Here’s how I’m reading today’s tape — stripped down and without the noise:

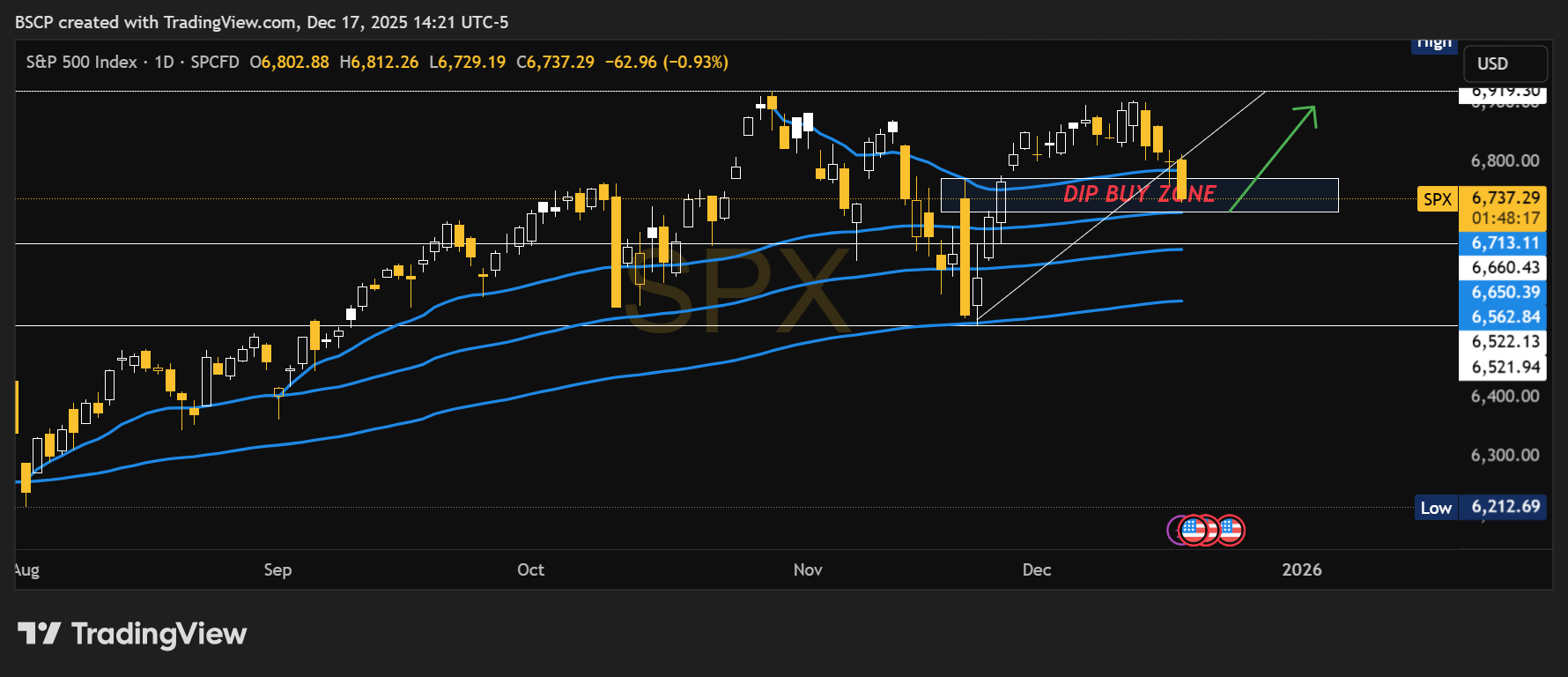

SPX is digesting, not breaking. We’re hovering around the ~50% retrace of the Nov 20 low → high move. That zone (roughly 6715–6700) is doing what it’s supposed to do: slow things down and force patience ahead of CPI.

Today looks ugly because Tech is heavy. Large-cap Tech is doing most of the damage, which makes the decline feel worse than the underlying reality. When Tech sneezes, the index headlines exaggerate it.

Breadth isn’t great — but it’s not panic. Roughly ~3:2 negative. That’s choppy, not catastrophic. If this were a real problem, you’d see 3:1 or 4:1 downside pressure. We’re not there.

More than half of sectors were green today. That matters. This isn’t broad liquidation — it’s rotation and short-term positioning.

Seasonality still matters. Two bad Decembers in a row would be an outlier. Historically, this window often resolves into a late-December turning point, especially near December expiration.

Key levels I’m watching:

Near-term support: ~6714

Line in the sand: ~6670

As long as 6670 holds on a weekly basis, this looks like consolidation — not trend damage.

Base case: Markets work through this chop and find a short-term low in the next 1–3 trading days.

Translation: If you have a 1–2 month timeframe, today’s weakness is closer to opportunity than danger.

This isn’t the market rolling over — it’s the market frustrating people who are positioned too tightly and thinking too short-term.

More once CPI hits.

— Connor

Alpha Before It Prints

A quick note on how I express conviction

For anyone wondering how this framework translates into actual positioning:

I run two live portfolios that reflect two very different parts of my thinking.

The Black Sheep Base Case Portfolio is exactly what it sounds like — core positioning for how I expect the broader market to resolve when structure matters more than headlines.

The Alpha Framework Portfolio is different.

That’s where I take long-term swings on smaller companies I believe can materially outperform over full cycles — names that usually look wrong before they look obvious.

A few past examples from that framework:

HIMS — $8.36 → +722% (ATH)

SOFI — $5.84 → +452% (ATH)

PLTR — $26.58 → +679% (ATH)

LMND — $31.31 → +171% (ATH)

ONDS — $1.74 → +532% (ATH)

CIFR — $2.96 → +762% (ATH)

IREN — $5.97 → +1,161% (ATH)

No alerts.

No perfection.

A lot of patience.

That’s not a promise — it’s just context for how I think and how I size risk.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe