Crypto feels uninvestable right now.

Not early.

Not misunderstood.

Just… abandoned.

And historically, that’s the environment where risk slowly shifts from asymmetric against you to asymmetric for you — even if price hasn’t confirmed it yet.

This isn’t a post about calling a bottom or declaring a new bull market.

It’s about understanding where we are in the reset, how I’m thinking about mean reversion trades, and how that fits into a much longer cycle roadmap.

The Bigger Picture: Altcoins at HTF Support

Zooming out first.

When you look past Bitcoin and the mega caps, the broader altcoin market has been under sustained pressure for years. That part of the market acts like crypto’s small-cap index — it reflects speculative appetite, liquidity, and risk tolerance.

On a weekly timeframe, that market has now flushed back into a major higher-timeframe uptrend support zone after completing a multi-year distribution structure.

Does that guarantee the bottom is in?

No.

But it does mean this:

We’re entering a zone where risk/reward is finally starting to shift, especially for longer-duration positioning.

At a minimum, this is where ignoring crypto entirely becomes lazy analysis.

Sentiment: Beyond Bearish, Deep Into Apathy

From a sentiment perspective, crypto feels completely written off.

Not hated.

Not debated.

Just ignored.

That doesn’t guarantee upside — but historically, this is the exact backdrop where longer-term opportunity starts getting built quietly, while most participants have already checked out.

That’s why I’m far more interested in selective accumulation through 2026 than chasing strength whenever the next narrative pops.

From Defense to Mean Reversion

After a deep washout — 50–80% drawdowns across crypto and crypto-adjacent equities — the posture shifts.

Not to “new bull market.”

Not to blind optimism.

To mean reversion.

After extended, crowded downside moves, relief rallies and counter-trend bounces are common — even if the higher-timeframe trend remains damaged.

That’s the window I’m focused on trading.

This is not about predicting a new cycle.

It’s about respecting probabilities after extreme conditions.

How Mean Reversion Bounces Are Usually Interpreted

When measuring a selloff from swing high → swing low, there are three retracement zones that matter. These are reaction levels, not promises.

Shallow / Weak Tape

Expect the bounce to stall near the 0.382 retracement

Very common in strong downtrends

Typically a quick relief rally, followed by continuation lower

Normal Mean Reversion

The 0.5 retracement is the classic magnet

Common after panic flushes and oversold RSI conditions

This is the bread-and-butter bounce target

Stronger Counter-Trend Rally

The 0.618 retracement

Often tagged when:

RSI was deeply oversold

Price hit higher-timeframe support

Sentiment was completely washed out

There’s no way to know in advance which retracement level price will reach — which is exactly why the goal isn’t prediction.

The goal is preparation.

The Rule That Keeps You Objective

Think of these levels as reaction targets, not upside forecasts.

If price pushes into these zones:

I’m evaluating strength

trimming exposure

reassessing risk

Not blindly holding and hoping for more.

Plan the trade.

Plan the trims.

Plan the invalidation.

Then let price do the rest.

That’s how you stay objective in mean reversion environments.

Two Buckets: Trades vs Long-Term Positions

Not everything is treated the same.

Some recent buys — like late-week Bitcoin and Ethereum entries — are not tactical bounce trades. Those go straight into the longer-term bucket and get tucked away as core holdings.

Everything else is traded tactically, with defined exits and zero emotional attachment.

Bitcoin, Ethereum & Altcoins — Mean Reversion Bounce Targets

Bitcoin (1D)

0.382 retracement: ~$79k–$80k

0.5 retracement: ~$86k–$87k

0.618 retracement: ~$94k–$95k

Ethereum (1D)

0.382 retracement: ~$2.5k–$2.6k

0.5 retracement: ~$2.8k–$2.9k

0.618 retracement: ~$3.2k–$3.3k

BNB (1D)

0.382 retracement: ~$796

0.5 retracement: ~$883

0.618 retracement: ~$980

Solana (1D)

0.382 retracement: ~$109

0.5 retracement: ~$127

0.618 retracement: ~$147

XRP (1D)

0.382 retracement: ~$1.75

0.5 retracement: ~$2

0.618 retracement: ~$2.3

Crypto-Adjacent Equities — Mean Reversion Targets

The same structure is showing up in crypto-adjacent equities — which reinforces that this isn’t isolated to tokens.

BMNR (1D)

0.382 retracement: ~$24

0.5 retracement: ~$27

0.618 retracement: ~$30

COIN (1D)

0.382 retracement: ~$214

0.5 retracement: ~$241

0.618 retracement: ~$272

GLXY (1D)

0.382 retracement: ~$22

0.5 retracement: ~$24

0.618 retracement: ~$26

HOOD (1W)

0.382 retracement: ~$96

0.5 retracement: ~$105

0.618 retracement: ~$115

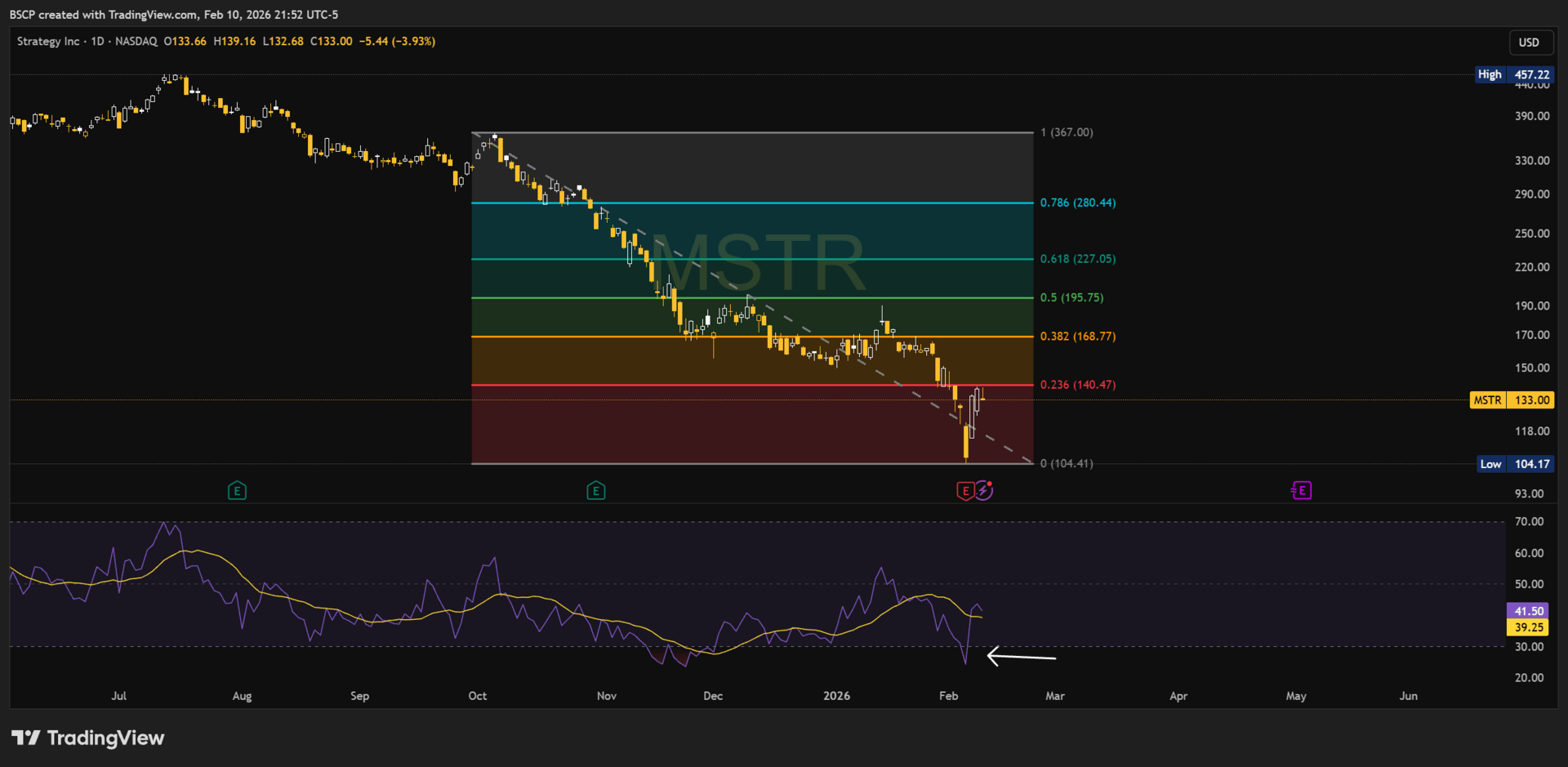

MSTR (1D)

0.382 retracement: ~$168

0.5 retracement: ~$195

0.618 retracement: ~$226

The Bottom Line

This isn’t a “crypto is back” post.

It’s a reset post.

Mean reversion trades are about structure, not conviction

Accumulation happens when sentiment is broken, not euphoric

Cycles repair before they expand

Most people will re-engage once it’s obvious.

That’s rarely where the edge is built.

Everything you just read is the framework.

Inside Alpha Before It Prints – Premium, I share:

how I size these trades in real time

where I actually trim vs fully exit

how I separate tactical bounces from core positions

and how this plugs directly into my live portfolio

Free gets you context.

Premium gets you execution.

If you want to understand markets, stay free.

If you want to operate inside them with discipline, upgrade.

That’s the difference between reading about opportunity

and being positioned for it.

— Connor

Alpha Before It Prints

© 2026 Alpha Before It Prints

Unsubscribe