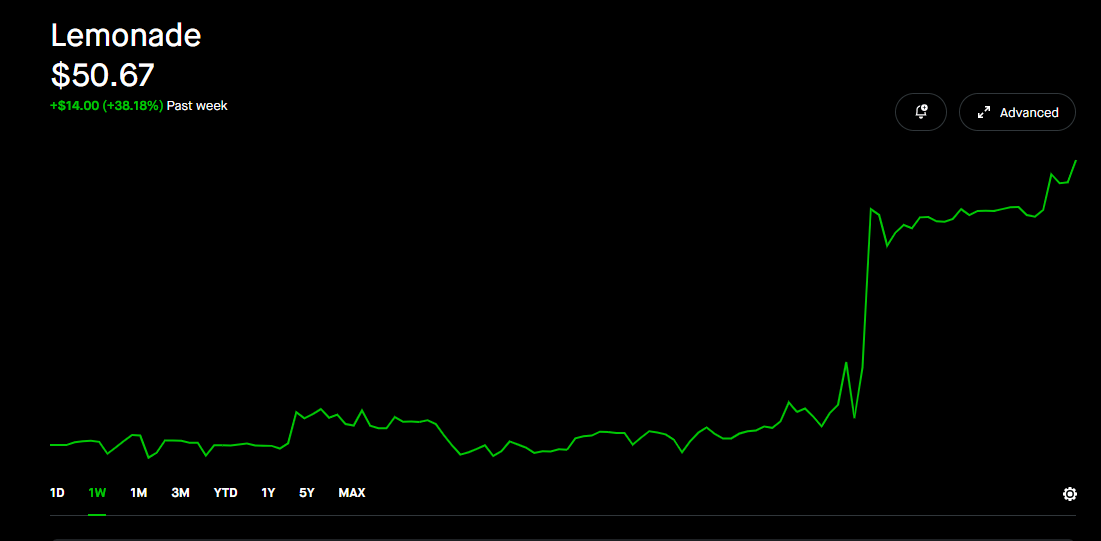

$LMND just ripped +30% in a single day after reporting what might be their cleanest quarter ever...and I’m still buying.

Here’s what stood out:

In-Force Premium grew 29% YoY to $1.08B

Revenue up 35% YoY

Gross Profit up 109% with margin expansion to 39%

Free Cash Flow positive for the second straight quarter

Net Loss improved 23% YoY

Adjusted Gross Profit up 96% YoY

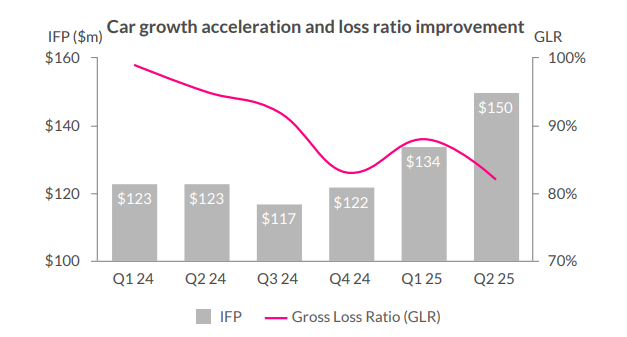

Loss Ratio down to 67% — their best result in over two years

Most investors are still trying to understand it.

But if you’ve been following here — you already know.

Most companies would be screaming from the rooftops after numbers like this.

Lemonade barely flinched. They’re just… executing. Quietly. Systematically.

While the rest of the industry is stuck in spreadsheets and service centers, $LMND is scaling with AI, automation, and a cost structure that doesn’t need to grow just because revenue does.

For the first time in a long time, you’re seeing the full thesis show up in the numbers:

7 consecutive quarters of compounding growth

Reinsurance scaled back → more profit retained going forward

Europe scaling faster than the U.S. ever did

Lemonade Car loss ratios finally dialed in and improving

And here's the part that really matters…

This isn’t just a recovery.

This is a re-rate.

If you’re still viewing Lemonade as a “niche renters insurance play,” you’re not seeing the bigger picture.

This is what Amazon looked like in 2002.

What Netflix looked like in 2010.

What $HIMS looked like when I first started buying.

The alpha always shows up in the fundamentals first.

The price action just confirmed it.

Subscribe to Alpha Before It Prints for deep dives like this—before the story breaks wide open.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe