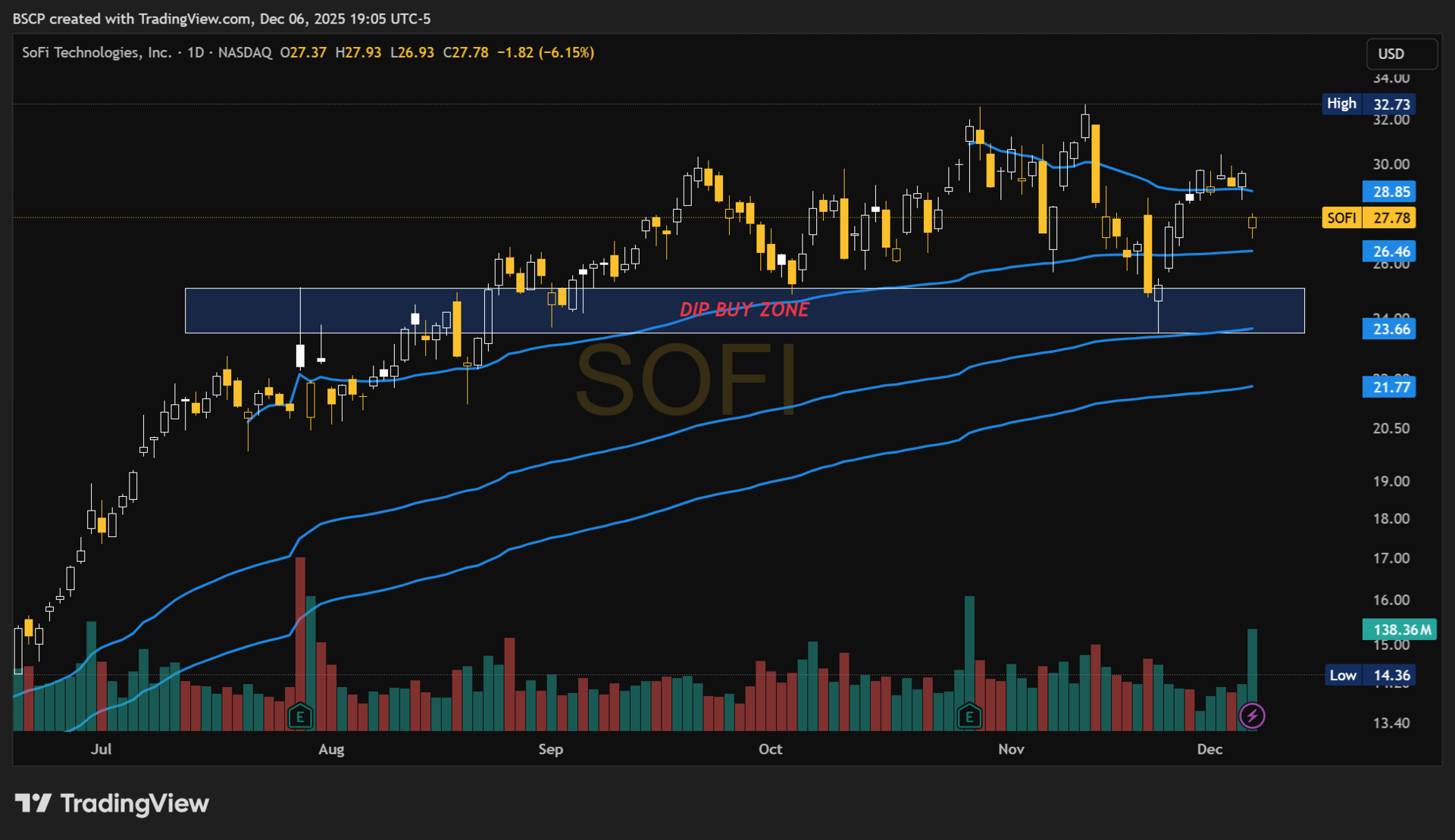

SOFI — SoFi Technologies

The clearest rate-cut upside beneficiary in the book.

Dip Buy Zone: $23–$25

Interpretation: Lower funding costs + improving credit = accelerating profitability.

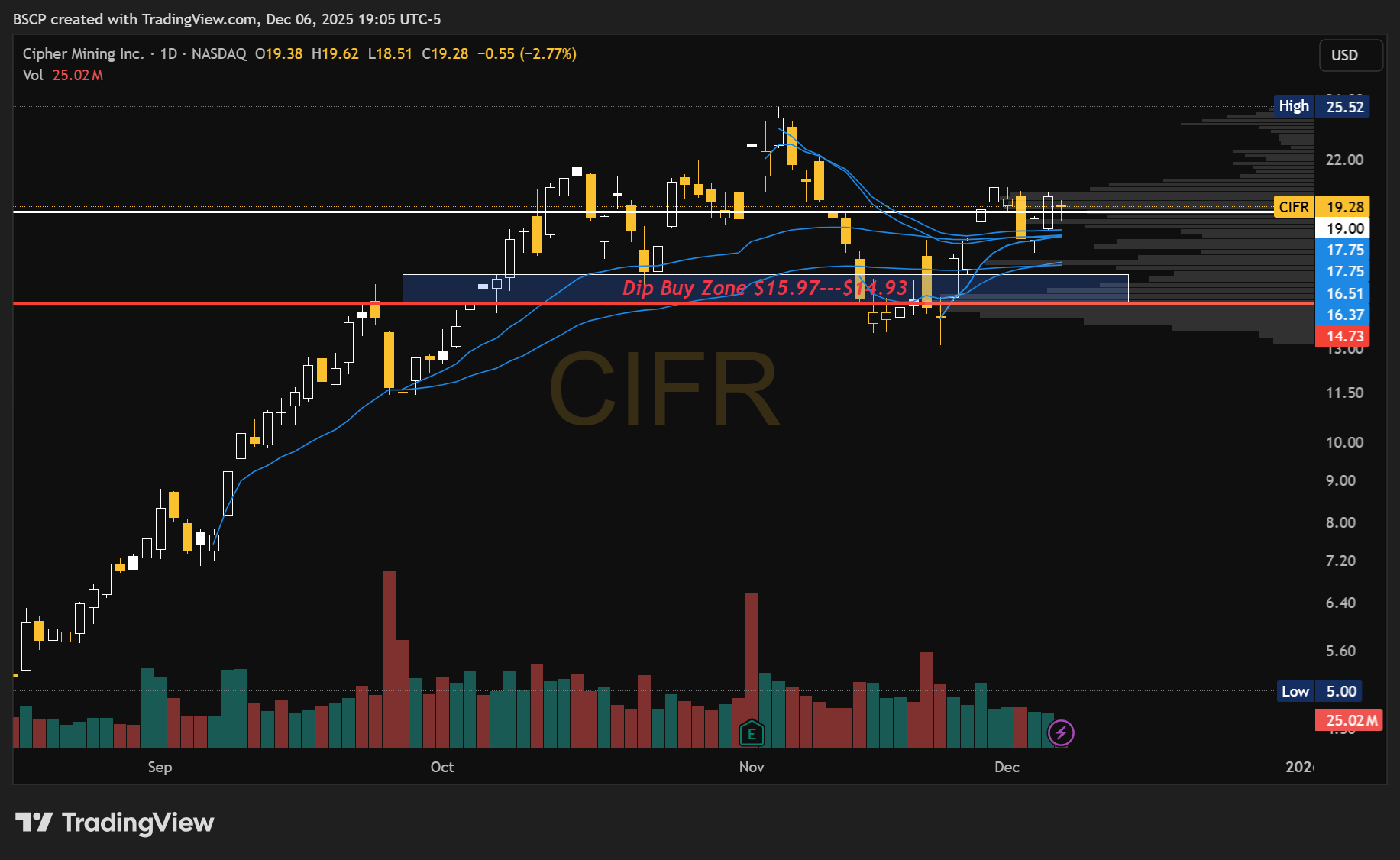

CIFR — Cipher Mining

The most asymmetric play we own.

Dip Zone: $15.97–$14.93

Interpretation: This is AI compute infrastructure, not a miner.

Dips into the zone are gifts.

LMND — Lemonade

IPO AVWAP reclaimed and respected.

Textbook early-stage rerating structure.

Dip Buy Zone: $62.70—$68.97

Interpretation: Quiet accumulation → violent repricing.

FRONT-RUNNING RULES (READ THIS TWICE)

• Front-running is fine only with a long-term perspective.

• Do not front-run with full size.

• Dip zones exist for a reason.

• Save ammo. Volatility is your friend.

This is how operators win while tourists blow themselves up.

High-Quality Software Reversal (Personal Portfolio Adds)

This week I added CRM and ADBE to my personal portfolio.

Both charts are showing early signs of reversal across high-quality software — the first constructive strength these names have shown in months.

CRM — Salesforce

Strong bounce off lows, reclaiming declining moving averages.

First real structure improvement in a long time.

ADBE — Adobe

Sharp move off the lows and pushing into its first momentum shift since Q2.

No calls, no hype — just the behavior change.

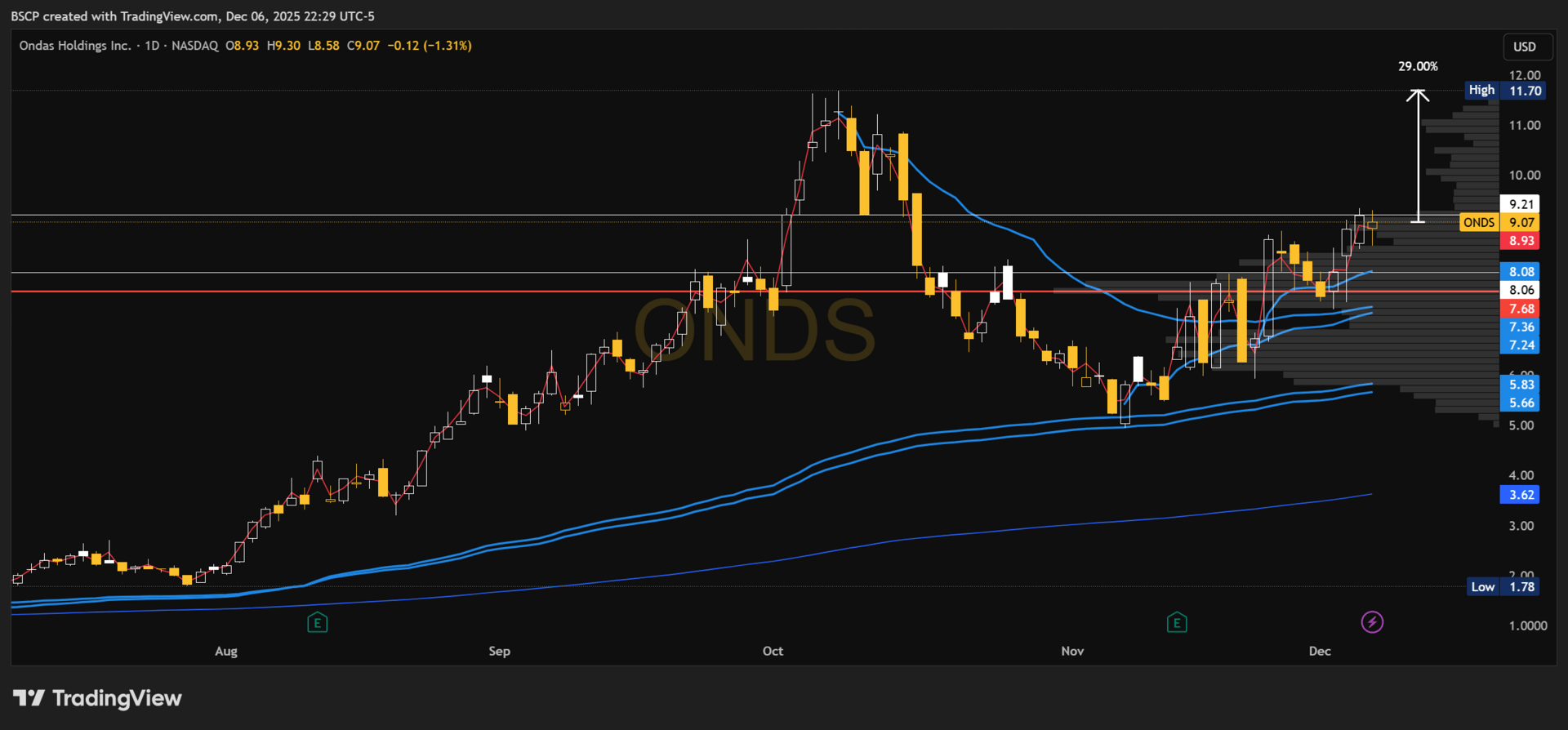

Side Note — Back in ONDS (Trading Account)

Re-entered ONDS in my trading account.

It reclaimed the levels it needed to reclaim and momentum flipped.

Targeting ~$11 by end of month as long as this breakout zone holds.

Simple setup. Clean target. Short interest still above 24%. That’s fuel if momentum continues.

Other Trades I’m In (Outside the Alpha 40K Portfolio)

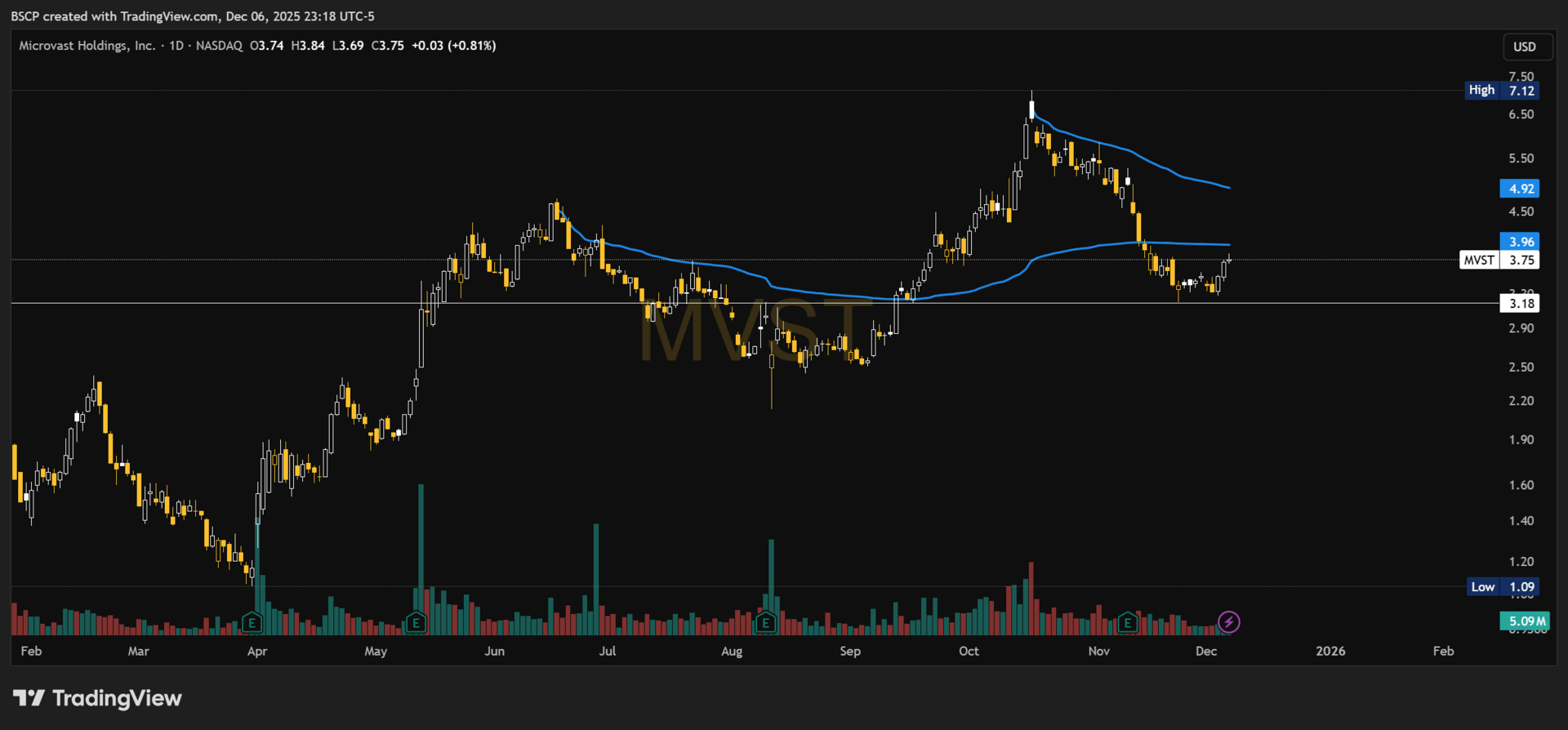

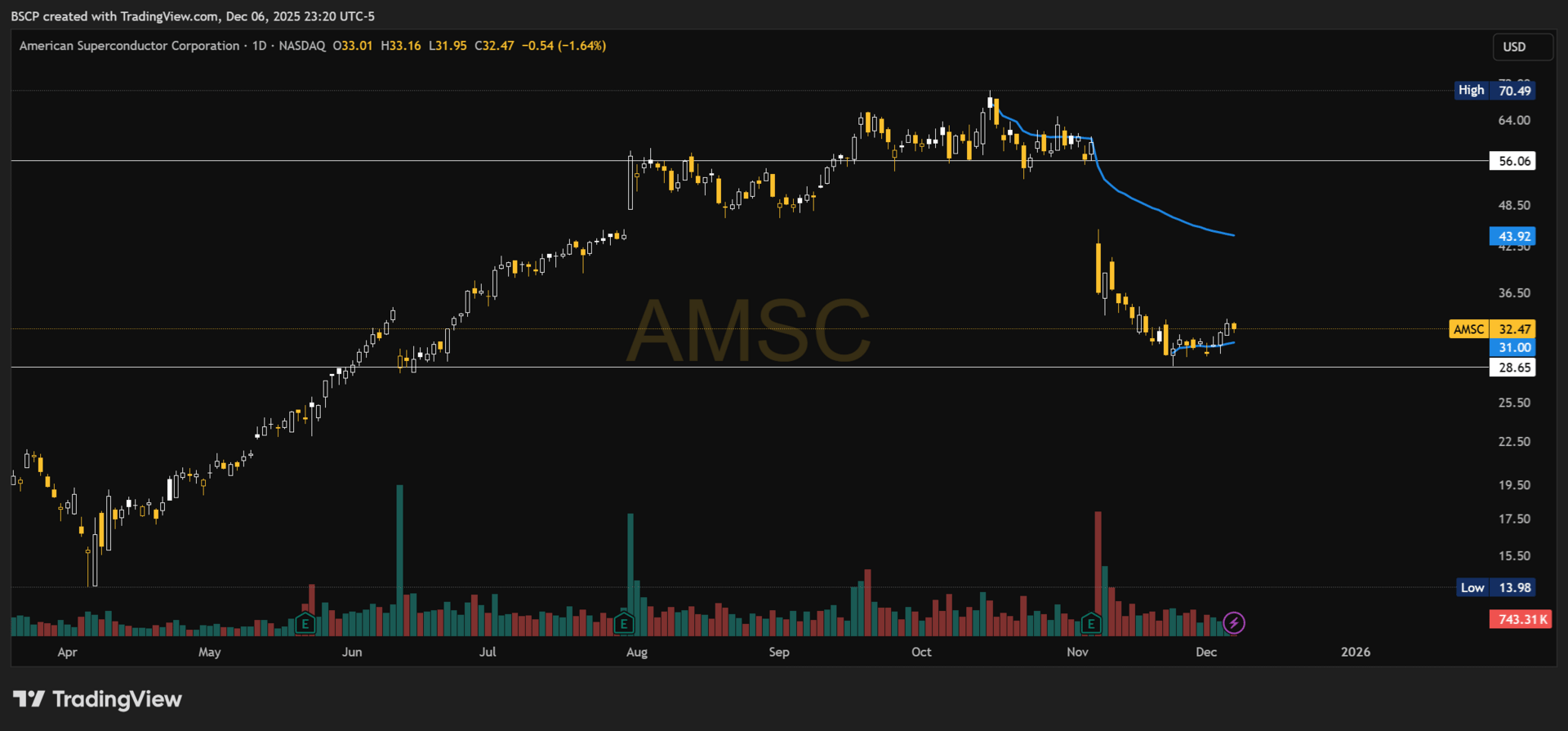

BETTING ON THESE BEING TRADABLE LOWS

Here are other trades I’m in personally that don’t fit inside the Alpha 40K mandate.

These look like tradable lows with asymmetric upside and clearly defined risk.

Long-Dated Calls (High Asymmetry)

CRWV — $150C (04/17/2026)

ERO — $30C (04/17/2026)

Strong breakout to multi year highs. Will trade higher with Copper.

CLSK — $20C (03/20/2026)

Flipped S/R zone and ready to run it back to $20

BABA — $200C (03/20/2026)

Coiling breakout imminent

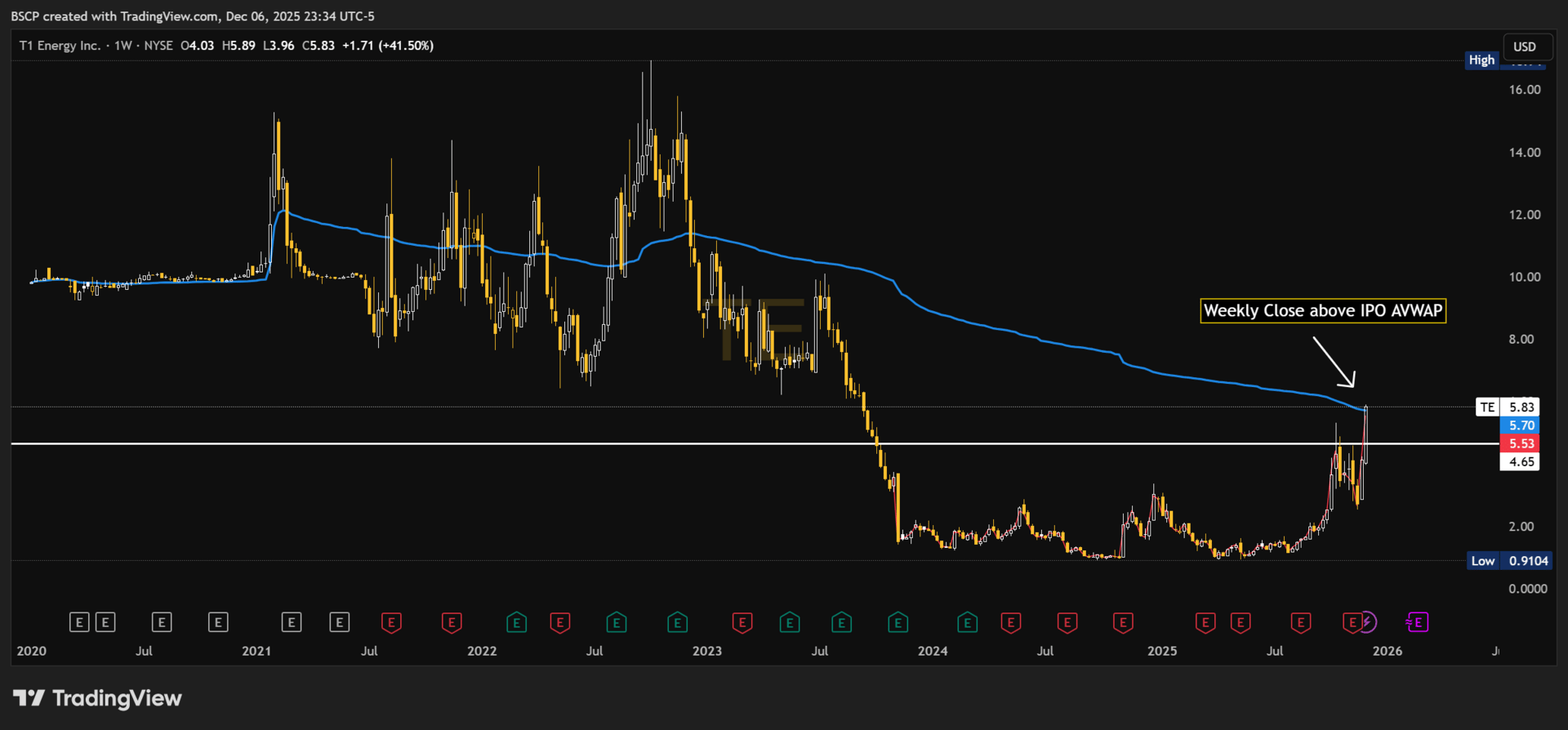

TE — $7.50C (04/17/2026)

This thing is ready to run to $11

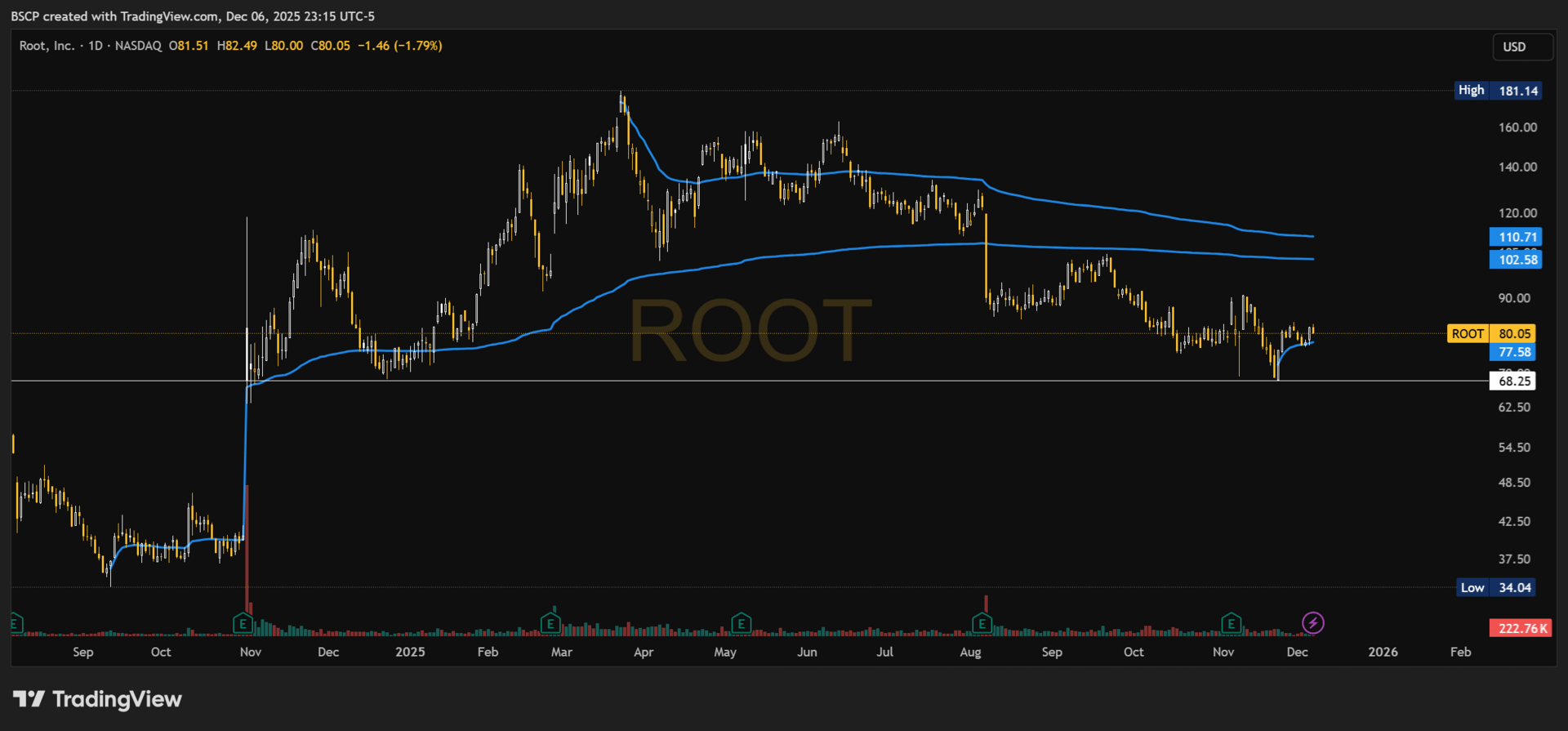

S/L: $68.66

PTs: $100 / $116 / runners

S/L: $3.12

PTs: $4.65 / $7.22 / runners

S/L: $27.45

PTs: $48 / $73 / runners

S/L: $21.32

PTs: $29.58 / $39 / $44.77

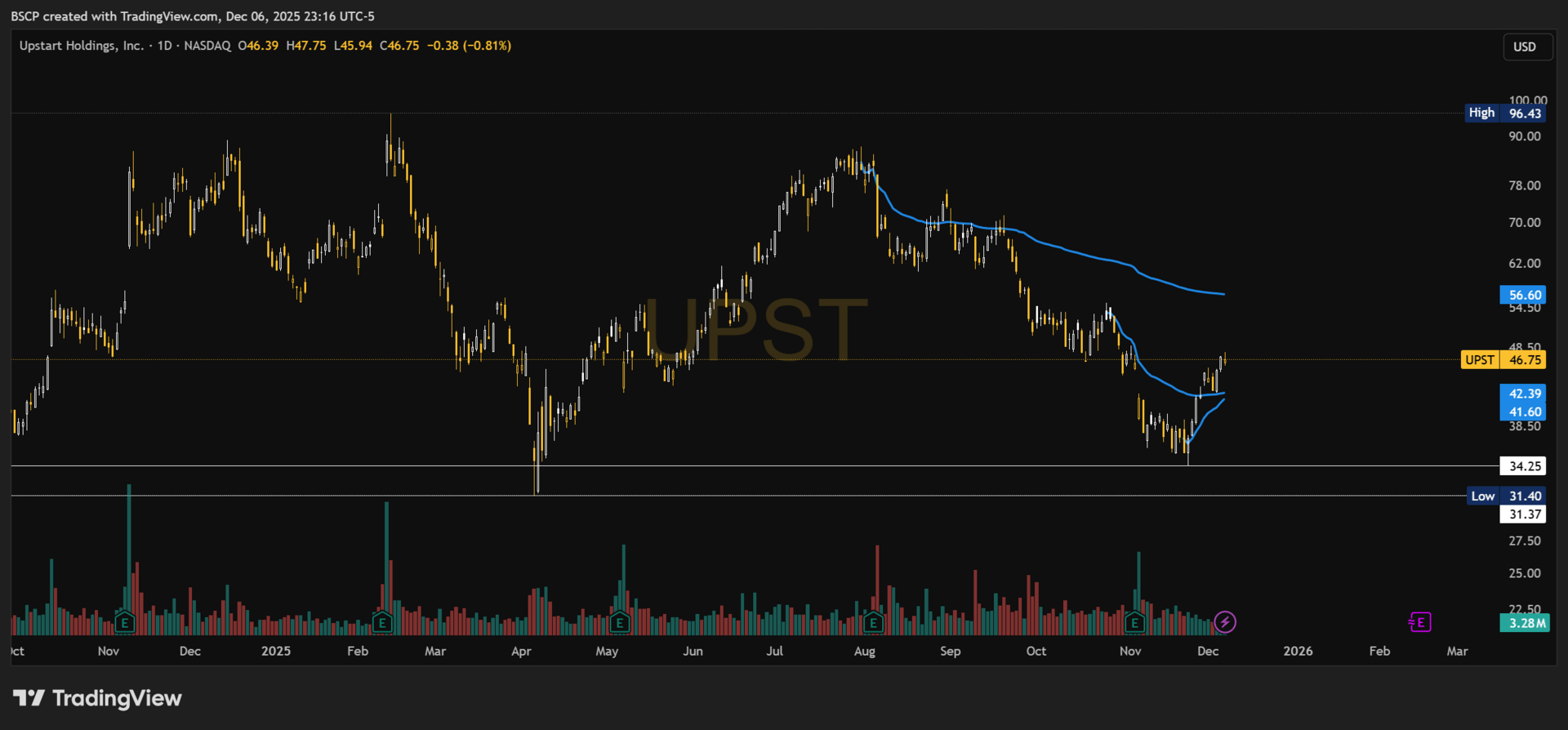

Potential S/L: $34.06

PTs: $62.36 / $85 / $98.55

PTs: $87.45 / $139.43 / $197.46

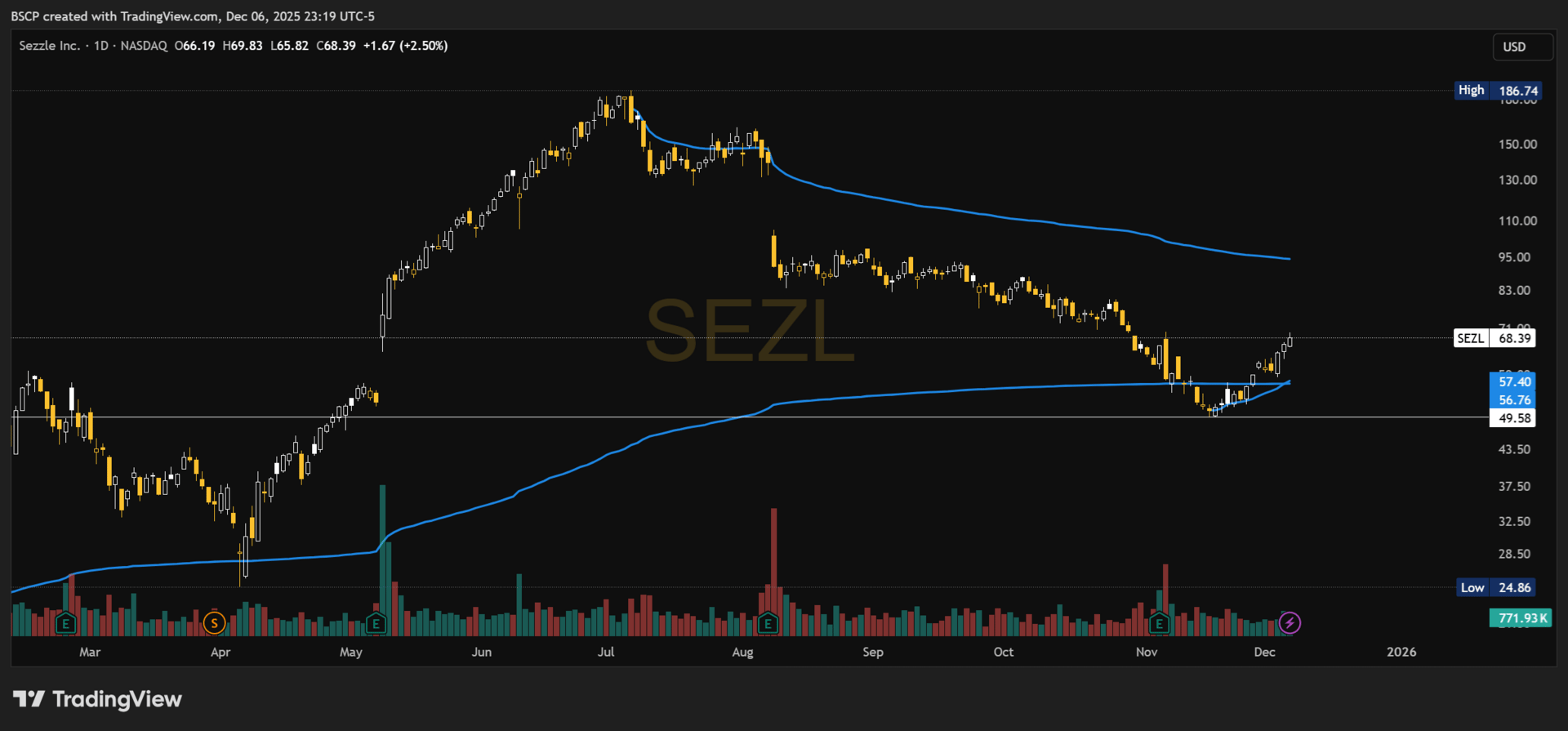

Potential S/L: $48.77

S/L: $65

PTs: $100 / $134 / $160 / runners

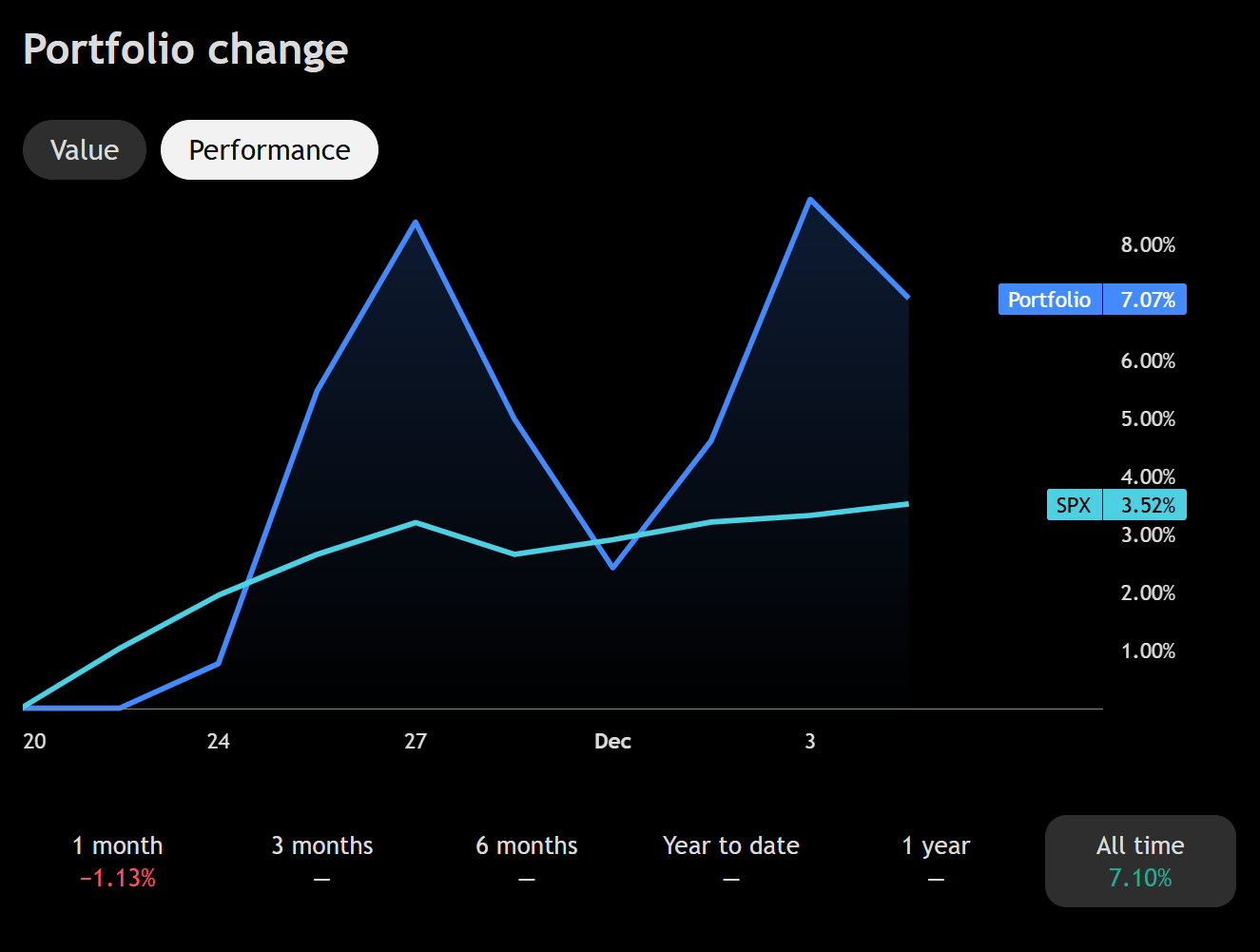

Portfolio Update

Before you look at the numbers, here’s the truth:

Volatility didn’t hurt the portfolio — it clarified it.

The names meant to hold, held.

The names meant to lead, led.

And the weakness we saw simply reset better entry levels.

IF YOU ONLY READ ONE SECTION…

We’re entering a rate-cut regime while high-quality growth sits on support, failed breakdowns stack up, breadth expands, and fear is still higher than positioning.

That’s not a top.

That’s a launchpad.

Use your zones.

Let the market do the heavy lifting.

— Connor

Alpha Before It Prints

A quick note on how I express conviction

For anyone wondering how this framework translates into actual positioning:

I run two live portfolios that reflect two very different parts of my thinking.

The Black Sheep Base Case Portfolio is exactly what it sounds like — core positioning for how I expect the broader market to resolve when structure matters more than headlines.

The Alpha Framework Portfolio is different.

That’s where I take long-term swings on smaller companies I believe can materially outperform over full cycles — names that usually look wrong before they look obvious.

A few past examples from that framework:

HIMS — $8.36 → +722% (ATH)

SOFI — $5.84 → +452% (ATH)

PLTR — $26.58 → +679% (ATH)

LMND — $31.31 → +171% (ATH)

ONDS — $1.74 → +532% (ATH)

CIFR — $2.96 → +762% (ATH)

IREN — $5.97 → +1,161% (ATH)

No alerts.

No perfection.

A lot of patience.

That’s not a promise — it’s just context for how I think and how I size risk.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe