This Feels Like $HIMS at $7

When I started buying $HIMS at $7, everyone thought I was early, maybe even reckless.

Wall Street couldn’t get past the GAAP losses.

But I was looking deeper: cohort curves, margin expansion, product velocity.

That bet played out.

Now I’m seeing the same setup with $LMND—and I believe the market is missing it.

The Setup

While everyone’s still hung up on net losses, Lemonade has flipped the script:

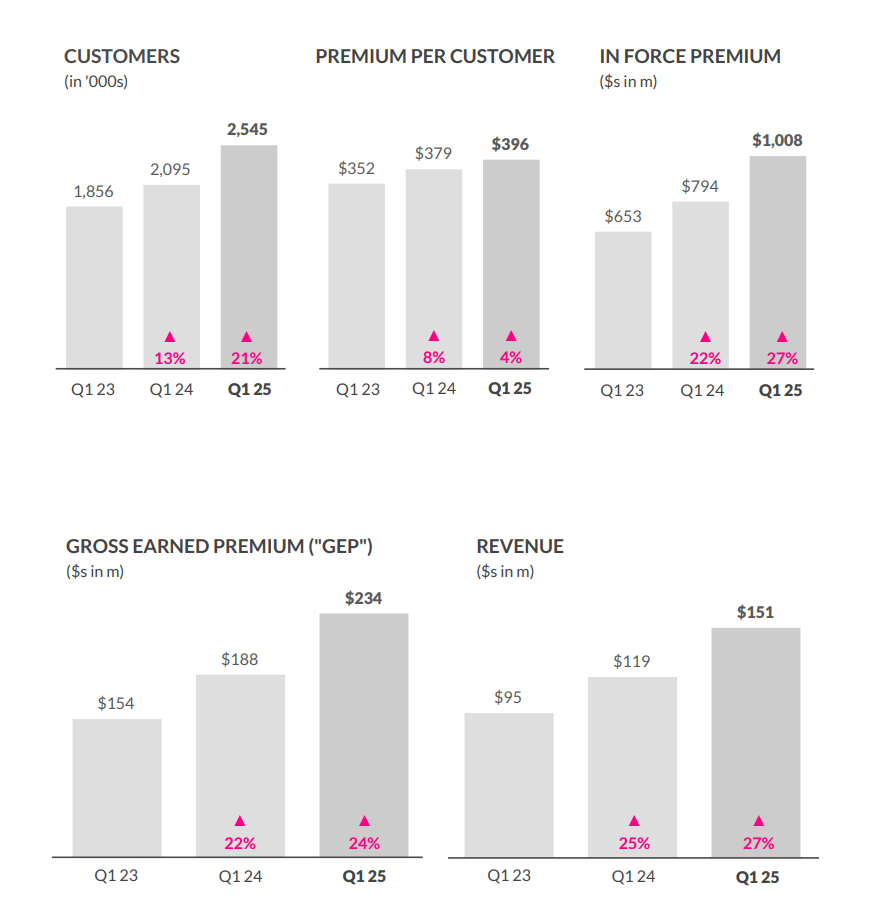

In-force premium just passed $1B

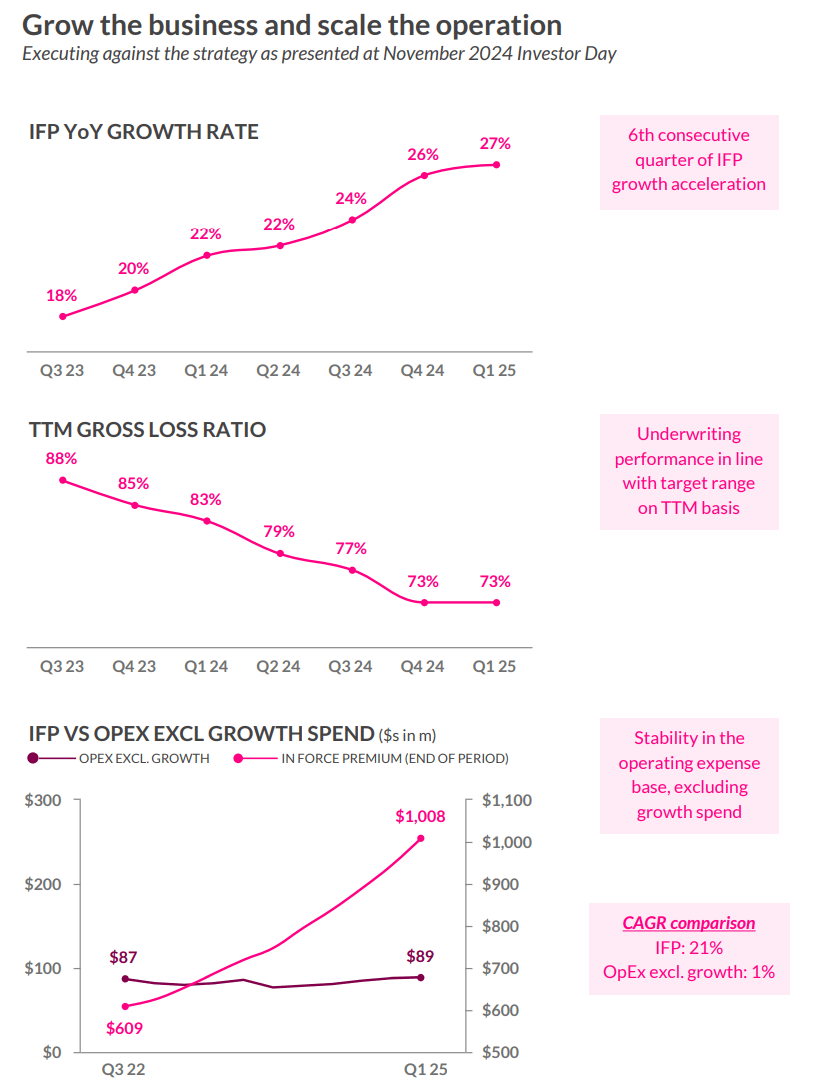

6 straight quarters of accelerating YoY IFP growth

Gross loss ratio stable at 73%, hitting internal targets

Operating expenses are flat, even as premiums scale

Customer count >2.5M, up 21% YoY

Premium per customer now $396, up 4% YoY

Adjusted gross profit up 25% despite California wildfire drag

Adjusted FCF would have been positive in Q1 if not for that one-time event

Short interest: 16.9M shares shorted (~30% of float), $733M bet against it

Customer count, IFP, and premium per customer are compounding steadily — setting the foundation for long-term margin expansion.

Loss ratios are stabilizing within target — a critical milestone in early-stage insurance plays.

This is mispriced asymmetry.

And I want to be positioned before the narrative catches up to the numbers.

Built Different

Legacy insurers are fighting gravity:

Trillions in debt

Bloated cost structures

Tech built for another era

Meanwhile, Lemonade is:

Full-stack AI from the ground up

No brokers, no paper

Native app-first experience

Their platform cancels your old policy, evaluates your new address, reprices your plan, and binds your policy in seconds.

That’s not a vision. That’s what they’re doing right now.

They’re not "going digital." They are digital.

Flat OpEx against surging IFP highlights Lemonade's digital-native architecture and cost leverage.

Operating Leverage Is Already Showing Up

From Q3 2022 to Q1 2025:

IFP grew from $609M to $1,008M

OpEx excluding growth spend went from $87M to $89M

That’s almost zero cost increase, with 65% IFP growth.

They’ve hit escape velocity on their fixed cost base.

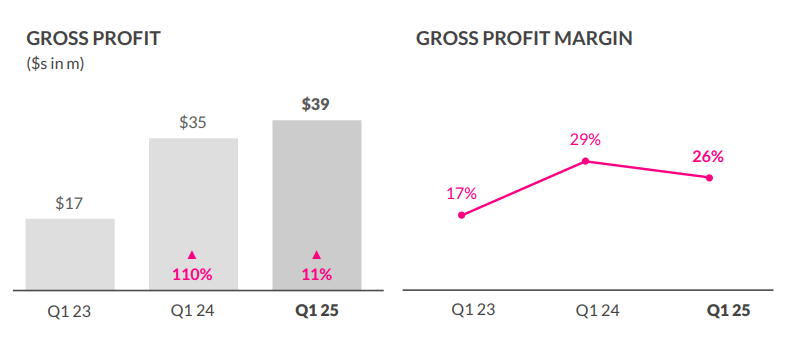

Gross profit continues to grow alongside margin consistency — a classic sign of early operating leverage.

Margins are holding up as scale increases. That’s rare in insurance — and it’s a major signal.

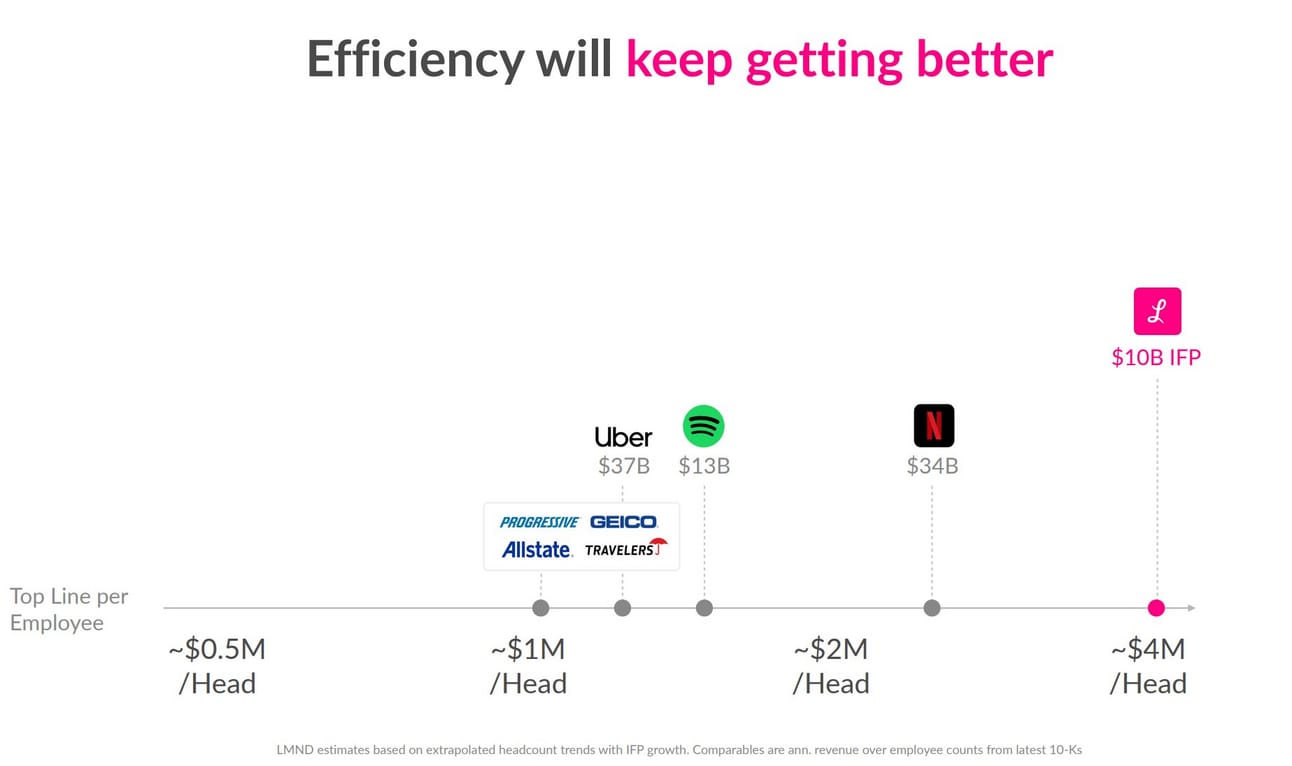

Headcount has barely moved — a clear sign of scalable efficiency.

Why the Market Doesn’t Get It Yet

Insurance is slow. Painfully slow.

It’s regulated. Capital-intensive. Built on long feedback loops.

But that’s exactly why Lemonade has the moat.

They’ve spent the last 8 years doing the hard work incumbents can’t stomach:

Full-stack build

AI-native workflow

Cross-border product launches

Underwriting refinement

Regulatory lift

Now they’re ready to compound.

Loss ratios have remained stable even with wildfire volatility — signaling underwriting discipline.

The AI Stack

55%+ of claims processed automatically

Fraud detection embedded from onboarding

AI bots (Jim & Maya) run end-to-end workflows

All interactions are measured, recorded, optimized

Ingests 1,000s of micro-signals for better risk modeling:

Time of day user signs up

Whether they read fine print

Which keywords they used

What items they insure

Lemonade’s platform unlocks stronger unit economics as they scale — gross profit per customer continues to expand. Shai Wininger’s vision is unfolding: an insurance company that runs itself.

CAC, LTV, and the Long Game

90% of Lemonade’s customers are first-time insurance buyers.

They start with renters. Then add homeowners. Then car. Then life.

And when they bundle? Risk profiling improves. Margins go up. Loyalty deepens.

They’re playing the long game:

Acquire young, safe customers early

Grow with them over decades

Use AI + bundling to maximize margin and minimize loss

Their LTV/CAC ratio is 3:1+, validated by both internal data and General Catalyst’s "Synthetic Agent" loan structure.

This flywheel is already spinning.

Early customers compound in value as they expand across product lines — a natural LTV engine.

Valuation Math

This is the part that makes people uncomfortable.

But let’s walk through it anyway:

If $LMND hits 1% market share by 2040:

That’s $100B in revenue

15% op margin = $15B operating income

35x multiple = $525B market cap

That’s a 200x from today.

Even if you're conservative and cut it in half... still a monster outcome.

You don’t need them to dominate. You just need them to survive and compound.

Even with conservative assumptions, this is one of the most asymmetric public market bets I’ve seen.

The Short Setup

16.9M shares shorted

Days to cover dropped from 9.8 to 5.6

Short interest = ~30% of float

If the story flips, the unwind could be violent. The setup is there.

The "Obvious in Hindsight" List

Every cycle has one:

$AMZN: Everyone mocked the losses

$SPOT: "Streaming isn’t profitable"

$NFLX: "Mailing DVDs isn't tech"

Then the inflection hits. And it’s obvious.

Lemonade is building toward that moment.

They’ve absorbed the pain.

They’ve scaled the tech.

They’ve cracked CAC.

They’ve stabilized loss ratios.

It’s not a startup anymore.

It’s an early-stage platform compounding quietly.

Final Word

$LMND is operating in a $10T industry where no one owns more than 4% market share.

They’re AI-native.

They’re lean.

They’re global.

They’ve been misunderstood because they invested in the future before the numbers made it obvious.

Now the numbers are catching up.

This is what conviction looks like before consensus arrives.

It’ll be obvious in hindsight.

Subscribe for deep dives like this before they go mainstream.

Alpha Before It Prints — Where conviction beats consensus.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe