This post is a sneak peak of what premium members will receive on a weekly basis.

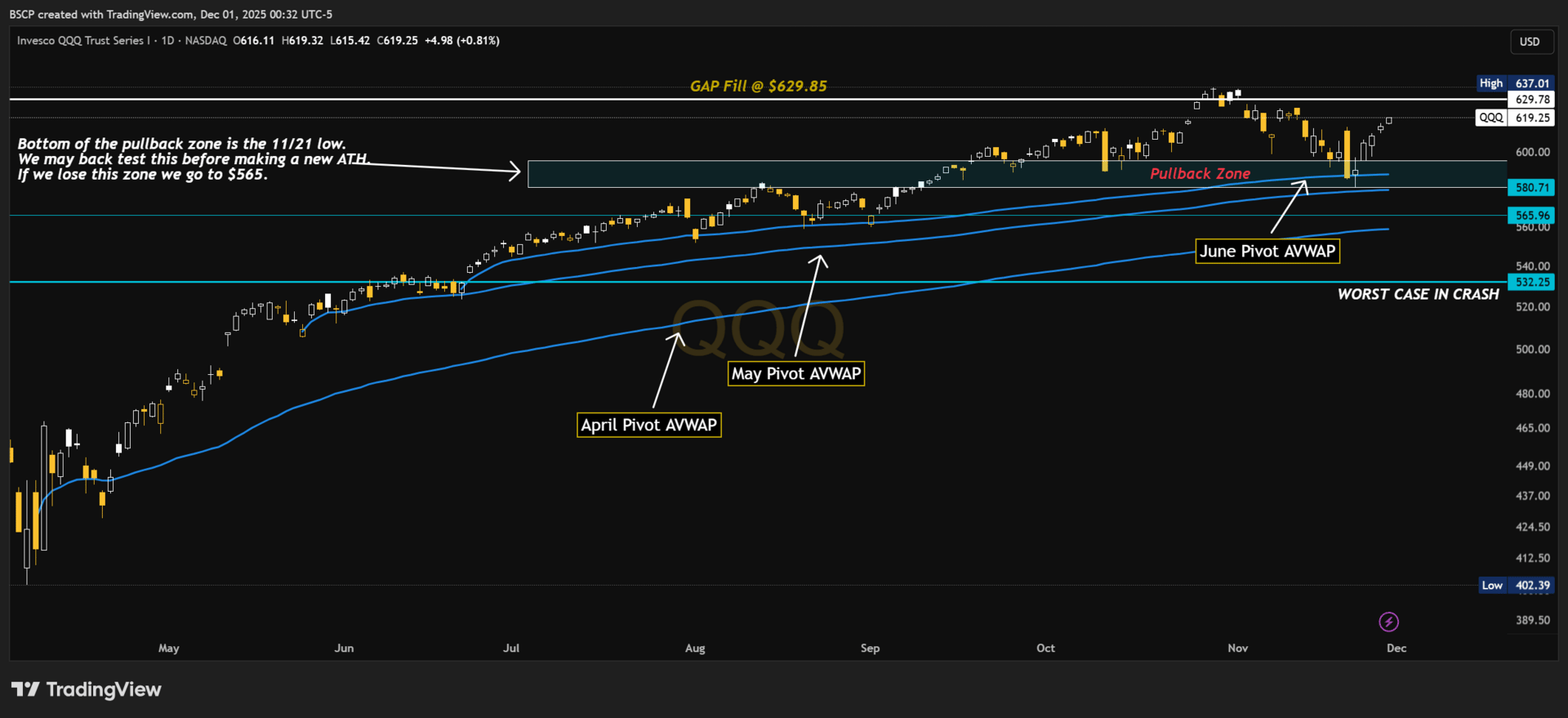

MACRO SECTION — QQQ BUY ZONE ROADMAP

QQQ – Nothing Changed. Still Following the Roadmap From Yesterday’s Alpha Premium Post.

There is nothing new to report on QQQ.

We are still following the exact same roadmap I laid out in yesterday’s Alpha Premium post, where I broke down the QQQ buy zones, the anchored VWAP structure, and the full macro path into mid-December.

Price is still above every single key anchored VWAP.

Not one level from yesterday’s roadmap has broken.

This is a drift — not a breakdown.

Short-term chop.

Long-term trend unchanged.

Same buy zones.

Same plan.

Alpha 40K – Tuesday Update

The lower timeframes look shaky. The long-term theses don’t move an inch.

Today was one of those choppy sessions where retail panics, algos overreact, and everyone suddenly “forgets” the bigger picture.

But this portfolio doesn’t operate in emotional mode.

It operates on structure, anchored levels, and long-term compounding.

Before we get into the charts, read this carefully:

How to Follow This Portfolio the Right Way

When I launched Alpha 40K, I had to buy initial positions so the portfolio existed.

Those entries do NOT matter.

Your focus should always be on the Buy Zones in the charts.

The Buy Zones are what matter.

The Buy Zones are where institutions accumulate.

The Buy Zones are where you should be looking to build size.

My fills were just the starting point.

Your advantage is waiting for the levels.

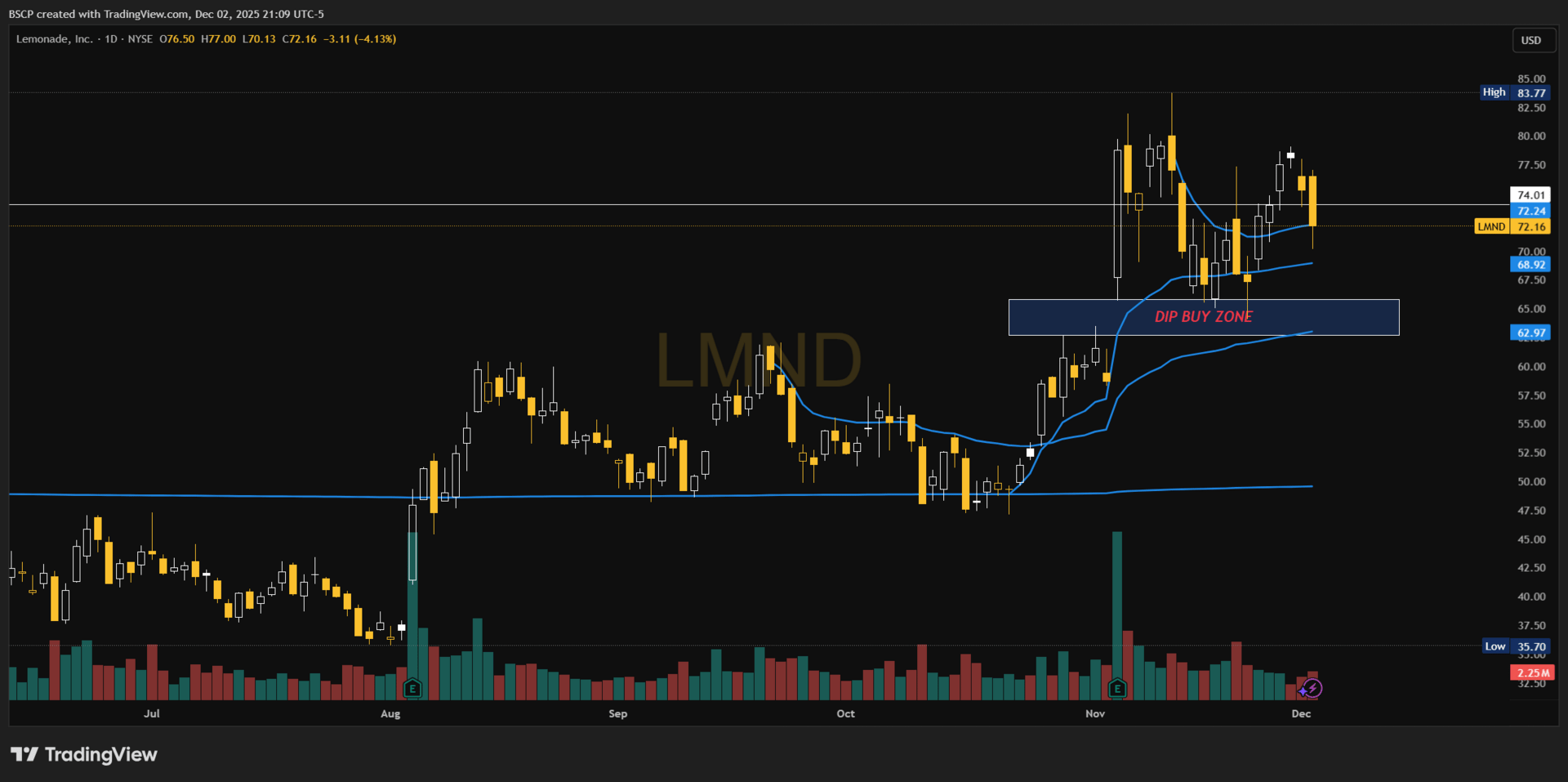

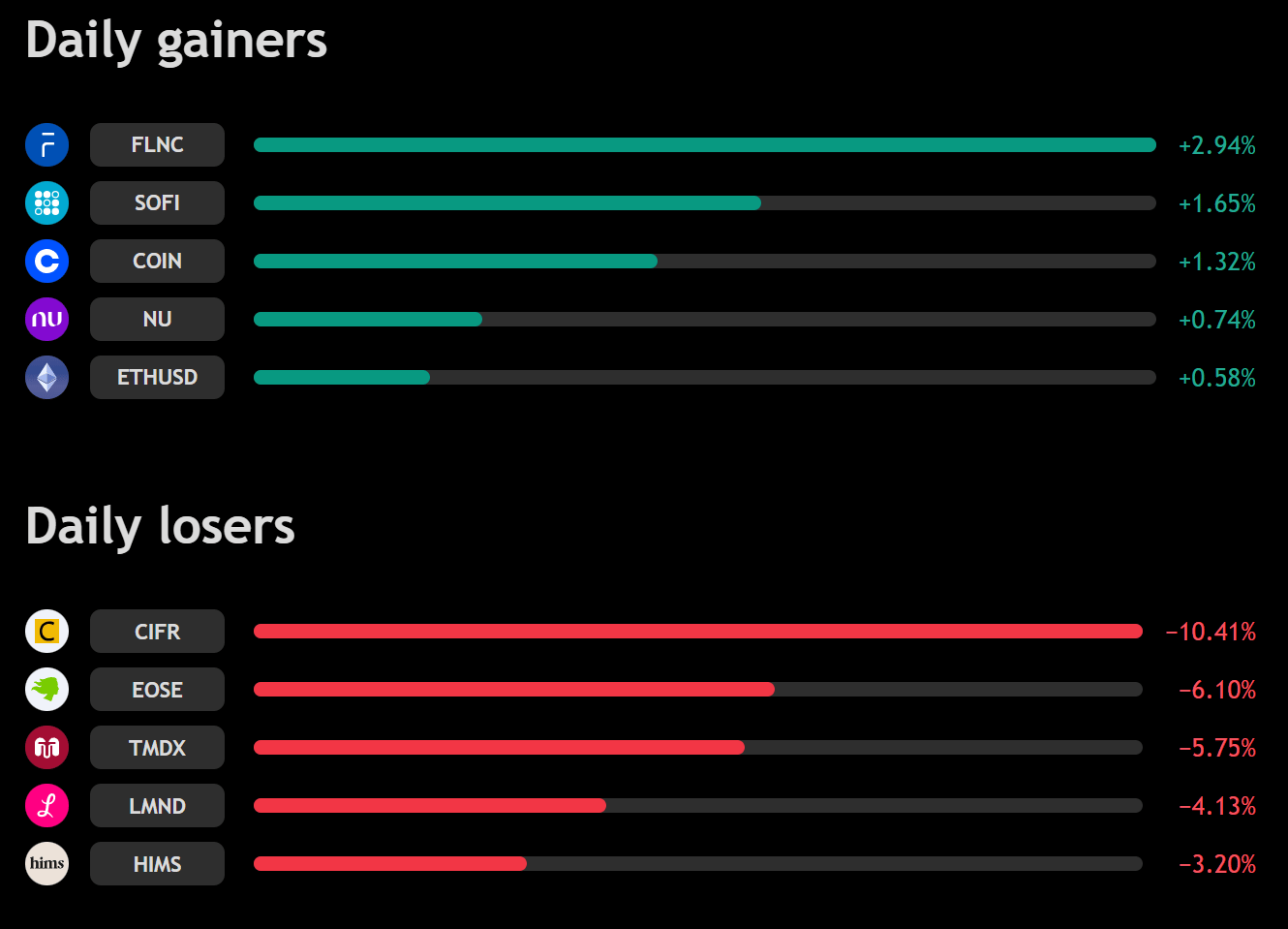

LMND – Trailing Stop Hit, Cash Raised, Watching the AVWAP Ladder

This one requires full clarity.

I had a trailing stop on 25 shares, and it triggered today — exactly as planned.

Why?

The portfolio was light on cash

LMND was extended under major resistance

If it couldn’t break the November 12th highs, the pullback could get deeper

I wanted to raise cash WITHOUT touching core size

Short-term, today was not a strong candle:

we closed below the recent high-pivot AVWAP

momentum stalled right where it needed to expand

sellers stepped in with conviction

But here’s the key: LMND still has 23% short interest.

This thing can erase today’s entire move in one session.

Nothing changed in the long-term thesis.

Roadmap:

Reclaim the lost pivot AVWAP tomorrow → breakout still alive

Fail to reclaim → test the October 22 Pivot AVWAP

Lose that → Buy Zone hits (ideal multi-year entry)

And again:

Don’t anchor to my entry — anchor to the Buy Zones.

Weekly Chart:

Daily Chart:

4-Hour Chart showing break and close below recent high AVWAP:

HIMS – Short-Term Chart Looks Ugly, But This Isn’t a “Buy Zone Story” — It’s a Long-Term Industry Transformer

Let me be blunt — the HIMS chart looks ugly right now.

We lost the recent pivot-low AVWAP

The lower timeframes are choppy and indecisive

Momentum is weak

And every bounce today got sold straight back down

Short-term, this has the look of a stock that wants to cool off more.

But here’s the truth:

HIMS was never about timing the perfect buy zone.

HIMS is a long-term industry transformer.

This is a company reshaping:

direct-to-consumer healthcare

telemedicine adoption

prescription fulfillment

patient retention economics

and the entire “modern men’s health” category

The Buy Zones still exist, sure — but they’re not the main point here.

Nobody is going to look back at a 10-year HIMS chart and say:

“Wow I’m so glad I waited for a $2 difference on my entry.”

That’s not what this is.

This is one of the few names in this portfolio where:

Short-term weakness = irrelevant.

Long-term execution = everything.

Nothing that happened today — or this whole week — touches:

revenue velocity

subscription expansion

margin expansion

TAM expansion

new category launches

retention cohort strength

Short-term chart is ugly.

Long-term story is untouched.

This is the kind of compounder where the big money is made by staying grounded in fundamentals while the chart goes through its mood swings.

Weekly Chart:

Daily Chart:

CIFR – Sitting Right on the Reversal Zone… but This Level MUST Hold

CIFR is parked at the most logical spot on the entire chart for a short-term reversal — the convergence of multiple pivot AVWAPs all stacked in the same zone. CIFR respects anchored VWAP better than almost any stock in this portfolio, and historically this is where buyers step in.

But today’s candle was flat-out ugly:

clear rejection at $20

heavy intraday selling

close back under the AVWAP cluster

momentum rolled over into the close

This is where CIFR either stabilizes… or we break lower first.

Here’s the roadmap exactly as you laid it out:

1. If this AVWAP cluster holds → immediate reversal is on the table

This is the spot where CIFR has reversed every time for months.

2. If it fails → September 8th Pivot AVWAP @ $16.31 comes next

That’s the next clean level with real historical demand.

3. If that doesn’t hold → the primary Buy Zone hits ($15.97–$14.93)

And that’s where I’ll get aggressive — exactly as planned from the beginning.

Long-term, nothing changed.

CIFR isn’t trading on some meme narrative. It’s tied directly to Bitcoin’s next cycle and the massive expansion of AI compute infrastructure. Those two forces are structural, not sentimental.

Short-term pain.

Long-term opportunity.

Same thesis.

Same Buy Zones.

Same execution plan.

Daily Chart:

ZETA – Likely Heading Straight Into Buy Zone 1

ZETA looks like it wants a clean test of the August 15th Pivot AVWAP, which aligns perfectly with Buy Zone 1.

Your chart read was accurate:

rejecting the recent high-pivot AVWAP

fading momentum

controlled drift

low-volume selling

This is what healthy pullbacks look like in long-term winners.

Roadmap:

Tag Aug 15 AVWAP → first nibble

Enter Buy Zone 1 → add

Overshoot → aggressive add

Long-term thesis untouched.

Daily Chart:

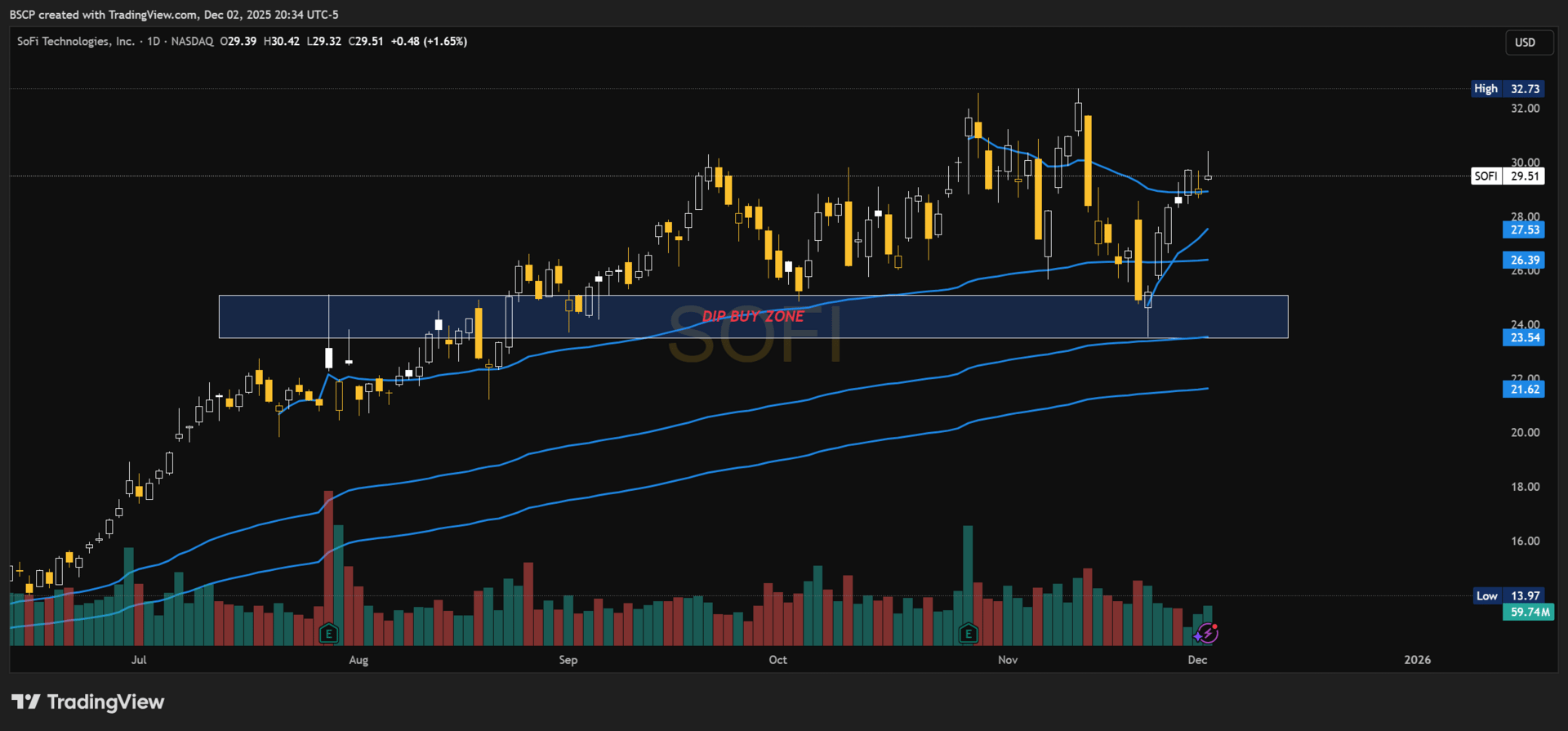

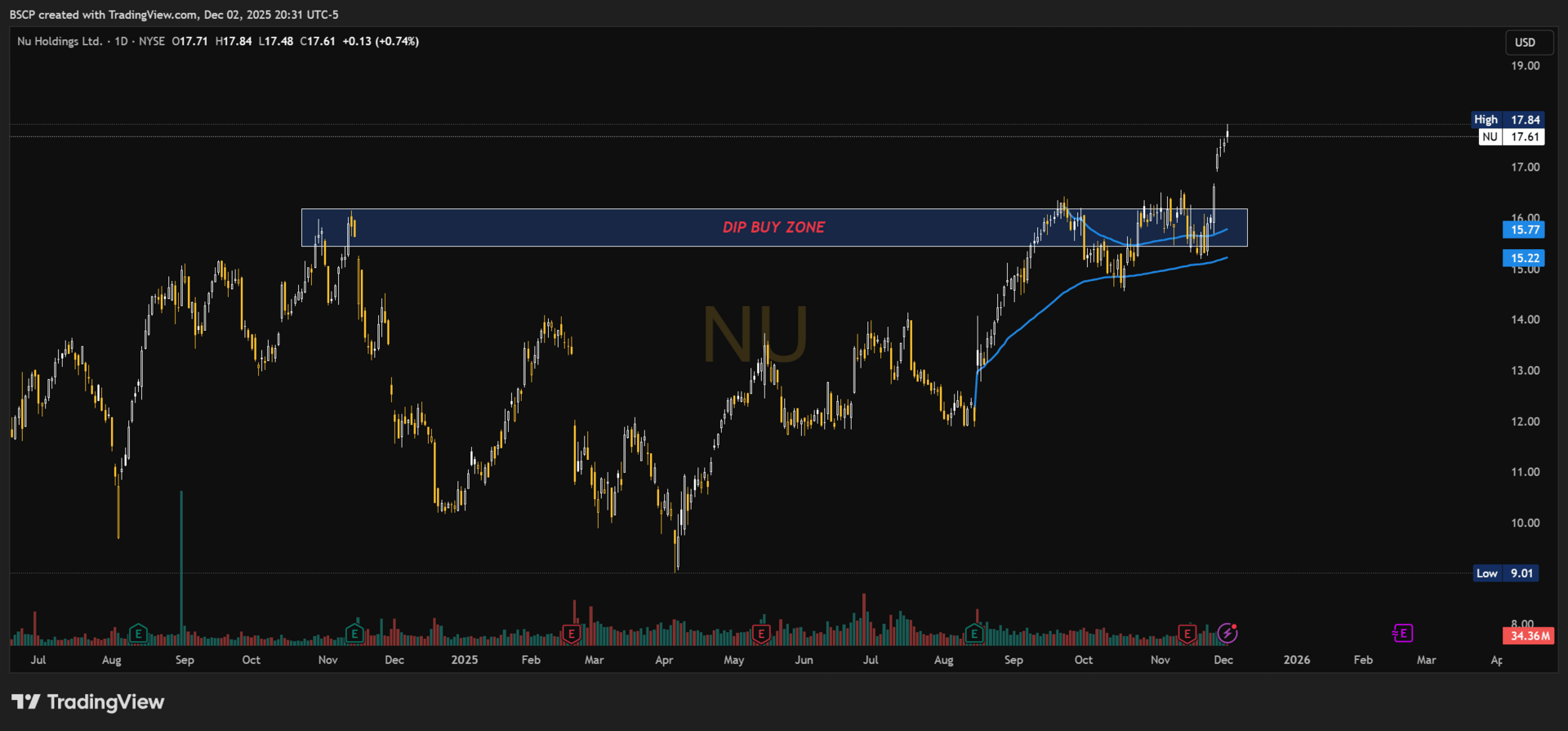

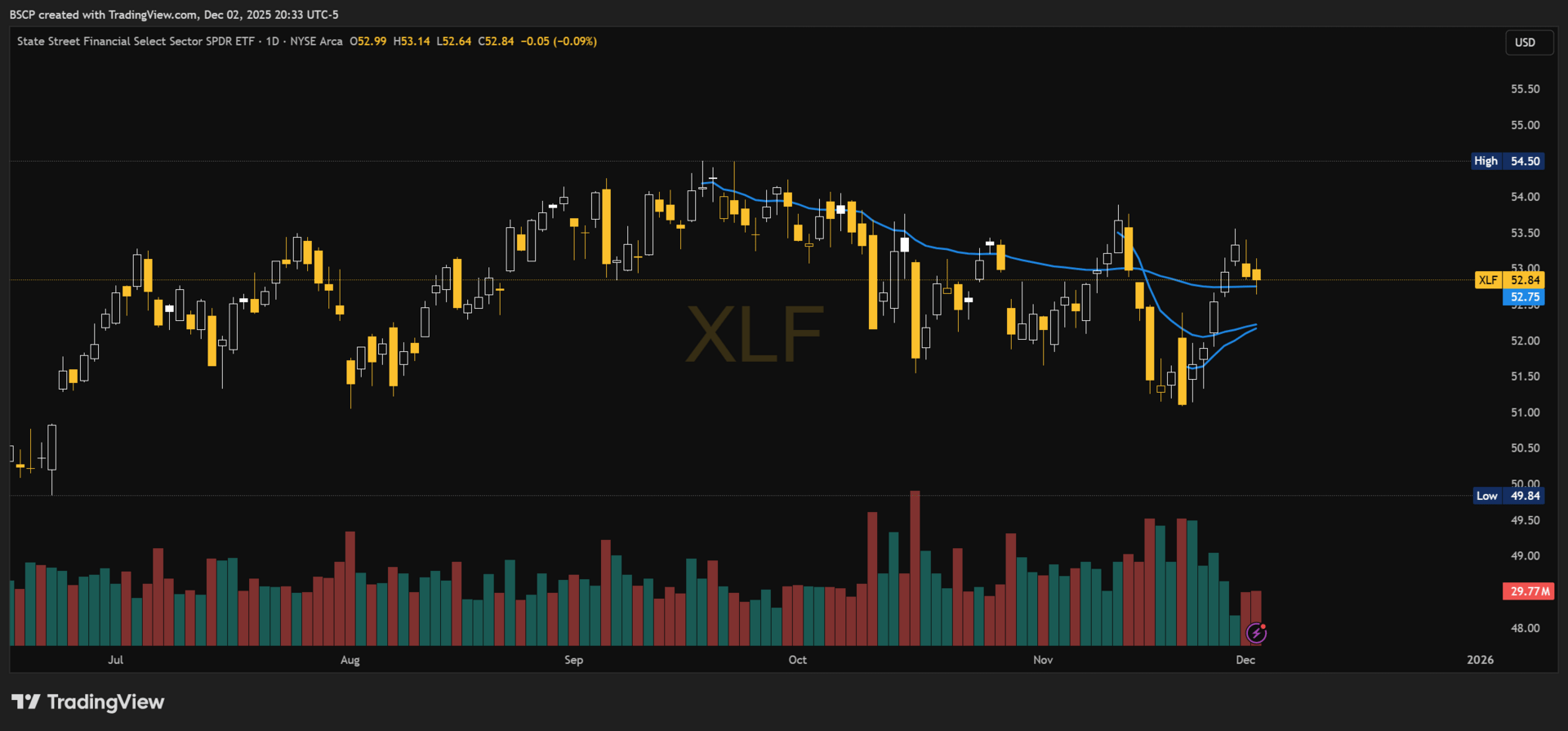

NU, SOFI, XLF – Financials Acting Like Quiet Leaders

Nothing changed for NU or SOFI today — and that’s bullish in this tape.

holding trend

respecting reclaimed pivot AVWAPs

no breakdown signals

steady volume behavior

XLF continues to show surprising strength despite the market’s volatility.

I am watching the recent low-pivot AVWAP across all three names.

If financials lose that cluster on volume → I will trim some exposure.

Until then, nothing to do.

EOSE – Clear Buy Zone, Clear Invalidation. That’s It.

EOSE isn't doing anything special here — it’s simply drifting lower into the levels we already mapped.

This isn’t about momentum.

This isn’t about a clean reversal.

This isn’t about strength.

This is strictly about knowing where the buy zone sits and knowing where the short-term structure breaks.

Here are the only two things that matter:

Buy Zone:

$11.62 — $9.78

That’s where the asymmetric risk/reward begins.

No guessing.

No overthinking.

That’s the zone.

Short-Term Invalidation:

Close below $10.12

If we lose that level on a closing basis, the current structure is failing and the retest needs more time.

Long-Term Target:

$40

Nothing about today’s action changes that long-term trajectory.

But there’s no strength here yet — this is not a reversal setup, not a breakout, not a momentum name right now.

This is simply:

price drifting

into the area where real entries exist

with a clear invalidation below

That’s it.

Daily Chart:

TMDX – Possible Failed Breakout, But Levels Are Clear

Today’s candle looked like a possible failed breakout:

big wick

heavy rejection

closed back into the prior range

But nothing is confirmed yet.

Key levels:

$137 → must hold

Nov 14 Pivot AVWAP → secondary support

$120 (July 22 Pivot AVWAP) → long-term gift zone

A drop to $120 would be an incredible entry — not a breakdown.

Long-term thesis unchanged.

Daily Chart:

FLNC – Strong Day, Strong Backlog… but Still a Small Position Until They PROVE It

FLNC showed real strength today — and unlike a lot of names, the strength actually makes sense.

When you’ve got:

a $5.3 billion backlog,

projected 50% revenue growth in 2026,

massive secular tailwinds from AI-driven energy demand,

and one of the strongest order books in the entire clean-energy infrastructure space…

…you’re supposed to trade well when the rest of the market is shaky.

But here’s the key point that matters for the Alpha 40K portfolio:

**Backlog is only backlog.

It doesn’t mean execution.

It doesn’t mean margins.

It doesn’t mean cash flow.

It doesn’t mean repeatability.**

That’s why FLNC is intentionally a small position for now.

The chart looks great.

The demand looks real.

The long-term setup looks strong.

But until they prove they can convert backlog → revenue → margins → cash flow consistently, we aren’t treating it like a core.

This is the exact type of name where:

the setup is compelling

the upside is real

the secular trend is enormous

but the burden of proof is still on the company

FLNC has held its dip buy zone perfectly, reclaimed structure, and is acting right — but the size stays small until the fundamentals stop being potential and start being reality.

No adjustments here.

Just respecting the execution curve.

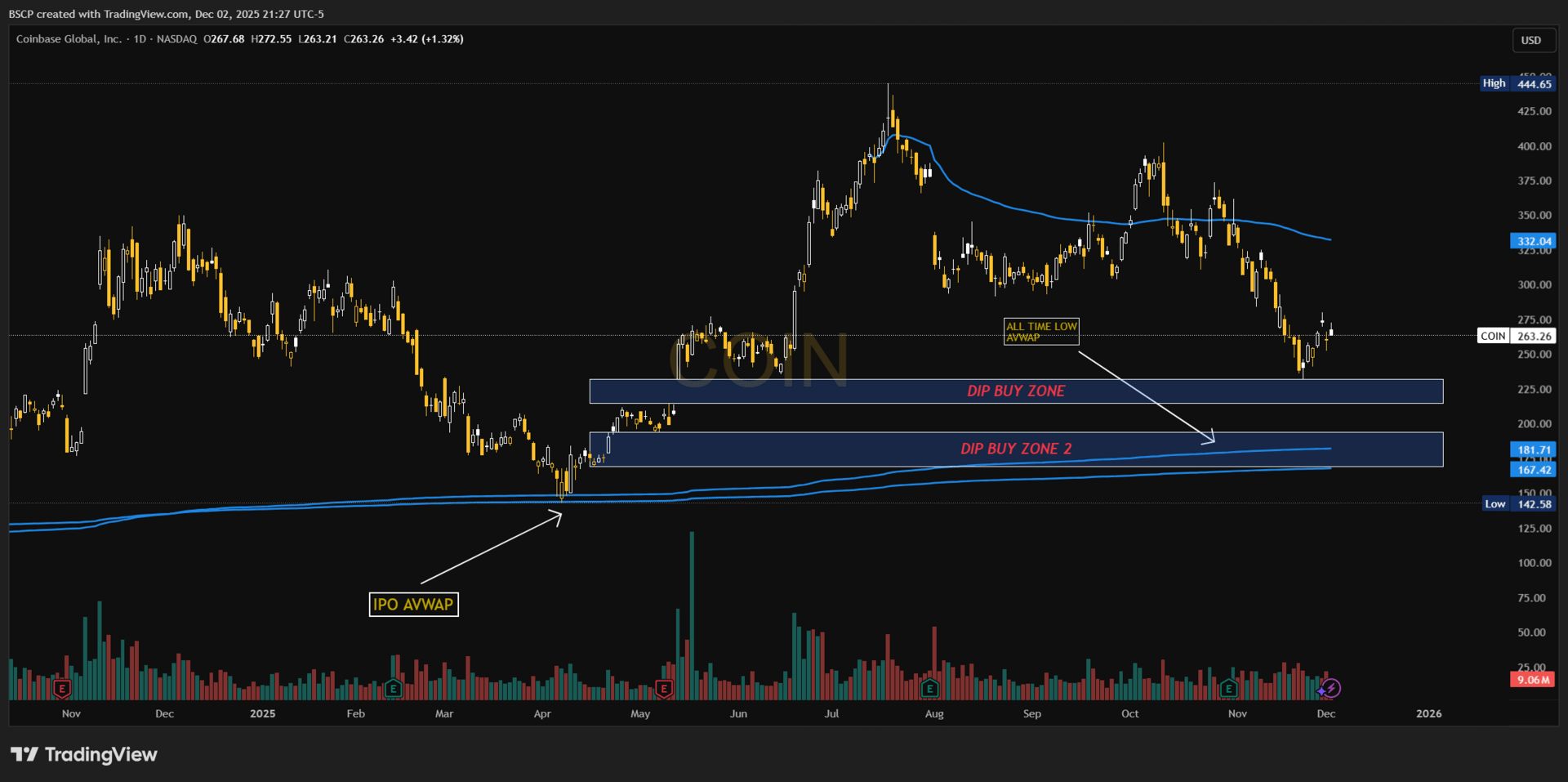

COIN – Still Following the Plan, But Buy Zone 2 Only Happens if Bitcoin Breaks $74K

Nothing meaningful changed on COIN today.

The structure is exactly the same, the roadmap is exactly the same, and the anchored VWAP stack continues to act as the long-term backbone of this chart.

Price is still hovering well above both major buy zones:

Buy Zone 1 (the shallow AVWAP reset)

Buy Zone 2 (the deep accumulation zone near the IPO + ATL AVWAP)

But here’s the key piece that needs to be said clearly:

I don’t think COIN gets anywhere near Buy Zone 2 unless Bitcoin breaks below $74K.

COIN’s deeper levels — specifically the buy zone tied to the rising IPO AVWAP + All-Time-Low AVWAP — really only come into play if Bitcoin itself takes a meaningful leg down.

And based on how COIN has behaved this entire cycle:

shallow BTC pullbacks → COIN holds Buy Zone 1

deeper BTC flushes → COIN wicks into Buy Zone 2

Right now, BTC remains well above the range that would pull COIN into that lower zone.

So unless BTC loses $74K with conviction, I’m not expecting COIN to hit the second buy zone.

Bottom line:

Nothing changed technically

Nothing changed structurally

Nothing changed in the thesis

And the deeper buy zone only comes into play if BTC breaks trend

For now, COIN is simply drifting — and drifting is exactly what it should be doing until Bitcoin makes its next decision.

Daily Chart:

Portfolio Snapshot

Total Value: $40,981.47

Cash: $3,005.36

Unrealized Gain: +$875.97 (+2.36%)

Note:

I trimmed 25 shares of LMND today via trailing stop to raise cash.

This will be reflected in the weekly Portfolio Page update.

Final Reminder

If you’re following the Alpha 40K Portfolio:

Focus on the Buy Zones — not my entries.

I had to build positions to start the portfolio.

You get the advantage of waiting for the high-probability accumulation levels.

That’s how you compound intelligently over a multi-year horizon.

You’re early.

You’re in the right place.

And every level you just read is built from the same process I use with my own capital.

Share this with someone who’s tired of getting in late.

— Connor

Alpha Before It Prints

Upgrade to Alpha Premium — Founding Members keep $14.99/mo or $150/yr permanently.

A quick note on how I express conviction

For anyone wondering how this framework translates into actual positioning:

I run two live portfolios that reflect two very different parts of my thinking.

The Black Sheep Base Case Portfolio is exactly what it sounds like — core positioning for how I expect the broader market to resolve when structure matters more than headlines.

The Alpha Framework Portfolio is different.

That’s where I take long-term swings on smaller companies I believe can materially outperform over full cycles — names that usually look wrong before they look obvious.

A few past examples from that framework:

HIMS — $8.36 → +722% (ATH)

SOFI — $5.84 → +452% (ATH)

PLTR — $26.58 → +679% (ATH)

LMND — $31.31 → +171% (ATH)

ONDS — $1.74 → +532% (ATH)

CIFR — $2.96 → +762% (ATH)

IREN — $5.97 → +1,161% (ATH)

No alerts.

No perfection.

A lot of patience.

That’s not a promise — it’s just context for how I think and how I size risk.

🔗 Connect with me:

✖️ Twitter | 💼 LinkedIn | 🚀 Subscribe

© 2025 Alpha Before It Prints

Unsubscribe