Why this matters

China doesn’t usually turn when people feel confident.

It turns when people feel tired of caring.

That’s the environment we’re in now.

I just closed a BIDU call position for roughly 3x. Not because the move is finished — but because the part that paid for immediacy has already paid.

What I’m interested in now is something different:

duration.

Not chasing momentum.

Not reacting to headlines.

Letting time do more of the work.

What consensus is missing

Most China takes still anchor to narrative risk:

policy uncertainty

geopolitical overhang

structural skepticism

Those aren’t wrong. They’re just fully priced.

What isn’t being priced correctly is the shift from deterioration to stabilization.

Markets don’t require improvement to re-rate.

They require less bad — sustained long enough for positioning to matter.

Right now:

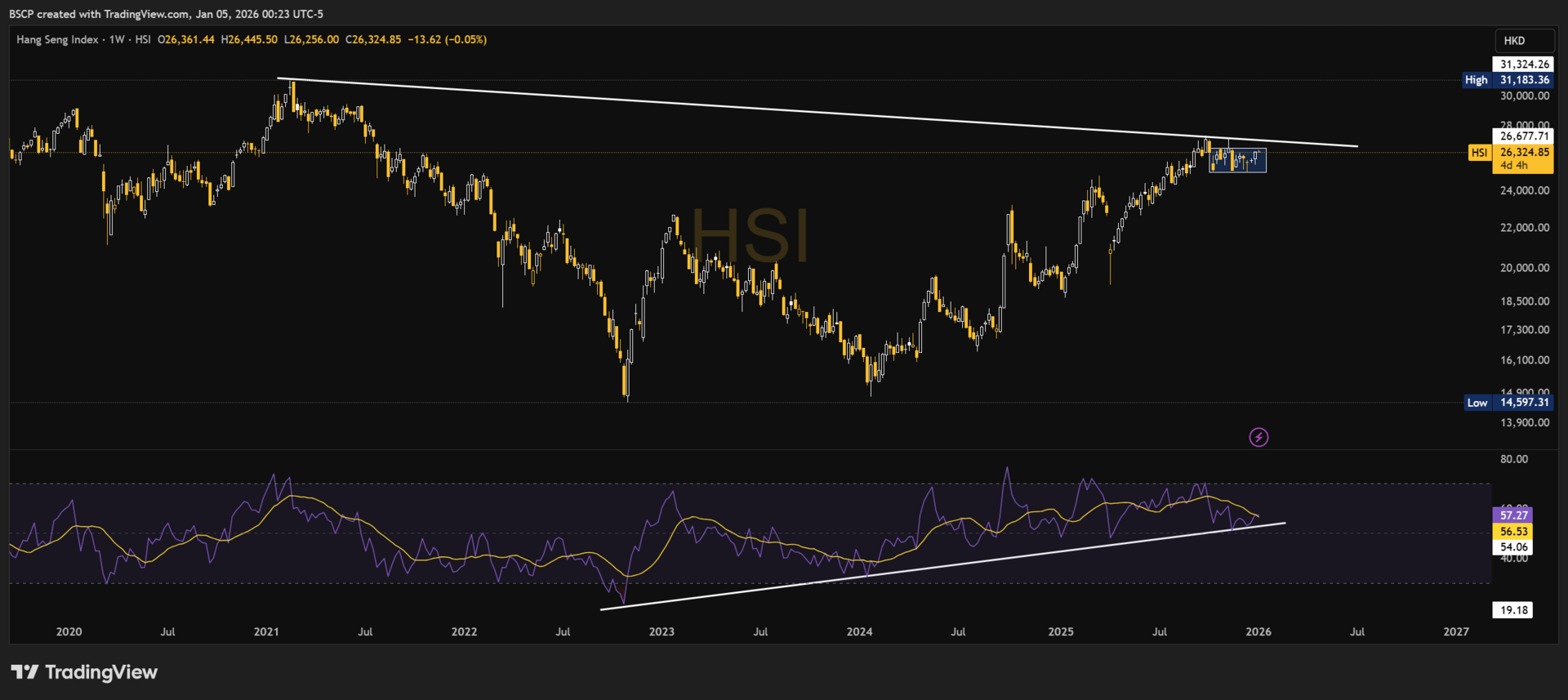

The HSI is pressing the top of a multi-month consolidation

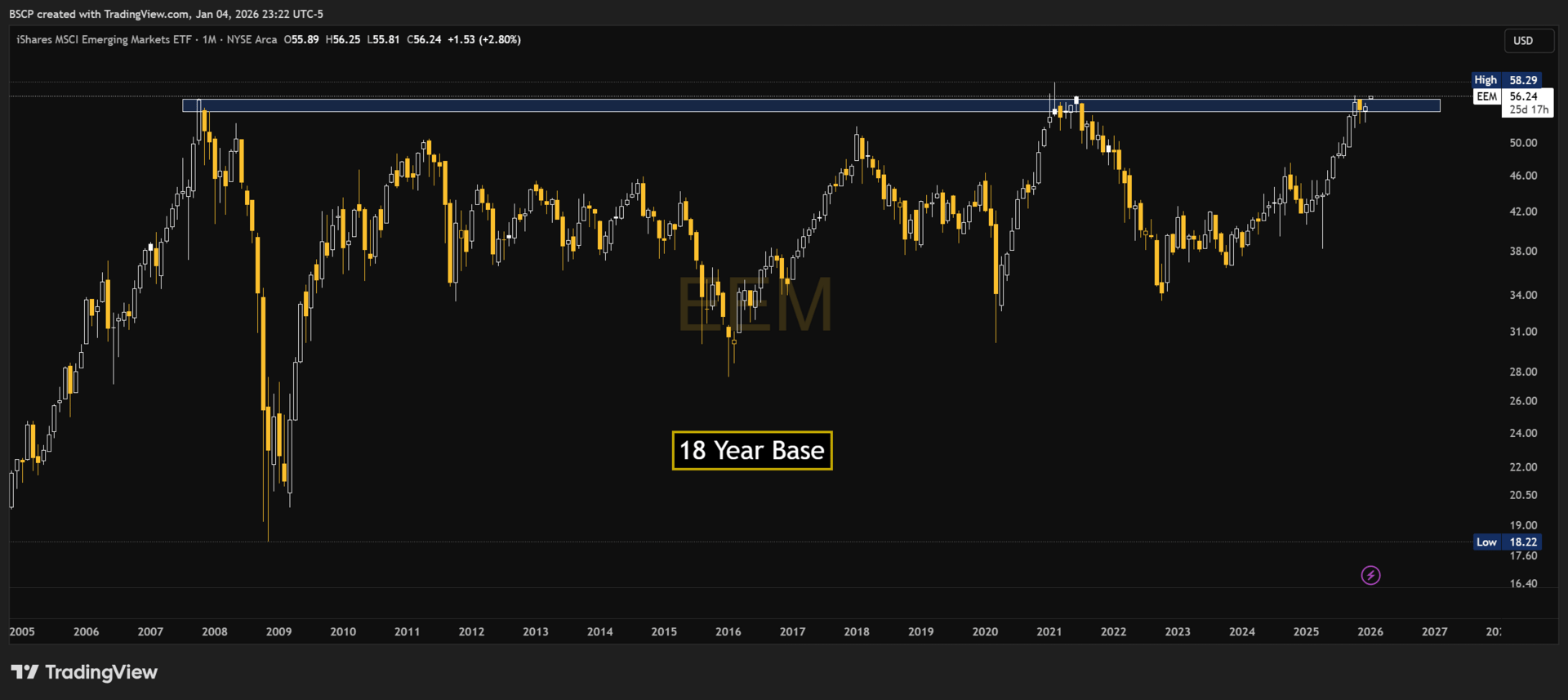

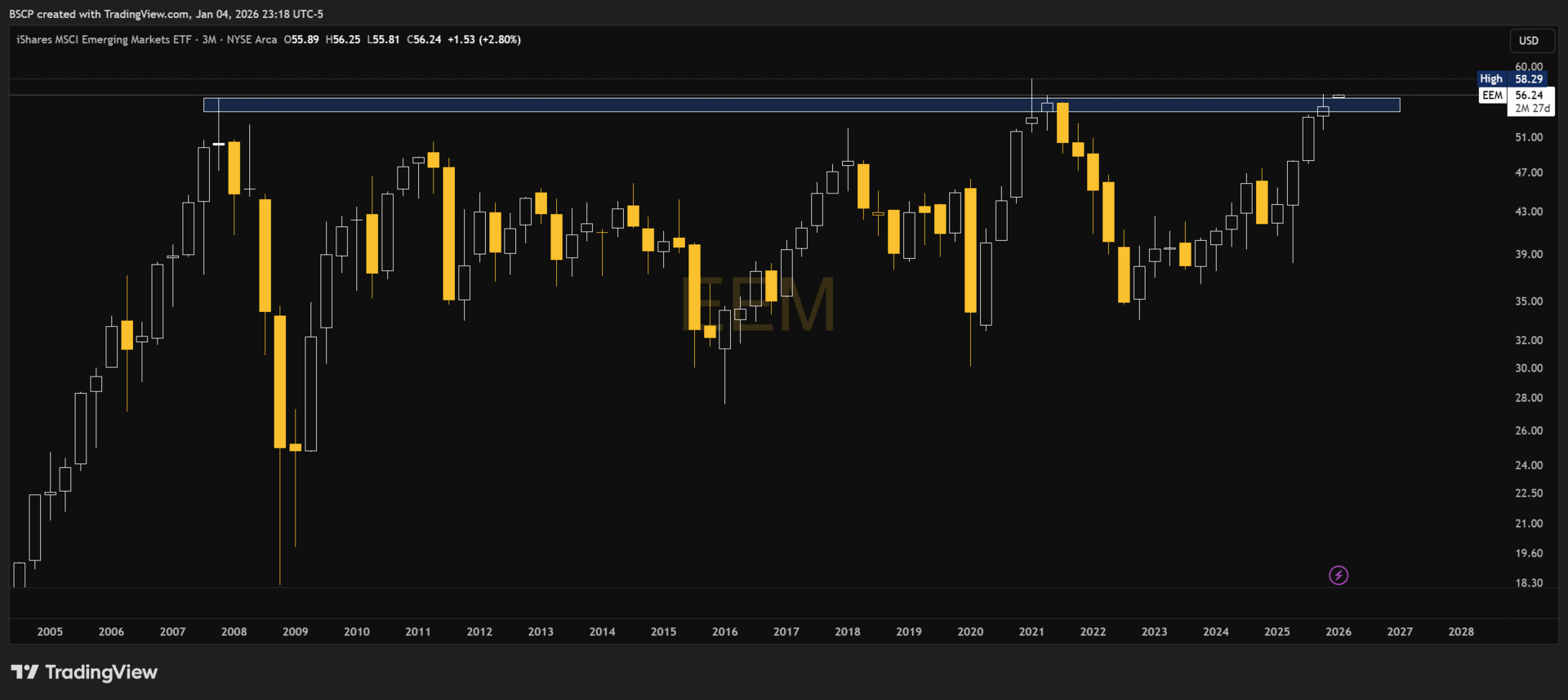

Emerging Markets are coiled after an 18-year base

Volatility is cheap relative to potential path, not outcome

This is not a momentum trade.

It’s a time asymmetry trade.

$EEM ( ▲ 0.74% ) still needs a quarterly close above $55.15.

I suspect we may get that in Q1 2026.

Subscribe to Alpha Premium to read the rest.

Become a paying subscriber of Alpha Premium to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Full Alpha Framework Portfolio Allocation

- Weekly Alpha Notes (what changed, what matters, what’s noise)

- Weekly Macro Updates

- Position sizing & conviction levels for every holding

- Before-it-prints setups I’m watching early

- Priority ticker breakdowns (member requests reviewed weekly)

- Charts

- Micro-cap Home Runs