Both ETH and BTC just gave back more than half of their late-November bounce… and the way it happened wasn’t bullish.

It wasn’t a “healthy retest.”

It wasn’t a “shakeout before the next leg.”

It was a failed breakout, a lower high, and a fast unwinding of everything the market just tried to build.

But here’s the part most people are missing:

This is exactly the type of move that happens before a December bottom — not after.

And with the FOMC rate decision coming on December 10th at 2 p.m. ET, plus Powell at 2:30 p.m., there’s zero incentive for this market to trend until that event clears.

The most likely path?

Chop → bleed → flush → bottom → then the January rally everyone is waiting for.

Let’s break down each chart.

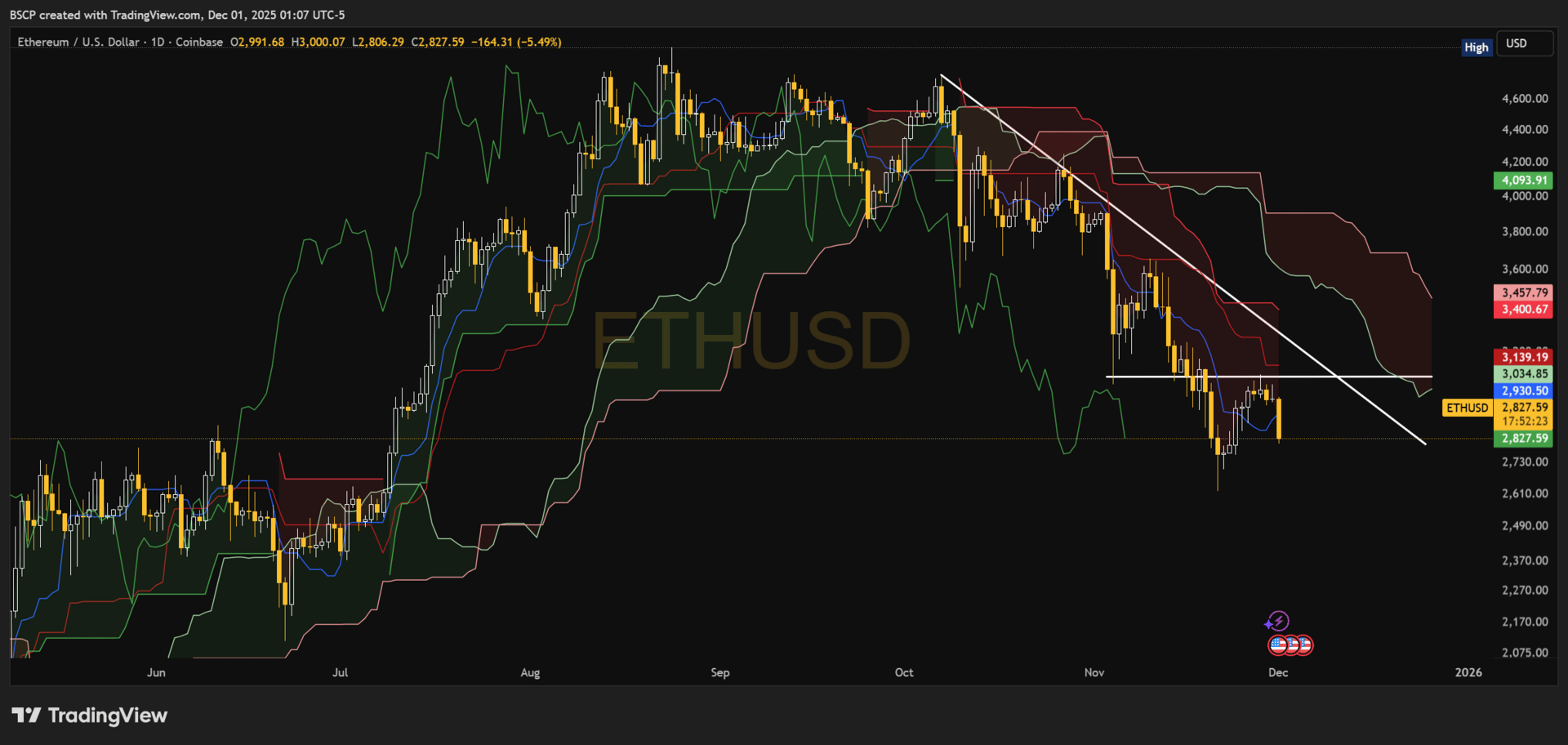

ETHEREUM (ETH 1D)

ETH ran straight into the downtrend from late October near $3,300, stalled, and rolled over. It couldn’t break the 11/4 swing low, couldn’t take out the trendline, and the weekend move erased 50% of the entire run off the 11/21 bottom.

A rally that erases itself in a weekend never had real strength behind it.

Upside Levels (ETH must reclaim these to matter):

$3,097

$3,300

As long as ETH is below both, the trend is still down.

Downside Path (where the December bottom likely forms):

Break $2,763 → sets up a retest of $2,621

Stronger selling could tag the DeMark exhaustion target near $2,362 in the next 2–3 weeks

That 2–3 week window drops us right into mid-December, not January.

That’s the real window where this trend dies.

Until then, ETH is dead money stuck in the FOMC waiting room.

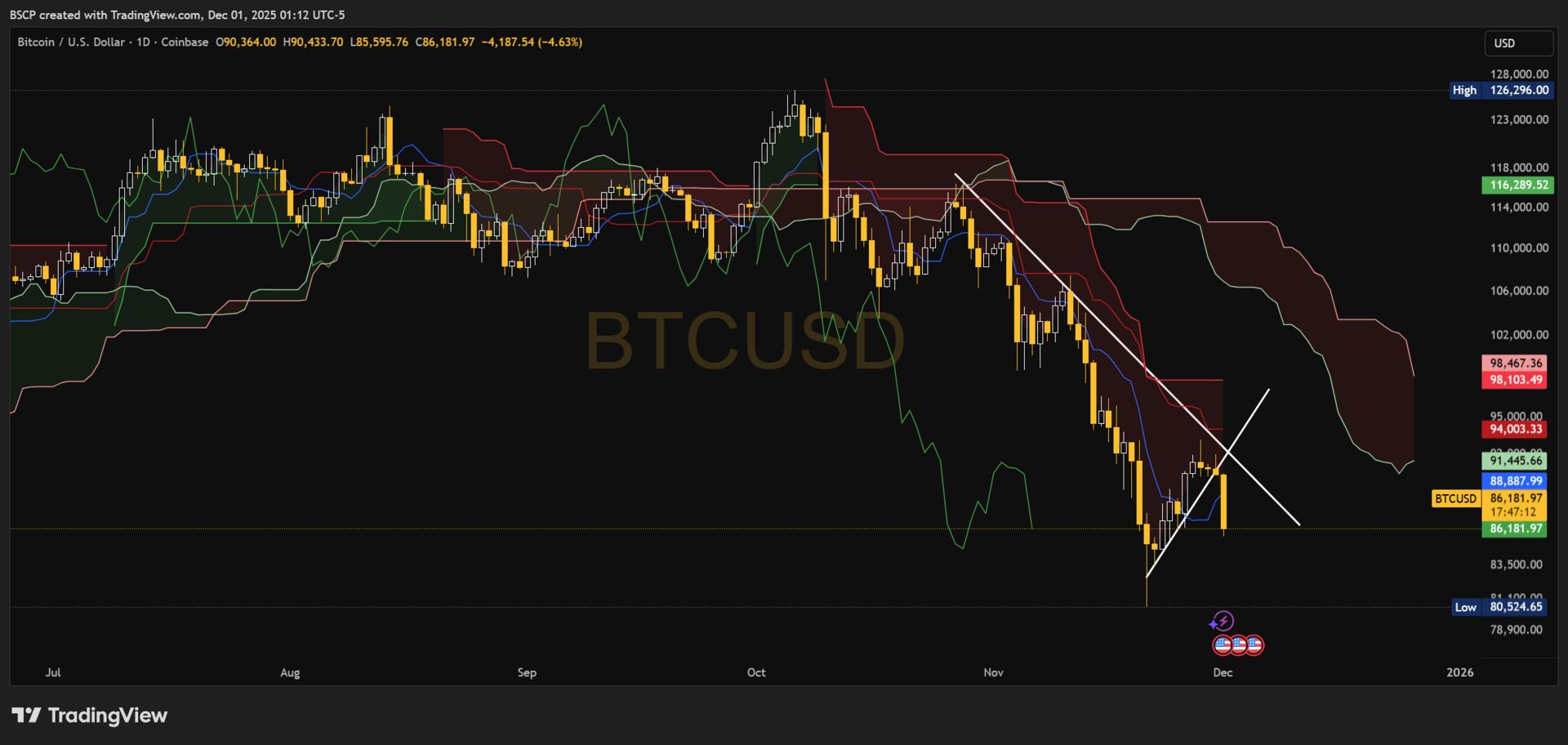

BITCOIN (BTC 1D)

BTC did the exact same thing ETH did — just cleaner.

It pushed into the downtrend from late October, failed instantly, and the weekend selloff erased half the bounce in one shot. The entire structure flipped from “maybe reversal” back to “still a downtrend.”

Upside Levels:

Must reclaim $93,091

Anything under that is just noise inside a bearish trend.

Downside Levels:

Break $85,225 → opens the door to new lows

Full retrace of the April level sits at $74,434

DeMark exhaustion still shows 2–3 more weeks of potential weakness

Again — that timing lands squarely in mid-December.

ETH and BTC are singing the same song.

THE BIG PICTURE

People keep talking about a “January bottom,” but the charts disagree.

This price action — fast failure, lower highs, weak bounces, and ugly weekend reversals — is a December flush setup, not a January one.

Combine that with:

negative weekly momentum

weak follow-through

FOMC chop on December 10

holiday liquidity vacuum

tax-loss pressure

and DeMark exhaustion 2–3 weeks out

And the highest-probability play is simple:

**Bottom in December.

Rally in January.**

Not the other way around.

THE PLAYBOOK

This isn’t the spot to force longs.

This is the spot to let the market finish what it’s trying to do.

What I want to see:

FOMC chop

One more rollover

A break of obvious lows

A disgust candle

DeMark exhaustion

Sentiment capitulation

Then the reversal

That’s the asymmetric entry.

Not this bounce.

Not pre-FOMC.

Not early December.

December is where the bottom forms.

January is where everyone finally realizes it.

— Connor

Alpha Before It Prints

Upgrade to Alpha Premium — Founding Members keep $14.99/mo or $150/yr permanently.

A quick note on how I express conviction

For anyone wondering how this framework translates into actual positioning:

I run two live portfolios that reflect two very different parts of my thinking.

The Black Sheep Base Case Portfolio is exactly what it sounds like — core positioning for how I expect the broader market to resolve when structure matters more than headlines.

The Alpha Framework Portfolio is different.

That’s where I take long-term swings on smaller companies I believe can materially outperform over full cycles — names that usually look wrong before they look obvious.

A few past examples from that framework:

HIMS — $8.36 → +722% (ATH)

SOFI — $5.84 → +452% (ATH)

PLTR — $26.58 → +679% (ATH)

LMND — $31.31 → +171% (ATH)

ONDS — $1.74 → +532% (ATH)

CIFR — $2.96 → +762% (ATH)

IREN — $5.97 → +1,161% (ATH)

No alerts.

No perfection.

A lot of patience.

That’s not a promise — it’s just context for how I think and how I size risk.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe