Energy Is Setting Up for Its Next Big Move

Why I’m positioned in VLO, PSX, and XOM ahead of the next leg in the cycle.

Every big energy move starts with the same quiet set of conditions — and all of them are here right now.

1. The Dollar Is Fading — and That Changes Everything

A weakening dollar is the ignition switch for commodities — and it’s already happening.

We’ve watched the dollar fail at the underside of resistance again and again. Every bounce gets sold. Every rally attempt dies early.

A fading dollar is the macro tailwind that energizes:

commodities

emerging markets

metals

energy

This sets the stage for the next leg of the cycle.

2. Commodities Are Leading the World Right Now

This doesn’t get talked about nearly enough:

Gold miners: +140%

Uranium: +84%

Steel, copper, lithium: +74–78%

While the S&P is up around 17%.

This is not a rotation.

This is a regime shift into real assets.

When real assets lead, refiners historically become some of the highest-velocity trades in the entire market.

3. Energy Is the Last Domino — and It’s Starting To Move

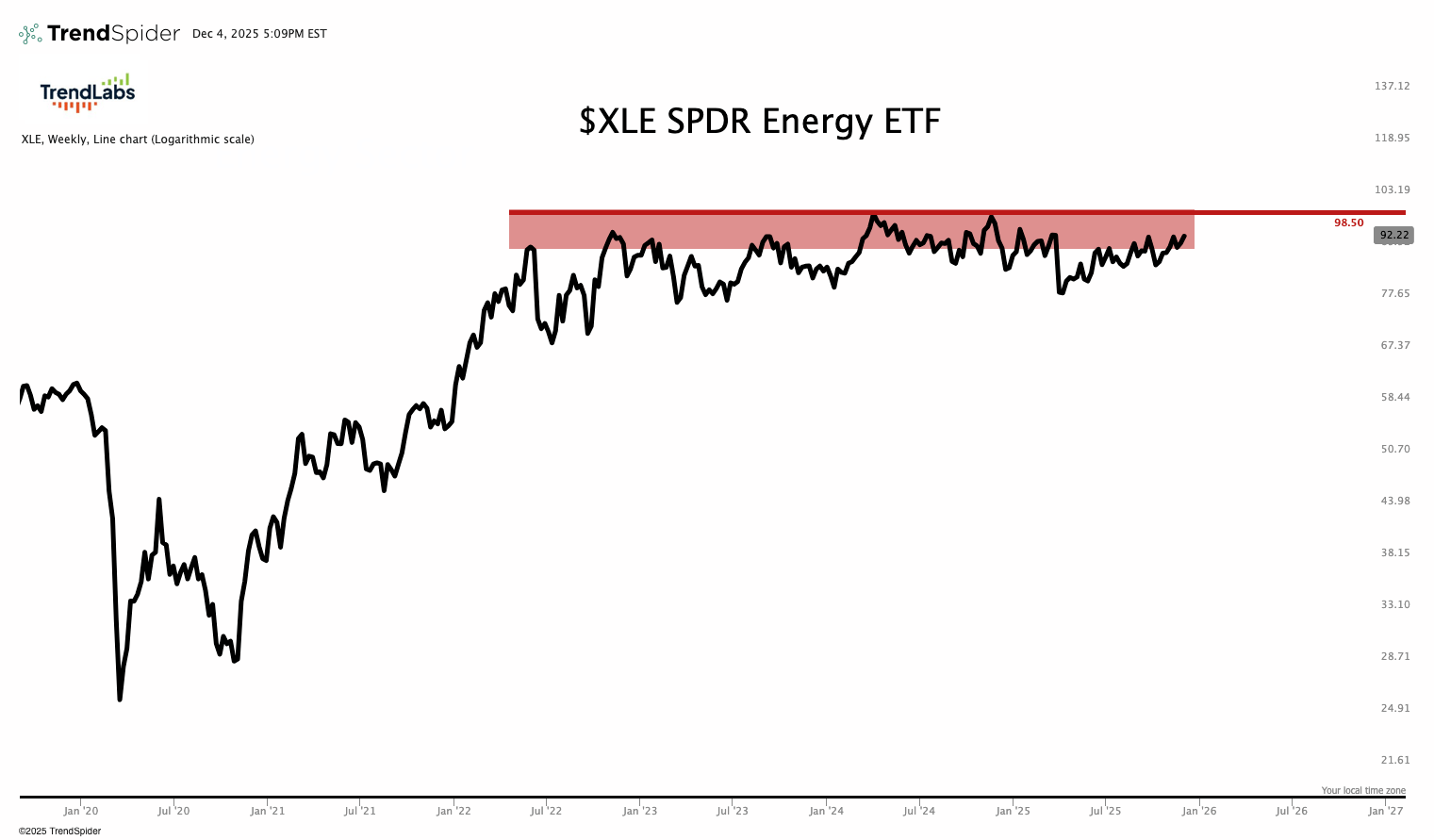

TrendLabs highlighted something massive in XLE that most investors are missing:

Two years of:

sideways consolidation

compressed volatility

exhausted sellers

repeated resistance tests

This is exactly what major secular breakouts look like before they happen. Everything surrounding energy (commodities, metals, the dollar) has already moved.

Energy is the final domino.

And refiners are already anticipating the move.

4. The Refiners: VLO & PSX Are Breaking the Rules (In a Good Way)

While oil prices lagged and XLE stayed muted, refiners did the opposite:

They broke out anyway.

Josh Brown described it perfectly: when a whole sub-industry starts ripping together despite sector headwinds — that’s not random. That’s the market yelling at you.

Valero (VLO)

VLO checks every technical box:

Golden cross

Clean bounce at support

Higher highs while the sector was flat

Strong volume confirmation

This is leadership behavior.

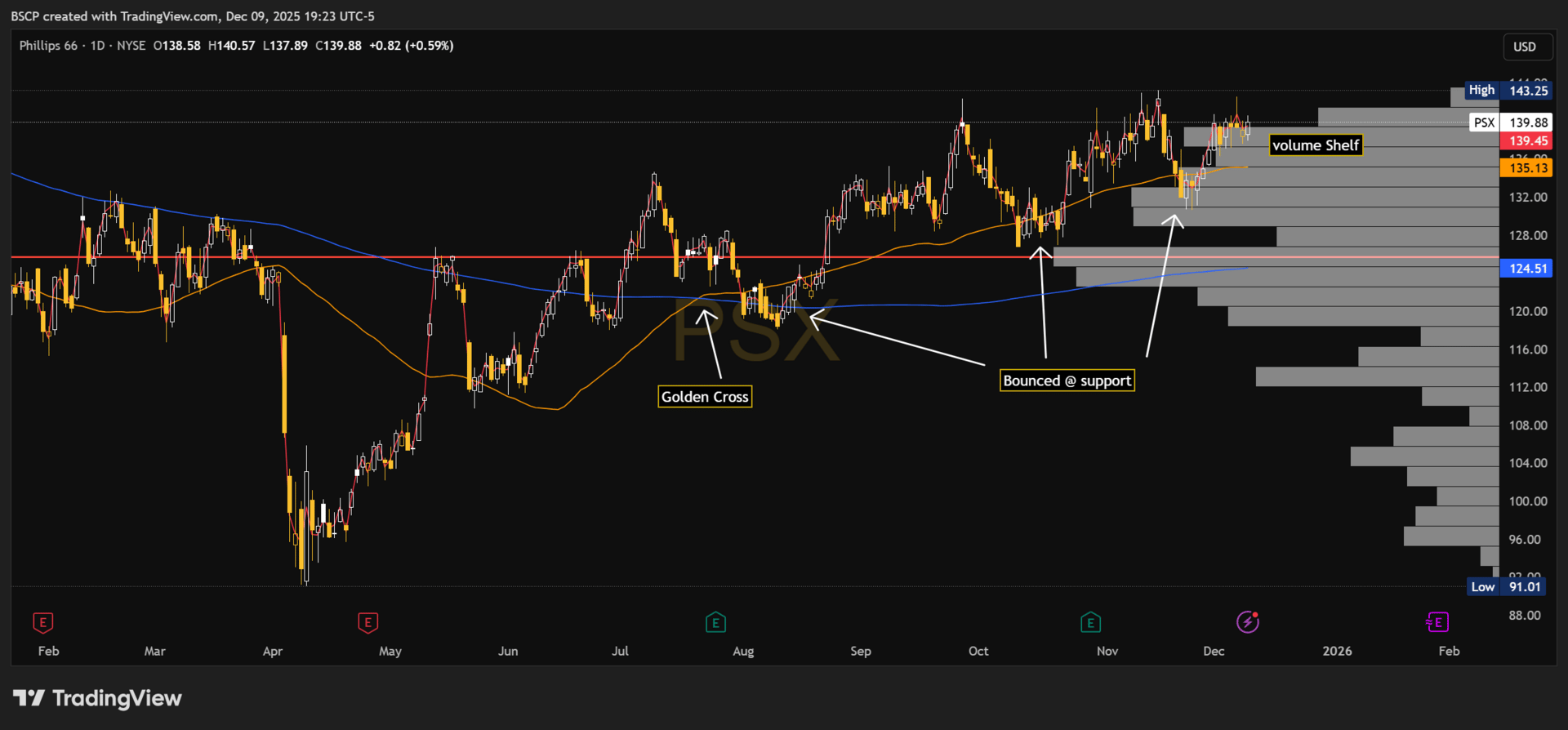

Phillips 66 (PSX)

PSX has been one of the cleanest technical setups in the group:

Major support at the 200-day

Strong momentum off the lows

A clean breakout structure forming

The activist involvement only strengthens the risk/reward.

Josh Brown’s point:

When the whole group is breaking 52-week highs together…

just shut up and buy.

5. Why I’m In XOM Calls: Multi-Year Base + Energy Rotation = Asymmetry

Exxon Mobil (XOM) has been building one of the cleanest, most explosive multi-year bases in the entire large-cap energy space. This doesn’t drift out of a 3-year base — it explodes.

This chart tells the whole story:

1. A multi-year rounded base

XOM has spent nearly three years carving out a massive consolidation structure — the kind of pattern that doesn’t result in small moves. Bases this large resolve with multi-quarter upside when they break.

2. A deep, well-defined volume shelf at $110–118

This is where institutions accumulate.

Price keeps revisiting this area, getting absorbed, and turning higher.

There’s no distribution here — only accumulation.

3. Repeated resistance tests without any structural breakdown

Every push into the $118–$120 zone pulls back shallowly and then re-tests.

That’s exactly what a coiled asset looks like before the pivot.

4. Energy (XLE) itself is coiled and ready

As I said earlier — XLE is the final domino. If the sector breaks out, XOM is the most liquid, most institutionally-owned, most “must-own” name that gets repriced first.

5. This is where options give you perfect asymmetry

If Energy goes the way the macro setup suggests — weaker dollar, commodity leadership, refiners ripping, global rotation into real assets — XOM doesn’t just drift higher.

It explodes out of a 3-year base.

That’s why I’m positioned in:

• XOM 01/16/2026 $120 Calls

• XOM 03/20/2026 $120 Calls

If this breaks out, those calls don’t move 20–30%.

They move 200–300%+ because you’re sitting directly on top of a multiyear structural inflection.

6. The Cycle Is Turning — And Energy Is “Becoming” Again

TrendLabs used a perfect phrase:

“Before every major trend shift, the data begins to tighten, coil, and hum — long before the breakout itself.”

That’s exactly where energy is right now.

The dollar is fading.

Commodities are leading.

Refiners are breaking out in unison.

XLE is coiled beneath a multi-year ceiling.

The transformation is already happening.

The breakout will just be the part everyone finally notices.

I prefer being positioned before that moment — not after.

— Connor

Alpha Before It Prints

A quick note on how I express conviction

For anyone wondering how this framework translates into actual positioning:

I run two live portfolios that reflect two very different parts of my thinking.

The Black Sheep Base Case Portfolio is exactly what it sounds like — core positioning for how I expect the broader market to resolve when structure matters more than headlines.

The Alpha Framework Portfolio is different.

That’s where I take long-term swings on smaller companies I believe can materially outperform over full cycles — names that usually look wrong before they look obvious.

A few past examples from that framework:

HIMS — $8.36 → +722% (ATH)

SOFI — $5.84 → +452% (ATH)

PLTR — $26.58 → +679% (ATH)

LMND — $31.31 → +171% (ATH)

ONDS — $1.74 → +532% (ATH)

CIFR — $2.96 → +762% (ATH)

IREN — $5.97 → +1,161% (ATH)

No alerts.

No perfection.

A lot of patience.

That’s not a promise — it’s just context for how I think and how I size risk.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe