Peter Lynch made his fortune using it. And when I see a sub-1 PEG on a company with this kind of momentum?

I pay attention.

Actually — I buy.

Right now, only one Big Tech name has that setup:

$AMD — PEG ratio of 0.7x.

That’s not just undervalued. That’s mispriced growth.

Meanwhile, Apple and Google are at 3.3x. Tesla’s at 2.9x. Even Nvidia’s sitting at a "fair" 1.0x PEG.

And yet $AMD, with faster-growing data center revenue and a legitimate AI advantage, is priced like it’s still a sidekick.

But here's what the market’s missing — and what I’m betting on:

1. $AMD Is Winning on AI Inference

At their 2025 keynote, AMD dropped a bomb:

Their new MI355X GPU delivers up to 40% more tokens per dollar than Nvidia’s B200, released just months earlier.

This is massive. Inferencing is exploding (>80% CAGR) and AMD is cheaper and faster for it.

Why? Because AMD's chiplet architecture allows faster iteration, better yields, and modular upgrades.

Nvidia still runs monolithic designs — great if wafer technology keeps scaling. But that game’s slowing. The next phase of AI hardware? It’s about packaging. And AMD is ahead.

2. AMD’s Chiplet Advantage Is Just Getting Started

Chiplets allow AMD to:

Mix and match improvements across components

Customize memory or compute based on customer needs

Upgrade specific chiplets instead of redesigning entire GPUs

Meanwhile, Nvidia is boxed in — their latest chips are already bumping up against the maximum reticle size of a wafer. That’s a ceiling.

AMD is building sideways. Smarter. Faster. Cheaper.

3. The Helios Rack Is a Game-Changer

For a while, AMD’s biggest weakness was software and systems. CUDA dominated, and Nvidia’s turnkey racks made deployments easy.

That gap is closing fast:

ROCm is now “good enough” and getting even better with ROCm 7.

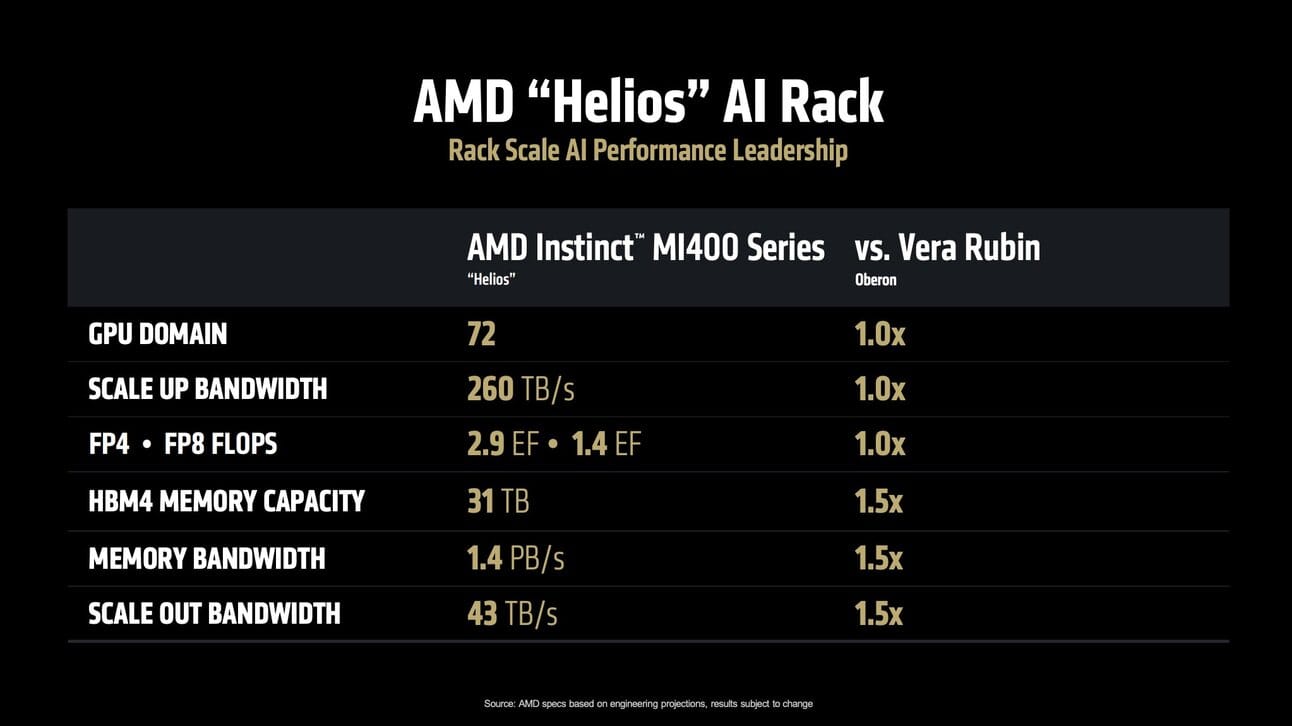

The Helios Rack (coming 2026) connects 72 GPUs and outperforms Nvidia’s upcoming Vera Rubin rack.

Now, AMD isn’t just a chip company. It’s offering full-stack AI solutions — exactly what hyperscalers want.

4. Revenue Growth Is Accelerating — Fast

While Nvidia is still dominant in raw share, AMD is starting to win the growth rate battle.

AMD’s Data Center revenue grew 57% YoY in Q1

$400M order from Crusoe just hit in June

Even with Nvidia’s B200 out early, AMD is catching up and passing in inferencing

Look at this chart and tell me this story isn’t changing in real-time:

5. The TAM Tailwind Is Staggering

The AI Data Center TAM is growing from $45B in 2023 to over $500B by 2028.

If AMD just bumps from 10% to 15% market share while the market grows 80%…

That’s a 170% jump in revenue in one year.

A 20% share within two years?

That’s over 500% growth.

And remember: Data Center is now half of all AMD’s revenue. This isn’t a side bet. This is the business.

6. And the Market Still Thinks This Is a Second-Rate Chip Company

Despite all of this… AMD trades at a 0.7x PEG ratio.

Wall Street is pricing it like the little brother.

But the numbers say it’s already on pace to outperform the big one.

I’m not saying $AMD is the next Nvidia.

I’m saying you don’t need it to be.

At this valuation, if it just becomes a strong #2 in a $500B+ market, the upside is massive.

And if inferencing keeps scaling — and AMD’s chiplets keep iterating — this could be one of the most mispriced growth stories in tech.

I’m long $AMD. Not because I believe the hype.

But because I believe in cost curves, architecture advantages, and PEG ratios.

And right now, $AMD checks all three.

Subscribe to Alpha Before It Prints for deep dives like this—before the story breaks wide open.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe