September has a nasty rep.

Historically? It's the worst month for equities.

On average, it underperforms 11 out of 12 months going back to 1950.

But this year...

It’s setting up to be one of the best.

And here’s why I’m leaning in—while everyone else is staying out.

The Setup No One’s Talking About

Tom Lee (Head of Research at Fundstrat) dropped a note that deserves attention:

“The only two times the Fed was on hold all year and then cut in September…

...were 1998 and 2024.”

Let that sink in.

Only twice in the last 50 years has the Fed stayed on the sidelines for 8 months and then pivoted dovish in September.

In both of those instances—stocks ripped:

The S&P 500 posted +3.3% average gains.

Volatility (VIX) started ticking up before the move.

Macro sentiment was near its lows.

Sound familiar?

Yeah.

Weak Data = Strong Market (In This Cycle)

Manufacturing ISM has now clocked in 31 straight months below 50.

That's contraction territory.

Normally, that’s a risk-off signal.

But when the Fed is finally blinking?

It’s actually bullish.

Because we’ve never had a bear market kick off when ISM was already sub-50.

The worst is priced in.

And now we’ve got policy support coming in behind it.

Where I’m Focused Right Now:

Lee pointed to some obvious spots:

AI thematic ETFs like $AIEQ and $ARTY

The Magnificent 7 (still leading structurally)

Crypto majors: $BTC and $ETH

But here’s how I’m framing it through the Black Sheep lens:

Crypto

Bitcoin $BTC: Likely entering a “blow off top” phase here. I do not like the risk/reward at this point in the cycle. If you are looking to accumulate a long term position my recommendation would be to pick a set amount and have a weekly DCA.

Ethereum $ETH: Finally flashing relative strength again. Likely see $6,000 + this month. I think this could ultimately top around $7,500 - $10,000.

Also holding positions in $SBET ( ▲ 4.74% ) & $BMNR ( ▲ 6.18% ) - From 09/03/24 to 11/20/24 $MSTR went up 258% …. I expect $SBET ( ▲ 4.74% ) & $BMNR ( ▲ 6.18% ) are both going to run like this by EOY.

Small cap AI/Robotics related positions I plan to hold through the rally…..(I will likely exit these positions at some point before EOY.)

price action is eerily similar to the breakout in November of last year.

Price action looks very similar to Oct/Nov 2024 once this thing moves it's going to move quick.

Defense Tech

$ONDS ( ▲ 3.79% ) - I’ve been pounding the table on drone stocks for months.

ONDS was one of the cleanest asymmetric setups out there.

Govt contracts are heating up.

Spec money hadn’t rotated yet.

Retail hadn’t caught the story.

Once defense flow meets AI narrative, this gets real interesting. I am long since $1.99 (current price over $5) and have not sold any of the 9,999 shares I own. I do still think this could go to $8 - $10 at some point this year.

If this thing goes to $10 by the end of September I will get an $ONDS ( ▲ 3.79% ) tattoo.

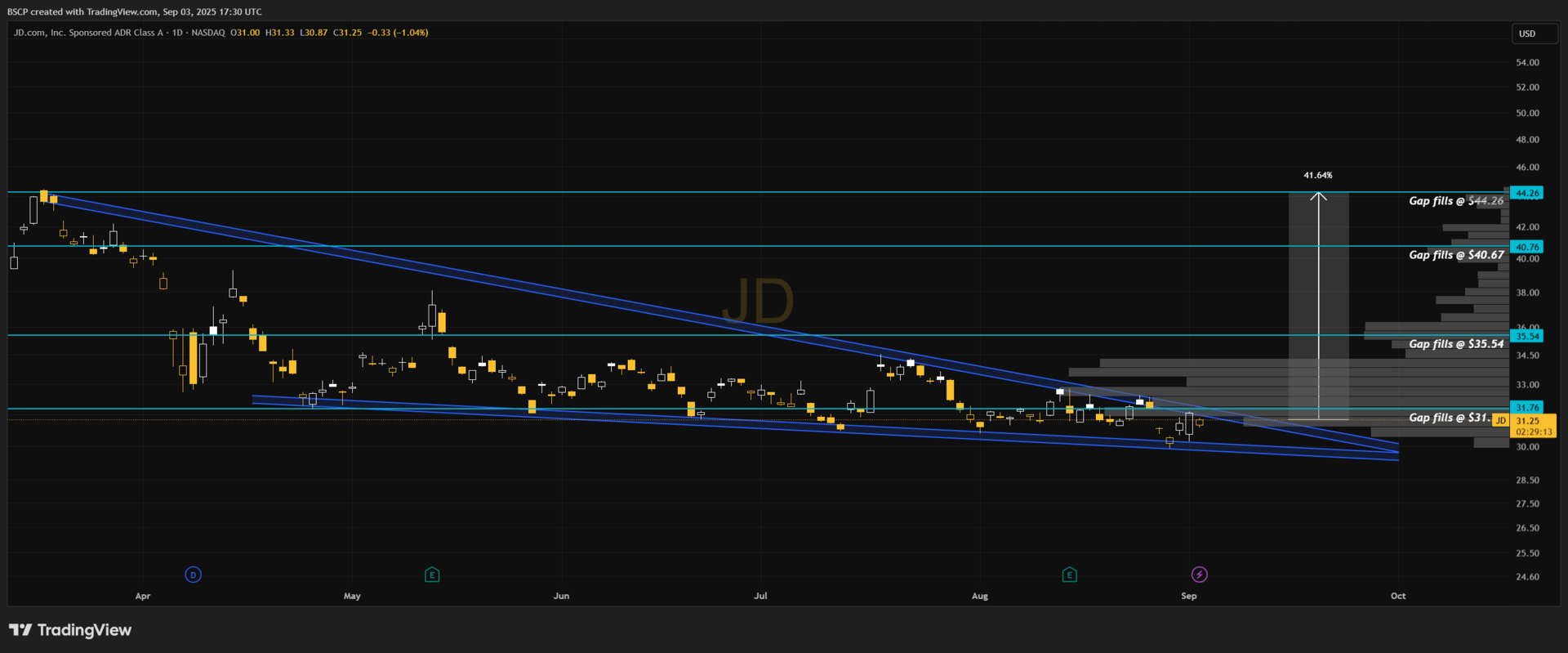

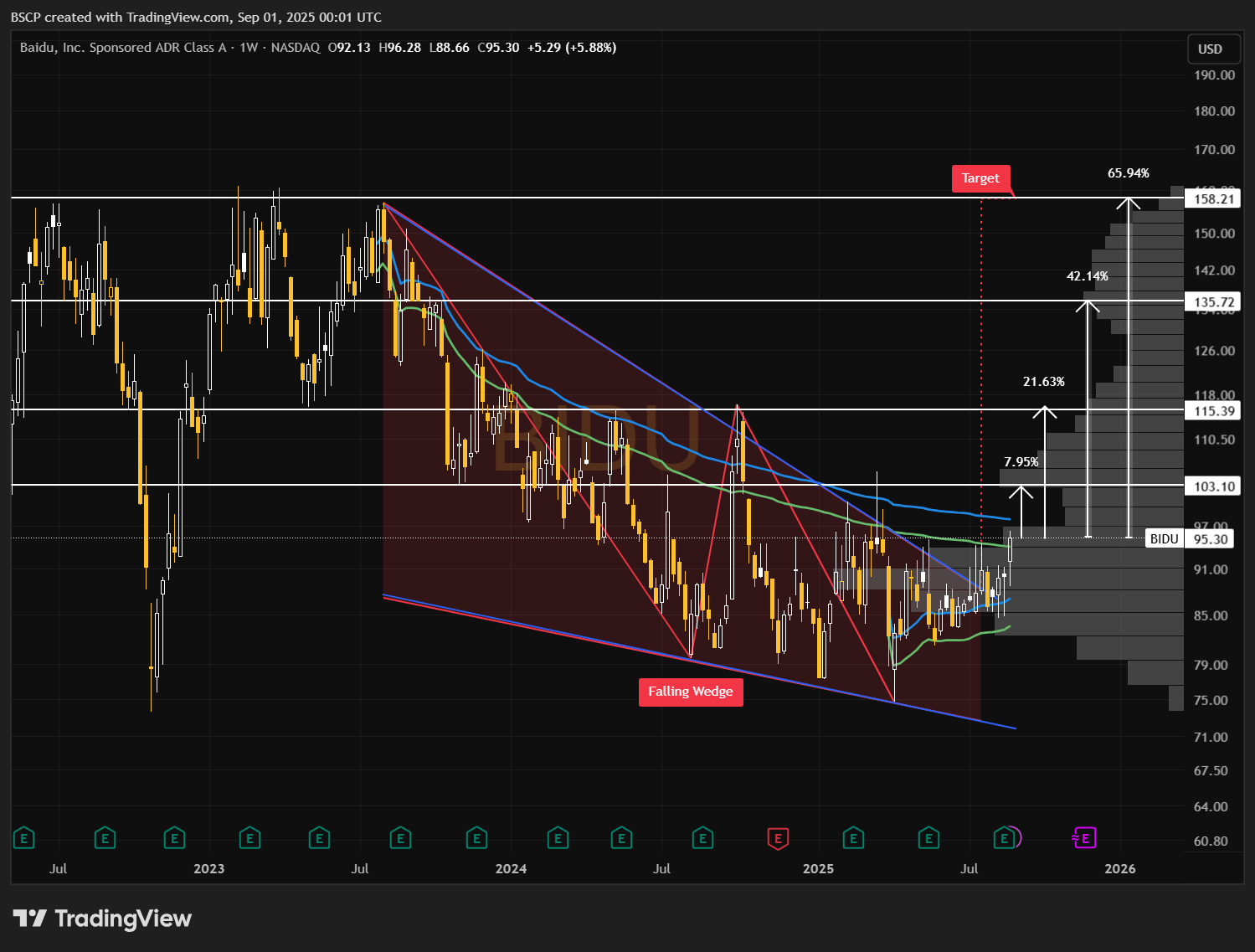

Chinese names I am bullish on through the EOY as Chinese markets hit multi year highs.

Bonds (the trade almost no one wants)

I’m bullish on bonds right here.

Fed cutting = yields down = bond bid.

I’m buying calls on $TLT (20+ Yr Treasury ETF) as a levered way to play the policy shift. This is the hedge no one’s talking about.

Right now, I’m running more of a swing trader’s playbook—stacking gains from short- to mid-term setups and rolling that capital back into my highest-conviction long-term names: $LMND ( ▲ 2.91% ) , $TSLA ( ▲ 0.09% ) , $HIMS ( ▲ 3.17% ) , $ZETA ( ▲ 3.2% ) , $OSCR ( ▼ 2.12% ) , $NBIS ( ▲ 9.23% ).

You don’t get alpha by following consensus.

You get it by anticipating where money has to rotate next.

Subscribe to Alpha Before It Prints for deep dives like this—before the story breaks wide open.

Disclaimer: While I’m fundamentally a long-term investor, I don’t ignore asymmetric opportunities when they present themselves. At times, I’ll trade around positions or exit entirely if the price action breaks down. Nothing here is financial advice—just sharing how I navigate markets in real time.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe