Most people missed this.

But buried inside Lemonade’s latest shareholder update was a quiet shift with major implications:

They just cut reinsurance from 55% to 20%.

That might sound like a technical detail, but it’s not.

It fundamentally shifts the economics of their business.

Let me walk you through it.

The Reinsurance Shift

Lemonade used to cede 55% of their premium revenue to reinsurers. That meant for every $1 in gross earned premium (GEP), they only kept $0.45.

Now? They're keeping $0.80.

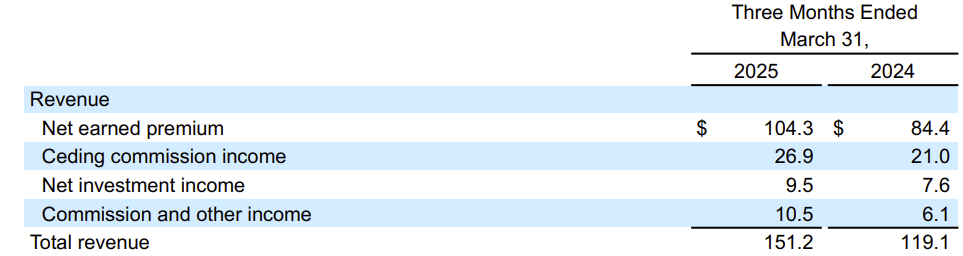

That change alone is expected to unlock $300M+ in additional revenue over the next 12 months. Here’s how it breaks down:

Q1 GEP = $186.7M

Annualized = $747M

Assuming 10% YoY growth = $821M GEP

At 45% retention (old model) = ~$370M revenue

At 80% retention (new model) = ~$660M revenue

Add in commission income, investment income, and other line items, and we’re looking at $900M–$1B in revenue over the next 12 months.

But What About Valuation?

With that kind of revenue growth, the forward multiple drops:

$LMND market cap = ~$3.2B

Forward revenue = ~$900M

NTM Price/Sales = ~3.5x

For a company growing top line 50%+ YoY with improving margins? That’s rare.

Here’s a short list of US-listed companies trading under 3.5x sales with >50% revenue growth:

$AAOI

$QXO

$GLXY

$GOGO

Those names come with baggage.

Lemonade doesn’t — it’s just being overlooked.

Why Would Management Make This Move?

Let’s start with the bull case:

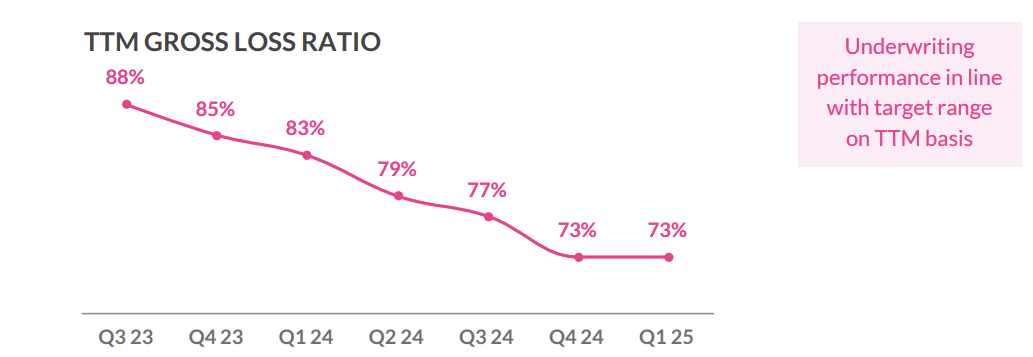

Management is confident in their underwriting

Models have improved

Loss ratios have stabilized (73%)

Reinsurance fees have gone up—cutting them boosts margins

Now the bear case:

They were forced to reduce due to weaker reinsurance market

Couldn’t secure favorable terms after recent catastrophe events

Capital surplus requirements go up, reducing flexibility

In my view, Lemonade’s earned the right to keep more risk on their books.

They've hit their internal loss targets for 6 straight quarters. They're sitting on capital. They're ready to scale.

My Take

This move is bold. But it’s not reckless.

This is Lemonade stepping into its next phase:

Leaner reinsurance = more revenue retained

More revenue = faster EBITDA path

Operating leverage already showing up

The risk? If a catastrophe hits, they eat more of the loss. But that's part of building a real insurance business.

And they’re doing it the right way:

Consistent transparency

Long-term targets intact

No flashy guidance or hype

Just quietly compounding.

This is what inflection looks like.

Conviction before consensus.

Subscribe to Alpha Before It Prints for deep dives like this—before the story breaks wide open.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe