This Is Rotation — Not a Breakdown

The market feels heavy this week. That part is undeniable.

But heaviness doesn’t equal damage.

What we’re seeing right now is concentrated pressure in a few large-cap tech names — not a broad exit from equities. When the biggest weights lean at the same time, the indices make it feel worse than it actually is.

This is digestion. Not deterioration.

The Big Picture

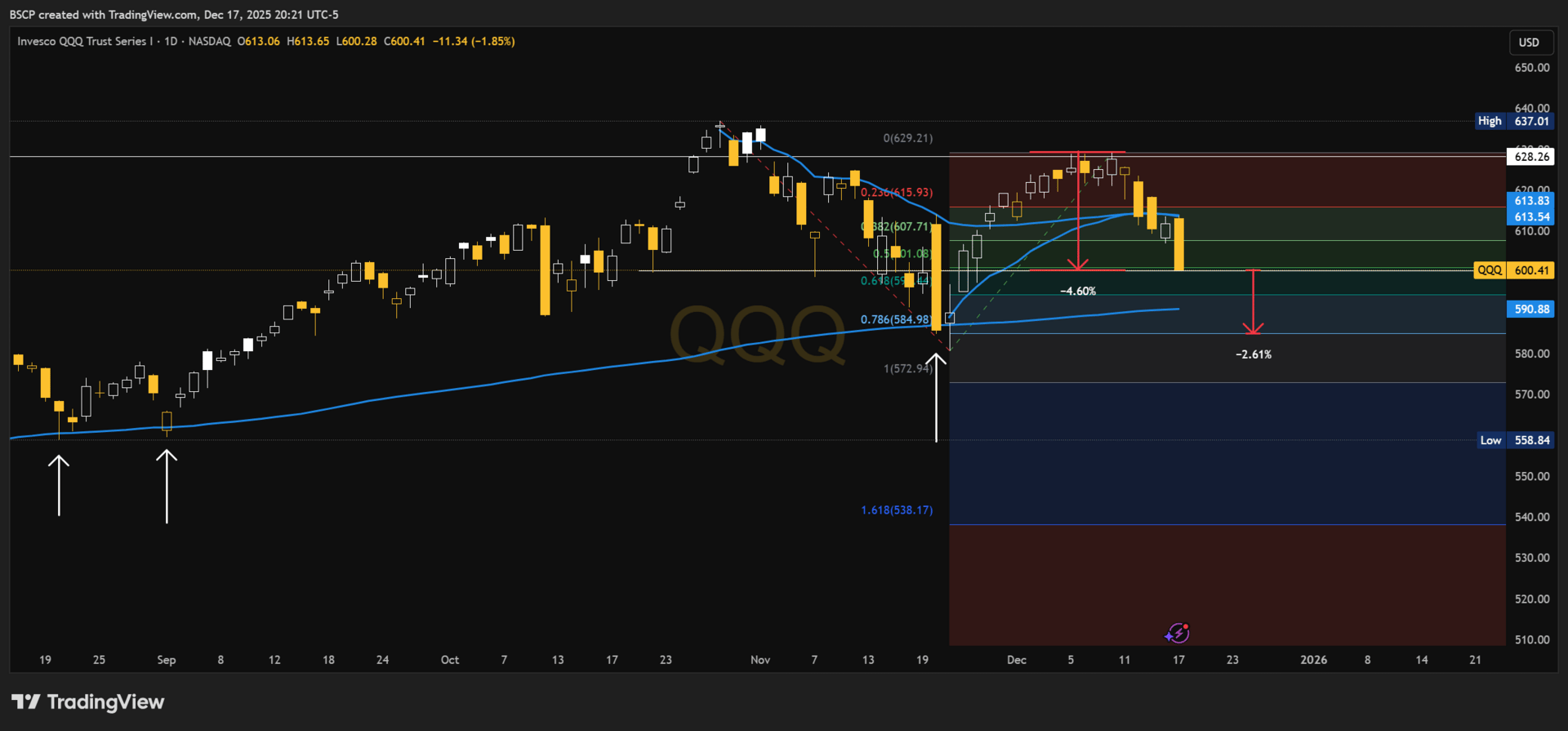

The S&P 500 is pulling back from recent highs, but it’s doing so within the context of an ongoing uptrend. Price is working off overbought conditions after a strong move off the late-November lows.

This is exactly how healthy markets reset.

As long as price holds these zones, the path of least resistance remains higher — even if the ride there isn’t clean.

Worst case, we have another ~2–3% downside before the next high-probability reversal zone, where we’ve already seen multiple successful bounces.

Why This Feels Worse Than It Is

The pressure everyone is reacting to is coming from the same place: large-cap tech.

When AAPL, NVDA, GOOGL, and MSFT all pull back together, it drags the index with it. That doesn’t mean money is leaving the market — it means leadership is temporarily pausing.

Worst case we have another -2.61% to go before the next most likely point of reversal at the .786 fib.

Tech is heavy. But heavy doesn’t mean broken.

Market Breadth

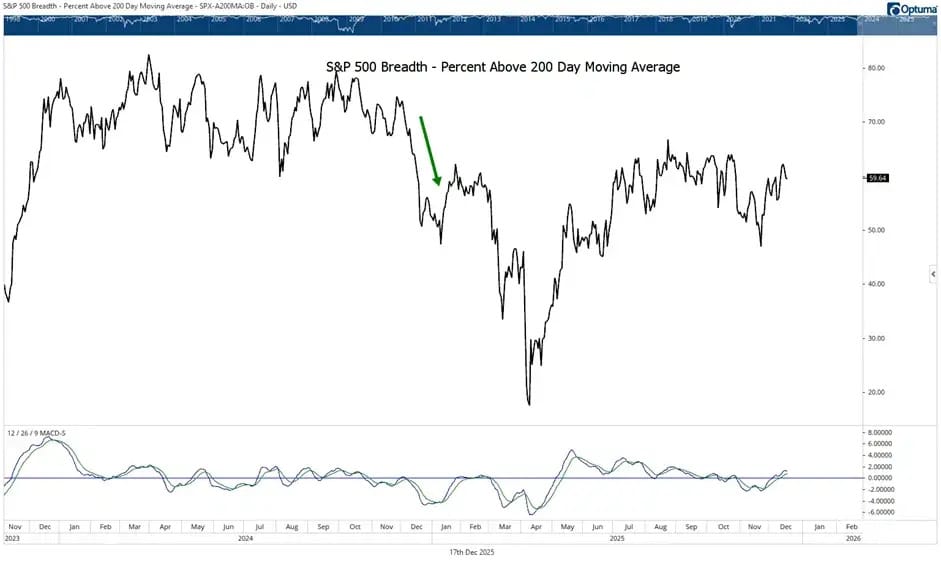

Last year, breadth quietly broke down before price did. That was the warning sign most people missed.

This year looks different.

Using the percentage of S&P 500 stocks above their 200-day moving average, breadth has been trending higher since late November, rising from the high-40% range just a few weeks ago to roughly 58% today.

That matters.

In 2024, this same metric was collapsing into late November, printing the weakest readings of the year and setting the stage for a broader correction. This year, the weakness showed up earlier — between October and late November — and has since improved, even as large-cap tech has come under pressure.

That tells me the current tech pullback isn’t infecting the rest of the market.

Could breadth weaken later in 2026? Absolutely. That’s something to monitor as we move forward. But right now, this technology-led drawdown has not translated into broad market damage.

Internals are holding up better than headlines suggest.

Small Caps (IWM)

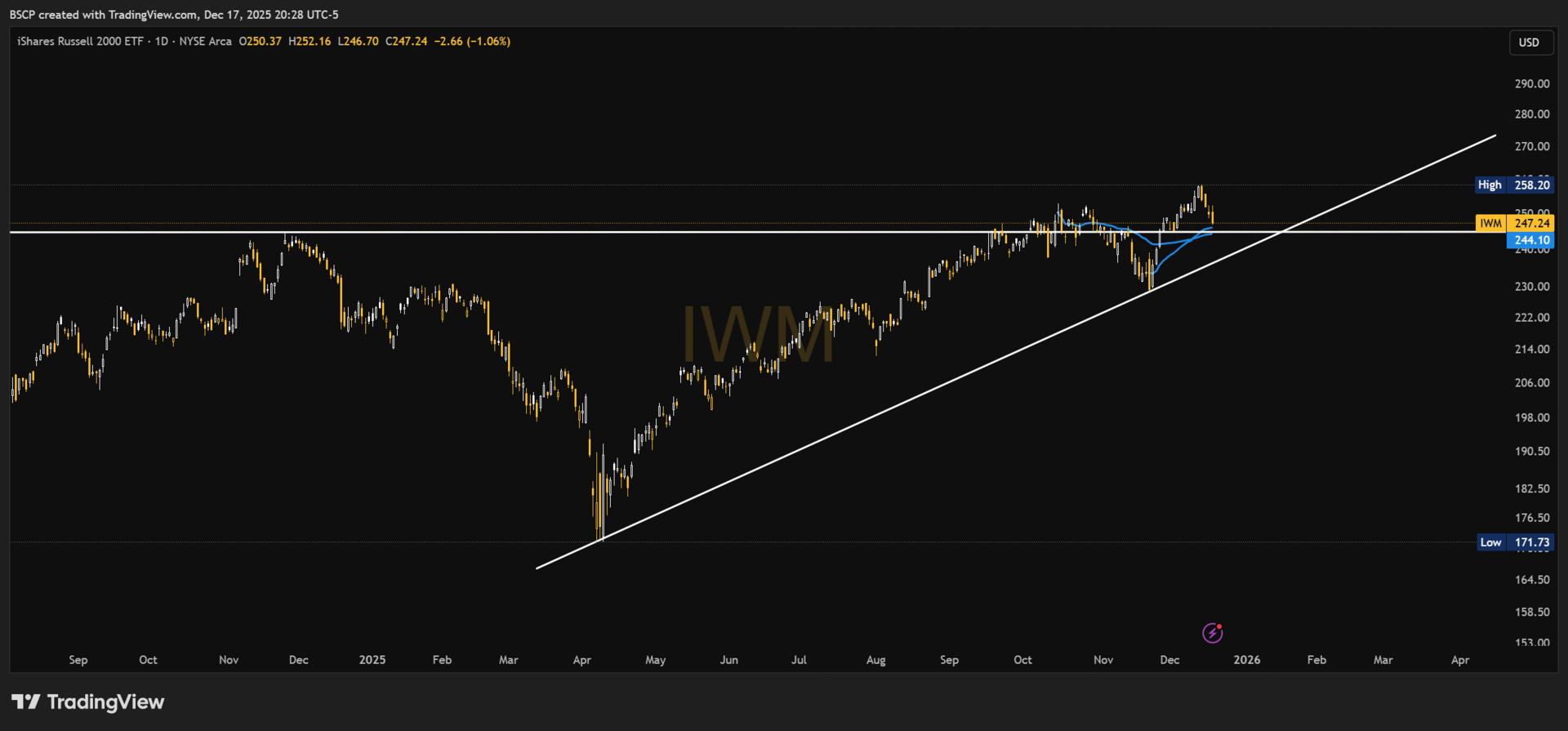

Small caps are doing exactly what you’d want to see in a constructive pullback.

IWM remains above its most recent breakout level, and more importantly, price is sitting right near the most recent pivot anchored VWAPs. That area is where buyers have consistently stepped in over the past few months.

This isn’t a breakdown — it’s a test.

Pullbacks back into former resistance and anchored VWAP support are often where short-term reversals start, especially when they occur within a broader uptrend. So far, that structure remains intact.

As long as IWM continues to hold this zone, the higher-low thesis stays alive, and the recent breakout remains valid.

That’s not what a market preparing for a broader selloff looks like.

Where This Likely Resolves

Short-term, markets can stay choppy. A few more days of frustration wouldn’t surprise me.

But structurally:

The indices are still within support.

Breadth remains constructive.

Rotation is favoring areas outside crowded mega-cap tech.

That combination usually resolves higher — not lower.

How I’m Positioned

I’m not chasing strength.

I’m not panicking on weakness.

This is the part of the cycle where patience beats prediction.

Letting price come to me.

Respecting structure.

Avoiding emotional decisions driven by headlines.

Bottom Line

This isn’t a breakdown.

It’s a reset.

Late-year volatility feels uncomfortable by design. That’s how markets shake out weak positioning before the next leg.

As long as breadth holds and support remains intact, I’m treating this as opportunity — not warning.

— Connor

Alpha Before It Prints

A quick note on how I express conviction

For anyone wondering how this framework translates into actual positioning:

I run two live portfolios that reflect two very different parts of my thinking.

The Black Sheep Base Case Portfolio is exactly what it sounds like — core positioning for how I expect the broader market to resolve when structure matters more than headlines.

The Alpha Framework Portfolio is different.

That’s where I take long-term swings on smaller companies I believe can materially outperform over full cycles — names that usually look wrong before they look obvious.

A few past examples from that framework:

HIMS — $8.36 → +722% (ATH)

SOFI — $5.84 → +452% (ATH)

PLTR — $26.58 → +679% (ATH)

LMND — $31.31 → +171% (ATH)

ONDS — $1.74 → +532% (ATH)

CIFR — $2.96 → +762% (ATH)

IREN — $5.97 → +1,161% (ATH)

No alerts.

No perfection.

A lot of patience.

That’s not a promise — it’s just context for how I think and how I size risk.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe