Back in 2023, I wrote a short piece comparing Hims & Hers to Amazon in its early days. It wasn’t something I shared publicly at the time. I was just trying to make sense of what I was seeing—and more importantly, what I was buying.

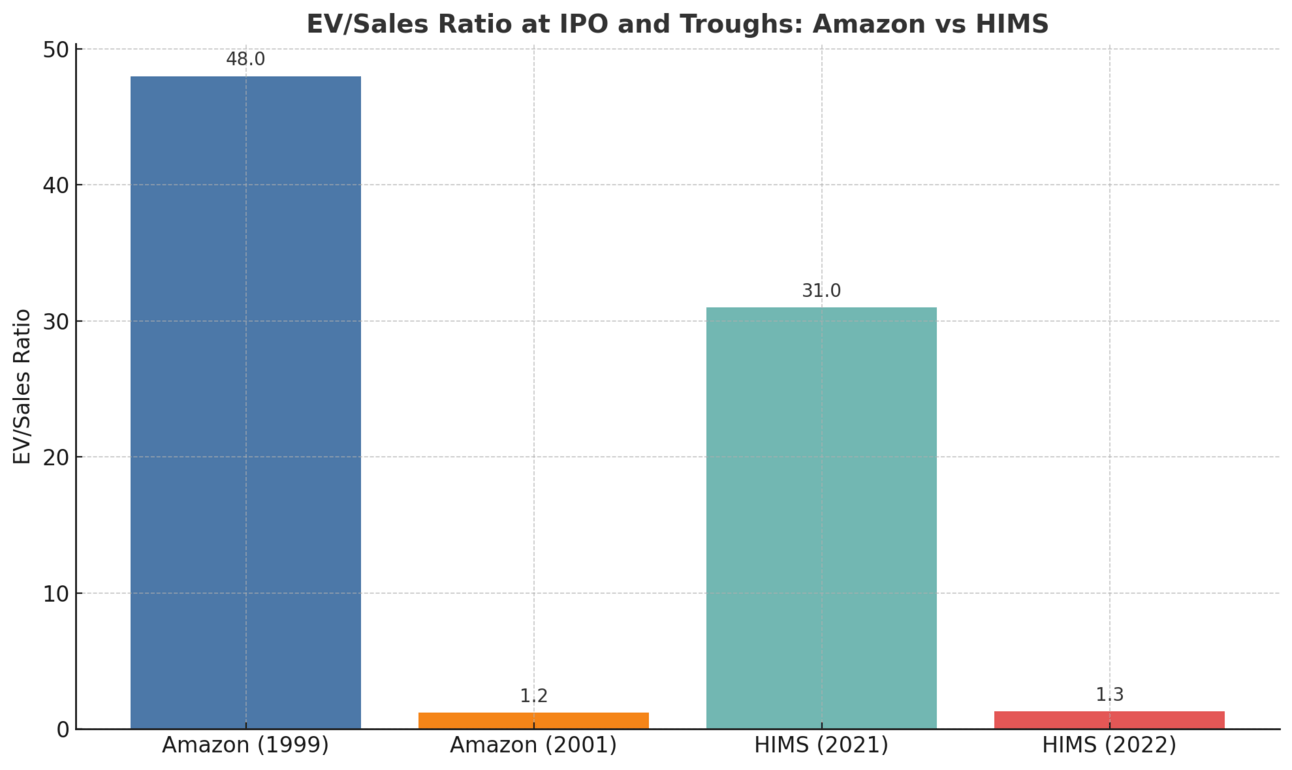

HIMS was hated. Retail sentiment was dead. The stock had dropped from a euphoric EV/sales multiple of 31x down to 1.3x. But when I zoomed out, it felt like Amazon in 2001.

Here’s what I wrote:

The resemblances between Hims & Hers and Amazon are so significant, it cannot be a coincidence.

#1: IPO during the rise of a bubble

Amazon IPO’d in 1999 at the peak of dot-com greed—trading at 48x EV/sales. Two years later, it cratered to 1.2x at the depths of fear.

HIMS IPO’d in 2021 at 31x EV/sales. One year later, it was down to 1.3x.

Emotion created the opportunity for both companies. And for bold investors.

#2: From hypergrowth to consistent growth

Amazon cooled from triple-digit growth to 20–40% and stayed there for 20+ years.

HIMS is showing the same trajectory, with growth stabilizing around 20–40% based on 2024 guidance.

#3: The transition to profitability

In 2001, Amazon showed its first net income. The stock popped +24%.

In Q4 2023, HIMS reported its first profitable quarter. The stock jumped +31% in one day.

#4: A dream team

Bezos brought in strong operators (ex-GE, EA) to scale the business and navigate profitability.

Dudum has done the same—bringing in a CFO from Uber/Google and a board member from Netflix who personally bought $3M worth of shares.

#5: Obsession with customer experience

Both companies reinvested in value—lowering prices, building trust, and playing the long game.

“We earn trust with customers over time... that actually does maximize free cash flow.” – Jeff Bezos

“We’ve begun systematically lowering prices to make our offerings more mass market accessible.” – Andrew Dudum

Why I’m Still Buying $HIMS in 2025

Since then, the company has executed flawlessly — and the market is still underestimating what they’re building.

Let’s break it down:

Founder-led with a long-term vision. Andrew Dudum, CEO of $HIMS, has compared their roadmap to early $AMZN and $NFLX. But the market hasn’t caught up. Hims & Hers is far more than just a GLP-1 weight-loss trade.

Subscriber growth is on fire. They're delivering deeply personalized treatment and expanding into new categories. 2.4 million total subscribers. That’s a 38% YoY increase.

Global expansion is underway. $HIMS acquired Zava, a telemedicine leader in Europe, bringing 1.3M users and a fast track to international scale.

AI-powered data loop. Every new user improves the product, which leads to better outcomes, more trust, and more users. It’s the same compounding flywheel Netflix and Spotify used to dominate.

58% of users are now on personalized treatment. That’s up 136% YoY and trending toward 100%. This isn’t generic healthcare. It’s precision care at scale.

The $NVO partnership fallout? Not a problem. $HIMS posted 111% revenue growth YoY in Q1 — without leaning on Novo’s Wegovy. The breakup just proved that HIMS is committed to treating individuals, not just trends.

Valuation remains irrationally low. Price-to-sales ratios: $HIMS at 5.27x. PLTR at 106x. DUOL at 25.13x. HOOD at 20.67x. You’re getting real growth with real margins at a sane multiple.

2030 forecast is $6.5B in revenue. Even at today’s multiple, that implies a ~$35B market cap. That’s a 4x from current levels. Re-rating optional. Execution mandatory.

The setup today? Just as strong as 2022. Rapid subscriber growth. AI + data flywheel. Disciplined leadership. Dirt-cheap valuation.

I’m still buying. Not because the stock is cheap. But because the business is strong — and getting stronger.

This is how multibaggers are made.

I’m not here to flex that I got it right. I’m sharing this because it’s how I build conviction—by studying the DNA of companies during the storm, not after the rally.

$HIMS is now up over 1,200% from those lows. That one position changed how I look at asymmetric bets forever.

I still look for that same setup:

Undervalued by the market

Inflecting on fundamentals

Led by mission-driven operators

Right now, I’m building positions in four companies that fit that exact mold:

$LMND, $SOFI, $HIMS (still), and $OSCR.

Each of them is going through some version of the HIMS journey. If you want the full breakdown on why I’m buying these names, read the post here:

What I’m Buying Right Now for Asymmetric Upside →

We’re still early.

— Connor

Founder Partner, Black Sheep Capital

Dad of 3, part-time freight operator, full-time misfit

Subscribe to Alpha Before It Prints for deep dives like this—before the story breaks wide open.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe