Let’s get one thing out of the way first:

Yes — this is peak season.

And yes — seasonality always creates noise.

But what’s happening underneath the surface right now is not just holiday volatility.

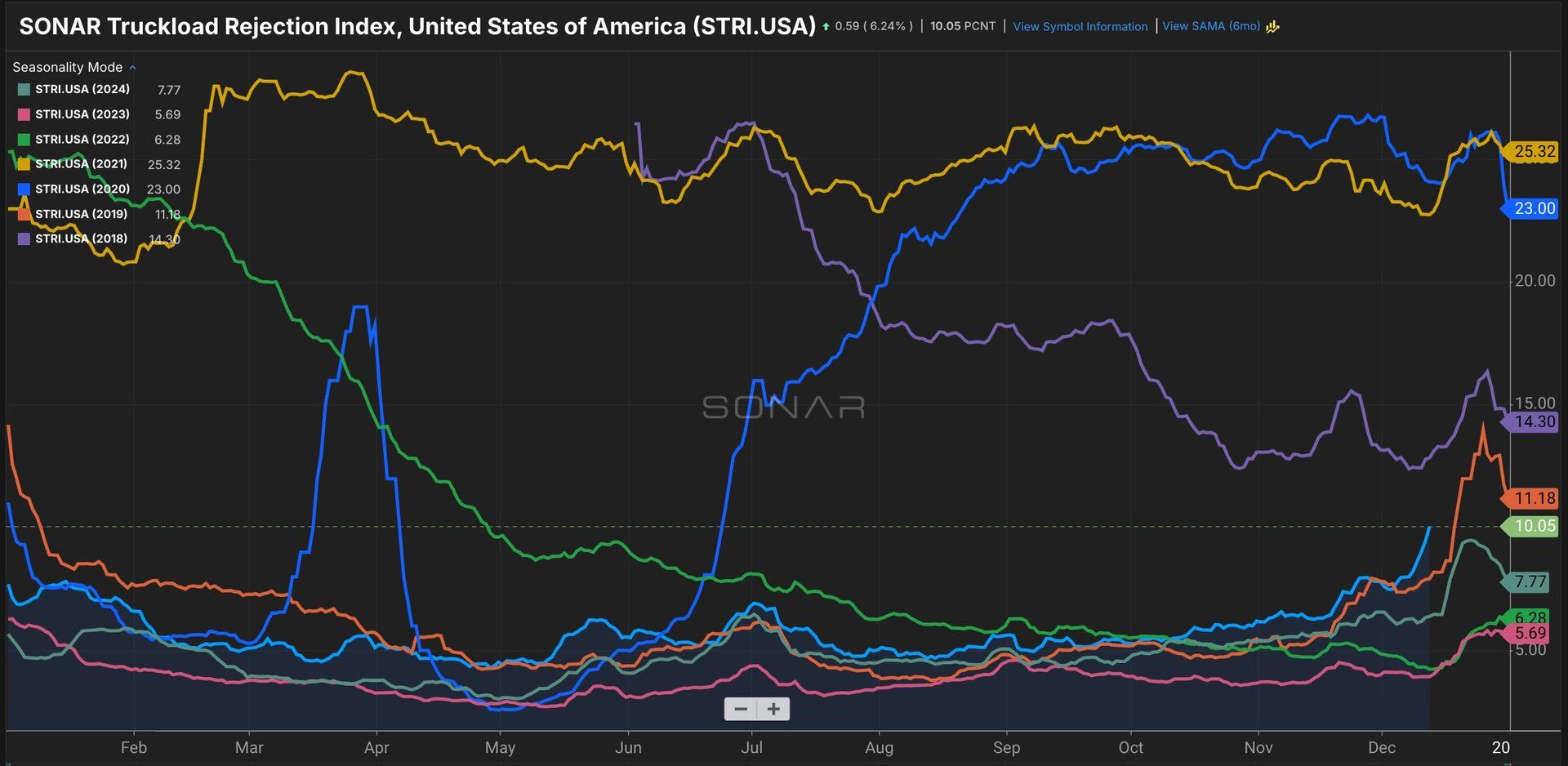

Nationwide outbound tender rejection rates have surged to levels not seen since April 24, 2022.

In just the past week, the SONAR Truckload Rejection Index (STRI) jumped 255 basis points, rising from 8.24% to 10.79%. That puts rejections:

+448 bps month over month

+366 bps year over year

And more than 600 bps higher than the same period in 2022–2023

That matters.

This isn’t a slow grind higher.

Rejections have accelerated sharply, which usually only happens when carriers suddenly gain leverage.

That leverage doesn’t come from demand exploding — it comes from capacity tightening faster than expected.

The multi-year context is what makes this important

Zooming out tells the real story.

At this point in the calendar:

Rejection rates are meaningfully higher than 2023

Higher than 2022

And far above the post-freight-recession lows

This isn’t just a seasonal bounce.

It’s the strongest peak-season rejection environment in over three years.

Demand is still soft — and that’s the point

Truckload demand remains muted relative to prior years. Volumes are slightly lower than:

2024

2023

2022

But here’s the key distinction:

Rejections are rising despite demand not meaningfully improving.

That almost always signals a supply-side shift, not a demand story.

Capacity is leaving the system — quietly, unevenly, and then all at once.

Vans and reefers are both confirming the move

Breaking rejection rates down by mode shows the same trend.

Dry van rejection rates (STRIV):

+224 bps week over week

+310 bps year over year

Reefer rejection rates (STRIR):

+351 bps week over week

+447 bps year over year

Still holding significantly more pricing power than van

This isn’t isolated to one segment or region.

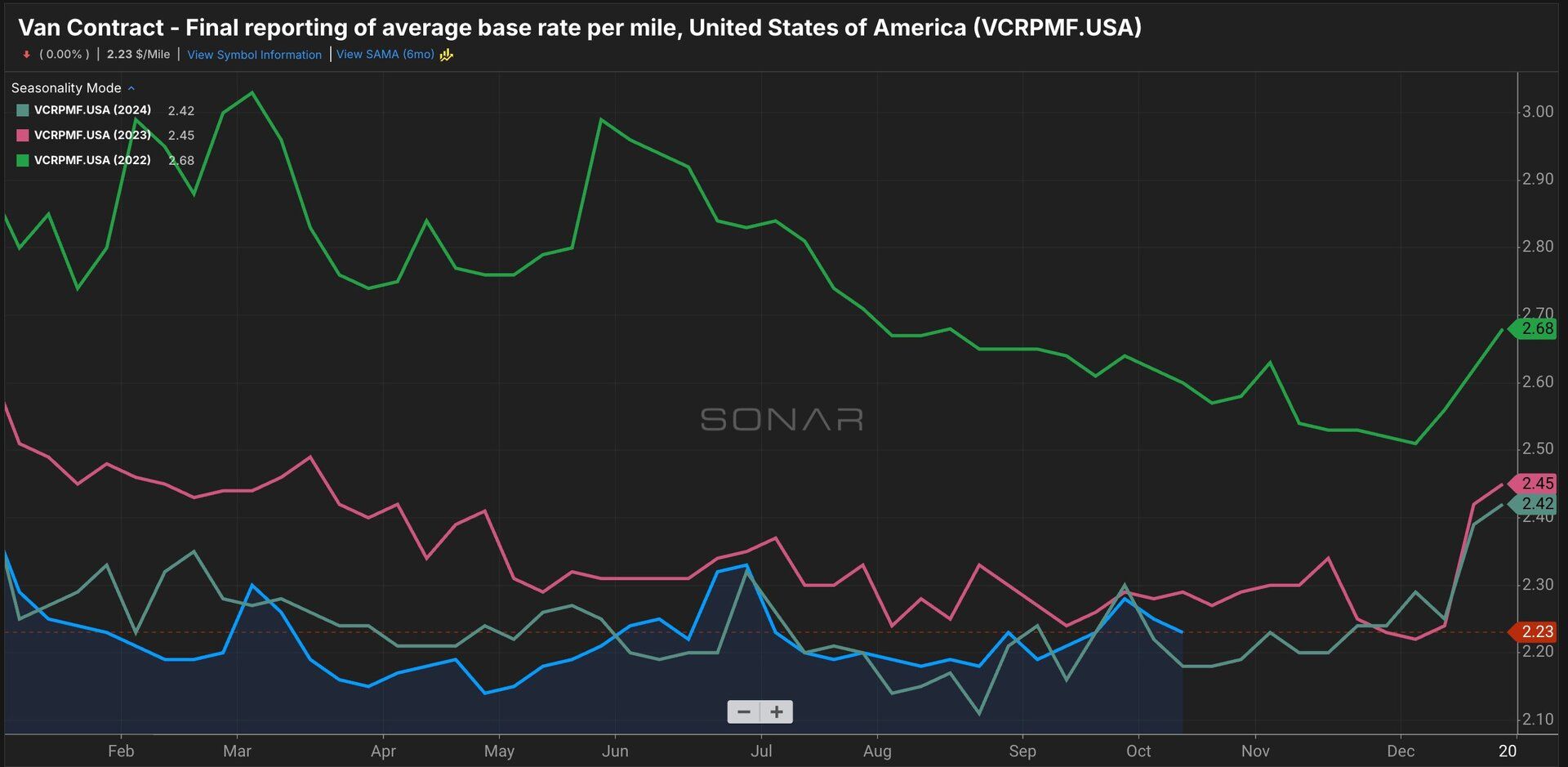

Spot rates are responding exactly how they always do

Spot rates have surged alongside rejection rates.

Truckload spot pricing is now sitting around $2.54 per mile, a three-year high.

That move has happened while contract rates remain flat.

When spot materially outpaces contract, carriers don’t hesitate:

They shift trucks to the spot market.

That behavior:

Pushes rejection rates higher

Further tightens capacity

And accelerates the cycle

Contract rates are the last domino

Contract rates are still down roughly 16% over the past three years.

Carriers will try to get that back — but not all at once.

Absent a full-blown capacity crisis, this will likely be a multi-year reset, not a single-year spike.

That’s why the implications extend beyond 2025.

Why 2026 may surprise people

The freight market doesn’t need a demand boom to change.

History shows cycles can flip simply because:

Enough capacity exits

Replacement capacity can’t come back quickly

And pricing power quietly returns

Peak season noise will fade in January.

If rejection rates remain elevated after the holidays, the market will be forced to reassess assumptions that have been baked in for years.

Most people will still be watching volumes.

The real signal — as always — is capacity.

— Connor

Alpha Before It Prints

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe