If you’ve been following Alpha Before It Prints waiting for the next Lemonade-level conviction call — this is it.

$CIFR ( ▲ 1.99% ) is my next asymmetric setup.

Real contracts. Real cash flow. Real infrastructure.

The market still thinks Cipher is a miner. It’s not.

It’s becoming the backbone of AI compute power — and the rerating has only just begun.

AI isn’t constrained by chips anymore. It’s constrained by megawatts.

When the CEOs of Amazon, Microsoft, Meta, and Google all say the same thing, pay attention.

Power Is the Bottleneck

Andy Jassy wasn’t kidding when he said:

“Power is [AWS’s] single biggest constraint.”

When the leaders of Amazon, Microsoft, Meta, and Google all say the same thing —

you pay attention. And while the world debates GPUs, Cipher Mining ($CIFR) is quietly becoming the company that powers them all.

The Quarter That Changed Everything

Cipher’s Q3 2025 wasn’t just strong — it was transformational.

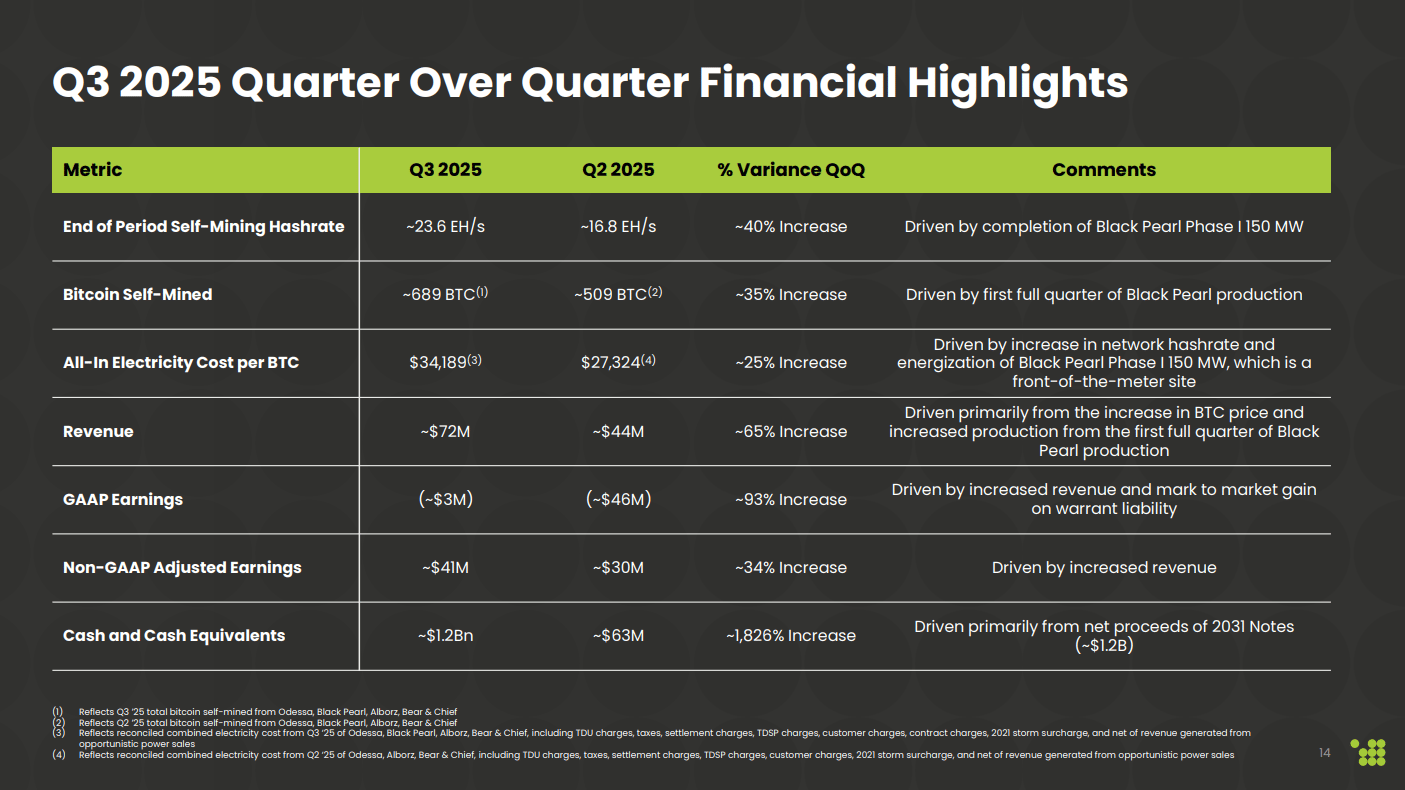

Caption: Q3 2025 was Cipher’s inflection point — explosive revenue, real profits, and balance sheet strength.

Revenue: $72 million (+65% QoQ)

Adjusted Earnings: $41 million (+34% QoQ)

GAAP Net Loss: Just ($3 million), a 93% improvement from Q2

Cash Balance: $1.2 billion (up from $63M last quarter — a 1,826% increase)

Self-Mined Bitcoin: 689 BTC (+35% QoQ)

Hashrate: 23.6 EH/s (+40% QoQ)

Fleet Efficiency: 16.8 J/TH

Total BTC Held: ~1,500 BTC

Cipher’s mining backbone — over 23 EH/s of operating hashpower across Texas, built for scale and efficiency.

The market is waking up to the truth: power, not chips, is the new scarcity.

The AWS + Google Effect

In just 90 days, Cipher secured $8.5 billion in AI hosting contracts with two of the biggest hyperscalers on the planet.

Amazon Web Services (AWS):

15-year, $5.5 billion lease for 300 MW of AI compute capacity

Construction starts 2026, rent begins August 2026

Dual-cooled (air + liquid) data center design

Cipher’s 15-year, 300 MW lease with AWS — turnkey power and cooling for Amazon’s next-gen AI workloads.

Fluidstack + Google:

10-year, $3 billion lease for 244 MW (168 IT MW)

Google backstopping $1.4 billion of Fluidstack’s obligations

Rent begins October 2026

10-year, 244 MW lease with Fluidstack backed by Google — $3B+ in minimum revenue.

That’s $8.5 billion in future contracted revenue — secured before the next AI hardware cycle even begins.

This is what structural power leverage looks like.

The Pipeline: America’s Next Power Grid

Cipher’s current and upcoming sites across Texas include:

Site | Status | Power (MW) | Energization |

|---|---|---|---|

Odessa | Active | 207 | Operating |

Alborz/Bear/Chief | Active | 120 | Operating |

Black Pearl | Active | 300 | Operating |

Barber Lake | Active | 300 | Operating |

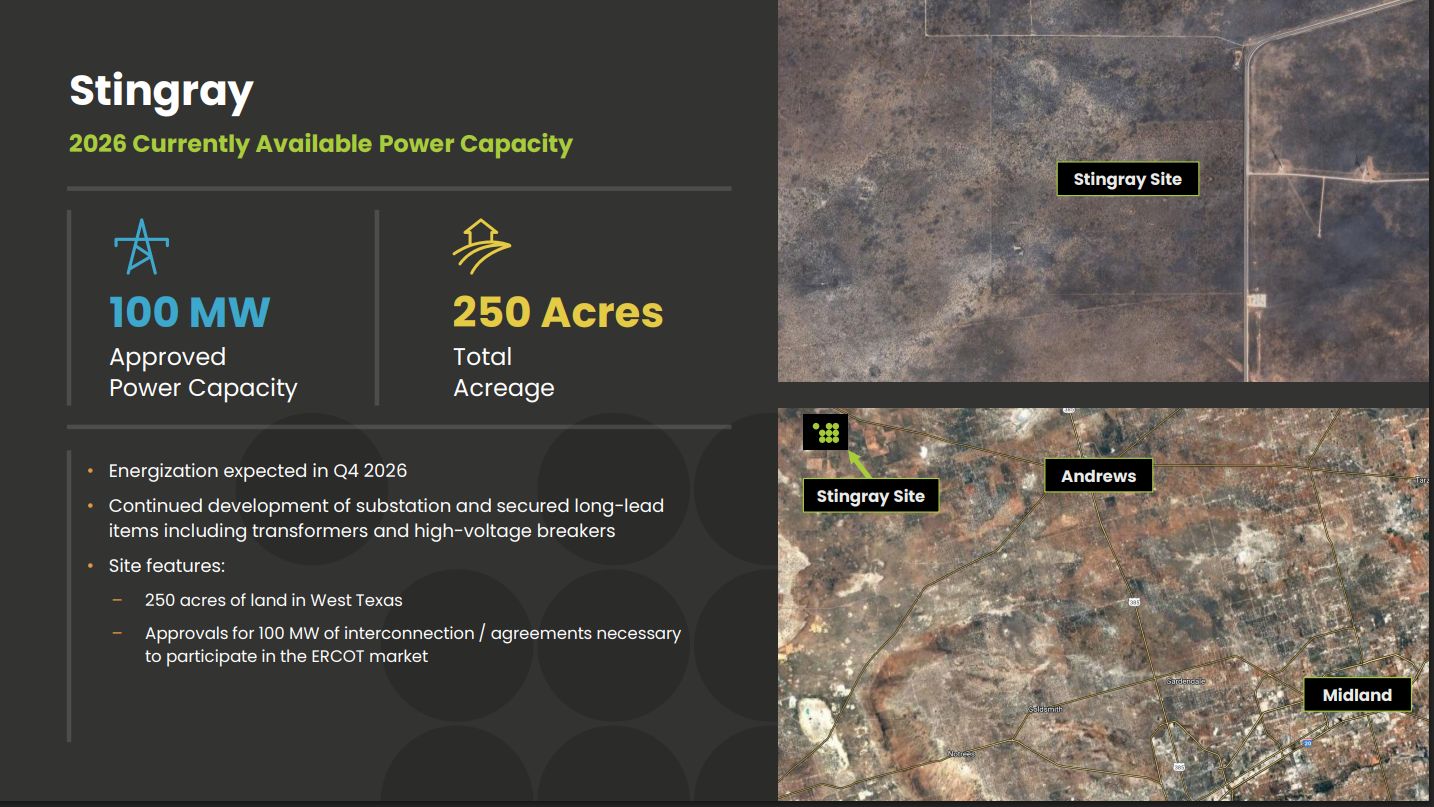

Stingray | Active | 100 | 2026 |

Reveille | Development | 70 | 2026 |

Mikeska | Development | 500 | 2027 |

Milsing | Development | 500 | 2027 |

Barber Lake III | Development | 500 | 2028 |

Colchis | New | 1,000 | 2028 |

Total Potential Capacity: 4.0+ GW

Stingray: 250 acres in West Texas with 100 MW approved capacity — energizing 2026.

Cipher’s roadmap — from self-mining to a full-scale HPC operator controlling 4 GW of total capacity. This isn’t theoretical — every site is tied to secured land, signed agreements, and ERCOT approvals.

Cipher expects to own ~95% of its 1 GW Colchis joint venture, fully backed by a Direct Connect Agreement with AEP — making it one of the largest HPC projects in U.S. history.

Colchis — 1 GW dual-interconnection site in West Texas. Cipher expects 95% ownership under standard HPC terms.

At 1 gigawatt, Colchis alone could eclipse the total data center capacity of some legacy miners. And Cipher will own 95% of it. READ THAT AGAIN.

Colchis is just one piece of a much larger playbook. Cipher’s future pipeline stretches across Texas, with multiple 500 MW sites already moving through ERCOT approvals.

Cipher’s full development roadmap — more than 3 GW of new power capacity scheduled through 2028.

From Miner to Infrastructure Operator

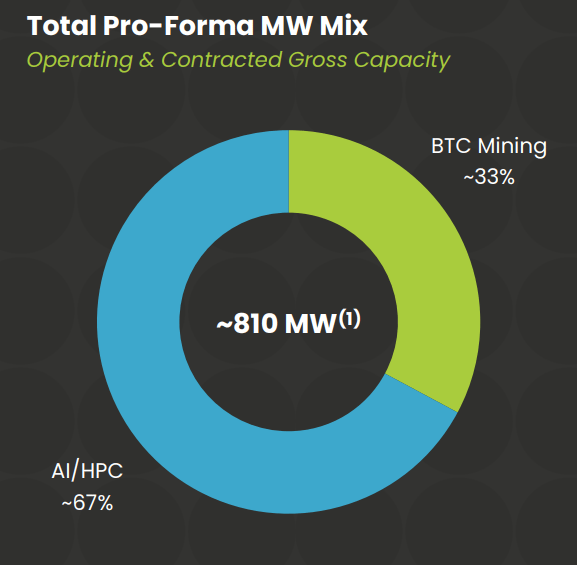

Cipher’s mix is now 67% AI/HPC and 33% Bitcoin mining.

This pivot isn’t a narrative — it’s already visible in the books.

Cipher is now effectively an energy infrastructure company that earns recurring cash flow from hyperscaler leases while maintaining optional exposure to Bitcoin upside.

Cipher’s revenue mix — now two-thirds driven by AI and HPC hosting.

$1.2B cash position

$0 short-term debt pressure

0% convertible notes due 2031

Long-term rent-backed revenue streams

No dilution. No desperation. No hype.

Just execution.

Cipher’s pivot is complete. Two-thirds of its revenue base now comes from AI and HPC hosting, not Bitcoin mining. That’s a structural re-rating, not a hype trade

The Market Still Doesn’t Get It

Everyone’s fighting for GPUs.

Cipher’s fighting for — and winning — megawatts.

And as Andy Jassy, Satya Nadella, and Mark Zuckerberg have all said, power is the bottleneck for AI’s next wave.

Cipher owns the one thing every tech titan needs.

When supply is zero and demand is exponential, pricing power becomes absolute.

That’s where Cipher sits — the landlord of compute.

My Take

Cipher Mining is the real deal — disciplined, well-capitalized, and ahead of every other miner in repositioning for the AI era.

They’re not just surviving the transition — they’re defining it.

This is the kind of story I want to hold for years.

Targets:

Short-Term: $50

Long-Term: $100+

Timeframe: 6 months / 2 years

Those who own megawatts will own the future.

Subscribe to Alpha Before It Prints for deep dives like this—before the story breaks wide open.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe