Today felt worse than the index suggested — and that matters.

The S&P didn’t collapse.

But growth got hit.

Volatility showed up.

And positioning started to unwind.

That combination doesn’t signal panic.

It signals rotation + timing.

The Market Didn’t Break — Leadership Shifted

When markets top, weakness spreads everywhere.

That didn’t happen.

Today’s pressure stayed concentrated in:

• large-cap growth

• high-multiple tech

• momentum-heavy pockets

Outside of that, damage was contained.

That’s how rotations behave — not bear markets.

One detail worth calling out here: not all growth is behaving the same way.

While much of big tech and high-multiple growth was making multi-day lows, a few names refused to break — and that matters.

When markets are topping, leaders crack first.

When markets are rotating, leadership fractures.

The names that hold their structure while everything else is under pressure tend to tell you where capital wants to go next — not where it’s fleeing from.

Tesla is a good example of this dynamic — holding its structure while much of growth was making multi-day lows.

TSLA DAILY CHART

Breadth Softened — It Did Not Break

What this chart proves:

Internals weakened, but they did not collapse.

More stocks were red than green, but the damage stayed mostly inside Technology.

Outside that pocket, participation held together far better than fear suggested.

That distinction matters.

When breadth breaks, everything goes.

When breadth softens, leadership rotates.

One more macro tell that helps explain this tape: consumer spending isn’t collapsing — it’s concentrating.

We’re seeing record activity in value-driven categories while higher-end discretionary spending softens. That’s not a recession signal. It’s a bifurcation signal.

When consumers trade down but don’t stop spending, markets don’t implode — they rotate.

And rotations tend to favor balance sheets, pricing power, and selective leadership, not broad multiple expansion.

Consumer Spending: Concentration, Not Collapse

What this chart proves:

Participation has been thinning for months — today didn’t create the problem, it exposed it.

Growth vs Value: This Has Been the Tell for Weeks

Growth dominated for years.

That dominance cracked earlier this cycle.

Recent attempts for growth to reclaim leadership stalled again this week, while value continues to quietly grind higher.

That doesn’t mean growth is finished.

It means leadership is changing hands.

We’re seeing that play out across multiple lenses.

What this chart proves:

Growth is consolidating while value leads — a classic mid-cycle rotation signal.

Where this comes from in the uploads:

• Growth vs Value slide showing consolidation risk for growth before the next leg

Small Caps and Equal-Weight Are the Quiet Confirmation

One of the most important developments right now is happening away from the headlines.

Small caps have been breaking a long-term relative downtrend.

Equal-weight exposure is making new highs.

Leadership is broadening even as mega-caps digest gains.

That’s not bearish behavior.

That’s market health.

What this chart proves:

The market is redistributing leadership, not losing it.

Where this comes from in the uploads:

• Small-cap relative breakout slides

• Equal-weight vs cap-weight confirmation

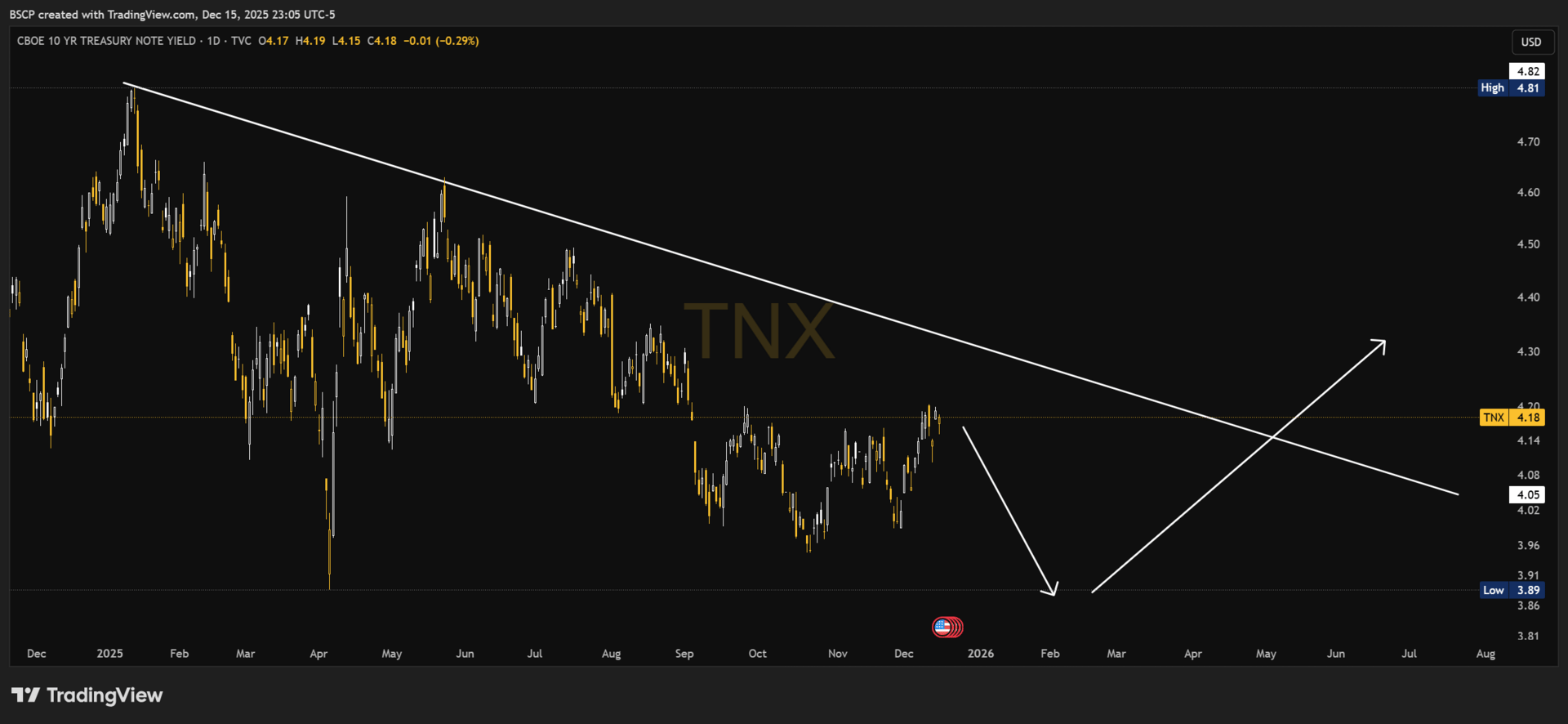

Rates Are a Near-Term Headwind — Not a Trend Killer

Yields didn’t collapse after the Fed.

They bounced.

That matters because higher yields:

• pressure long-duration growth

• favor value and cyclicals

• often coincide with leadership changes, not market tops

This is a timing issue, not structural damage.

What this chart proves:

Rates pushing higher short-term explains growth pressure without implying equity trend failure.

The Calendar Matters More Than the Headlines

A quick note on crypto, since I know some people are using it as a risk barometer right now.

The weakness there is largely flow-driven — year-end positioning, tax-loss harvesting, and mechanical selling — not a sudden shift in macro risk appetite.

Crypto often looks messy before equities during rotation phases. That doesn’t make it a leading indicator of equity stress — it makes it a volatility amplifier.

Important distinction.

This week sits directly in front of quad witching. Which we called out in the Saturday Alpha notes.

That means:

• forced option unwinds

• index rebalancing

• positioning compression

Price action into quad witching almost always looks worse than the underlying trend.

Selling pressure pulls forward.

Volatility spikes early.

Late-week lows are common.

That’s not a red flag.

That’s mechanics.

Volatility Is Not the Enemy

Volatility doesn’t show up at market tops.

It shows up at transitions.

It clears leverage.

It shakes weak hands.

It creates opportunity.

If you’re trying to build a long-term compounding portfolio, volatility is not something you fear.

It’s something you need.

LMND: Why You Must Zoom Out When Volatility Hits

LMND DAILY CHART

What this chart shows:

Sharp pullbacks, messy candles, emotional price action.

This is where people panic.

LMND WEEKLY CHART

What this chart shows:

Structure intact.

Long-term support holding.

A normal reset inside a much larger base.

Daily charts amplify fear.

Weekly charts reveal truth.

And this same dynamic is playing out across the market right now.

If you want to see how this macro setup translates into real positioning — cash decisions, buy zones, and how I’m navigating each holding through this volatility — that’s where the portfolio update begins. This is the exact point where most investors freeze — and where long-term returns are actually built.

Upgrade to Alpha Premium — Founding Members keep $14.99/mo or $150/yr permanently.

A quick note on how I express conviction

For anyone wondering how this framework translates into actual positioning:

I run two live portfolios that reflect two very different parts of my thinking.

The Black Sheep Base Case Portfolio is exactly what it sounds like — core positioning for how I expect the broader market to resolve when structure matters more than headlines.

The Alpha Framework Portfolio is different.

That’s where I take long-term swings on smaller companies I believe can materially outperform over full cycles — names that usually look wrong before they look obvious.

A few past examples from that framework:

HIMS — $8.36 → +722% (ATH)

SOFI — $5.84 → +452% (ATH)

PLTR — $26.58 → +679% (ATH)

LMND — $31.31 → +171% (ATH)

ONDS — $1.74 → +532% (ATH)

CIFR — $2.96 → +762% (ATH)

IREN — $5.97 → +1,161% (ATH)

No alerts.

No perfection.

A lot of patience.

That’s not a promise — it’s just context for how I think and how I size risk.

Subscribe to Alpha Premium to read the rest.

Become a paying subscriber of Alpha Premium to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Full Alpha Framework Portfolio Allocation

- Weekly Alpha Notes (what changed, what matters, what’s noise)

- Weekly Macro Updates

- Position sizing & conviction levels for every holding

- Before-it-prints setups I’m watching early

- Priority ticker breakdowns (member requests reviewed weekly)

- Charts

- Micro-cap Home Runs